Available inventory of homes for sale surprises again this week!

Supply fell 1% to 547,000 SFR

Let's look at how all this plays out in this week's @AltosResearch #realestatemarket video 🧵📽️👇

1/7

Supply fell 1% to 547,000 SFR

Let's look at how all this plays out in this week's @AltosResearch #realestatemarket video 🧵📽️👇

1/7

There's just a remarkable dearth of new listings.

25% fewer new listings each week than we'd expect for this time of year

The portion selling immediately (light red part of each bar here) is finally evaporating.

2/7

25% fewer new listings each week than we'd expect for this time of year

The portion selling immediately (light red part of each bar here) is finally evaporating.

2/7

Our inventory forecast has been consistently wrong since July

I expected we'd have 625k homes on the market now, but we only have 547k

Currently projecting 470k EOY, but that could easily be too high

450k? 430k? Will 2023 start with fewer homes available than 2021?

3/7

I expected we'd have 625k homes on the market now, but we only have 547k

Currently projecting 470k EOY, but that could easily be too high

450k? 430k? Will 2023 start with fewer homes available than 2021?

3/7

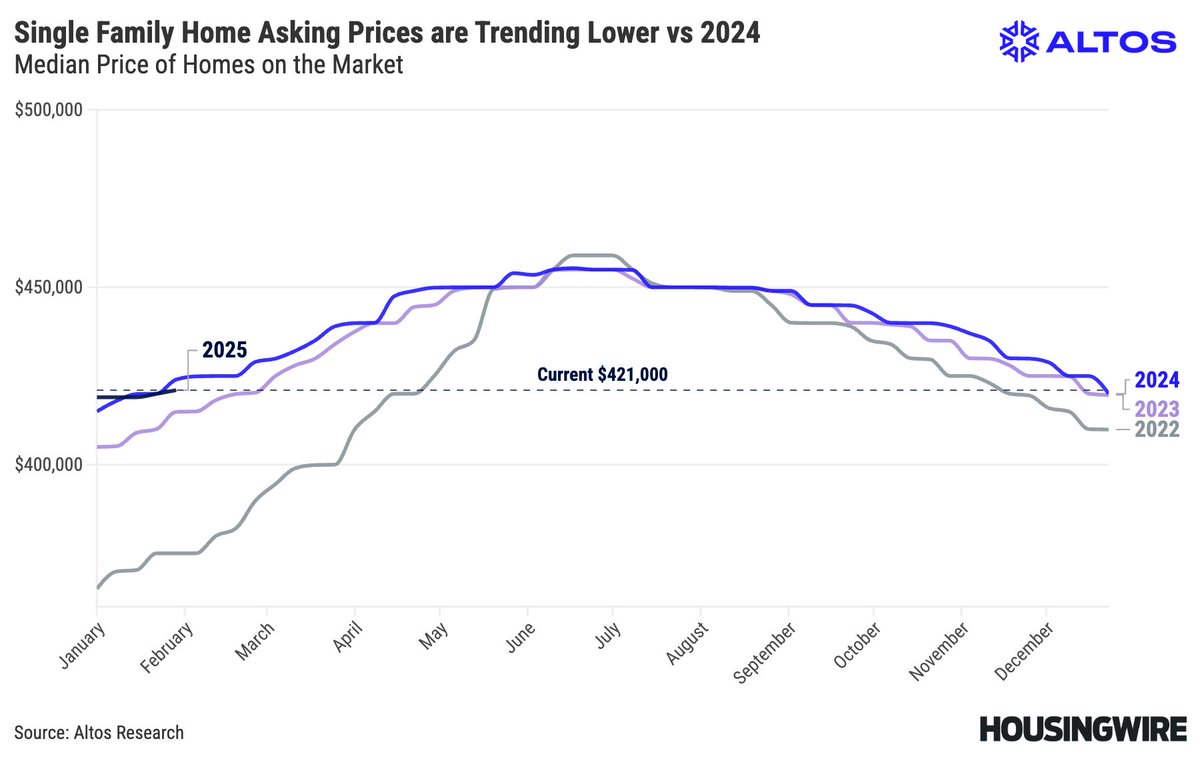

Home prices meanwhile are steadily, slowly pulling back for the fall

Median home price in the US this week is $439,900

The price of the new listings (light red line) shows consistent discounting by new sellers

None of this is catastrophic, but worth noting

4/7

Median home price in the US this week is $439,900

The price of the new listings (light red line) shows consistent discounting by new sellers

None of this is catastrophic, but worth noting

4/7

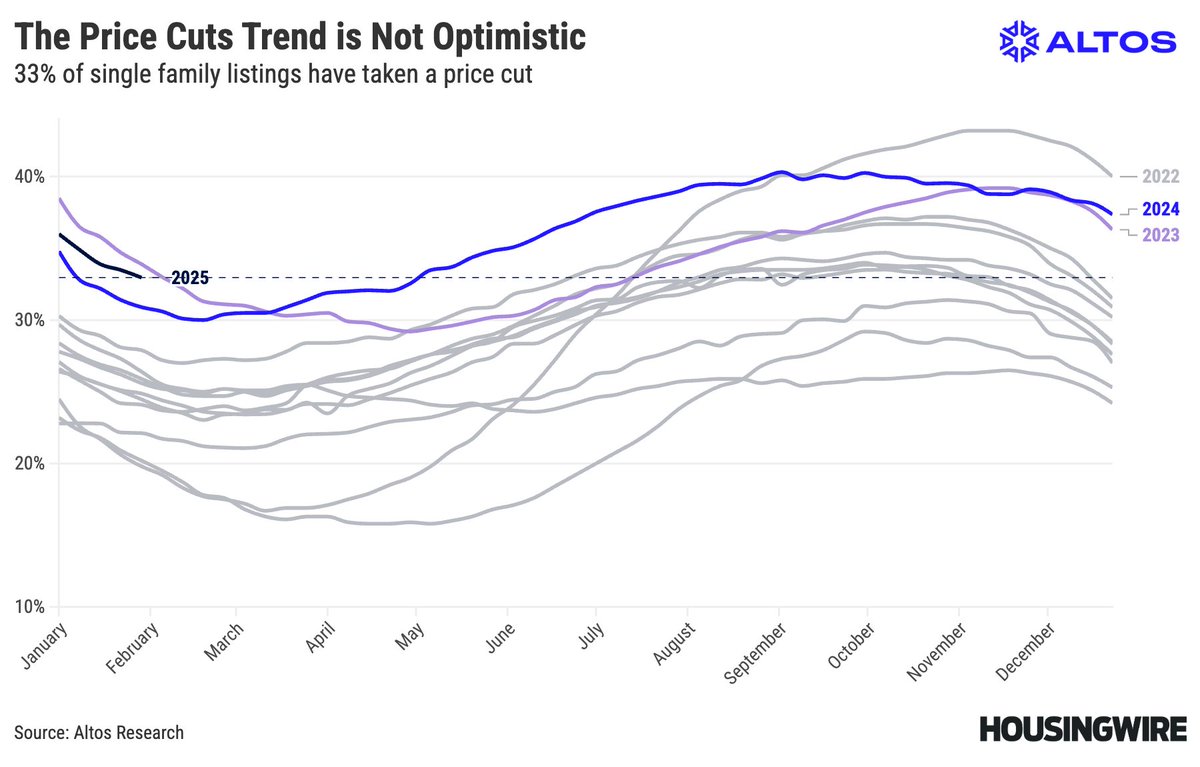

Price reductions have reached the summer plateau

40% of the homes on the market have had a price cut

The fact that this is level tells us that the market is not tanking

The supply of homes for sale is just too short for the market to tank hard

5/7

40% of the homes on the market have had a price cut

The fact that this is level tells us that the market is not tanking

The supply of homes for sale is just too short for the market to tank hard

5/7

Next week Tuesday Sept 20, we'll do our hour long webinar

We'll look at the inventory forecast for the rest of the year plus local markets

Discuss what buyers & sellers should know right now

These are limited to 1000 people, so grab your spot now

bit.ly/altos-sept2022…

6/7

We'll look at the inventory forecast for the rest of the year plus local markets

Discuss what buyers & sellers should know right now

These are limited to 1000 people, so grab your spot now

bit.ly/altos-sept2022…

6/7

What's behind the surprising drop in inventory?

Full details in this week's real estate market video from @AltosResearch

7/7

Full details in this week's real estate market video from @AltosResearch

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh