1/ Being a concentrated investor means having to say no to most investment ideas.

How to say NO…🧵 👇🏽

How to say NO…🧵 👇🏽

2/ Recognize that the safety of crowds is something you will need to avoid. Social proof has value but the concentrated investor has to be comfortable being the black sheep walking against the crowd.

3/ Others may do very well with some of the ideas you say no to. This doesn’t affect you in any real way. Envy is a powerful driver of human psychology and needs to be conquered.

4/ When researching a business, start with the least sales pitch related content. Start with the filings, move onto other material after that. The order will make a big difference. The investor presentations are framed by management for you and are often a sales pitch.

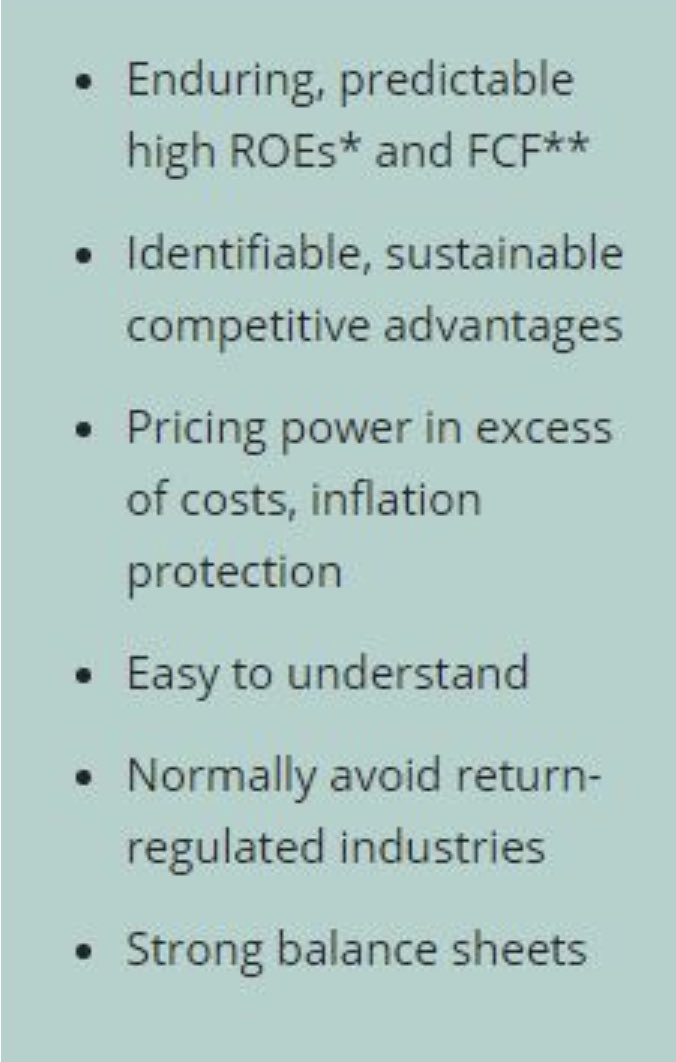

5/ Remember with a focused portfolio, you should only have your very best ideas. Set a very high bar and make sure the incumbent is difficult to replace. As @MohnishPabrai might say, “you better be sure that the mistress is way better than the wife”.

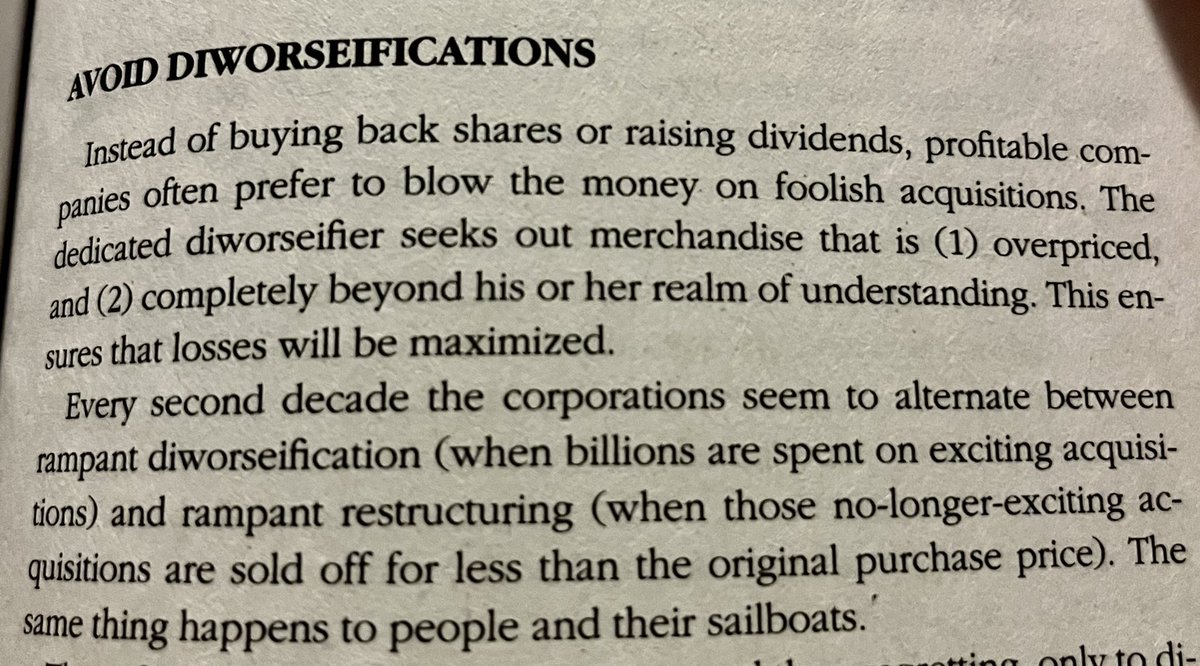

6/ Stick to within your circle of competence, even if an idea seems to present very high return potential. This will make your universe small enough to manage right away.

7/ Utilize a checklist when making decisions. This will help you be more strict about the quality of your decision and hold yourself accountable against your own optimism for the new shiny thing that you found.

8/ Be aware of the sunk cost fallacy. If you have spent 10 hours investigating and researching a stock, that won’t make it a better idea but we will tend to want to not lose this effort so will rationalize why it is a great investment.

9/ Write out your investment thesis. What is the upside, downside, and what is your edge? Now make sure can explain it to a 5 year old and that very few things need to happen for it to work.

“If you have no edge, the correct position size is don’t bet” @wabuffo

“If you have no edge, the correct position size is don’t bet” @wabuffo

10/ That’s it for now, what else do you have if you have trouble with saying no?

• • •

Missing some Tweet in this thread? You can try to

force a refresh