Have you ever heard the story of The Immaculate Rebalance?

Gather ‘round and I’ll tell the tale...

Gather ‘round and I’ll tell the tale...

https://twitter.com/choffstein/status/1567935668310970371

Back in the pre-GFC days, Rob Arnott was running around telling everyone he could about his new Fundamental Indexing approach.

(Annoying folks like Cliff Asness along the way: aqr.com/-/media/AQR/Do…)

(Annoying folks like Cliff Asness along the way: aqr.com/-/media/AQR/Do…)

Now Fundamental Indexing was a rather simple idea: Weight stocks in proportion to fundamental variables.

In the original 2005 paper the authors rebalanced the portfolio once a year in December.

papers.ssrn.com/sol3/papers.cf…

In the original 2005 paper the authors rebalanced the portfolio once a year in December.

papers.ssrn.com/sol3/papers.cf…

Later they would launch the FTSE/RAFI indexes based on the concept.

These indexes were also rebalanced once per year.

The date chosen in was the third Friday of March.

These indexes were also rebalanced once per year.

The date chosen in was the third Friday of March.

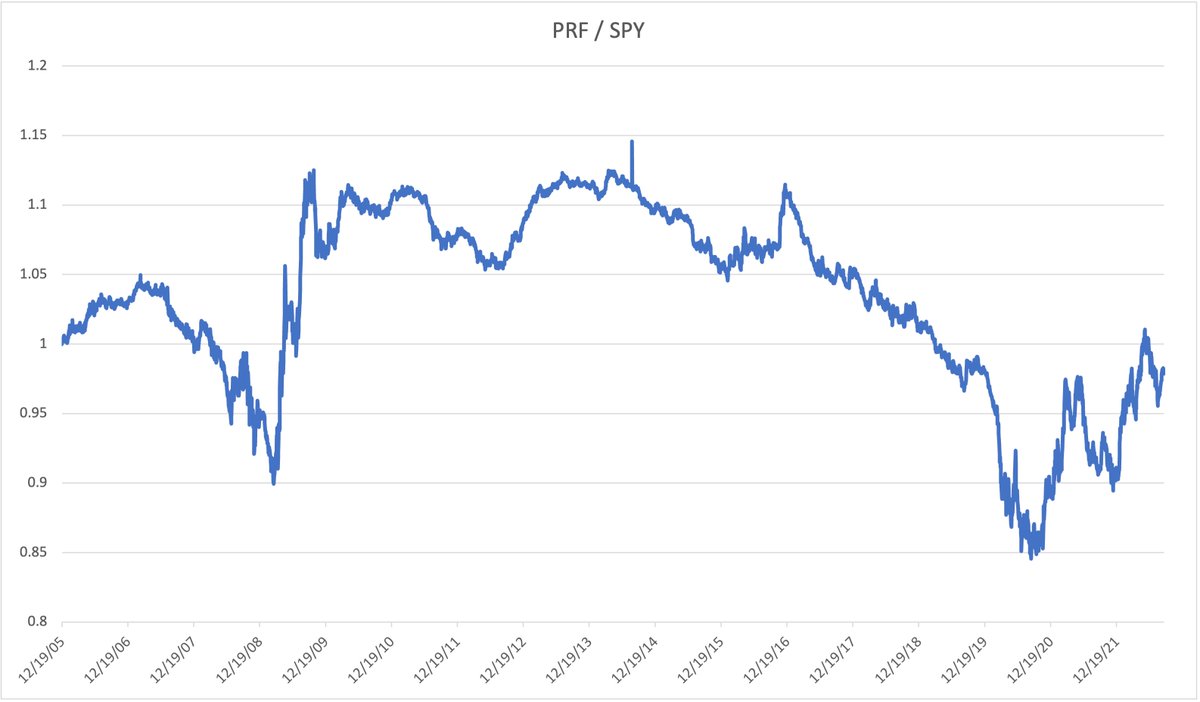

In December 2005, the ETF $PRF was launched to track this index.

We can compare it’s performance to the S&P 500 (SPY) and see that something rather BIG happened in 2009.

We can compare it’s performance to the S&P 500 (SPY) and see that something rather BIG happened in 2009.

That rocket ride up in relative performance in 2009 starts in March.

But the market also generally bottomed in March 2009.

So is this just a case where Fundamental Indexing went on to outperform, or is something else happening?

But the market also generally bottomed in March 2009.

So is this just a case where Fundamental Indexing went on to outperform, or is something else happening?

In 2010, Blitz, van der Grient, and van Vliet investigated.

Their question was simple: what would have happened if the FTSE/RAFI index had rebalanced at a different time of the year?

papers.ssrn.com/sol3/papers.cf…

Their question was simple: what would have happened if the FTSE/RAFI index had rebalanced at a different time of the year?

papers.ssrn.com/sol3/papers.cf…

So they replicated every part of the process.

The only thing they changed was the date the index rebalanced.

And what they found was pretty eye opening:

The relative out-performance versus the benchmark varied WILDLY depending upon the rebalance date.

The only thing they changed was the date the index rebalanced.

And what they found was pretty eye opening:

The relative out-performance versus the benchmark varied WILDLY depending upon the rebalance date.

What’s the intuition here?

Well, let’s say you follow a bunch of rules to pick value stocks.

If you follow those rules to pick stocks every June, you might end up with a very different basket of stocks had you picked them in December!

Well, let’s say you follow a bunch of rules to pick value stocks.

If you follow those rules to pick stocks every June, you might end up with a very different basket of stocks had you picked them in December!

If the FTSE/RAFI index had rebalanced in September instead of March, it would’ve had *negative* alpha in 2009, rather than the 10%+ out-performance it posted.

That kind of difference makes and breaks careers.

All over an arbitrary rebalance date.

That kind of difference makes and breaks careers.

All over an arbitrary rebalance date.

To their credit, FTSE/RAFI eventually acknowledged this rebalance timing luck risk and decided to adopt staggered rebalancing.

research.ftserussell.com/products/downl…

research.ftserussell.com/products/downl…

And their research demonstrated that the dispersion in returns could be quite massive based upon this arbitrary decision, even if you increased the frequency with which you rebalance!

So they adopted staggered rebalancing as a fix.

Basically, “diversification over time.”

Create a bunch of sub-portfolios and rebalance them in a staggered fashion, eliminating the emphasis of a specific rebalance date.

Basically, “diversification over time.”

Create a bunch of sub-portfolios and rebalance them in a staggered fashion, eliminating the emphasis of a specific rebalance date.

While Research Affiliates has “fixed” the problem going forward, that Immaculate Rebalance back in 2009 forever lives in their returns.

Of course, this is the part where I hope you realize that… well, this stuff is everywhere.

Benchmarks that reconstitute annually? Timing luck.

Strategic allocations that rebalance annually? Timing luck.

Benchmarks that reconstitute annually? Timing luck.

Strategic allocations that rebalance annually? Timing luck.

Hedged equity that resets its put spread quarterly? Timing luck.

https://twitter.com/choffstein/status/1565334679330357249

If it happens on a schedule, there’s rebalance timing luck in there. It’s just a question of “how much.”

As far as I know, there’s like 3 papers in the world on this subject. Nobody cares.

Except me.

As far as I know, there’s like 3 papers in the world on this subject. Nobody cares.

Except me.

Here’s some stuff I’ve written on it.

jii.pm-research.com/content/10/1/27

papers.ssrn.com/sol3/papers.cf…

jii.pm-research.com/content/10/1/27

papers.ssrn.com/sol3/papers.cf…

• • •

Missing some Tweet in this thread? You can try to

force a refresh