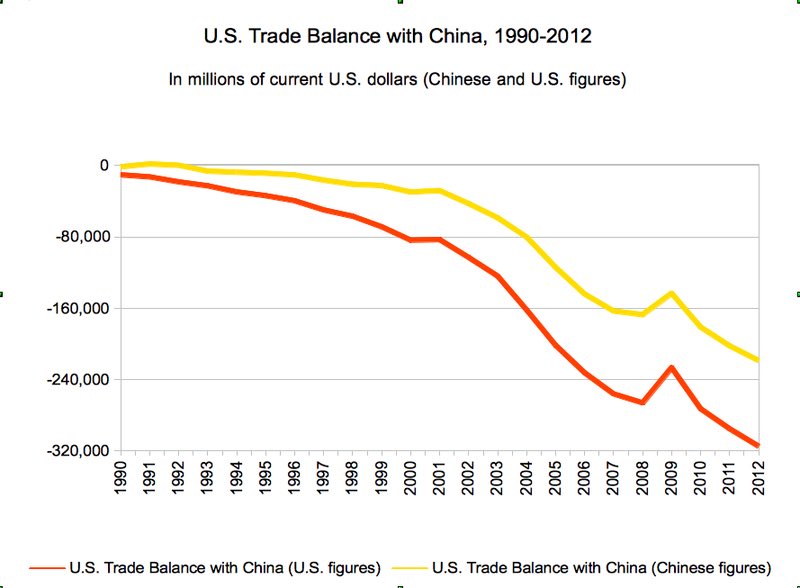

It is impossible to understand the current existential threat the US feels from China without first understanding what happened to Japan 37 years ago.

This is the story of the Plaza Accord 🧵

This is the story of the Plaza Accord 🧵

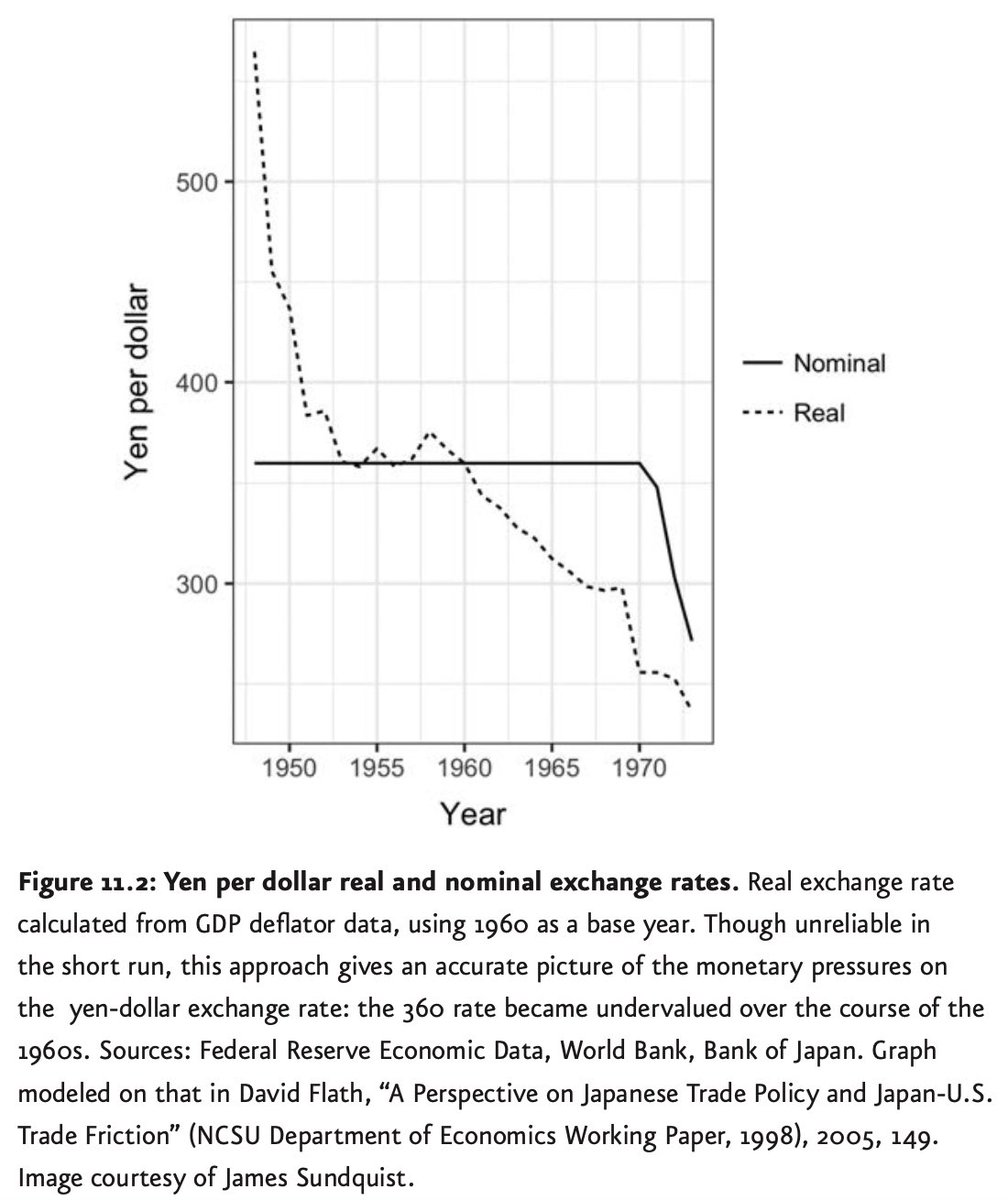

As Japan emerged shattered from WW2, the US was intent on establishing a forward operating base from which to combat communism in Asia. So in the spring of 1949, under allied occupation, Japan joined a US-led system of monetary management known as the Bretton Woods agreement.

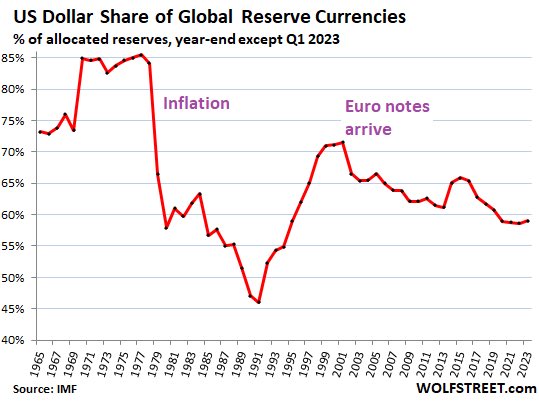

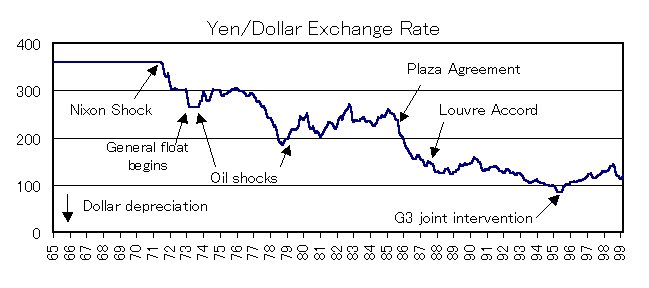

The agreement pegged the currencies of the largest economies to the USD, and the USD to gold, establishing the dollar as the global reserve currency. As a concession, the US allowed Japan to peg the yen to dollar at a favorable rate of 360:1, buoying Japan’s export economy.

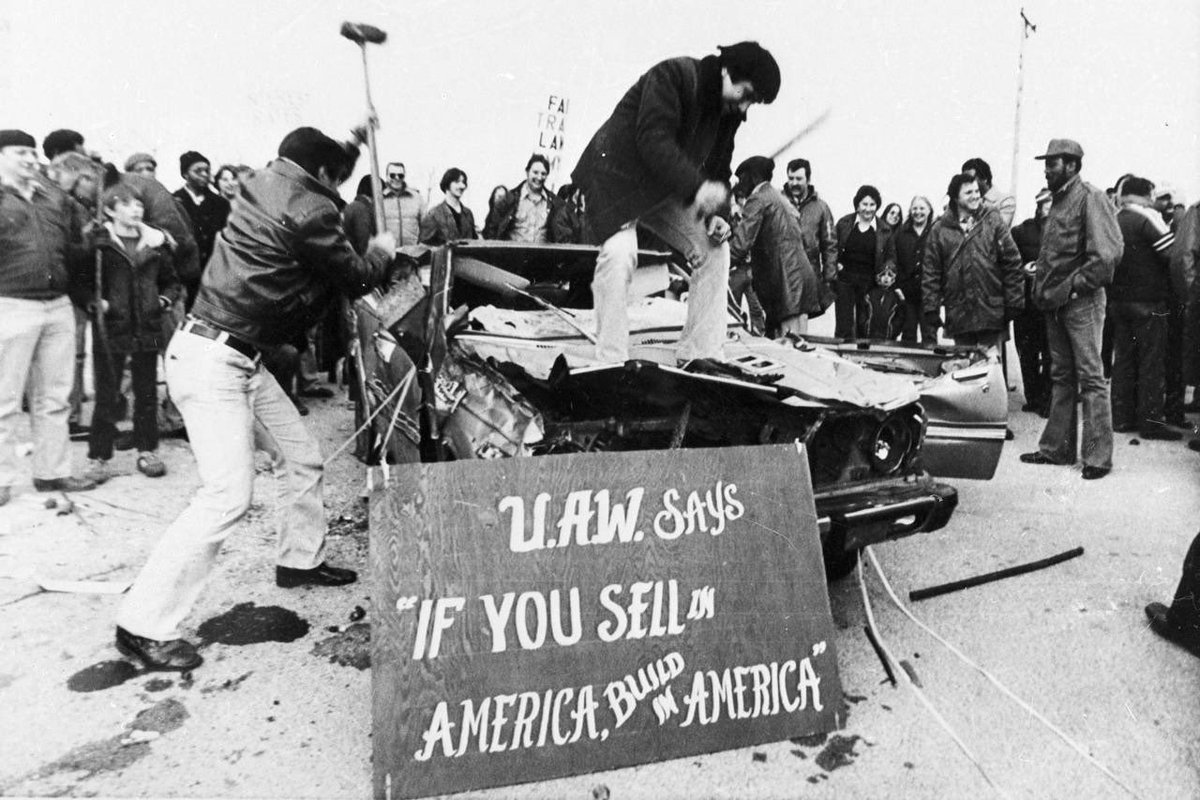

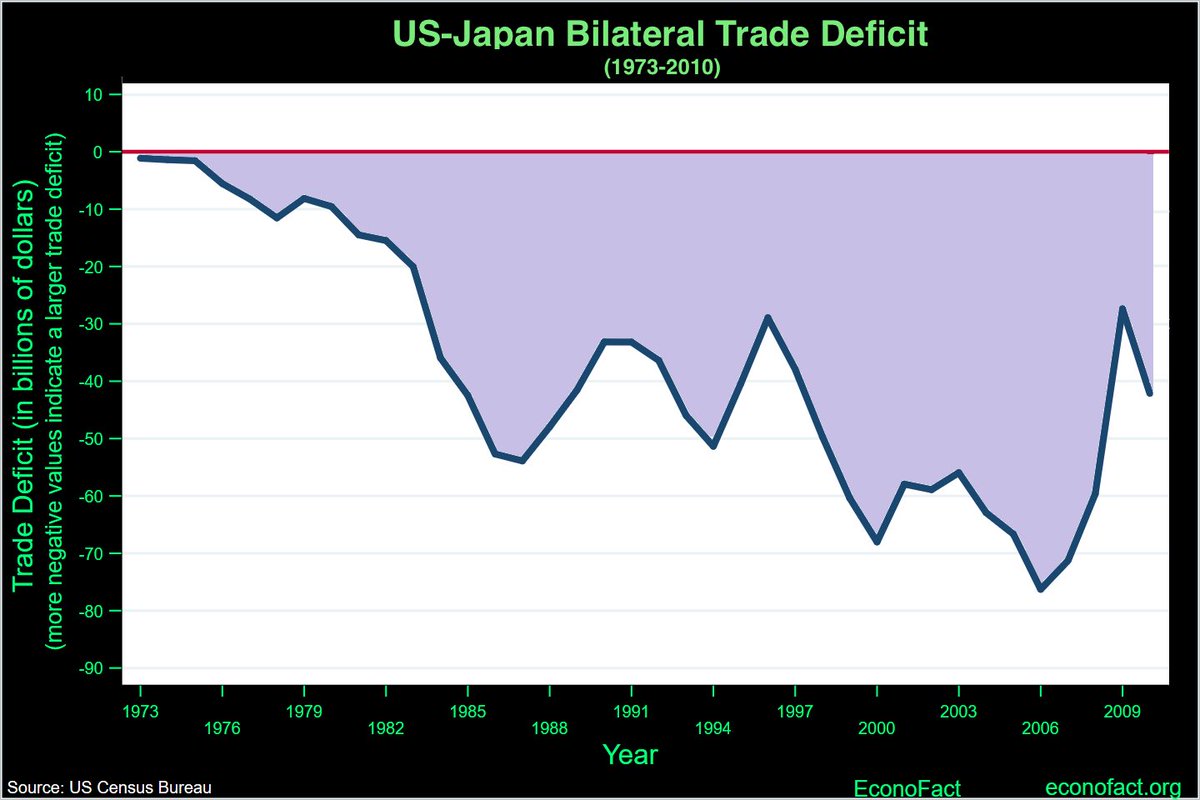

While initially tolerable, the rapid post-war growth of Japan’s export industry quickly allowed them to outcompete US manufacturing by producing similar quality goods at 1/3rd the price. This led to significant anti-Japan reaction in the US, particularly amongst auto workers.

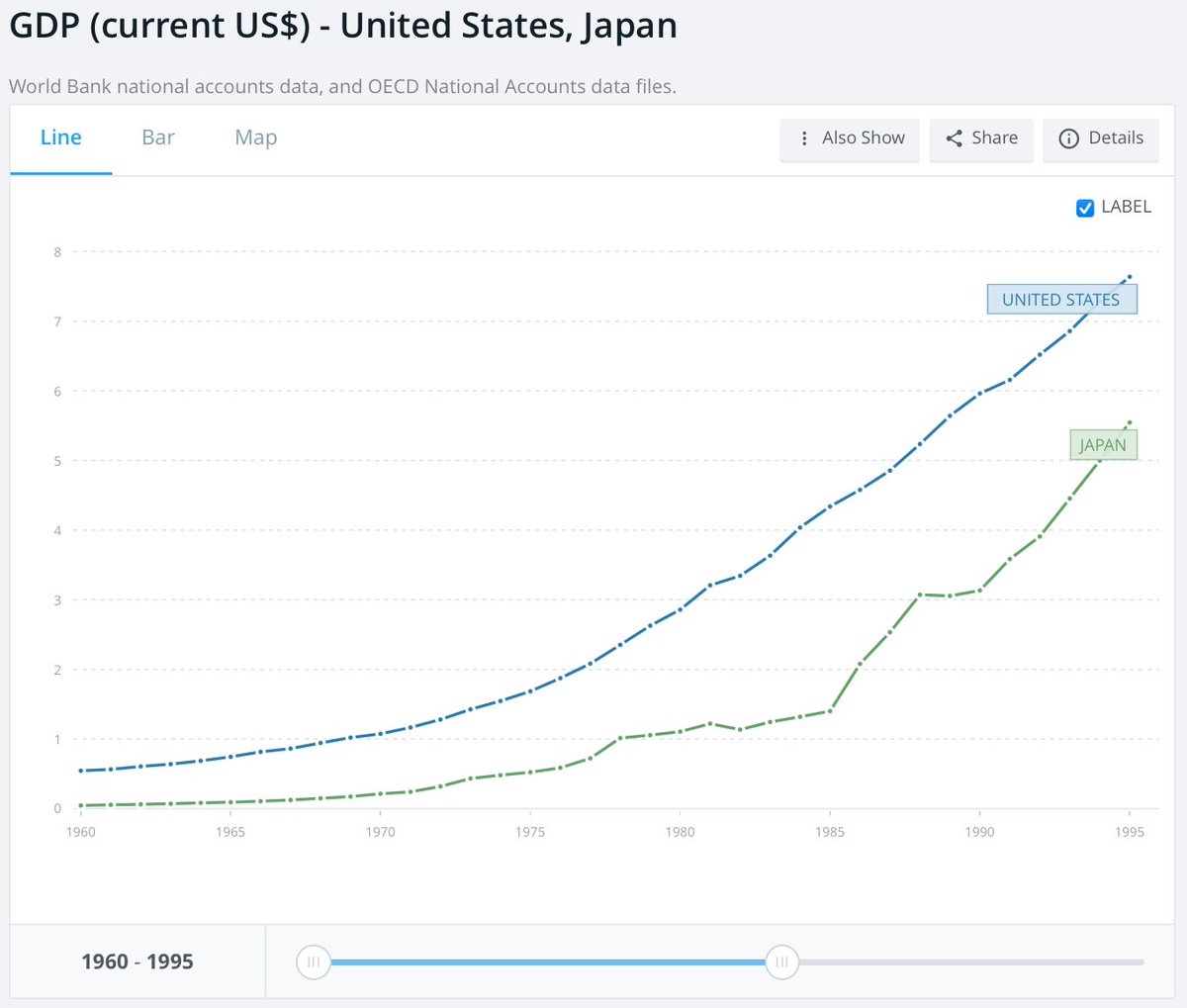

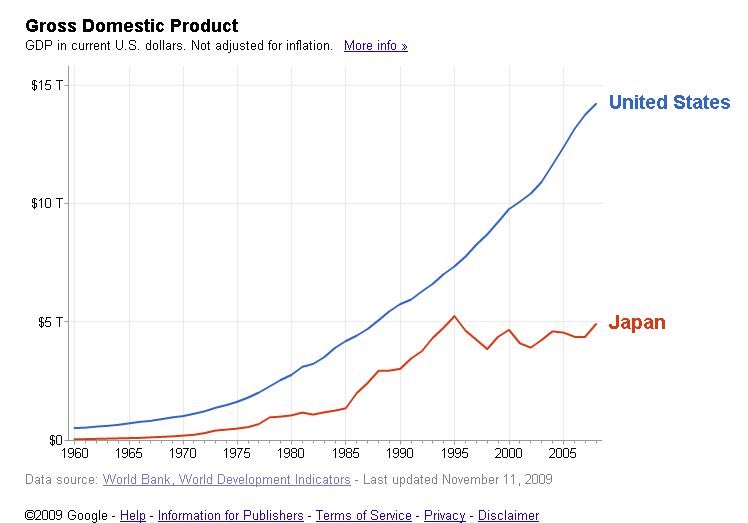

As a result of this growth, experts began predicting in the ’70s that Japan could overtake the US as the world’s largest economy by century’s end. This trend only accelerated when the US was hit by the ’73 oil embargo.

nytimes.com/1970/12/13/arc…

nytimes.com/1970/12/13/arc…

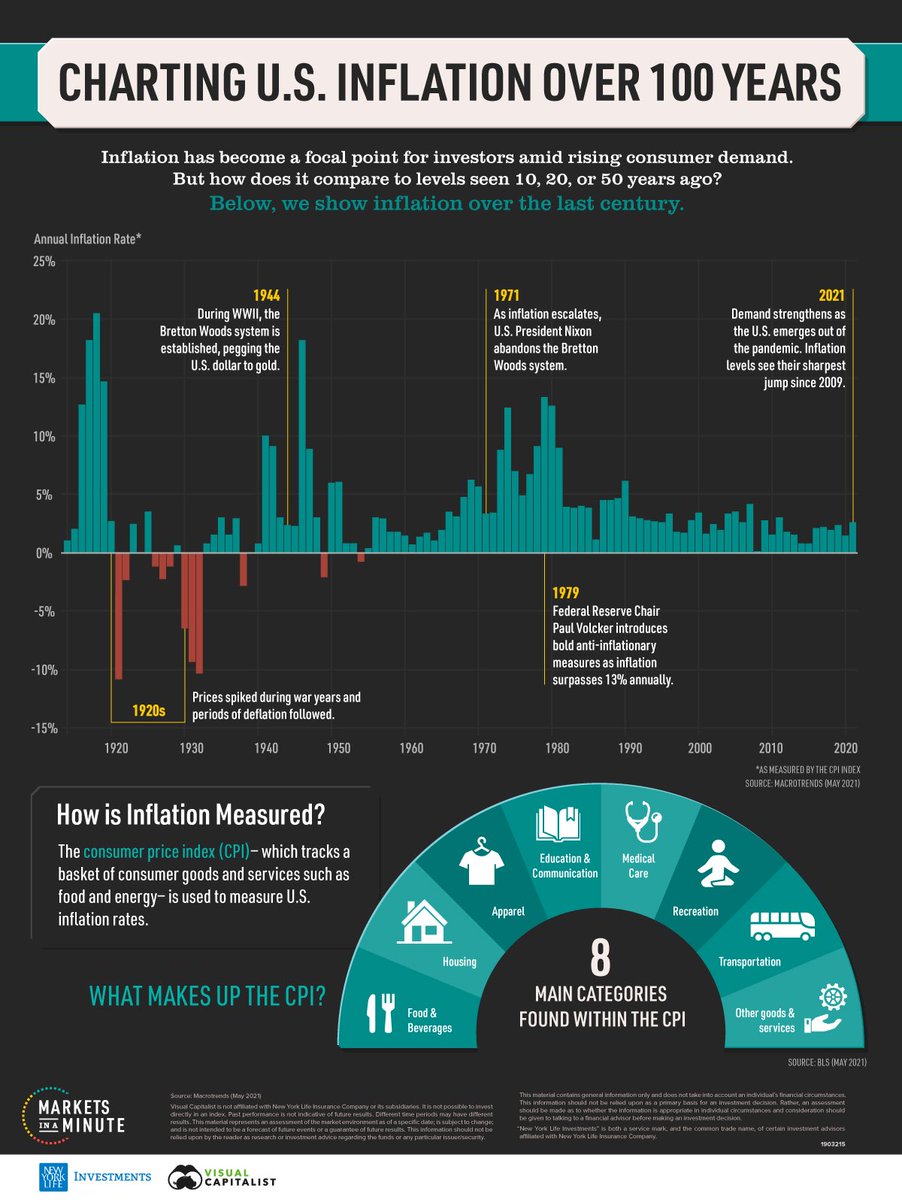

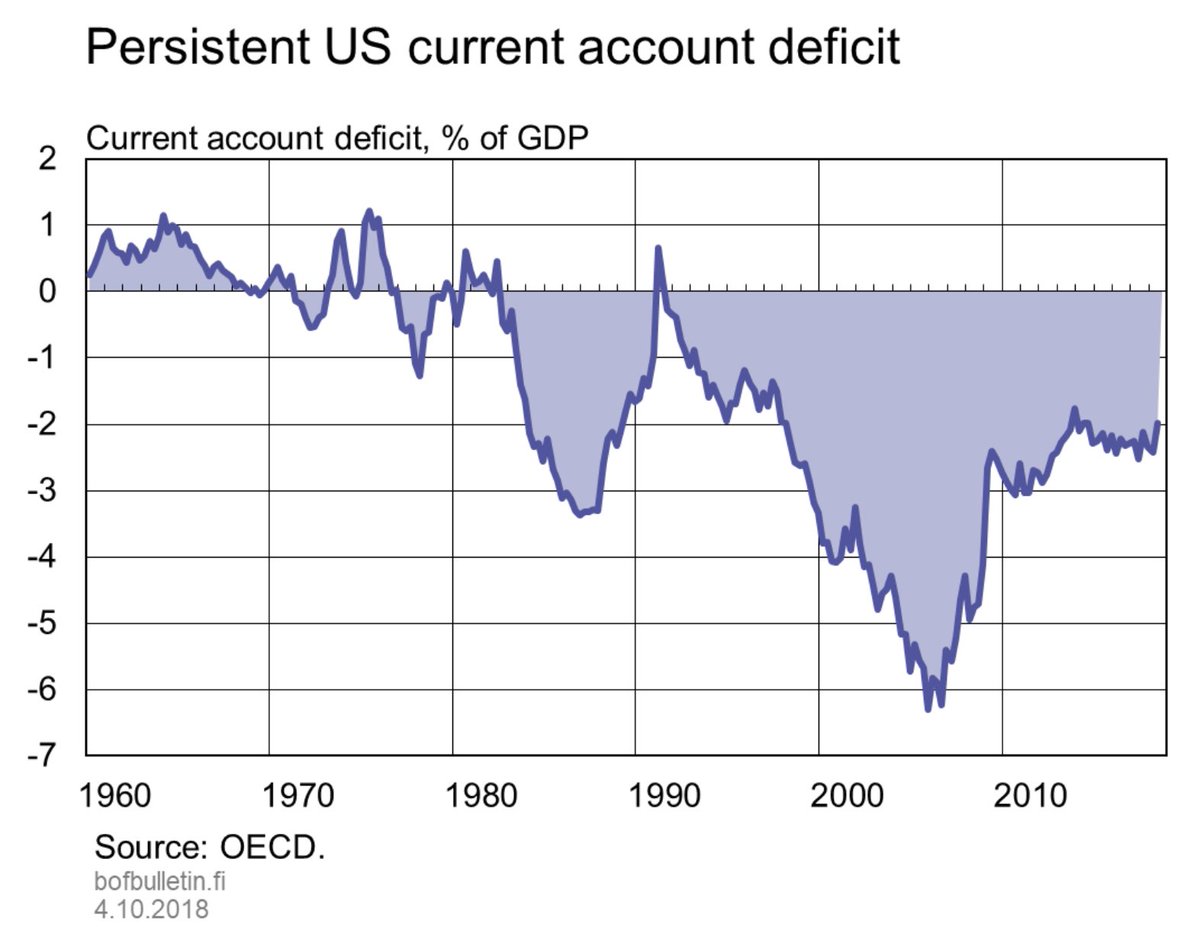

Meanwhile in the US, the costly Vietnam war, high social spending, and growing negative trade balance were all being financed by money printing. But almost as soon as they were printed, these newly minted dollars left the country via the US’s negative balance of trade.

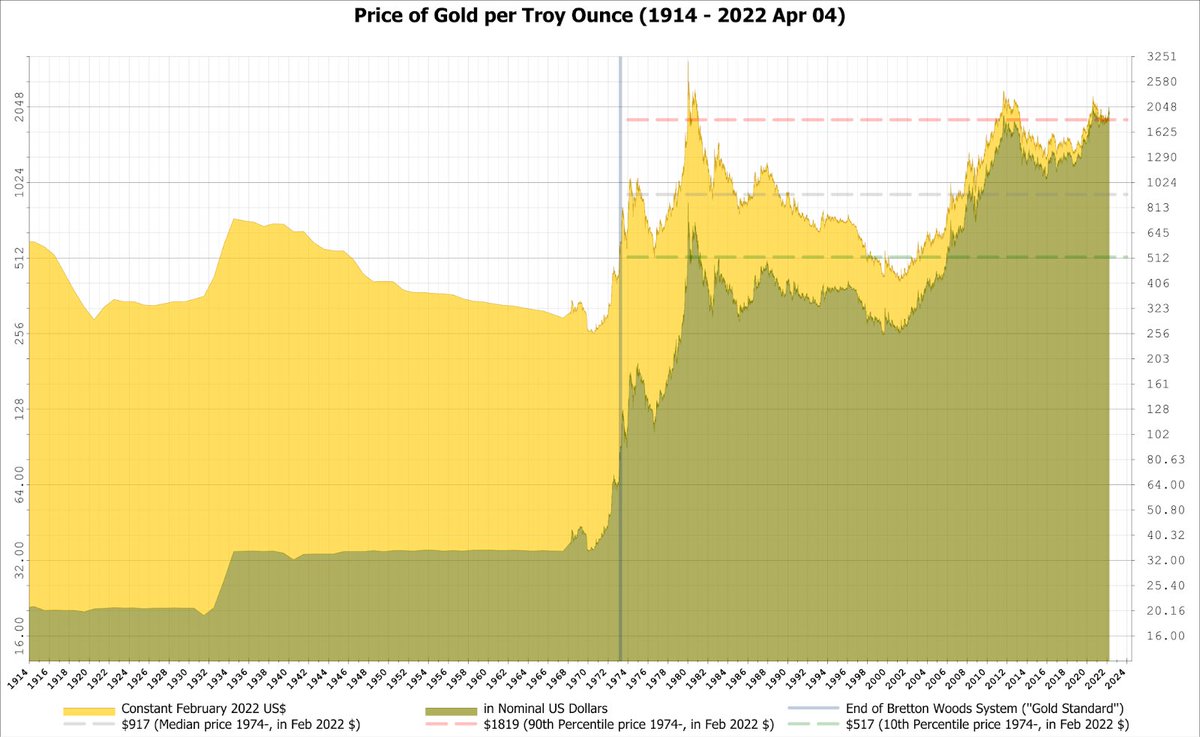

As a result of this monetary inflation, it was becoming increasingly clear the USD was overvalued relative to its fixed gold tether and in 1968, this overvaluation manifested as a collapse of the London gold pool, when growing US debts caused a loss of confidence in the dollar.

In 1971, Nixon intervened to address rising inflation by instituting domestic price controls and a blanket 10% import tariff. He also officially ended the direct convertibility of dollars to gold, untethering the dollar and effectively kicking off the fiat currency era.

With the dollar untethered, it could now drift toward its ‘true’ value. In ’73, the USD was again devalued against its official rate as the price of gold continued to rise. Soon after, Japan and the EEC were forced to let their currencies float, ending the Bretton Woods system.

With the USD now in turmoil, the late 70s saw the worst US inflation in decades. When Reagan took office in ’81, inflation had reached a crisis. To get it under control, the Fed increased interest rates to the highest level ever, with the prime rate peaking in Aug ’81 at 20.5%

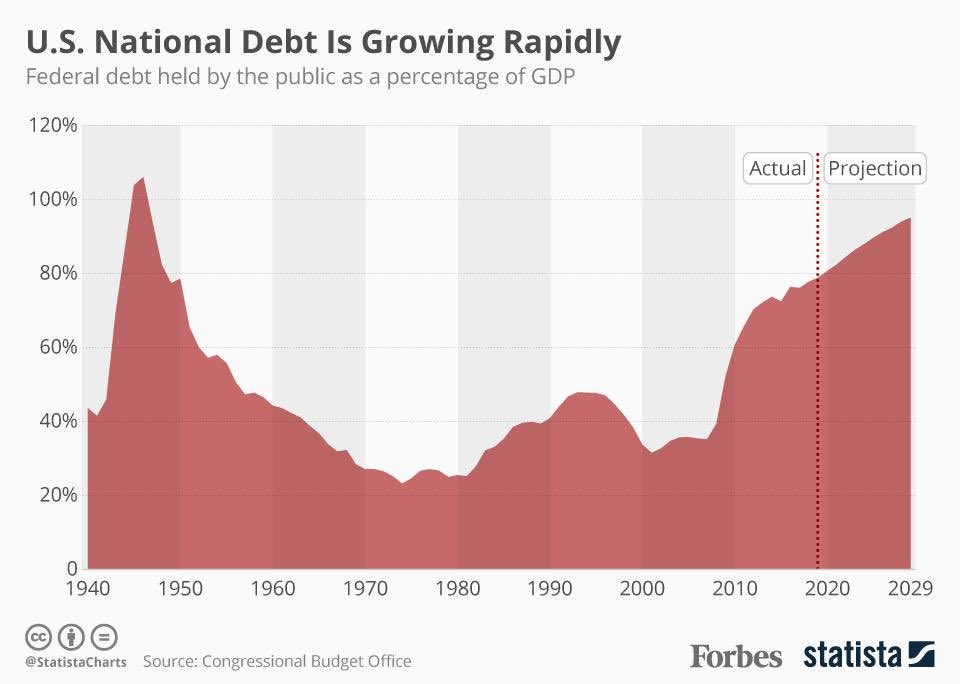

While this finally brought inflation under control, it came at the expense of dramatic economic slowdown and mass unemployment. What followed was an era of lower interest rates, slashed social spending, regressive taxation, and massive military spending, aka ‘Reaganomics’.

Reagan’s policies of military spending while cutting tax revenues resulted in an exploding deficit. This deficit spending combined with the contraction of US exports needed to be financed somehow. And the solution that was chosen was to sell the debt.

As a result of the high interest rates of the early 80s, combined with a flood of new government debt entering the market, demand for USD soared, and between 1980 - 85 the dollar appreciated against the currencies of the next four largest economies by a whopping 50%.

While good news for the cost of imported goods, this strong dollar was disastrous for US exports, and contributed to the further collapse of domestic manufacturing.

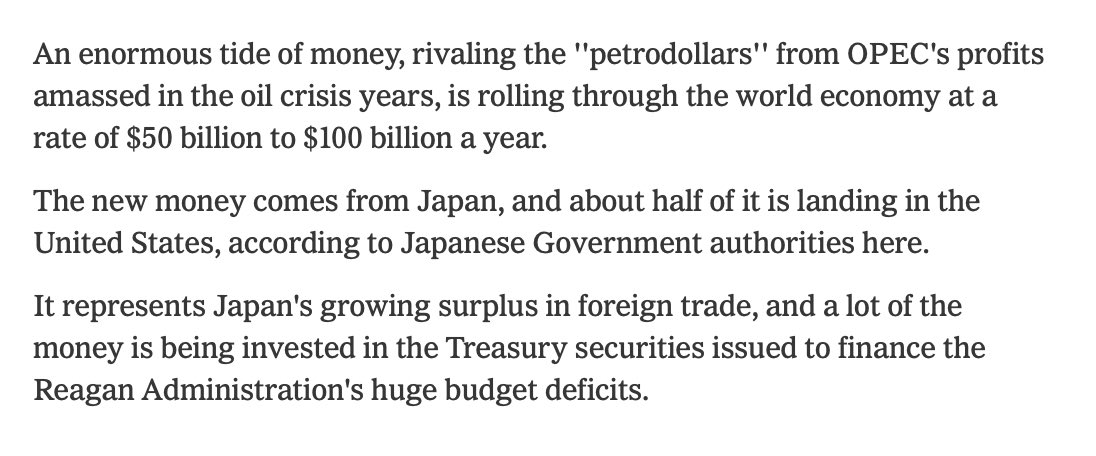

But who was buying all this debt?

But who was buying all this debt?

Japan.

By 1985, capital inflow attracted by these high interest rates meant that Japan owned more US-treasuries than any other country. But why buy only treasuries?

By 1985, capital inflow attracted by these high interest rates meant that Japan owned more US-treasuries than any other country. But why buy only treasuries?

Because after the collapse of Bretton Woods, the US began stipulating that dollars accrued through trade surplus could not be used to buy major American companies, only allowing them to be recycled back into the American economy to purchase debt securities.

With this, the USD had finally landed on a foundation seemingly more stable than gold: dollar recycling. This recycling became the way in which the US has been able to maintain both a budget deficit and a balance-of-payments deficit year-over-year, seemingly without consequence.

And while export countries gain a small but stable return from these US securities, they inadvertently finance the cost of surrounding themselves with 800 American military bases, which are then used to break any country that tries to form alternatives to this dollar system.

But this system of maintaining the dollar created a new problem: too much indebtedness to one country would pose a strategic threat. And with Japan now the primary debt holder, the US needed to throw a wrench in the engine driving Japan’s growing leverage.

Enter the Plaza Accord

Enter the Plaza Accord

Assembling leaders from the top 5 economies in Sept ’85, the Plaza accord was designed to boost US manufacturing and agricultural exports and lower the value of the US Treasury instruments purchased with the trade surpluses held by other countries. At least on paper.

But the true aim of the accord was to cripple Japan’s manufacturing-driven economy.

The plan had 2 parts. The 1st part was to decrease the value of the USD, while the 2nd was to deregulate Japan’s economy, loosen monetary policy / liberalize markets, and cut government spending.

The plan had 2 parts. The 1st part was to decrease the value of the USD, while the 2nd was to deregulate Japan’s economy, loosen monetary policy / liberalize markets, and cut government spending.

To accomplish the first, Germany agreed to dump a massive portion of its USD foreign reserves, flooding markets with USD and driving the relative value downward. The actual USD surplus that entered the market was less impactful than the implied threat of further intervention.

Almost overnight, the higher relative value of the yen made Japanese exports much less competitive. At the same time, Japanese capital was being incentivized by the US-backed deregulation of the Japanese economy into real estate, the stock market, and even more US treasuries.

The deregulation that followed also led to foreign capital flowing into Japan like a firehose. Tokyo’s stock market index rose 49% in the year after the accords. By 1989, it had risen 300% and Japanese stocks comprised almost half the entire world’s equity market cap.

As the newly available cheap credit created by the Bank of Japan congealed within Japan’s real estate sector, a massive asset price bubble began to grow.

In 1987, Washington piled on further to break the back of Japan’s manufacturing base by imposing 100% tariffs on $300 million worth of imports from Japan, effectively blocking them from the US market.

Eventually, Japan’s financialized frenzy had to end. On the eve of 1990, the real-estate and stock market bubbles finally popped, resulting in widespread collapse and sustained stagnation of Japan’s economic growth, beginning a period now known as “the lost decades”.

And while Japanese exports became more expensive overnight, productive capital couldn’t shift as quickly. It took another 5 years after the financial bubble popped before the actual productive output of Japan finally began to sputter.

Where did production shift to? In response to the tariffs, some production, such as Japanese auto manufacturers, relocated to the US, while the rest, particularly electronic goods, moved to China.

Given that this exact outcome was largely predictable at the outset of the accords, why did Japan agree to so thoroughly subordinate their own economy to US interests?

Because the post-WW2 US occupation of Japan never ended.

Because the post-WW2 US occupation of Japan never ended.

• • •

Missing some Tweet in this thread? You can try to

force a refresh