Going thru charts, these 5 stood out:

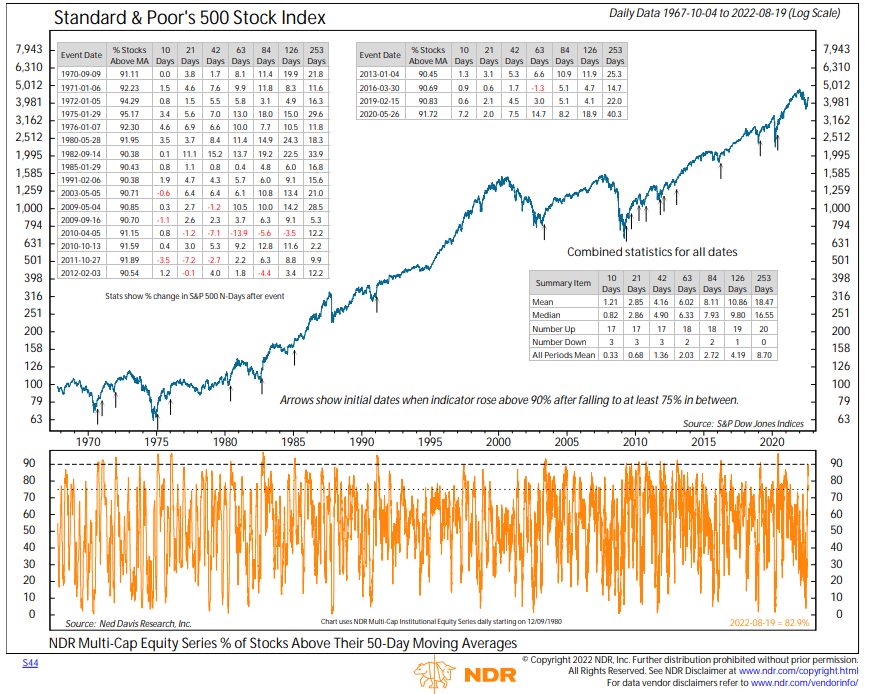

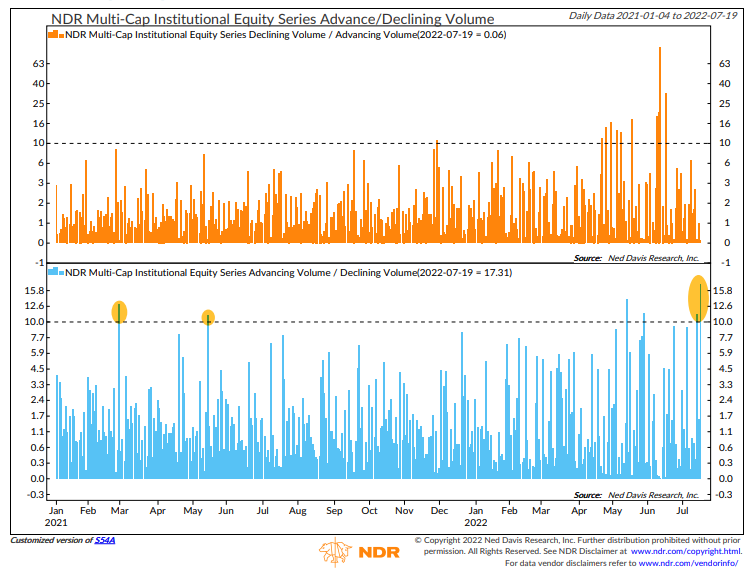

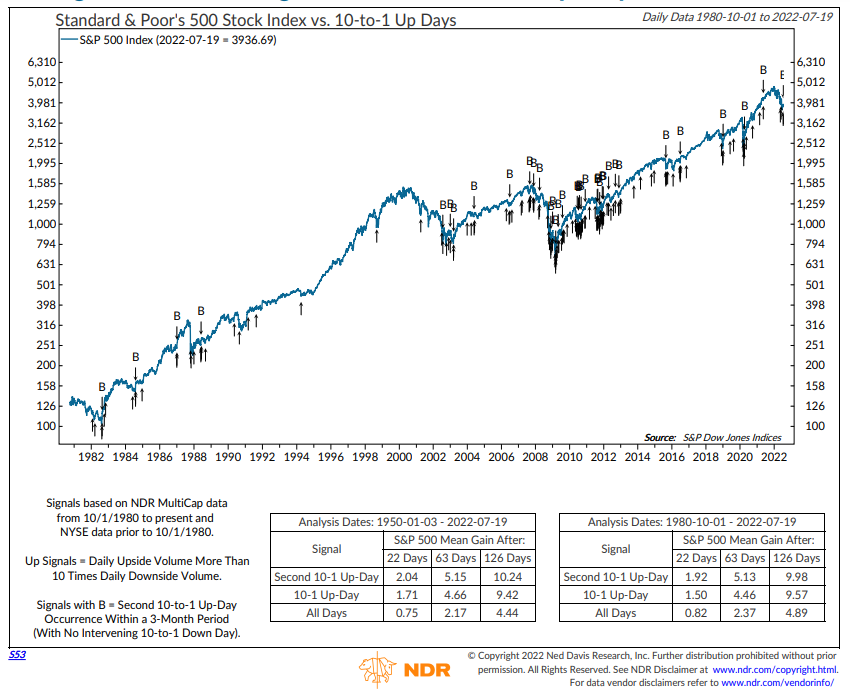

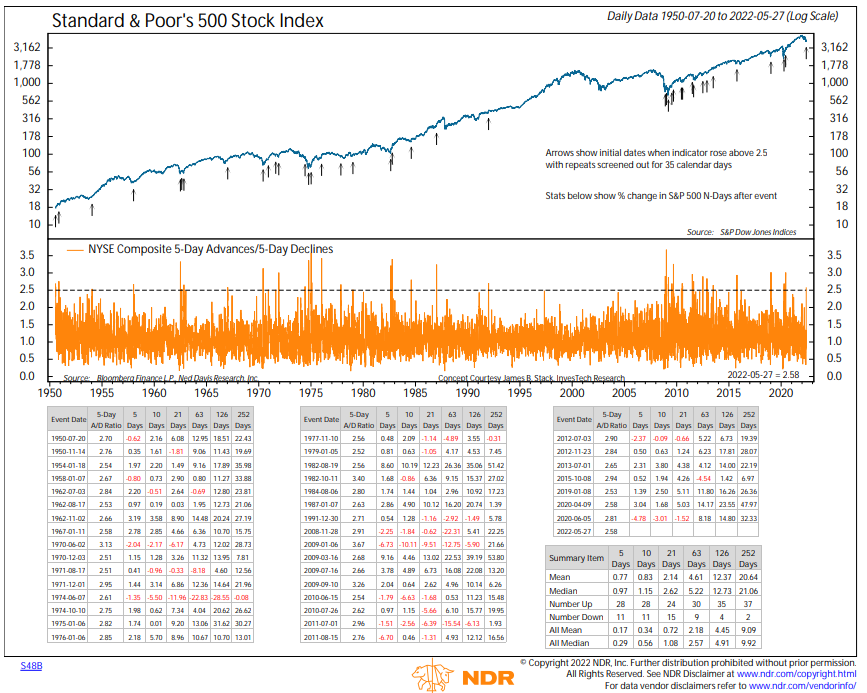

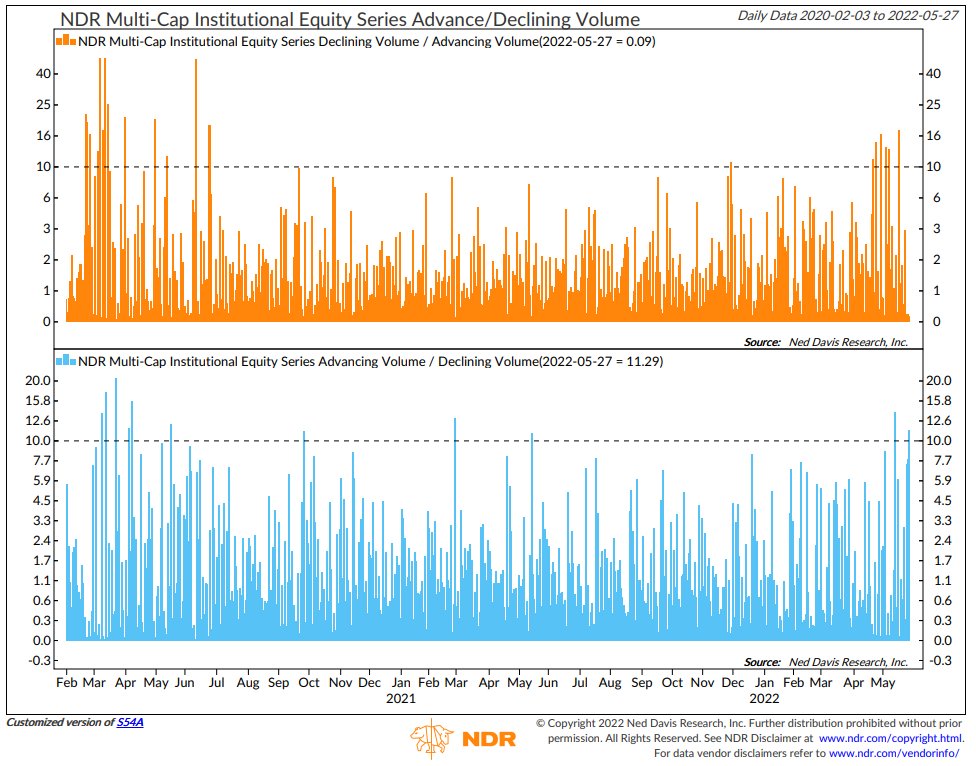

1. Friday was a 12:1 up day (advancing volume/declining volume) based on NDR Multi-Cap universe. For a double 10:1 up day, we need another 10:1 day because the Aug 10 10:1 up day was negated by the Aug 22 10:1 down day. @NDR_Research 1/5

1. Friday was a 12:1 up day (advancing volume/declining volume) based on NDR Multi-Cap universe. For a double 10:1 up day, we need another 10:1 day because the Aug 10 10:1 up day was negated by the Aug 22 10:1 down day. @NDR_Research 1/5

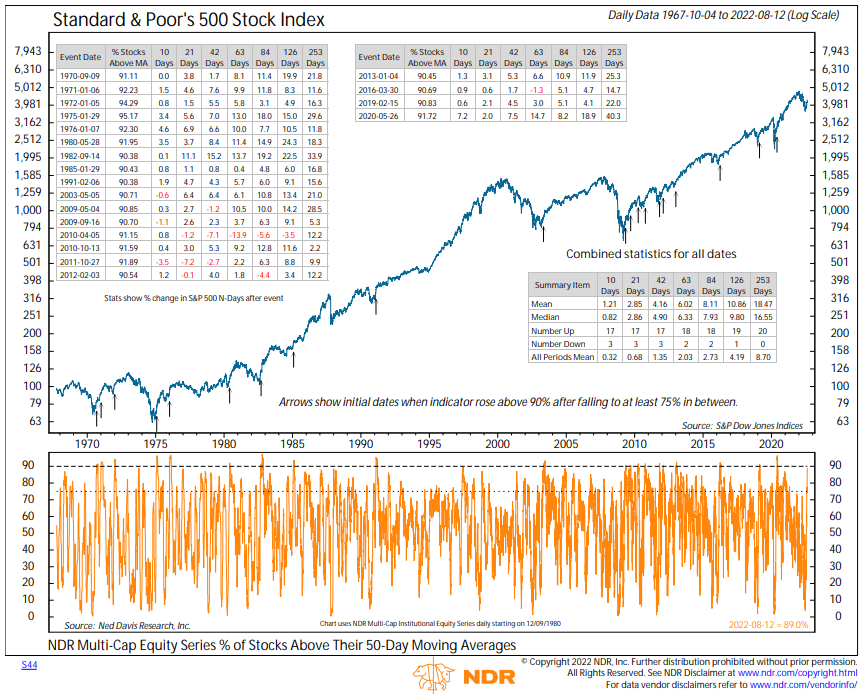

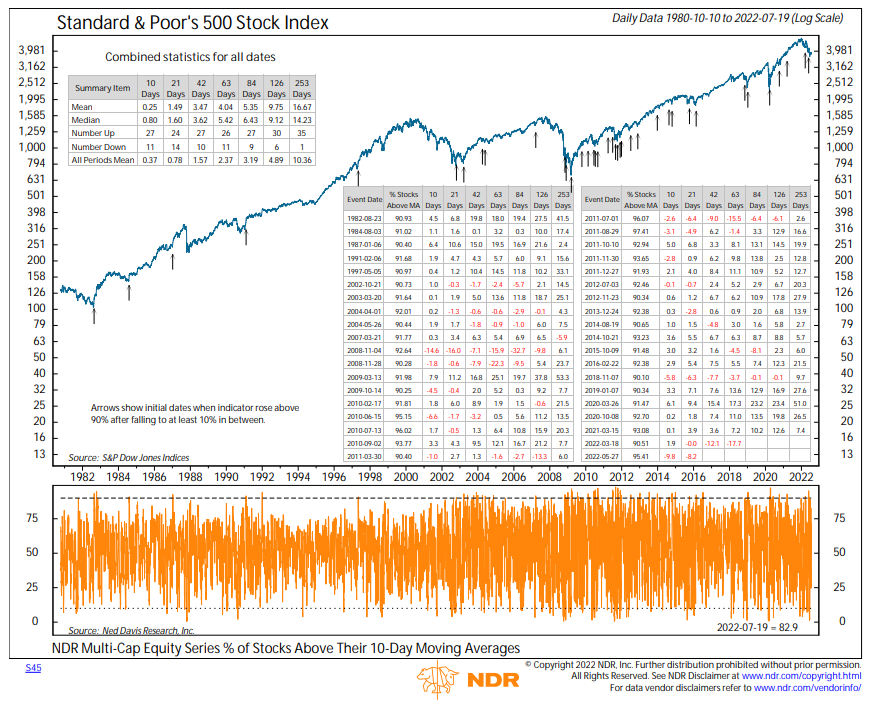

2. The % stocks >10-day moving averages jumped from 6% on Tues to 86% on Fri. Has to climb above 90% to trigger a breadth thrust. 2/5

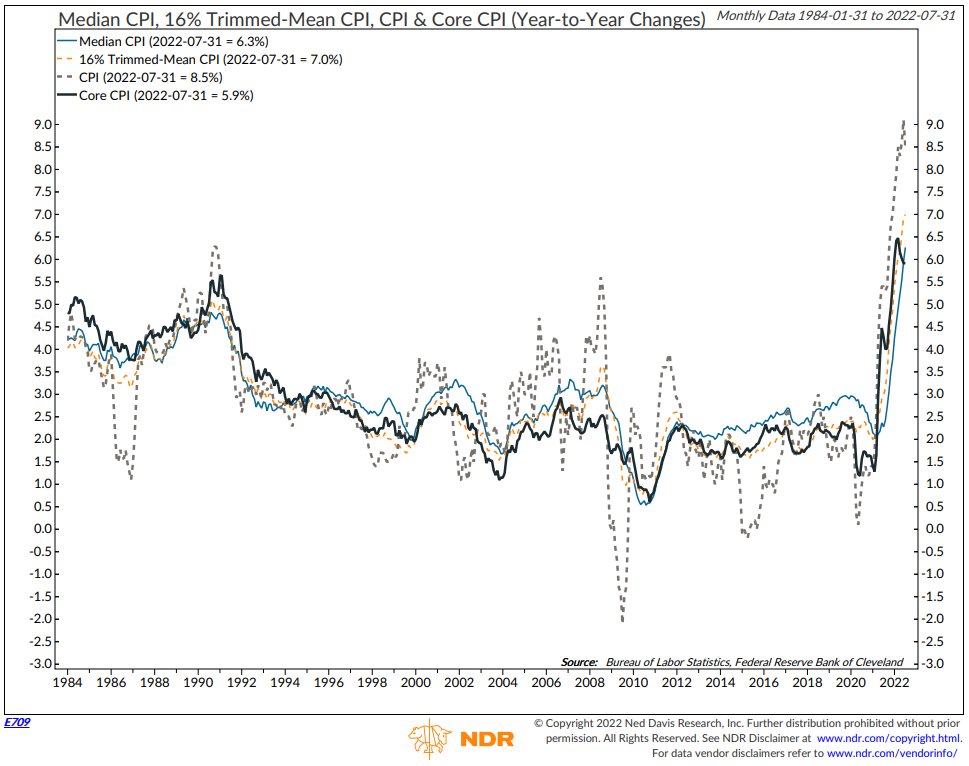

3. CPI report on Tues is the big report of the week. Can stocks rally with high inflation? Yes, if it's high *and* falling. The y/y CPI is likely to fall below its 6-month moving average, but in reality this cycle the market has already rallied in anticipation of it. 3/5

5. Not everything is rosy on the inflation front. The core CPI hasn't rolled over as quickly. Stocks have risen at a slower rate when the overall CPI has been greater than the core CPI. Perhaps low food and energy prices are good, but inflation broadly contained is better? 5/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh