FRAUD ALLERT !!

For Retail Investors It is very tough to find out fraud in a company ,I will tell you simple and easy to use techniques to find out frauds with Examples....

plz Retweet for maximum reach...

@Vivek_Investor

@niteen_india

For Retail Investors It is very tough to find out fraud in a company ,I will tell you simple and easy to use techniques to find out frauds with Examples....

plz Retweet for maximum reach...

@Vivek_Investor

@niteen_india

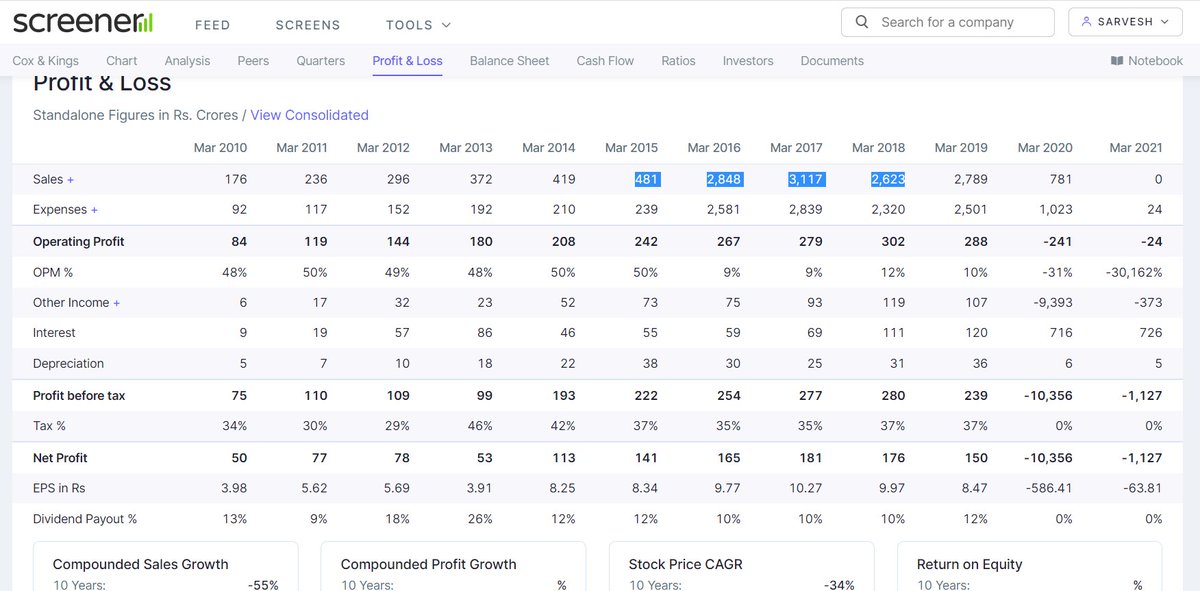

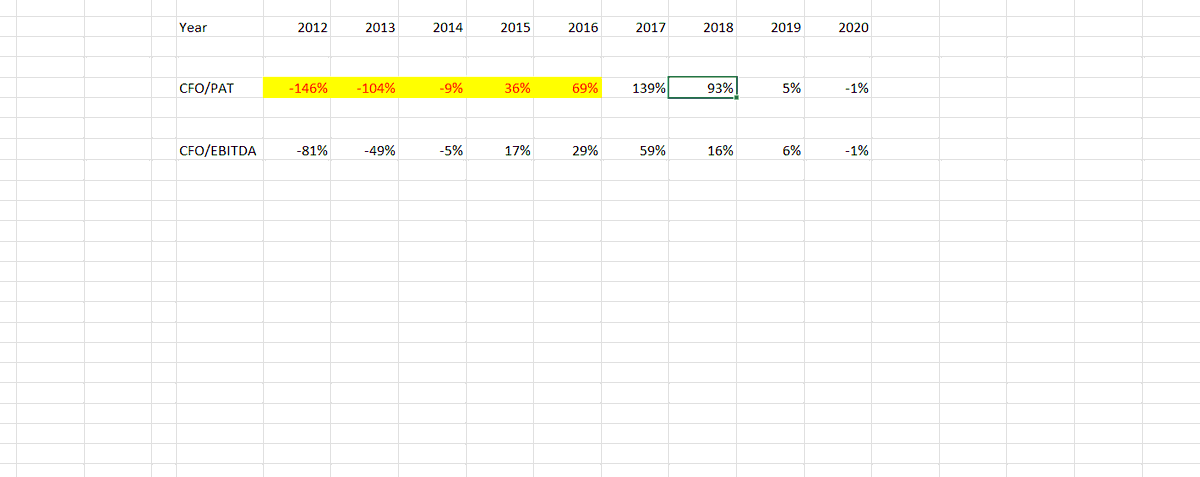

Check CFO(cash flow from operation) of a company...If it is -ve consistently then company might be in trouble or a fraud can be there .Compare CFO/PAT ratio, it should be near to 1. Compare last 5 year data.

@soicfinance @itsTarH @nid_rockz

@soicfinance @itsTarH @nid_rockz

e.g. Ricoh India... a 30X story

MNC growing sales and profits continuously

Share Price became 30X in just 28 months

Sales and profits growing very fast

@PrasadWakchaure

@Shubham_TLI

MNC growing sales and profits continuously

Share Price became 30X in just 28 months

Sales and profits growing very fast

@PrasadWakchaure

@Shubham_TLI

Just see the employee salary🙃...such a big company and growing so fast but salary of top management is low

Relatives (Friends) in the same business....But no one gave attention to these basic Information...

If one wants to read the whole case study then link is given below

2point2capital.com/blog/index.php…

@Arunstockguru @amitmantri

If one wants to read the whole case study then link is given below

2point2capital.com/blog/index.php…

@Arunstockguru @amitmantri

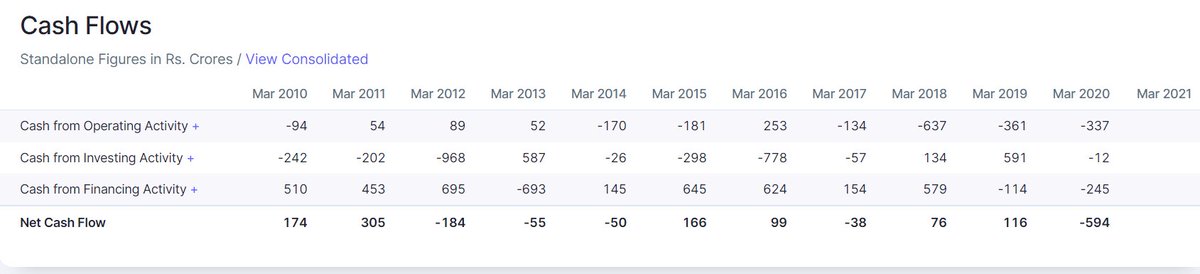

If one thinks it happens in India only now let me give you International example

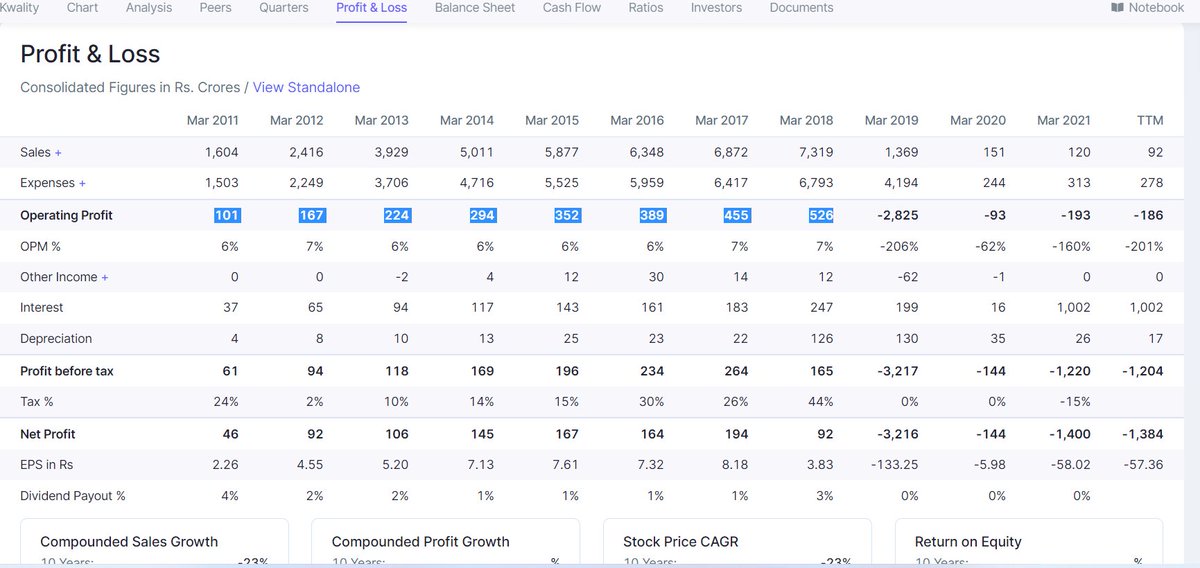

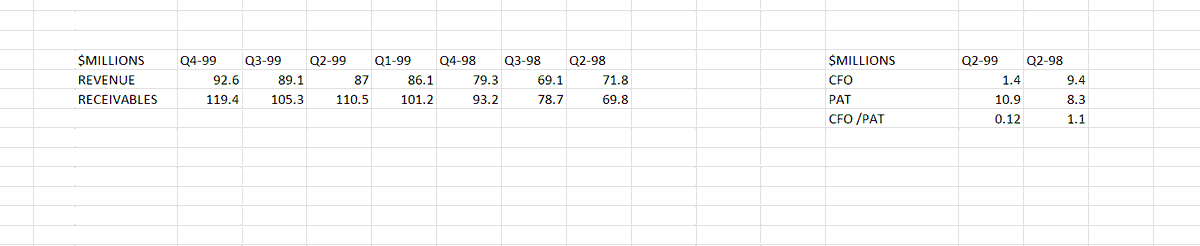

Company 5 Transactions System Ltd

Company changes its revenue policy to record the entire value of five years upfront as compared to previous approach of spreading the revenue over five years

Company 5 Transactions System Ltd

Company changes its revenue policy to record the entire value of five years upfront as compared to previous approach of spreading the revenue over five years

COMPANY-TRANSACTIONS SYSTEM ARCHITECT

A simple analysis of CFO /PAT would have saved many investors from loosing their money

@Arunstockguru @Vivek_Investor @oldschoolinvest @suchetadalal

A simple analysis of CFO /PAT would have saved many investors from loosing their money

@Arunstockguru @Vivek_Investor @oldschoolinvest @suchetadalal

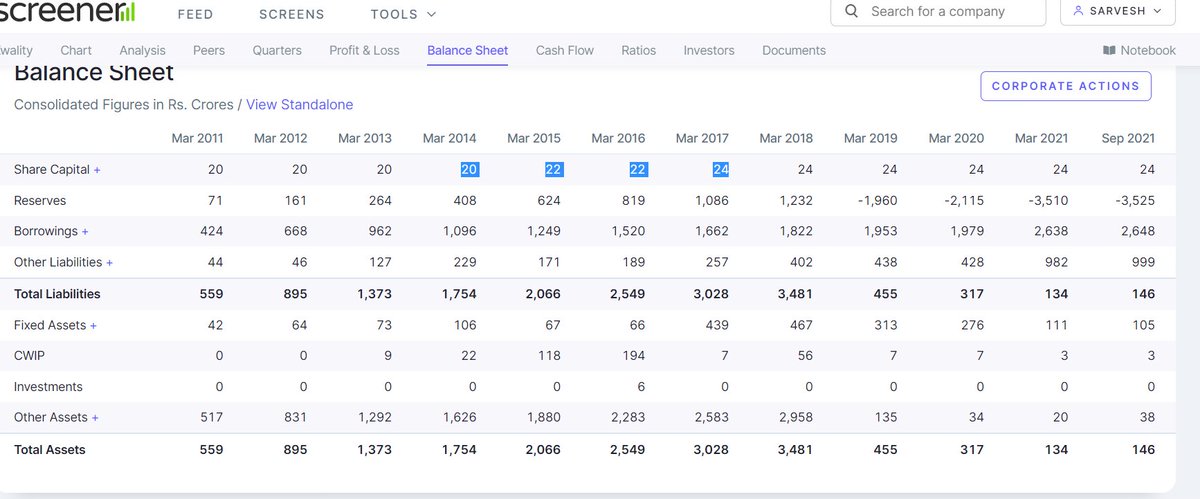

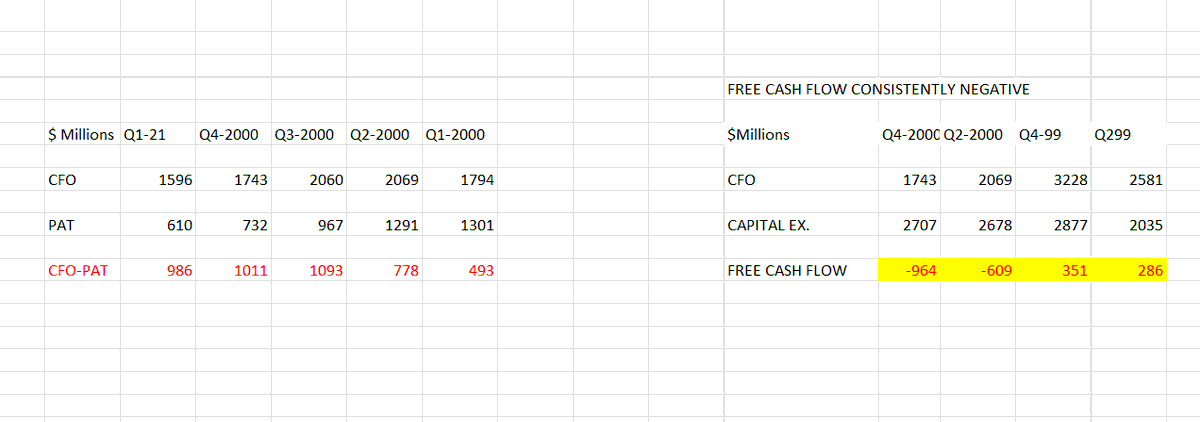

@Vivek_Investor @niteen_india Company 6 -WORLD COM

From 2000to2002,company classified its line cost expenses from P&L to Balance sheet.

It understated its expenses and inflated its earnings.

Company started capitalizing its cost .Some Indian companies have been doing it (Comment below if you know)

FCF 🫡

From 2000to2002,company classified its line cost expenses from P&L to Balance sheet.

It understated its expenses and inflated its earnings.

Company started capitalizing its cost .Some Indian companies have been doing it (Comment below if you know)

FCF 🫡

• • •

Missing some Tweet in this thread? You can try to

force a refresh