Available inventory of homes for sale is now declining for the season.

553,000 single family homes on the market.

Prices ticking down too.

This week's (belated!) @AltosResearch real estate market update 🧵📽️👇

1/6

553,000 single family homes on the market.

Prices ticking down too.

This week's (belated!) @AltosResearch real estate market update 🧵📽️👇

1/6

We'll quite obviously finish 2022 with fewer than 500,000 single family homes on the market.

Will homeowners *ever* unload their amazing investments?!

Buyers will face a pretty severe shortage again next year 😰

2/6

Will homeowners *ever* unload their amazing investments?!

Buyers will face a pretty severe shortage again next year 😰

2/6

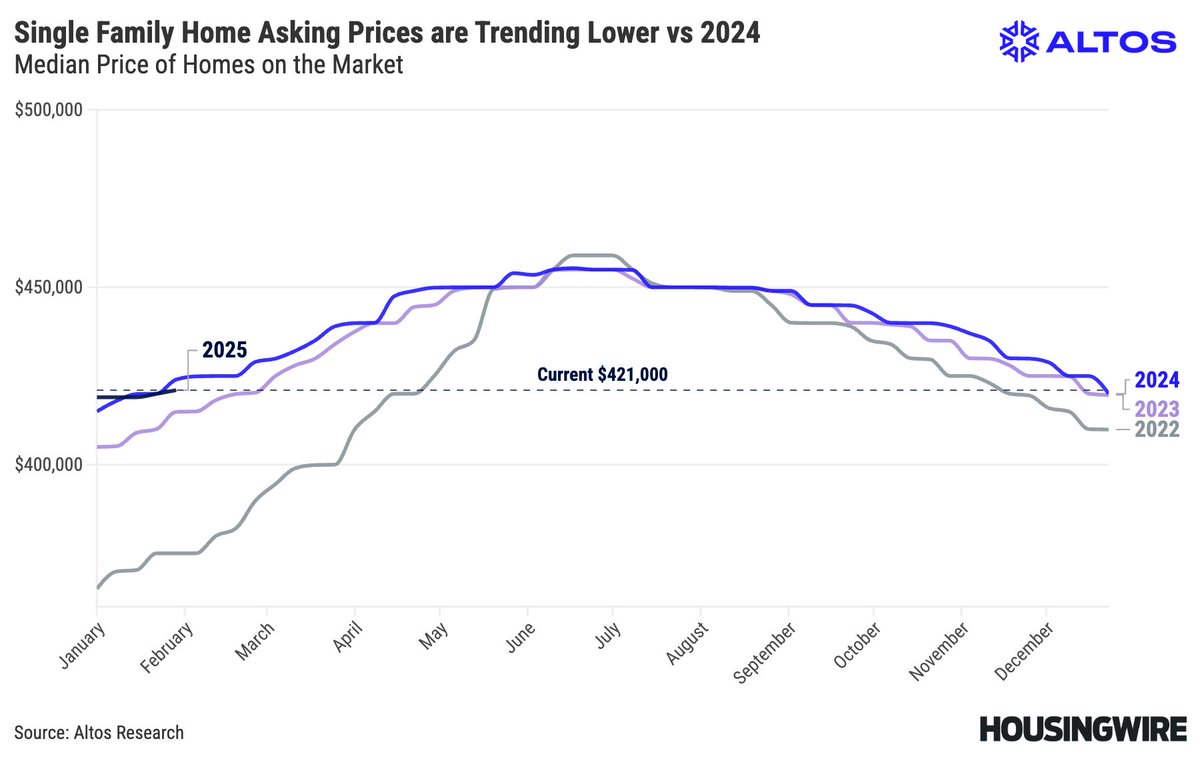

Home prices are ticking down.

Median price of single family homes in the US is $440,000 this week.

Seasonal declines in prices will continue through the end of the year.

We'll end 2022 with about 10% home price gains over 2021.

3/6

Median price of single family homes in the US is $440,000 this week.

Seasonal declines in prices will continue through the end of the year.

We'll end 2022 with about 10% home price gains over 2021.

3/6

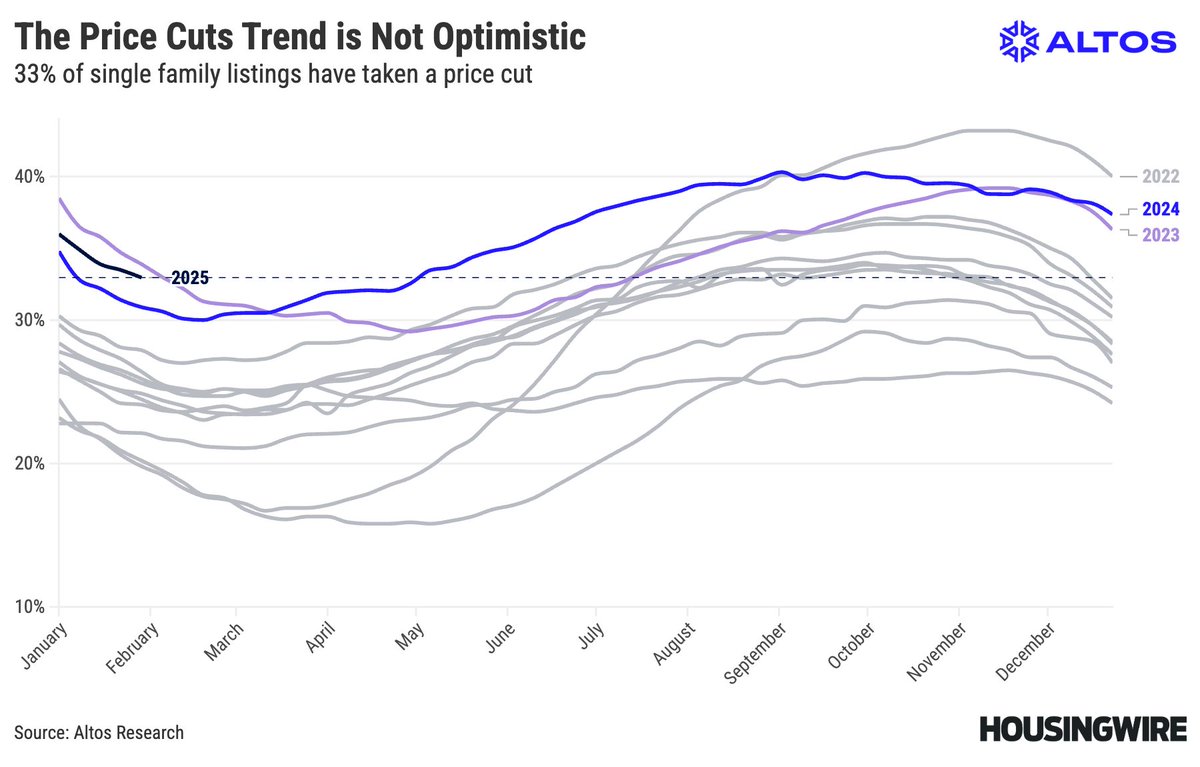

Price reductions show weakness in buyer demand.

The percent of homes that have taken a price cut from original list price climbed over 40% now.

Price reductions will keep climbing through October.

If we reach 45%, that'll be quite bearish for home prices in 2023.

4/6

The percent of homes that have taken a price cut from original list price climbed over 40% now.

Price reductions will keep climbing through October.

If we reach 45%, that'll be quite bearish for home prices in 2023.

4/6

Our immediate sales tracker has become more useful in showing how few properties are hitting the market each week now.

It's kinda incredible how abruptly sellers hit the brakes.

It's Labor Day week so we'll have fewer still new listings in next week's data.

5/6

It's kinda incredible how abruptly sellers hit the brakes.

It's Labor Day week so we'll have fewer still new listings in next week's data.

5/6

Here's the video with the detail on how inventory of homes for sale is declining.

What a surprise from even just a few weeks ago.

We'll end the year with fewer than 500k homes on the market. Wild.

6/6

What a surprise from even just a few weeks ago.

We'll end the year with fewer than 500k homes on the market. Wild.

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh