1/ A thread about annual allowance in 21/22👇 [+ new free tool]

Many will have received a nasty brown envelope from @nhs_pensions this week. If you have (and even if you haven't) you may need to take action. Pay attention and share (please RT) with colleagues who may need this!

Many will have received a nasty brown envelope from @nhs_pensions this week. If you have (and even if you haven't) you may need to take action. Pay attention and share (please RT) with colleagues who may need this!

2/ OK if you already have statements for 21/22 (& if you are member of two schemes i.e. 1995 & 2015 you need TWO statements) you can miss this step.

But if you are a high earner (say >£90k) & you haven't, request one today (it can take 3 months)

bit.ly/TGPSSRequest22

But if you are a high earner (say >£90k) & you haven't, request one today (it can take 3 months)

bit.ly/TGPSSRequest22

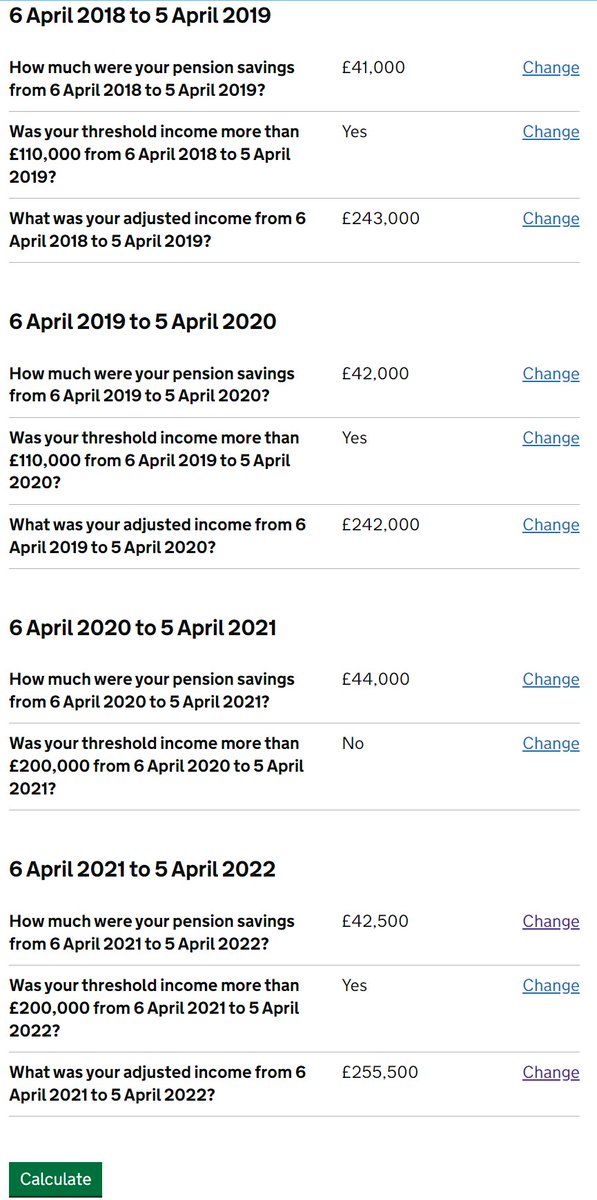

3/ Next you need to establish if you have an AA liability in 21/22. To do that you can use the free HMRC calculator. Its not that straightforward, but I would *strongly* advise to do your own calculations, even if you have an accountant/advisor.

4/ You can watch my video here. I did it for the 18/19 tax year, but its similar for the 21/22 tax year (see next tweets for differences) and I have updated the accompanying spreadsheet

5/ Ive updated the tool for the new 21/22 year

Download it here:

bit.ly/TGAAHelper2122

Basically fill in the grey cells with your pension growth (as per statements) & your total taxable income (from all sources) and it will give output in the yellow cells

Download it here:

bit.ly/TGAAHelper2122

Basically fill in the grey cells with your pension growth (as per statements) & your total taxable income (from all sources) and it will give output in the yellow cells

6/ You can access the HMRC calculator here:

tax.service.gov.uk/pension-annual…

As per the video above, & as per the HMRC instruction- tick years in which you were a member.

I would always tick *at least* 7 years prior to the current year, so you may need to get this data from the scheme

tax.service.gov.uk/pension-annual…

As per the video above, & as per the HMRC instruction- tick years in which you were a member.

I would always tick *at least* 7 years prior to the current year, so you may need to get this data from the scheme

7/ Ive added a section on the spreadsheet to make it easier to use the "check your answers" section on the HMRC calculator (left) with a copy of the data you have entered (right) to check its the same

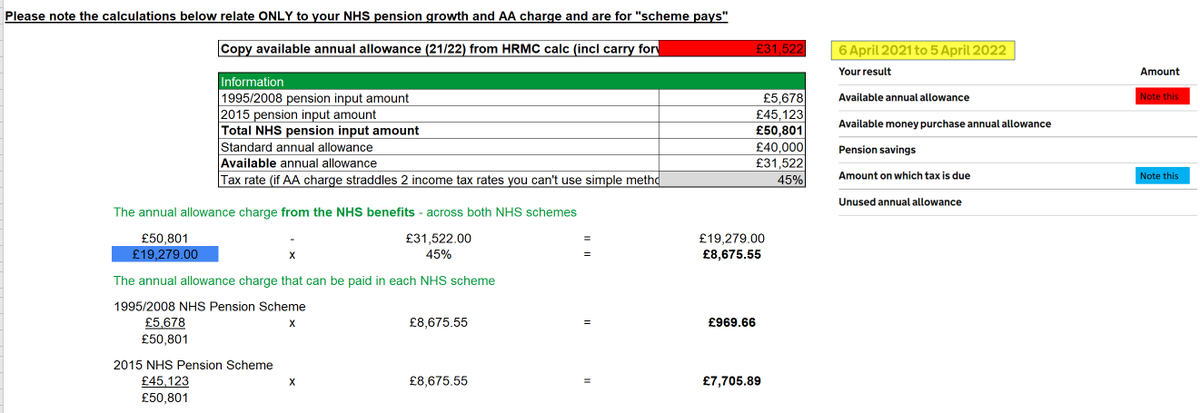

8/ When you get to the calculation results of the HMRC calculator (which looks a bit different to the earlier version from the video) note the "available annual allowance" - which includes any carry forward you might have and/or tapering, and put it the highlighed red cell

9/ As a further check the highlighed blue cell should be the same as the HMRC calculator "amount on which tax is due" (excl. any private pension) - this section will also show you any required split should you need to use "scheme pays"

10/ As noted in the video, DON'T assume if you haven't received an envelope = no AA charge. The scheme dont know if you are "tapered" (i.e. your taxable income was over £110k to 19/20, or £200k after 20/21, so available allowance maybe as small as £10k (£4k from 20/21)

11/ Similarly you might not have received one because your employer / (or PCSE / @CapitaPlc) have not updated the pension agency. So if you haven't received a PSS, request one today using that template above

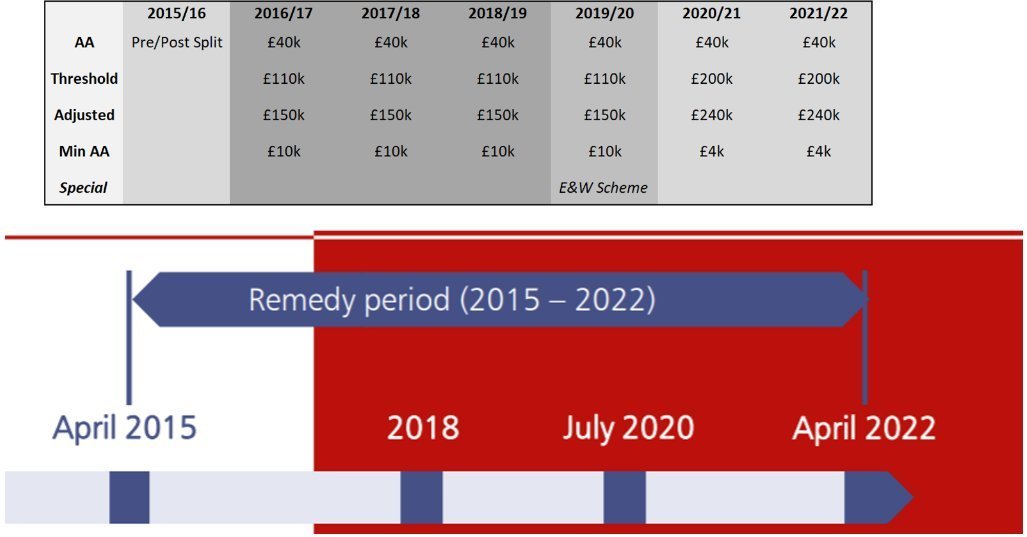

12/ Following an extensive @BMA_Pensions campaign, the taper changed from 20/21

From that tax year going forward (but not 16/17 to 19/20)

✅ Threshold income ⬆️ to 200k (previous 110k)

✅ Adjusted income ⬆️ to 240k (previous 150k)

❌ Min AA ⬇️ to 4k from 10k

From that tax year going forward (but not 16/17 to 19/20)

✅ Threshold income ⬆️ to 200k (previous 110k)

✅ Adjusted income ⬆️ to 240k (previous 150k)

❌ Min AA ⬇️ to 4k from 10k

13/ These changes take many doctors out of tapering (unless total income >£200k) but doesn't change the general AA (£40k) so many still affected

The new free tool

bit.ly/TGAAHelper2122

will apply the old limits to 19/20 (blue), & the new limits from 20/21 (green)

The new free tool

bit.ly/TGAAHelper2122

will apply the old limits to 19/20 (blue), & the new limits from 20/21 (green)

14/ OK so now, having watched the video, and used the tool / HMRC calculator, you should know if you have an AA charge for 21/22

Unlike 19/20 there is not a "compensation scheme" for clinicians (in England & Wales), so if there is a charge it needs to be paid (or scheme pays)

Unlike 19/20 there is not a "compensation scheme" for clinicians (in England & Wales), so if there is a charge it needs to be paid (or scheme pays)

15/ Many of you will be aware of the ongoing "age discrimination" or "McCloud" case. Im not going to go over it here (if you want to see threads in my pinned tweet).

Basically (after October 2023), this tax year will need to be recalculated as if you were in your "legacy" scheme

Basically (after October 2023), this tax year will need to be recalculated as if you were in your "legacy" scheme

16/ For now I would advise you to largely ignore this. For tax year 21/22 you can only work out your position based on the data provided by the scheme which will currently ignore the McCloud case (as per the scheme's instructions) from @hmtreasury

17/ *However* McCloud may affect your decision *how* to pay any AA charge for 21/22

For most clinicians and other high earners in the NHS, if you have an AA charge for 21/22 it will go down (or dissapear) when you "go back" to legacy only schemes in 2023

For most clinicians and other high earners in the NHS, if you have an AA charge for 21/22 it will go down (or dissapear) when you "go back" to legacy only schemes in 2023

18/ The main exceptions to this will be

i) pyschs with MHO status who can get "double years" back with McCloud so their AA charges may go up.

ii) people who came out of the scheme and may be able to retrospectively go back in under "contingent decision" on a case by case basis

i) pyschs with MHO status who can get "double years" back with McCloud so their AA charges may go up.

ii) people who came out of the scheme and may be able to retrospectively go back in under "contingent decision" on a case by case basis

19/ So please don't ignore your 21/22 AA tax liability because of the McCloud legal case - even if you think your AA tax charge may disappear if you revert to the old schemes.

It REMAINS unclear what will happen with AA if you choose to come back into 2015 schemes at retirement

It REMAINS unclear what will happen with AA if you choose to come back into 2015 schemes at retirement

20/ With any AA charge you have basically two choices

i) Pay the charge with your self assessment from cash (from taxed income)

ii) Pay the charge using a "scheme pays loan"

I've covered applying for scheme pays before in this video (for 19/20)

i) Pay the charge with your self assessment from cash (from taxed income)

ii) Pay the charge using a "scheme pays loan"

I've covered applying for scheme pays before in this video (for 19/20)

21/ Because of McCloud & the fact your charge may go down/dissapear in 2023 (although UNCERTAIN what will happen if you choose 2015 for the remedy period at retirement) I suspect more people will be inclined to use "scheme pays" this tax year as the loan amount can be changed

22/ In summary - no-one is going to magically send you a bill for your AA charge

YOU need to request a savings statement if you dont have one.

YOU need to calculate if you have a charge.

YOU need to tell HMRC you have a charge.

YOU need to pay the charge or use "scheme pays"

YOU need to request a savings statement if you dont have one.

YOU need to calculate if you have a charge.

YOU need to tell HMRC you have a charge.

YOU need to pay the charge or use "scheme pays"

23/ Penultimately 21/22 may be first or biggest AA charge. 2 factors for this - a bigger than normal difference between inflation Sep 20 (0.5%) & Sep 21 (3.1%), & similarly with the pay "award" (cut)

But current tax year (22/23) will be MUCH worse #CPIdisconnect

But current tax year (22/23) will be MUCH worse #CPIdisconnect

24/ Finally I can't in good conscience do a thread about AA without saying what a thouroughly stupid tax this is. It's a completely inappropriate tax in the context of a DB scheme.

Tax relief is removed by steep tiering, & removed again by AA, again by LTA = pension theft

Tax relief is removed by steep tiering, & removed again by AA, again by LTA = pension theft

25/ Can't emphasize enough how important this is- *EVEN IF HAVE WRITTEN RECENTLY*

New PM, new chancellor, & a new SOS - your MP needs to know how its affecting YOU / YOUR SERVICE / YOUR RETIREMENT PLANS

Please take 5 mins - and take time to customise it

New PM, new chancellor, & a new SOS - your MP needs to know how its affecting YOU / YOUR SERVICE / YOUR RETIREMENT PLANS

Please take 5 mins - and take time to customise it

https://twitter.com/TheBMA/status/1570827866224345089?s=20&t=LJJUbLD9bU7ntYoTL5BGzw

26/ Clinicians are dealing with unprecented pressures, & really shouldn't be dealing with this complex & unfair tax. Do the right thing @theresecoffey @KwasiKwarteng & talk to @BMA_Pensions about #FixTheFinanceAct & #TaxUnregistered like judges.

Please RT/share with colleagues

Please RT/share with colleagues

• • •

Missing some Tweet in this thread? You can try to

force a refresh