Liquidity Book: DeFit Learning 🧵 #2

One of the biggest advantages of the Liquidity Book is the level of customisability and efficiency it enables through its bin design and unique liquidity structures that can be deployed ... 👇

One of the biggest advantages of the Liquidity Book is the level of customisability and efficiency it enables through its bin design and unique liquidity structures that can be deployed ... 👇

Liquidity providers can choose and build positions that suit their own needs and goals, something that is simply impossible in DEXes of previous generations

Every user can independently pick bins they want to supply their tokens to or select from pre-defined liquidity structures

Every user can independently pick bins they want to supply their tokens to or select from pre-defined liquidity structures

Liquidity Book opens possibilities for your strategy

• Opt for easier management with a gaussian shape

• Minimize IL with a less concentrated approach

• Concentrate your liquidity to max your fees

• Capture volatility by buying low and selling high

• Opt for easier management with a gaussian shape

• Minimize IL with a less concentrated approach

• Concentrate your liquidity to max your fees

• Capture volatility by buying low and selling high

The choice depends on the market outlook and risk profile of every liquidity provider.

Some users might deposit everything into a few bins, while others might opt for a more balanced approach and spread liquidity into many bins.

Some users might deposit everything into a few bins, while others might opt for a more balanced approach and spread liquidity into many bins.

Because bins are effectively constant sum pools, the Liquidity Book buys and sells tokens inside one bin at a constant price

In practice, this means that there is ZERO price impact as long as a swap is performed using liquidity from only one bin

Swap 1, get 1...#BecauseBins

In practice, this means that there is ZERO price impact as long as a swap is performed using liquidity from only one bin

Swap 1, get 1...#BecauseBins

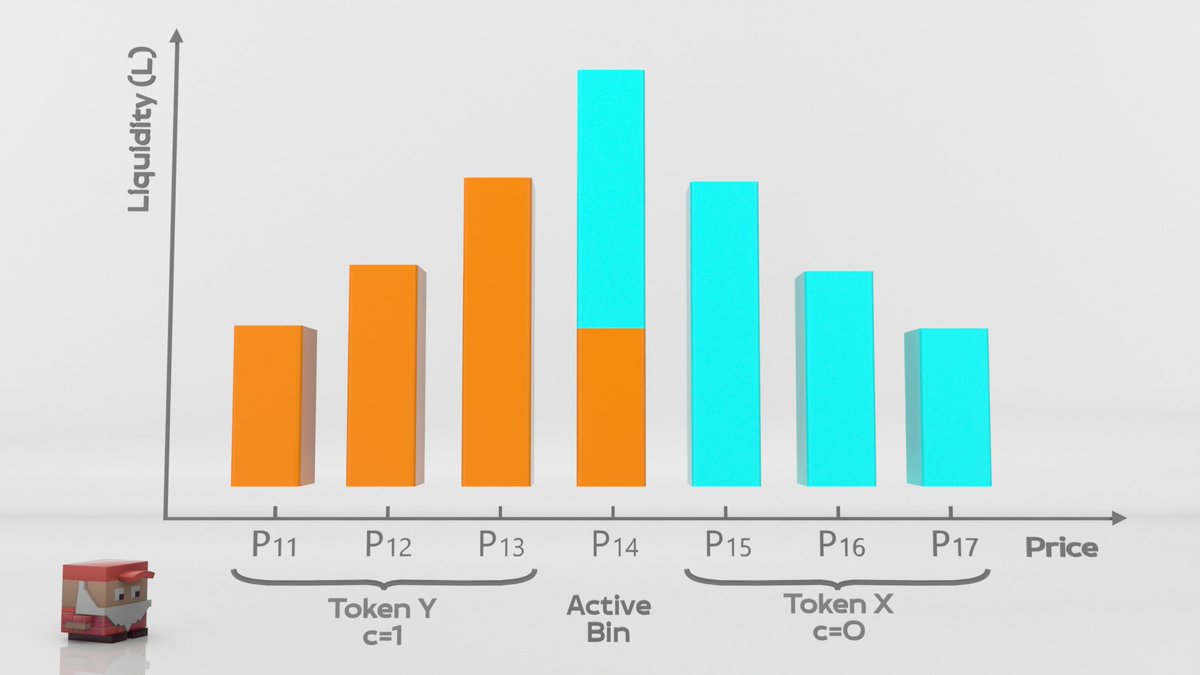

In Liquidity Book, the current market price is defined as a price assigned to a bin that holds both assets in a pair.

As reserves of one of the tokens in the bin become depleted during swap activity, the price moves to the next bin, and it becomes "active".

As reserves of one of the tokens in the bin become depleted during swap activity, the price moves to the next bin, and it becomes "active".

Bins above or below the current "active" bin will hold only one of the assets (see above graphic), allowing for single-sided liquidity provision for those who want to capitalise on future price movements.

Bin Architecture: The Liquidity Book protocol aggregates liquidity from all bins, for each token pair, into one complete structure and uses it to facilitate trading.

• • •

Missing some Tweet in this thread? You can try to

force a refresh