Thread 🧵

Now you can pay Income Tax via Debit Card, Credit Card, UPI too @IncomeTaxIndia

#incometax #upi

Please note, this is available when you pay taxes through Income Tax Portal and not from @Protean_Tech website.

Now you can pay Income Tax via Debit Card, Credit Card, UPI too @IncomeTaxIndia

#incometax #upi

Please note, this is available when you pay taxes through Income Tax Portal and not from @Protean_Tech website.

Earlier, tax payments majorly were done using 2 modes. Internet Banking or Physically visiting Bank.

Now you can pay via :

👉UPI

👉Internet Banking

👉Debit Card

👉Credit Card

👉Over the Counter

👉NEFT/RTGS

Now you can pay via :

👉UPI

👉Internet Banking

👉Debit Card

👉Credit Card

👉Over the Counter

👉NEFT/RTGS

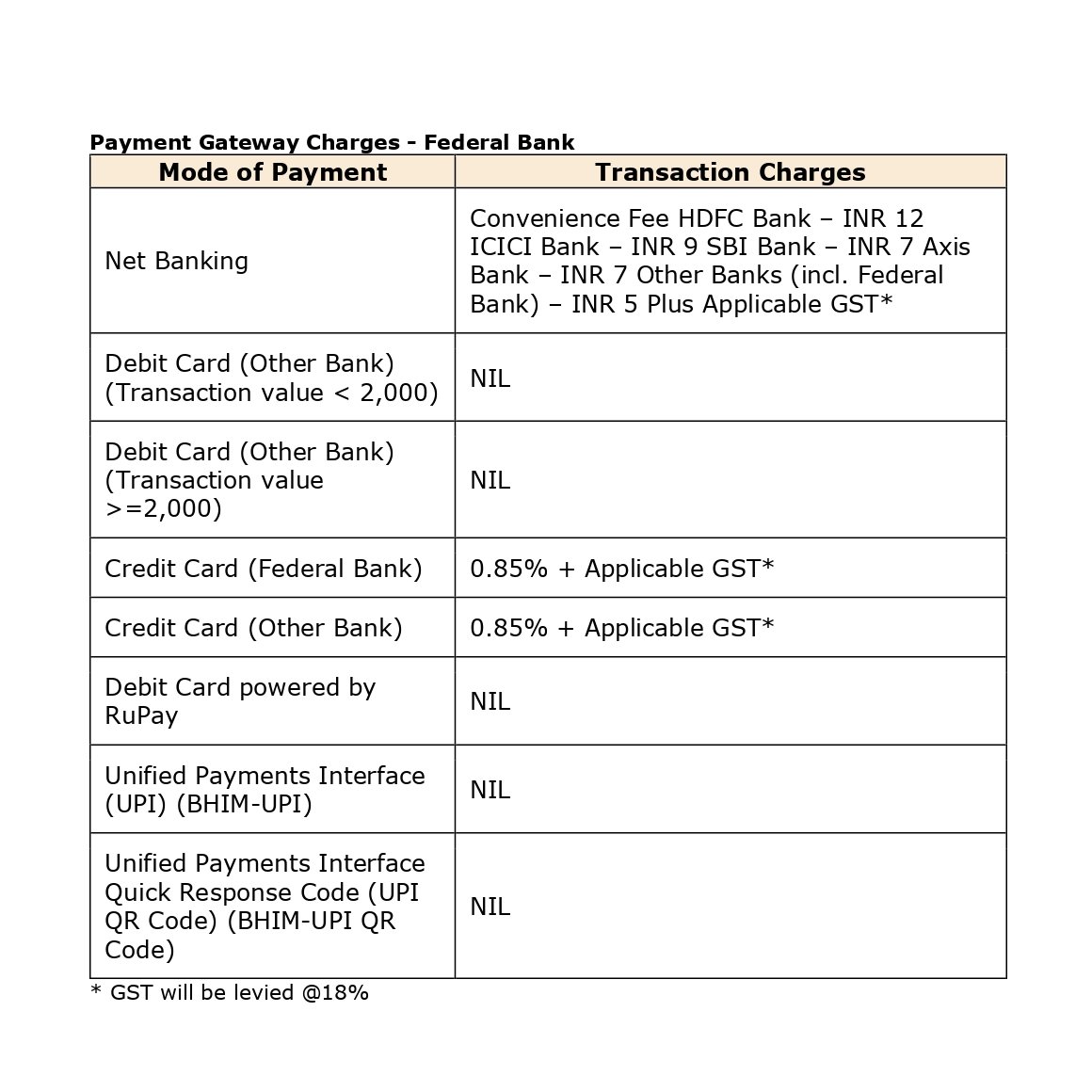

Paying through UPI, Debit Cards or Rupay Debit Card does not attract any transaction charges.

Income Tax systems using payment gateway of @FederalBankLtd

Snapshot of transaction charges 👇👇

Income Tax systems using payment gateway of @FederalBankLtd

Snapshot of transaction charges 👇👇

Good part is Email & Text communications receiving at the time making payments and on completion as well. Thanks @IncomeTaxIndia

This was long due. 🙏

Email communication mentioned that challan attached but not received paid challan copy. Challan after payment 👇

This was long due. 🙏

Email communication mentioned that challan attached but not received paid challan copy. Challan after payment 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh