Shoprite Group has plans to open 275 supermarkets in South Africa in 2023, and a majority of those will serve lower income customers.

Shoprite Group’s revenue stands at R184 billion with a trading profit of R11 billion.

Liquor stores had R10.8bn in sales.

[Thread]

Shoprite Group’s revenue stands at R184 billion with a trading profit of R11 billion.

Liquor stores had R10.8bn in sales.

[Thread]

Shoprite Group is the largest South African retailer by market cap, sales, profit and number of employees and customers.

Shoprite is the second biggest employer after the government with 149 000 employees.

It owns numerous brands such as; Shoprite, Checkers, uSave, OK.

Shoprite is the second biggest employer after the government with 149 000 employees.

It owns numerous brands such as; Shoprite, Checkers, uSave, OK.

Shoprite Holdings segments the market into the following Living Standards Measure (LSMs);

Checkers and Checkers Hyper: upper

Shoprite: middle

uSave: lower

Checkers and Checkers Hyper: upper

Shoprite: middle

uSave: lower

Why is Shoprite directing its efforts into serving the lower income customers and what is it doing about it?

1) sales growth expected in the South African grocery market by 2025, and

2) buying stores who operate in the lower LSM.

1) sales growth expected in the South African grocery market by 2025, and

2) buying stores who operate in the lower LSM.

1) sales growth expected.

The former Pick n’ Pay CEO Richard Brasher stated that of the R200 billion in sales growth expected in the South African grocery market to 2025, R140 billion will come from the discount market.

Shoprite wants a lion’s share of this expected growth.

The former Pick n’ Pay CEO Richard Brasher stated that of the R200 billion in sales growth expected in the South African grocery market to 2025, R140 billion will come from the discount market.

Shoprite wants a lion’s share of this expected growth.

2) buying stores who operate in the lower LSM.

In 2021, Massmart appointed Barclay's to facilitate the disposal of Cambridge Food, Rhino and Massfresh (comprising The Fruitspot and a meat processing facility) assets.

Window of opportunity opened for Shoprite.

In 2021, Massmart appointed Barclay's to facilitate the disposal of Cambridge Food, Rhino and Massfresh (comprising The Fruitspot and a meat processing facility) assets.

Window of opportunity opened for Shoprite.

20 Aug 2021, Shoprite agreed to buy following stores for R1.4bn from Massmart;

Cambridge Food business & Rhino Cash and Carry business (56 grocery stores in total + 43 liquor stores),

Fruitspot and Massfresh Meat comprising 4 facilities, and

12 Masscash Cash and Carry stores.

Cambridge Food business & Rhino Cash and Carry business (56 grocery stores in total + 43 liquor stores),

Fruitspot and Massfresh Meat comprising 4 facilities, and

12 Masscash Cash and Carry stores.

Early May 2022, the South African Competition Commission recommended that the Competition Tribunal approve Shoprite Supermarket’s R1.4bn proposed acquisition of the Cambridge Food, et al subject to competition and public interest conditions.

Shoprite will be adding 43 retail liquor stores operated under Massmart’s Rhino and Cambridge brands; 10 wholesale (cash and carry) stores; two wholesale liquor stores to the 537 stand-alone liquor stores operated by Shoprite and Checkers.

The close competitors have the following liquor stores;

Spar - 842 Tops stores.

Pick n’ Pay - 508 liquor stores as well as 87 Boxer liquor stores.

May 2021, Woolworths opened its first standalone liquor store

Spar - 842 Tops stores.

Pick n’ Pay - 508 liquor stores as well as 87 Boxer liquor stores.

May 2021, Woolworths opened its first standalone liquor store

The Shoprite Group is big and has the following number of stores* in South Africa;

Shoprite: 523

Usave: 398

Checkers: 230

Checkers Hyper: 38

House & Home: 39

OK Furniture: 301

Medirite: 145

*as at 31 Dec 2021.

Shoprite: 523

Usave: 398

Checkers: 230

Checkers Hyper: 38

House & Home: 39

OK Furniture: 301

Medirite: 145

*as at 31 Dec 2021.

Shoprite is going some crazy numbers based off its results for the 52 weeks to 3 July 2022.

Its core South African supermarket segment which is 80% of Group sales ⬆️ sales by 10.1%.

Shoprite & Usave which make up 52.8% of segment ⬆️ sales by 7.2%.

LiquorShop sales ⬆️ by 44.5%

Its core South African supermarket segment which is 80% of Group sales ⬆️ sales by 10.1%.

Shoprite & Usave which make up 52.8% of segment ⬆️ sales by 7.2%.

LiquorShop sales ⬆️ by 44.5%

The total group sales were up 9.6% to R184 billion with a trading profit of R11 billion.

If you break down the sales further, this is what you find;

Shoprite and uSave had R77.9bn in sales,

Checkers and Checkers Hyper had R58.7bn in sales,

Liquor stores had R10.8bn in sales.

If you break down the sales further, this is what you find;

Shoprite and uSave had R77.9bn in sales,

Checkers and Checkers Hyper had R58.7bn in sales,

Liquor stores had R10.8bn in sales.

Shoprite Group has 24.7 million members on its Shoprite and Checkers Xtra Savings Rewards Programme. This is like half of our population.

R9.4bn back in Xtra Savings discounts were “given” to customers.

R9.4bn back in Xtra Savings discounts were “given” to customers.

Shoprite was not spared from the July 2021 unrest.

231 of its stores were impacted.

37 stores have not re-opened, 10 of which have been permanently closed.

Shoprite was able to claim R1.6bn from insurances.

231 of its stores were impacted.

37 stores have not re-opened, 10 of which have been permanently closed.

Shoprite was able to claim R1.6bn from insurances.

Does Shoprite Group have the necessary resources to open 275 supermarkets in South Africa in 2023?

Shoprite Group’s 2022 capex guidance is R4.8bn and R5.9bn for 2023 (excludes investment capital for acquisitions).

31.8% of the capex will go towards new stores and upgrades.

Shoprite Group’s 2022 capex guidance is R4.8bn and R5.9bn for 2023 (excludes investment capital for acquisitions).

31.8% of the capex will go towards new stores and upgrades.

Shout out for making it to the very end.

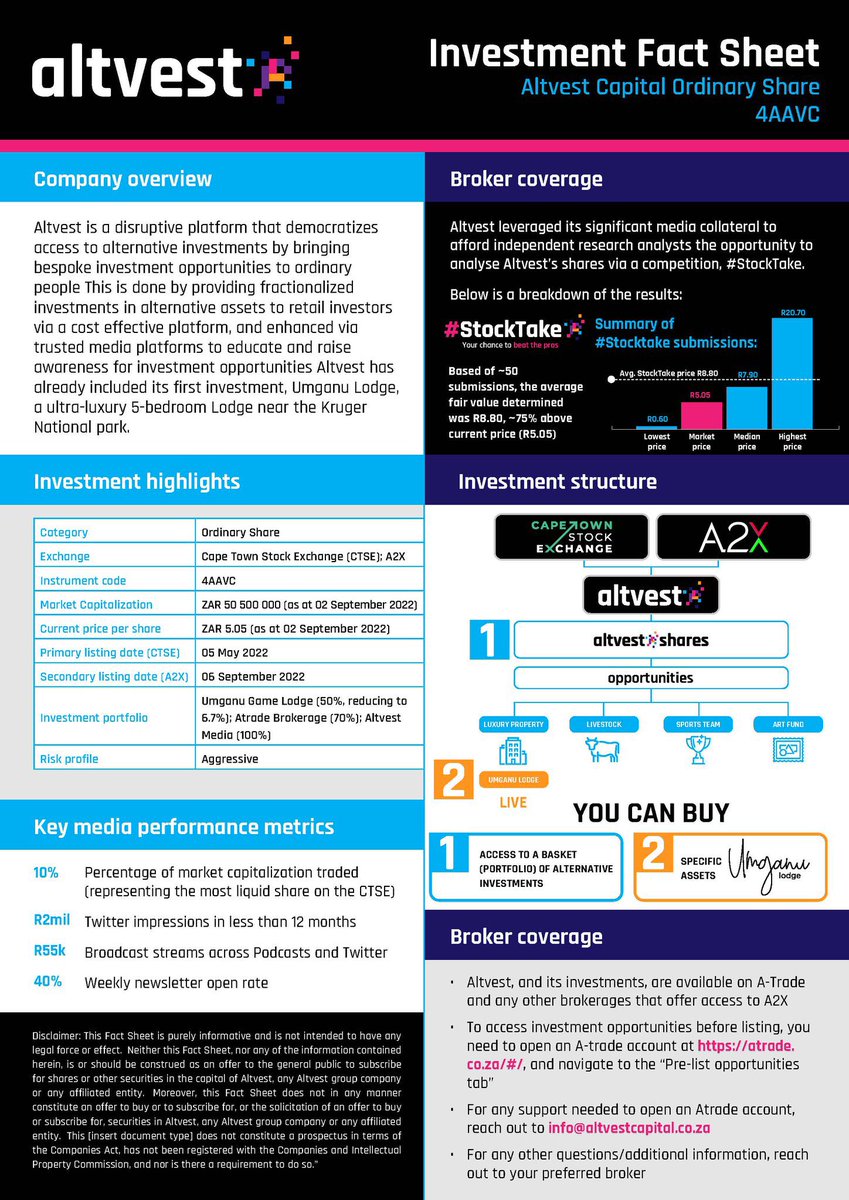

@CapitalAltvest has a primary listing on the Cape Town Stock Exchange (@CTSE_Group) and now has a secondary listing on @A2X_Markets. See attached image for more info on Altvest and quoted thread.

@CapitalAltvest has a primary listing on the Cape Town Stock Exchange (@CTSE_Group) and now has a secondary listing on @A2X_Markets. See attached image for more info on Altvest and quoted thread.

https://twitter.com/CapitalAltvest/status/1567132767200153602

Thread compiled by @MaanoMadima

• • •

Missing some Tweet in this thread? You can try to

force a refresh