It's been a while since I've done one of these, so in this thread I will deconstruct ADFs (@team3dstocks) credit spread #Thufrirule trade from this past week. Let's start with Monday, prior week had huge selloff after fed meeting, open interest on puts was still decent -

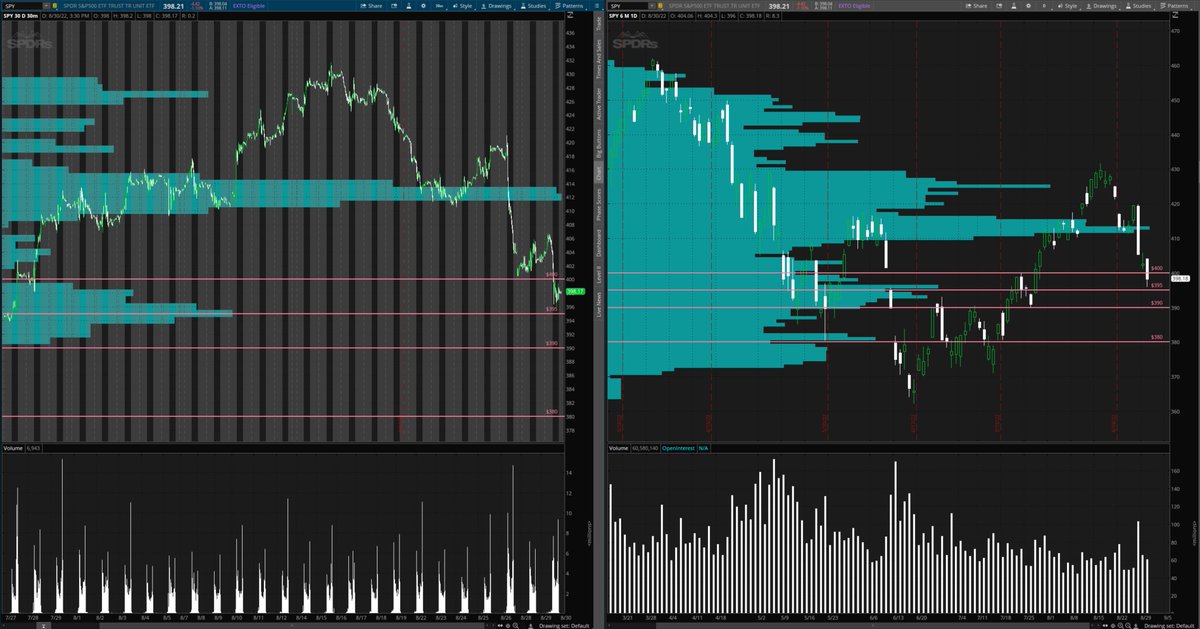

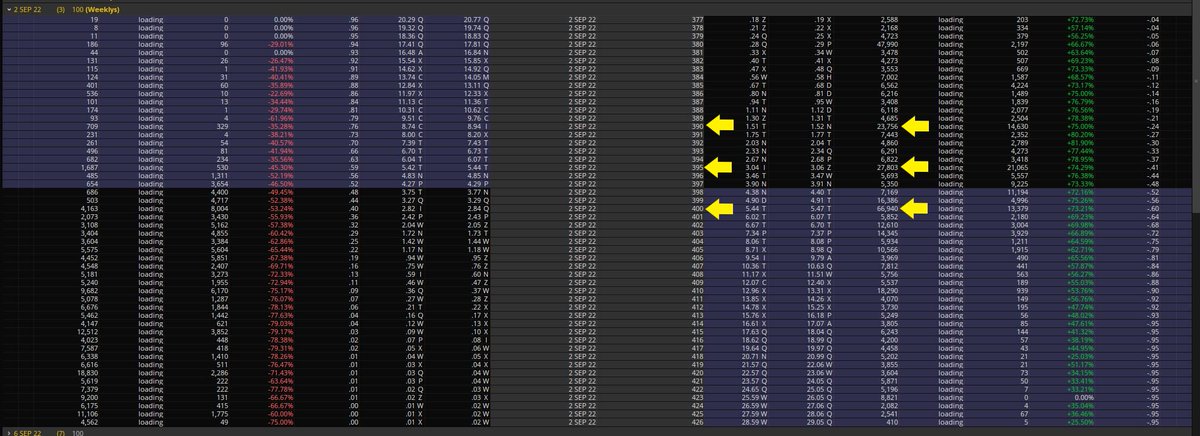

Here is the day (tues) ADF sold the first part at 395 & 390, the open interest on the 390 almost doubled this day. Notice the volume profile on the options at this point in time, along with the volume profile on $SPY. Supply and demand is clear.

Here is the day he added to the position, we had an increase in open interest this day, $SPY grinded lower. Notice the supply and demand on the actual option charts at this point.

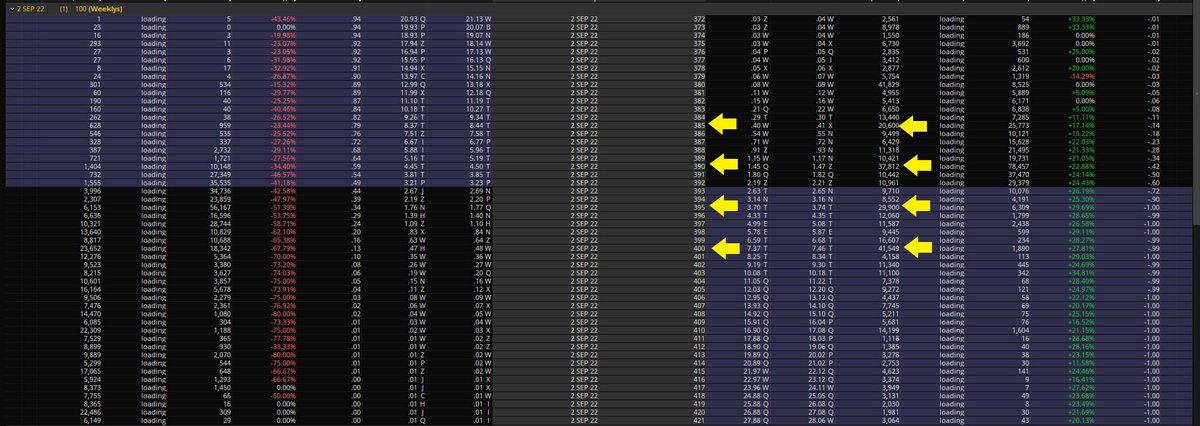

Thursday was the day open interest on the 390 increased even more, AND the SPY chart bounced off 390, notice the volume profile on SPY. This is where the chart aligned with the option chain and created timing for the bounce

Finally, Friday, after the bounce off 390 on thursday and push into end of day, people long puts were in big trouble, so what happens, a gap up and the puts are all worthless friday morning, time to take profits. Notice how $SPY volume profile lines up with options chain levels.

-So we can boil this down pretty effectively-

1) Panic selloff on $spy

2) Open interest increasing at OTM levels as it sells off more

3) $SPY chart begins to align with the option strikes that have high open interest

4) volume profile shows supply and demand

5) Options get bagged

1) Panic selloff on $spy

2) Open interest increasing at OTM levels as it sells off more

3) $SPY chart begins to align with the option strikes that have high open interest

4) volume profile shows supply and demand

5) Options get bagged

- The execution is where a lot of people will mess up because they want to be risk averse, but the market pays you to take other peoples risk on, especially people who FOMO and chase. This is the general profile of how a credit will play out. It just needs to hold above a level.

• • •

Missing some Tweet in this thread? You can try to

force a refresh