🕵️♀️The term "Multi-Ledger" hasn't been a term thats been used much. 99% been cross ledger interoperability.

$QNT is one of the few if not only solving multi scale interoperability

So when we hear "multi" solutions. Its definitely worth looking into

A 🧵 on Multiledgers📒📒📒

$QNT is one of the few if not only solving multi scale interoperability

So when we hear "multi" solutions. Its definitely worth looking into

A 🧵 on Multiledgers📒📒📒

⭐️To start, what is Multiledgers?

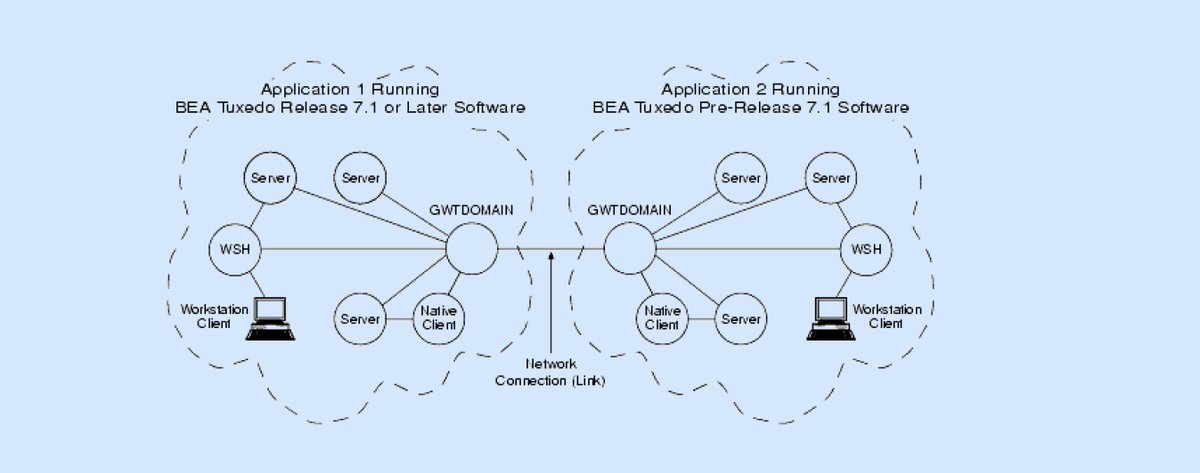

They're an IT Services company focused on offering cloud & blockchain solutions. But notice the way they're wording their operations

"Agnostic platform for MULTI cloud & MULTI blockchain protocols" 🤔

Definitely heard that somewhere before

They're an IT Services company focused on offering cloud & blockchain solutions. But notice the way they're wording their operations

"Agnostic platform for MULTI cloud & MULTI blockchain protocols" 🤔

Definitely heard that somewhere before

🔍Looking at their the services they offer, it also seems very $QNT-esque with the concepts of multi blockchain protocols w Hyperledger, Corda n Quorum

Additionally they've already collaborated w R3's Corda & an option to add new networks🤔

Quite a rare solution to show off

Additionally they've already collaborated w R3's Corda & an option to add new networks🤔

Quite a rare solution to show off

The other network they offer on their platform is none other than @LACChain, so it only makes sense they're also in this alliance alongside guys like $QNT, $AVAX Telefonica, Alastria, etc.

🇧🇷The first Brazilian company to do so!

🇧🇷The first Brazilian company to do so!

The partners collaborating within their ecosystem also seem pretty interesting💡

✅R3 connect always good sign for enterprise use cases

✅ITU X $QNT Connections thru TC307 collab

✅BID Labs=LACChain

✅R3 connect always good sign for enterprise use cases

✅ITU X $QNT Connections thru TC307 collab

✅BID Labs=LACChain

The next obvious step was to dig further for connections internally within their team to find more that tied to $QNT & #TC307

What we discovered seems to REALLY tie it altogether

🔽🔽🔽🔽🔽

What we discovered seems to REALLY tie it altogether

🔽🔽🔽🔽🔽

First off, their CEO Marcela Gonçalves

ITU member serving as Multiledgers Delegate. UN specialized agency for telecommunications collaborating w other SSBs like ISO/ETSI

But the highlights here are in her 5 years as a freelance researcher, working w ISO/ITU/RNP & healthcare🤯

ITU member serving as Multiledgers Delegate. UN specialized agency for telecommunications collaborating w other SSBs like ISO/ETSI

But the highlights here are in her 5 years as a freelance researcher, working w ISO/ITU/RNP & healthcare🤯

🖥️Their CTO, Paulo Brizola

While a bit less experience than Marcela working with other SSBs we see he also was an ITU member for blockchain research in reference architecture for DLT

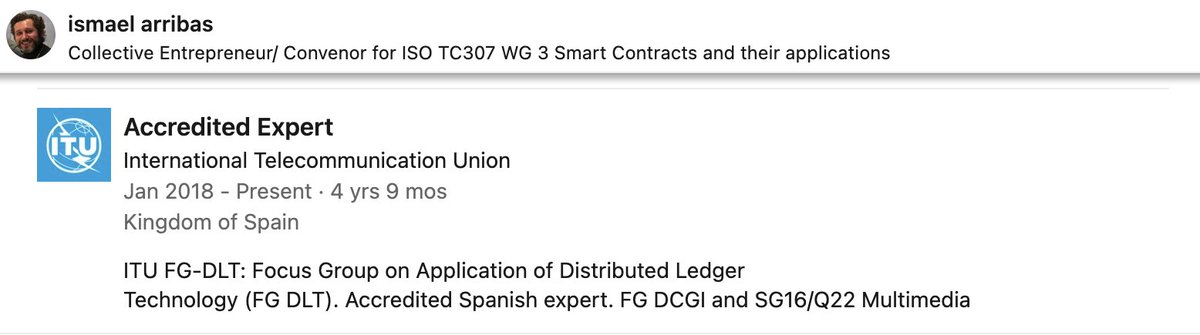

This is quite similar to @INATBA standardization co chair Ismael's experience within the ITU🖇️

While a bit less experience than Marcela working with other SSBs we see he also was an ITU member for blockchain research in reference architecture for DLT

This is quite similar to @INATBA standardization co chair Ismael's experience within the ITU🖇️

🗺️For anyone unaware of Ismael, he serves as a TC307 liasion & delegate for Spain.

Just about 90% of his activity has some times to $QNT & recently some MultiLedger interaction

(His LinkdeIn is a gold mine for $QNT researchers)🪙

Just about 90% of his activity has some times to $QNT & recently some MultiLedger interaction

(His LinkdeIn is a gold mine for $QNT researchers)🪙

https://twitter.com/Tokenicer/status/1564685142119297024?s=20&t=2enBmM2TYO3gUBeVxHUGBQ

🪟MultiLedger another white-label of Overledger? Potentially, plenty of leads that would agree from their CEOs time within ISO/ITU to their collabs w R3 & LACChain

But what I personally find the most fascinating is Ismael's & ITU's connections to the overall picture of $QNT 🖼️

But what I personally find the most fascinating is Ismael's & ITU's connections to the overall picture of $QNT 🖼️

If you guys enjoyed this thread, a follow/retweet would be much appreciated to spread the knowledge🤍

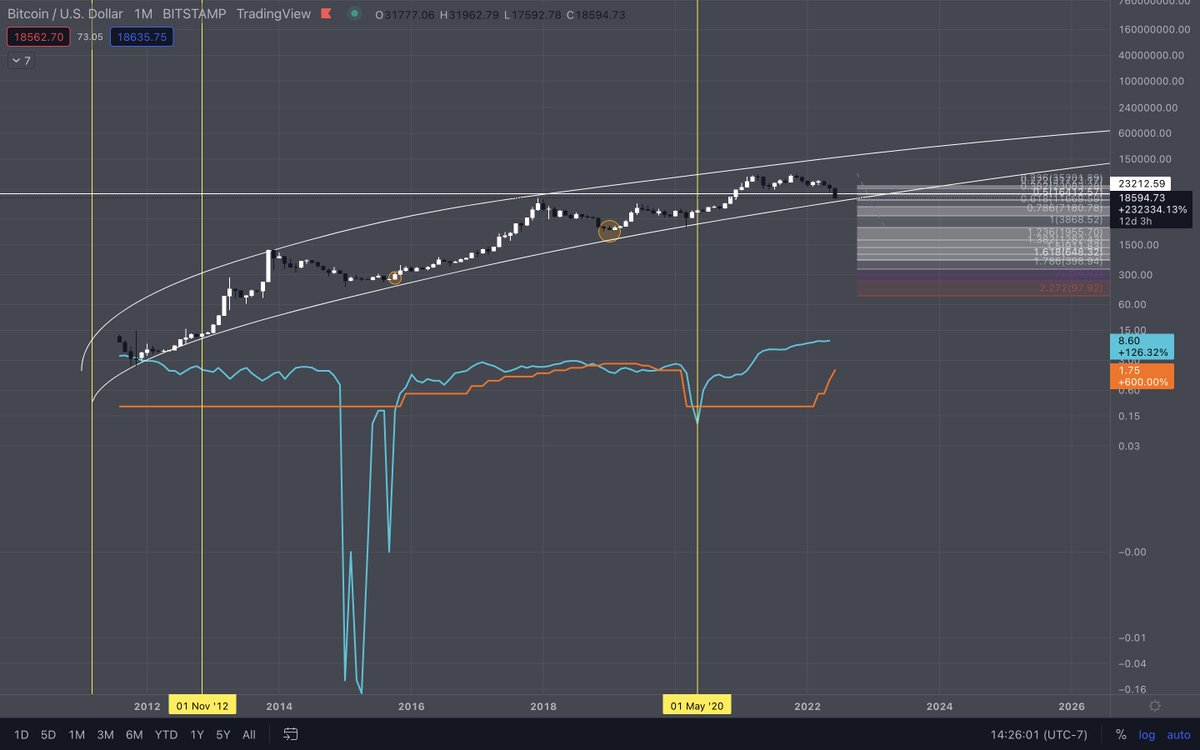

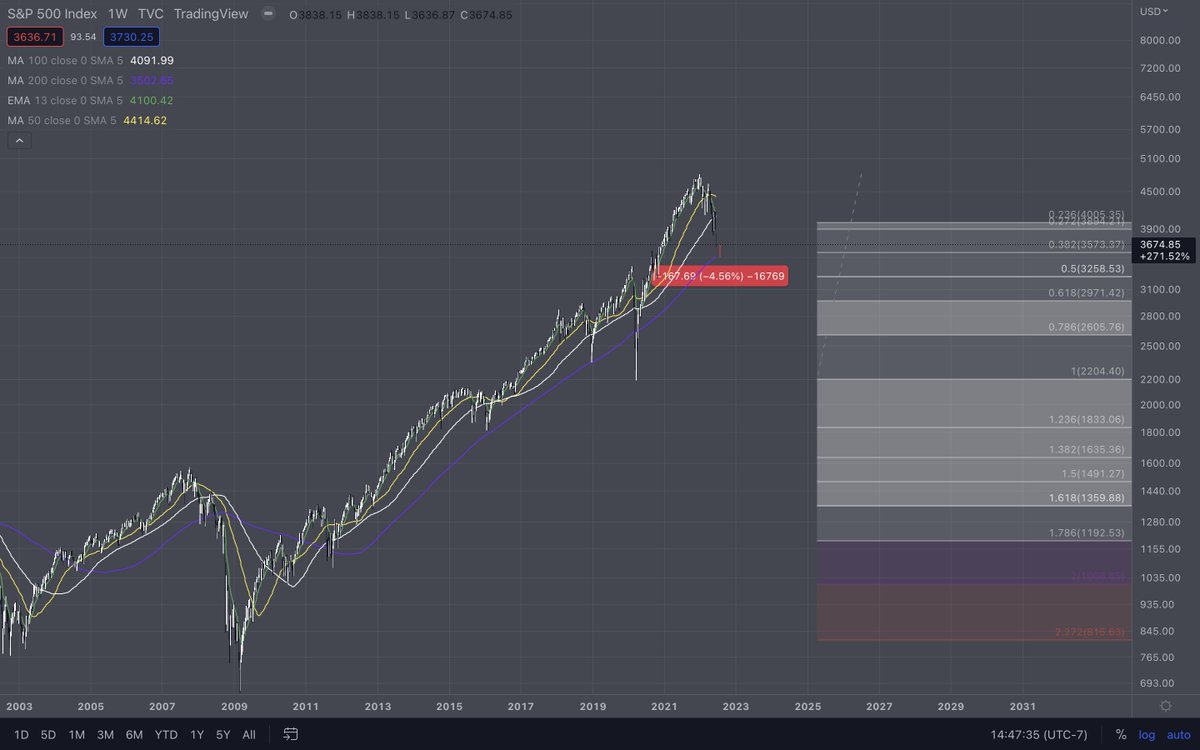

I do my best to bring quality DLT research revolving around subjects like $QNT $DAG $HBAR $LCX Hyperledger, Corda, ISO & more utility networks🌐

I do my best to bring quality DLT research revolving around subjects like $QNT $DAG $HBAR $LCX Hyperledger, Corda, ISO & more utility networks🌐

https://twitter.com/Tokenicer/status/1567268348320432131?s=20&t=H_L90ITi5fDkHgXtXQ7-Cg

• • •

Missing some Tweet in this thread? You can try to

force a refresh