We have just posted Financial Accounts of the U.S., with flow of funds, balance sheet, & integrated macroeconomic account data: federalreserve.gov/releases/z1/de… #FedData (1/4)

Household net worth decreased by $6.1 trillion in Q2, mainly because of a drop in stock prices. federalreserve.gov/releases/z1/20… (2/4)

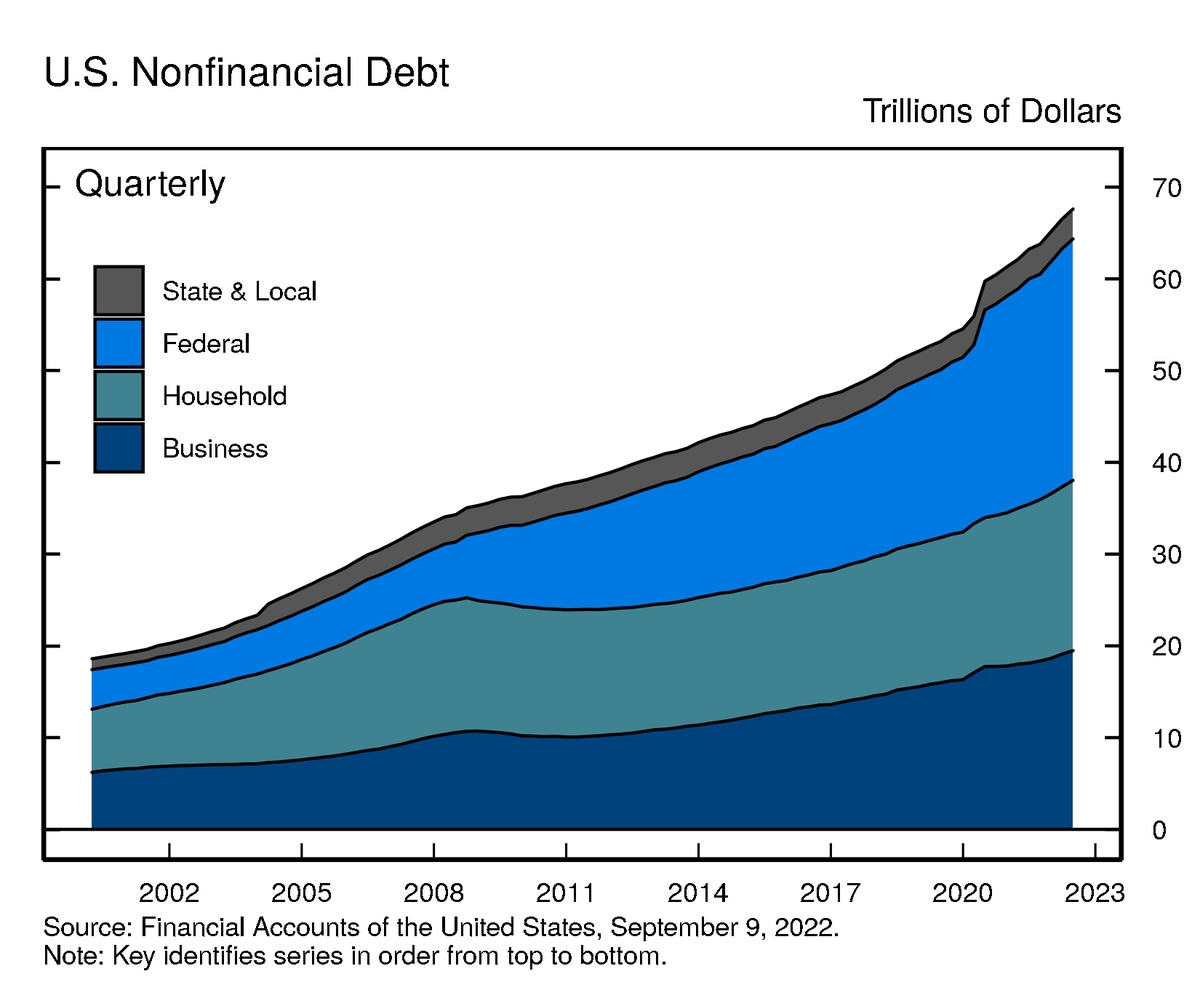

Household debt grew at an annual pace of 7.4% in Q2, with strong growth in both home mortgages and in nonmortgage consumer credit. #FedData (3/4)

In Q2 nonfinancial business debt grew at an annual pace of 7.7%. federalreserve.gov/releases/z1/20… #FedData (4/4)

• • •

Missing some Tweet in this thread? You can try to

force a refresh