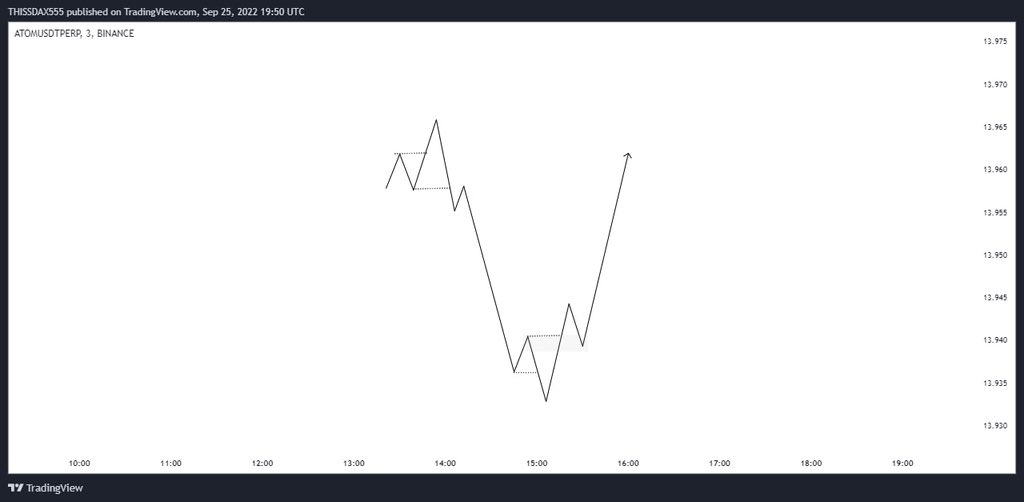

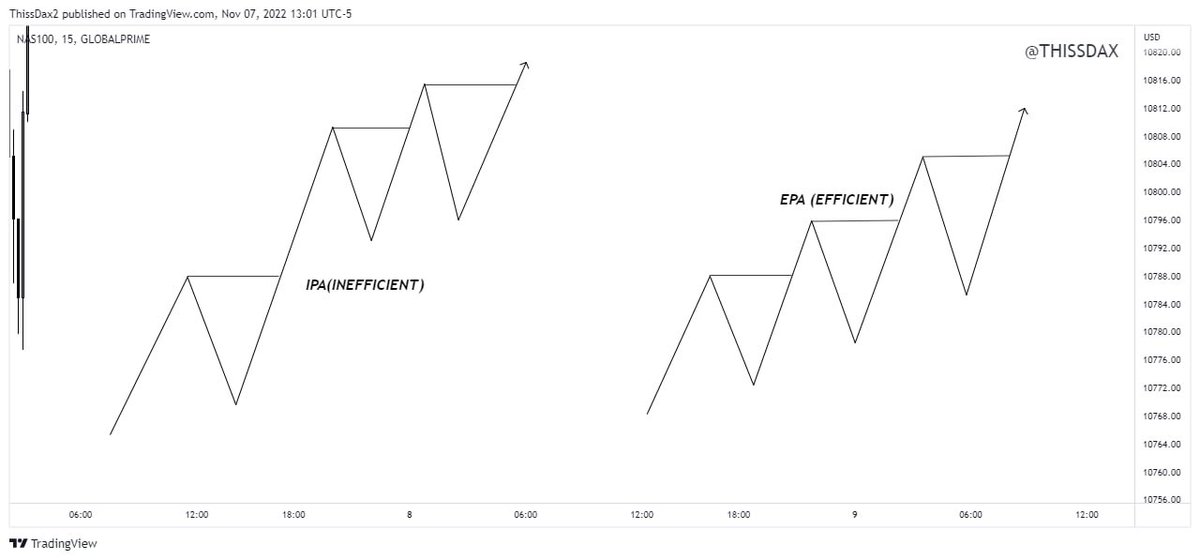

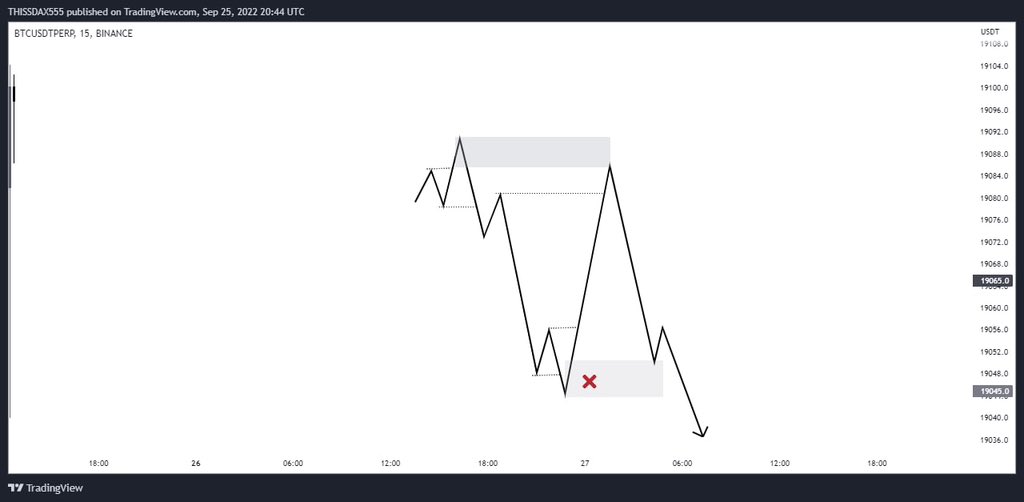

Ever wondered why your CHOCH, QM, or whatever you call it doesn't hold at times?

A 🧵

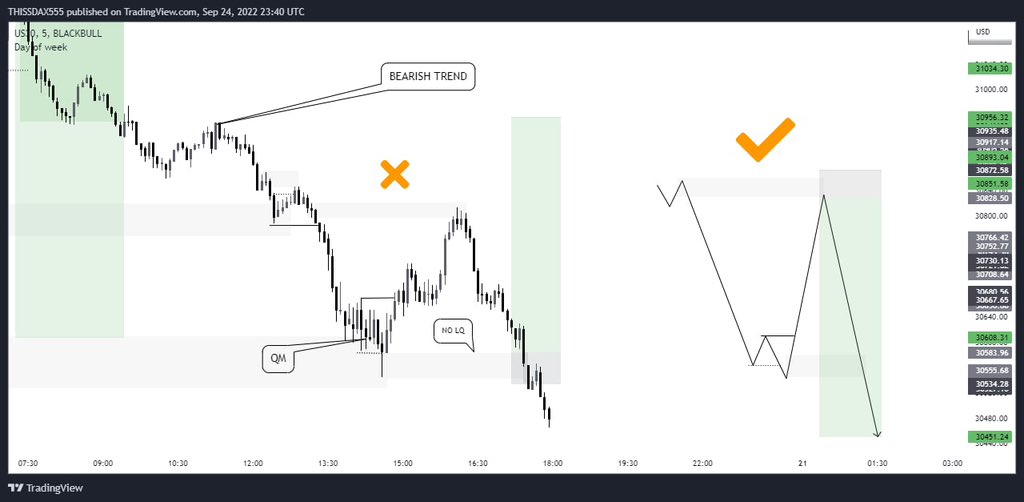

(IN A BEARISH TREND)

Once price does this, it creates a range with both strong lows and highs at the same time .the aim is to move to take out internal liquidity👇

A 🧵

(IN A BEARISH TREND)

Once price does this, it creates a range with both strong lows and highs at the same time .the aim is to move to take out internal liquidity👇

so if we can't catch the buy before it gets to the premium supply provided it aligns with HTF oderflow then the buy is no more valid and it turns to external liquidity to be grabbed in the sell continuation

But here price left the buy order run into the range extreme, it now aligns with sells.

Then the Buy/ CHOCH is no longer valid.

Then the Buy/ CHOCH is no longer valid.

• • •

Missing some Tweet in this thread? You can try to

force a refresh