Exciting to see the great and the good of UK think tanks and tax policy experts comment on @trussliz's initiative to cut Stamp Duty. The direction of travel is good but this reform should not take place in isolation. Here is why... 🧵👇thetimes.co.uk/article/liz-tr…

Housing taxes are of growing importance given the pressure on governments to raise revenues, improve the functioning of housing markets, and combat inequality. Many countries are looking to raise tax revenues without threatening economic recovery.

In July the OECD published an excellent paper on Housing Taxation. oecd.org/ctp/housing-ta…. It was picked up by @guardian's @phillipinman in this excellent article 👉 theguardian.com/business/2022/…

Rising house prices contribute to a growing economic divide between households that own property and those that do not. A point well made by @WeAreBrightBlue in their excellent paper 👉 brightblue.org.uk/wp-content/upl…

Unprecedented house price growth has made it harder for younger generations and renters to become homeowners and build up housing wealth.

Homeownership trends suggest that the benefits from house price growth will disproportionately accrue to older and higher-income households, as mentioned here by Lord David Willetts - thetimes.co.uk/article/proper…

In the UK homeownership rate at 25 years of age was 34% for those born in 1970-74, but fell to 16% for those born in 1985-89. Younger generations will not be able to rely on housing as a vehicle for wealth accumulation. Something that @inter_gen has highlighted on many occasions.

Rising house prices may make it more difficult for younger people to buy a home without receiving support, which could widen homeownership gap between young households that have benefited from inheritances & those that haven't, and increase intra-generational wealth inequality.

Rising housing costs may also affect households’ ability to relocate to areas that offer better employment and training opportunities, thereby reinforcing existing economic inequalities. A position well made by @ukonward 👉 ukonward.com/reports/reform…

But owner-occupied housing is both a consumption and investment good that is typically heavily tax-favoured compared to most other savings vehicles.

Many countries still levy recurrent property taxes on OUTDATED property values, significantly reducing their revenue potential (revenues have not risen in line with property values), their equity (households whose properties have increased in value may not be paying more tax)...

...as well as their economic efficiency (as property taxes levied on outdated values provide incentives for people to remain in undervalued housing even if it no longer suits their needs). Points well made by @TheIFS in this excellent paper 👉 ifs.org.uk/publications/r…

Revenues from taxes on housing have not kept up with increases in prices. The sustained growth in property values over recent decades should have been accompanied by a comparable rise in property tax revenues, but the design of these taxes has weakened this relationship.

Reliance on transaction taxes, such as stamp duty, is high, despite the potential for these taxes to reduce residential, and to some extent, labour mobility. @rcolvile highlighted the pitfalls 👉capx.co/cutting-stamp-…

We have seen many calls for Stamp Duty to be cut but what are the solutions to recover the lost revenue? The OECD report discusses a wide range of reform options that could help enhance the design, functioning and impact of housing taxes. Their strongest recommendation is 🥁🥁🥁:

Strengthening the role of recurrent taxes on immovable property (levied on regularly UPDATED property values) AND lowering housing transaction taxes would increase efficiency in the housing market and improve vertical and horizontal equity.

Over 8% of the UK's tax revenues is already generated by recurrent taxes on immovable property (Council Tax). But because Council Tax bands have not been updated since 1991 this tax is particularly punitive on low and middle-income households.

This unfairness was highlighted by @shreyagnanda in this excellent paper 👉 ippr.org/research/publi…

A recurrent tax on immovable property based on regularly updated market values may reduce the need for taxes (e.g. infrastructure levies) aimed at capturing property value increases resulting from local public investments. Case made by @TomJackSpencer 👉capx.co/who-wins-gains…

Recurrent taxes on immovable property are considered one of the most economically efficient forms of taxation because the tax base is highly immobile, which limits the scope for behavioural responses to the tax. See @HJWetzel and @Dave__Wetzel 👉 fairershare.org.uk/leading-lvt-ca…

Recurrent taxes on immovable property have also long been identified as a good source of revenue for local governments. The tax is borne mainly by local residents with limited spillovers. See @wpi_economics paper 👉fairershare.org.uk/wp-content/upl…

Recurrent taxes on immovable property can act as a substitute for an accrual-based capital gains tax so long as property values are regularly updated; the difference being that the recurrent property tax is levied on the overall value of the property, not just the rise in value.

The OECD paper suggested recurrent taxes on vacant homes can help increase housing supply, though they write that more research is needed to assess their effectiveness. @wpi_economics did this work 👉 fairershare.org.uk/wp-content/upl…

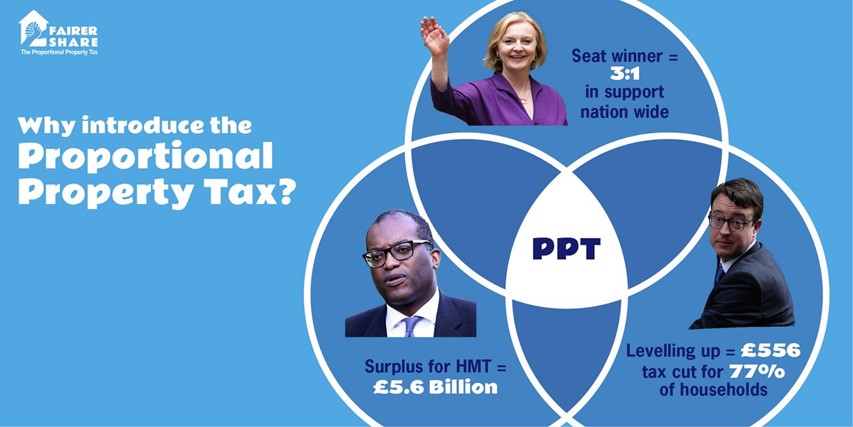

Conclusion: There is a great deal of consensus @TheIFS, @IPPR, @WeAreBrightBlue, @resfoundation - scrap Stamp Duty and Council Tax. Replace both with a recurrent tax on immovable property. @FairerShare, we call it the Proportional Property Tax. We can help.

And we leave you with @russ_lynch's excellent piece from January 2021. He captures all the key features and draws the same conclusion 👉 telegraph.co.uk/business/2021/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh