#MEGAFLEX #SMEIPO

Biz

-Mfg of Leno Bags used for packaging agri prod. like potatoes, onions, garlic, coconuts, fruits & vegies

- also mfg. Woven PP Fabric & Sutli (Fibrillated Twisted Thread)

-trading of Polypropylene Granules.

- 148 Emp

1/n

Biz

-Mfg of Leno Bags used for packaging agri prod. like potatoes, onions, garlic, coconuts, fruits & vegies

- also mfg. Woven PP Fabric & Sutli (Fibrillated Twisted Thread)

-trading of Polypropylene Granules.

- 148 Emp

1/n

Biz

- Mfg plant in Howrah, WB with captive power generation unit, UPS, water treatment plant

- production capacity of 60 looms & 51.30 million Bags /year

- export Leno Bags to Poland for 2 years

2/n

- Mfg plant in Howrah, WB with captive power generation unit, UPS, water treatment plant

- production capacity of 60 looms & 51.30 million Bags /year

- export Leno Bags to Poland for 2 years

2/n

Biz

-Sales mainly in WB due 2 capacity constraints but have started selling in last 2-3 years to UP, BH, RJ, MP & PN

- Top 10 cust 86.44% in 22,

- Top 10 suppliers 96.39% in 22

- Rev from WB 89.17%in 22

- Export of 0.85% & 1.47% in 21 and 20

Peers-

No listed Peers

3/n

-Sales mainly in WB due 2 capacity constraints but have started selling in last 2-3 years to UP, BH, RJ, MP & PN

- Top 10 cust 86.44% in 22,

- Top 10 suppliers 96.39% in 22

- Rev from WB 89.17%in 22

- Export of 0.85% & 1.47% in 21 and 20

Peers-

No listed Peers

3/n

Issue

- 950 lots, IPO proceeds towards Wcap

- 100% fresh issue, post iPO promoter holding is 73.32%

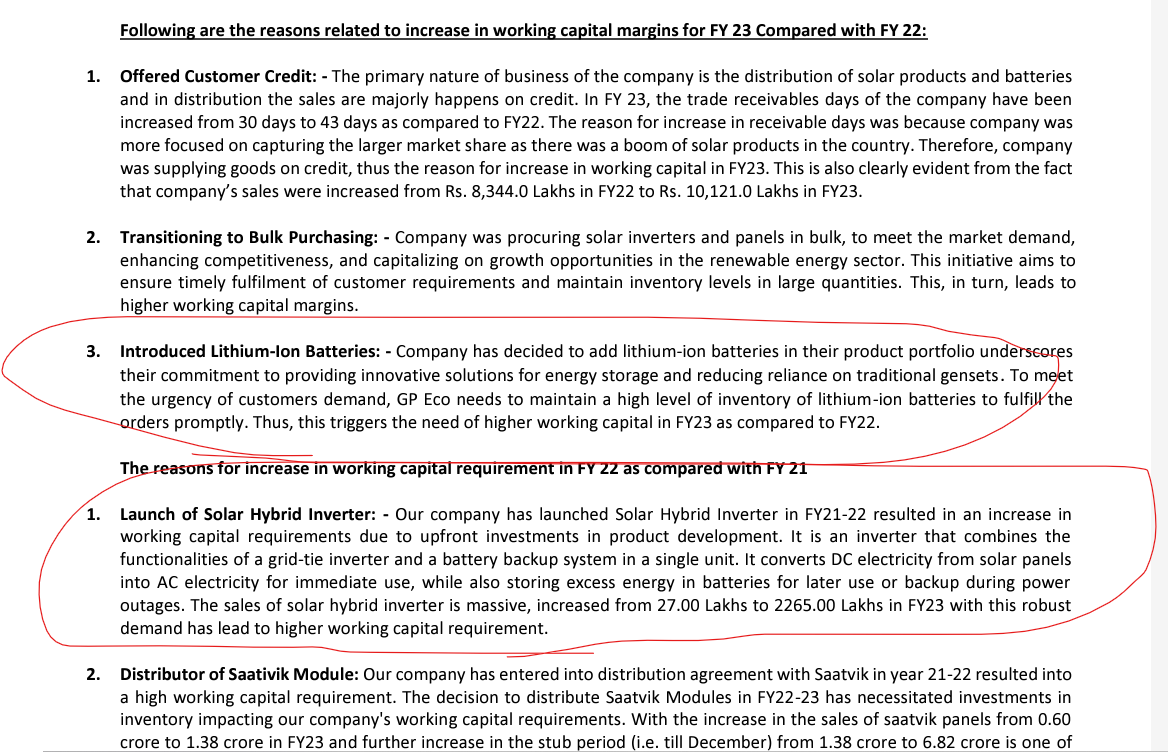

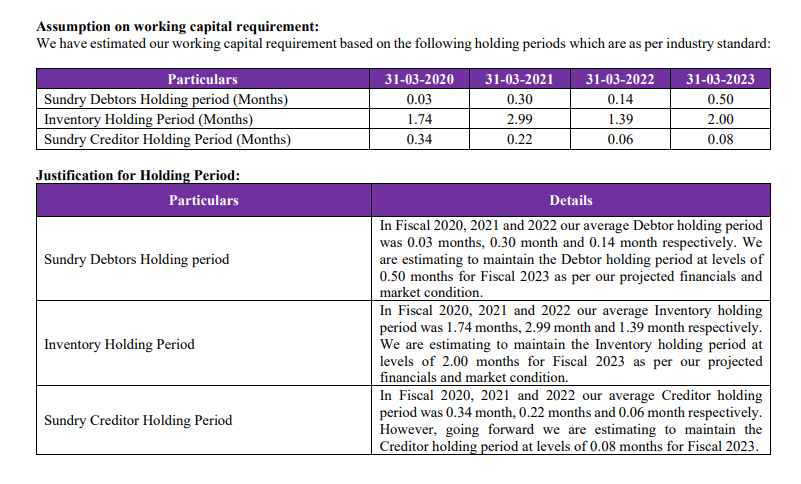

- IPO proceeds will reduce cost of RM - PP fabrics can help with margin expansion. Inventory holding is biggest bottleneck for them currently due to seasonality of the demand

4/n

- 950 lots, IPO proceeds towards Wcap

- 100% fresh issue, post iPO promoter holding is 73.32%

- IPO proceeds will reduce cost of RM - PP fabrics can help with margin expansion. Inventory holding is biggest bottleneck for them currently due to seasonality of the demand

4/n

Good

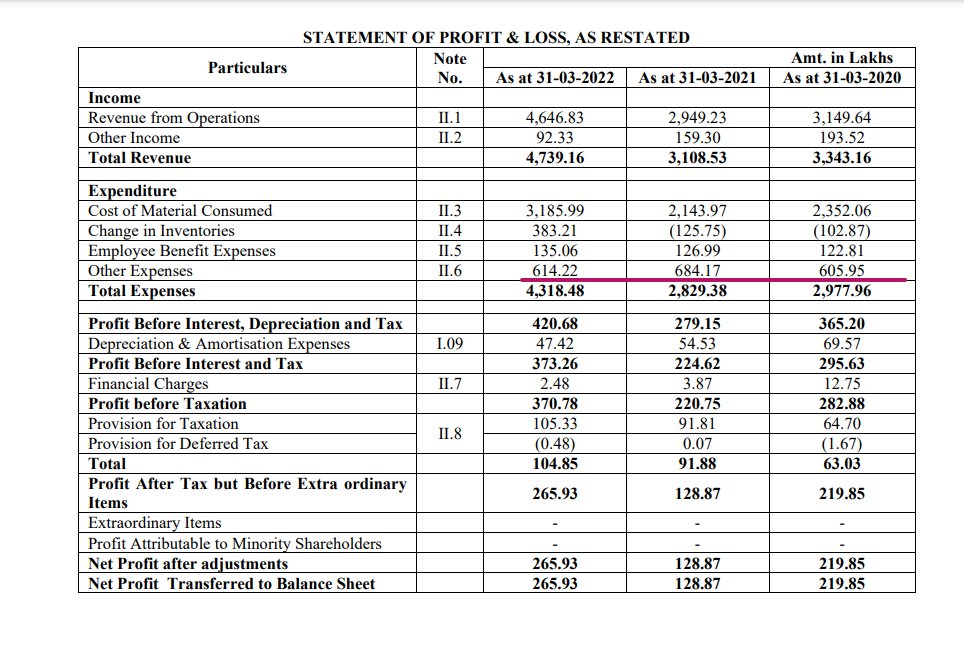

- Revenue is increasing

- reserves are good

- No debt in Mar 22

Bad

- Single digit OPM

- other income is high

- Mercedez & Honda city on company's name

- related party transaction of 6.5 cr in rev of 47 cr

5/n

- Revenue is increasing

- reserves are good

- No debt in Mar 22

Bad

- Single digit OPM

- other income is high

- Mercedez & Honda city on company's name

- related party transaction of 6.5 cr in rev of 47 cr

5/n

bad

- Bank gaurantee for a 10 cr loan by a grp company

- negative operating cash flow in 2020

- Utilization is almost at 90% & no plan for adding new capacity declared

- some mfg exp. in other expense

- repair & maintence charges are high as well may be due to old machine

6/n

- Bank gaurantee for a 10 cr loan by a grp company

- negative operating cash flow in 2020

- Utilization is almost at 90% & no plan for adding new capacity declared

- some mfg exp. in other expense

- repair & maintence charges are high as well may be due to old machine

6/n

Bad

- too many grp companies

- Bank gaurantee for a 10 cr loan for a grp company

- Return ratios are poor

in the end,

PE perspective company looks decent and also 0 debt is good

7/n

- too many grp companies

- Bank gaurantee for a 10 cr loan for a grp company

- Return ratios are poor

in the end,

PE perspective company looks decent and also 0 debt is good

7/n

subx is shaping up good for last day

some gmp heard but not sure.

i will decide if i want to apply around 2.30

some gmp heard but not sure.

i will decide if i want to apply around 2.30

I have applied in this IPO

• • •

Missing some Tweet in this thread? You can try to

force a refresh