#sabar #SMEIPO

Biz

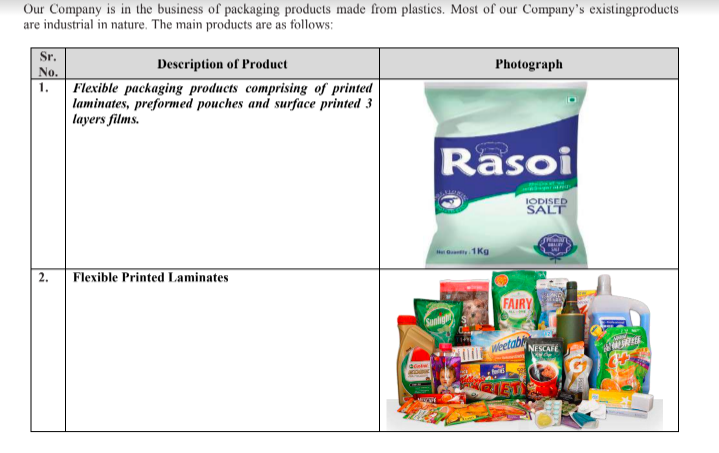

-Mfg of all kinds of Flexible packaging materials used for packing Food, Dairy, cosmetics, pharma, Chemical & agriculture products etc

- multi-color pouches, stand-up pouches, zip-lock pouches, vacuum pouch, paper bag, e-commerce bag, etc.

- 92 emp

1/n

Biz

-Mfg of all kinds of Flexible packaging materials used for packing Food, Dairy, cosmetics, pharma, Chemical & agriculture products etc

- multi-color pouches, stand-up pouches, zip-lock pouches, vacuum pouch, paper bag, e-commerce bag, etc.

- 92 emp

1/n

Biz

- 3 prod, Multilayer films, Printed laminates, & flexible packaging prod (pouches & bags).

-Customers Meghmani Org, Sabar Dairy, Baba Ramdev Salt Refinery, Sheetal Ice cream, Arbuda Ind, Pushp Henna, Moli Heena , Kashmirilal & Sons, Bhagwati Food , Prince Gruh Udyog etc.

2/n

- 3 prod, Multilayer films, Printed laminates, & flexible packaging prod (pouches & bags).

-Customers Meghmani Org, Sabar Dairy, Baba Ramdev Salt Refinery, Sheetal Ice cream, Arbuda Ind, Pushp Henna, Moli Heena , Kashmirilal & Sons, Bhagwati Food , Prince Gruh Udyog etc.

2/n

Biz

- Mfg plant is owned, close 2 RJ

- getting biz interest from southern india & Nepal

- Plans 2 start pharma packaging

Capacity Utilization @ 55%

Issue

- 407 lots, 100% fresh issue

- 78% of IPO proceeds for wcap

- Promoter Pre Issue holding 53.25% & Post issue 39%

3/n

- Mfg plant is owned, close 2 RJ

- getting biz interest from southern india & Nepal

- Plans 2 start pharma packaging

Capacity Utilization @ 55%

Issue

- 407 lots, 100% fresh issue

- 78% of IPO proceeds for wcap

- Promoter Pre Issue holding 53.25% & Post issue 39%

3/n

Peers

-Uflex, Paper Products ltd, Flexituff Intl., Radha Madhav Corp, & Uma Converters Ltd

-Feels similar to Clara

- Several public shareholder in the company pre-IPO

4/n

-Uflex, Paper Products ltd, Flexituff Intl., Radha Madhav Corp, & Uma Converters Ltd

-Feels similar to Clara

- Several public shareholder in the company pre-IPO

4/n

Good

- Rev increased in 21 & flatish in 2022

- Cap. utilization around 56% so room for growth with current capex

- PE is low at around 8.6 based on weighted Avg EPS

Bad

- OPM in single digit

- Pre Issue holding is 53.25% which dilutes to 39% post issue

- Borrowings at 25 cr

5/n

- Rev increased in 21 & flatish in 2022

- Cap. utilization around 56% so room for growth with current capex

- PE is low at around 8.6 based on weighted Avg EPS

Bad

- OPM in single digit

- Pre Issue holding is 53.25% which dilutes to 39% post issue

- Borrowings at 25 cr

5/n

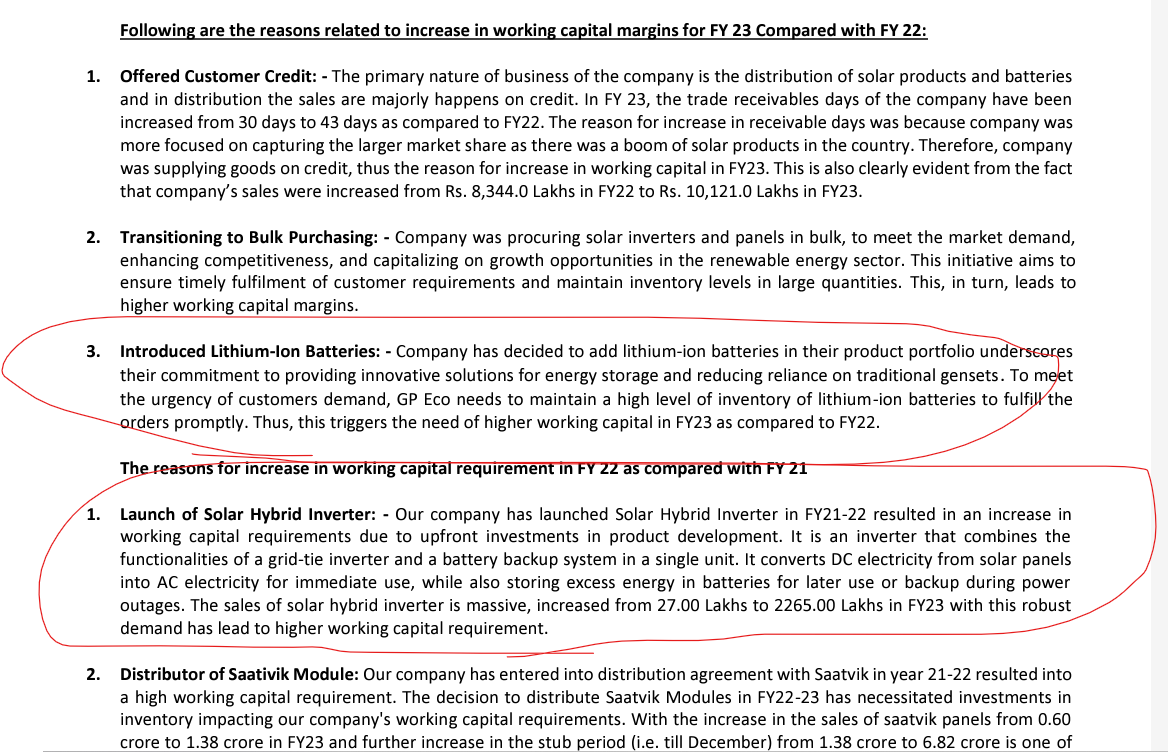

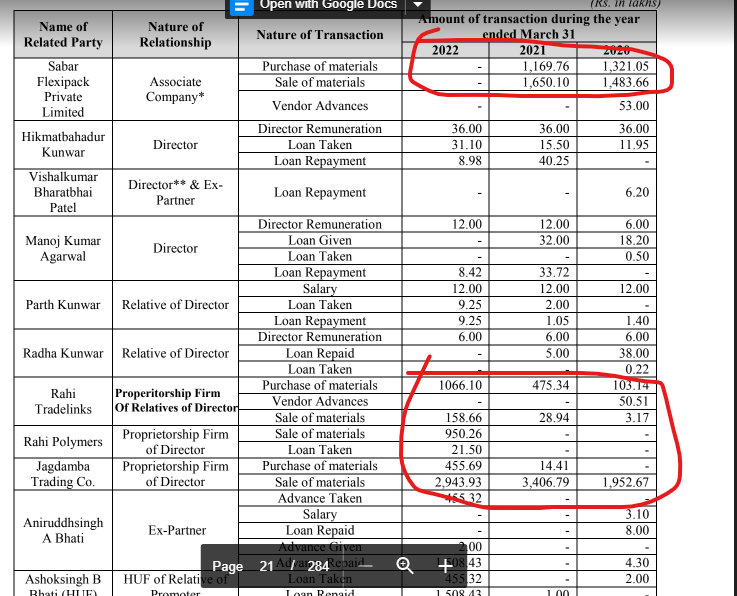

Bad

- Related party tx is high bet. grp companies esp Sales and Purchases

- 37 lakhs tax has been deferred in Mar 22

- very high trade recievables

6/n

- Related party tx is high bet. grp companies esp Sales and Purchases

- 37 lakhs tax has been deferred in Mar 22

- very high trade recievables

6/n

Bad

- IPO proceeds are drop in a bucket for Wcap so not sure whats the real purpose behind the IPO

- Had negative OCF in 20 and 21

Subx - shaping up good. GMP heard so Subx will pick up on last day. i will decide on last day looking at HNI subx

- IPO proceeds are drop in a bucket for Wcap so not sure whats the real purpose behind the IPO

- Had negative OCF in 20 and 21

Subx - shaping up good. GMP heard so Subx will pick up on last day. i will decide on last day looking at HNI subx

• • •

Missing some Tweet in this thread? You can try to

force a refresh