Important that journalists call out the falling £ and rising cost of government borrowing for what it is:

An "incompetency premium".

Quick 🧵

An "incompetency premium".

Quick 🧵

How do we know this?

Government borrowing is reflationary, resulting in high interest rates, which all else equal should put *upwards* pressure on £.

This makes the recent movement all the more remarkable.

Government borrowing is reflationary, resulting in high interest rates, which all else equal should put *upwards* pressure on £.

This makes the recent movement all the more remarkable.

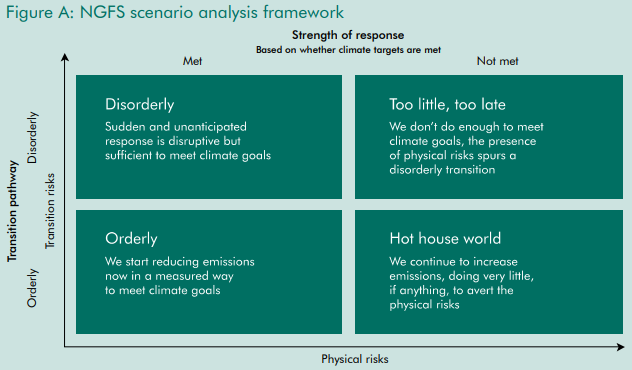

So why is £ falling? Best explanation is that markets think policy is incoherent.

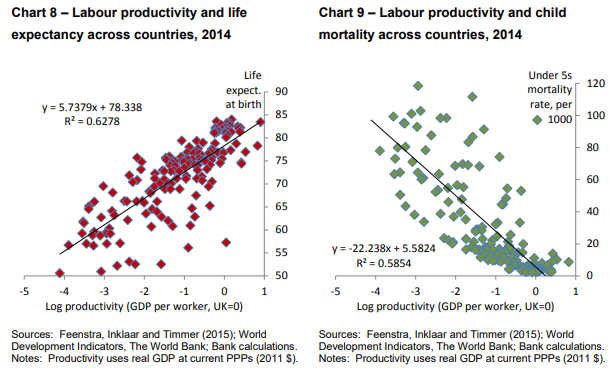

They don't buy (literally) the government's argument that tax cuts on the rich will improve economic supply, and therefore the medium/long run growth rate of the economy.

They don't buy (literally) the government's argument that tax cuts on the rich will improve economic supply, and therefore the medium/long run growth rate of the economy.

This means markets are not expecting increased investment into the UK (demand for £).

It's possible they fear the opposite - surplus savings in £ chasing the same amount of viable domestic investment, leading to people investing £ offshore (sales of £).

It's possible they fear the opposite - surplus savings in £ chasing the same amount of viable domestic investment, leading to people investing £ offshore (sales of £).

Another way of putting this is the thing you are borrowing for matters because markets take a view.

The question that has been asked is whether borrowing for tax cuts will improve the future health of the economy? The answer we've had since Friday is a resounding 'no'.

The question that has been asked is whether borrowing for tax cuts will improve the future health of the economy? The answer we've had since Friday is a resounding 'no'.

What next?

Pressure will now build on Bank of England to try and offset (or rather, 'price-in') the "incompetency premium" for the UK economy with higher interest rates.

That means we all pay the price: high borrowing costs, less investment, fewer new jobs & lower wages.

Pressure will now build on Bank of England to try and offset (or rather, 'price-in') the "incompetency premium" for the UK economy with higher interest rates.

That means we all pay the price: high borrowing costs, less investment, fewer new jobs & lower wages.

Quite an impressively destructive piece of policy making for a so-called 'mini' budget.

End.

End.

• • •

Missing some Tweet in this thread? You can try to

force a refresh