What do we know about the Nord Stream leaks and what does it imply?

Information is still coming in and there is a lot we don’t know.

I think this is a pretty big deal, and I am quite concerned. Here is my preliminary assessment.

Information is still coming in and there is a lot we don’t know.

I think this is a pretty big deal, and I am quite concerned. Here is my preliminary assessment.

1. What has happened?

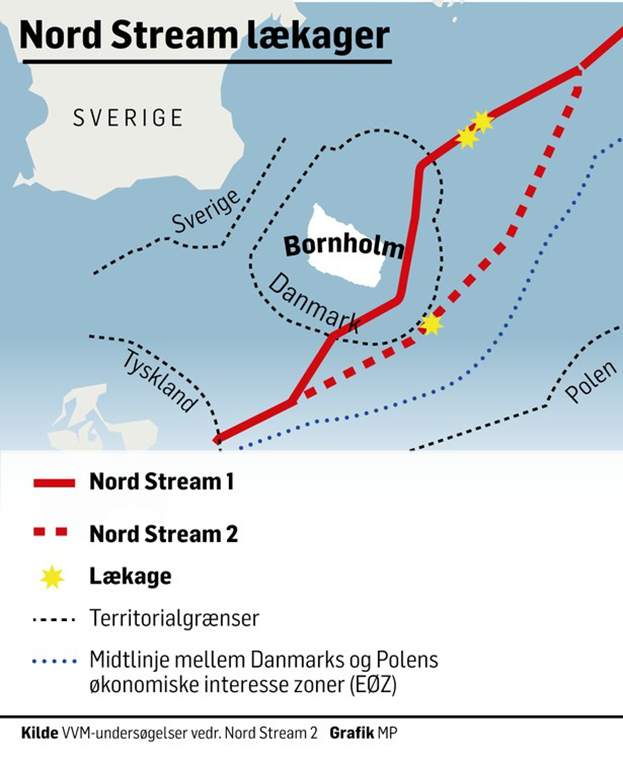

Within the past 24 hours, two leaks on the Nord Stream 1 pipeline were detected and one leak on Nord Stream 2. Neither pipeline was currently used to ship gas, but both were pressurized with natural gas and saw pressure drop.

Within the past 24 hours, two leaks on the Nord Stream 1 pipeline were detected and one leak on Nord Stream 2. Neither pipeline was currently used to ship gas, but both were pressurized with natural gas and saw pressure drop.

Note the timing: today, the new pipeline connecting Norway to Poland (BalticPipe) was inaugurated.

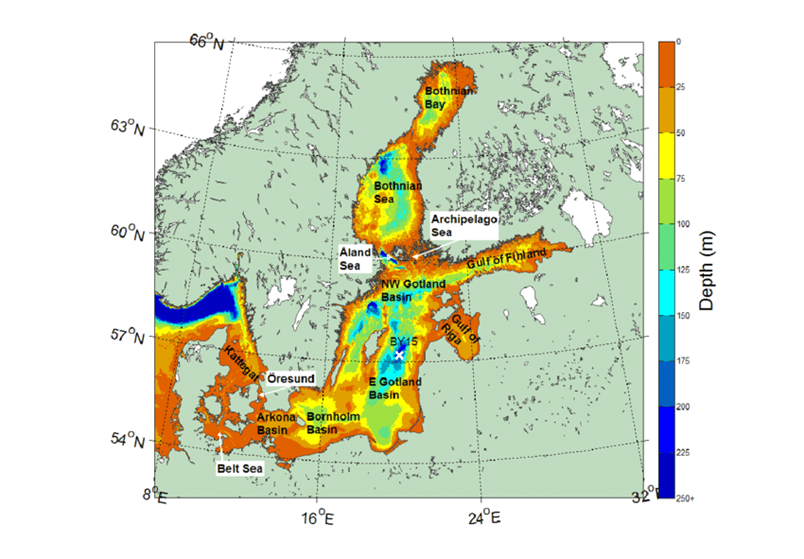

The location of the leaks is East of the Danish island Bornholm. This is the location of the three leaks:

The location of the leaks is East of the Danish island Bornholm. This is the location of the three leaks:

Impressive video footage of the leak

2. What’s the reason of the damage?

A leak of a deep sea pipeline is very rare. There hasn’t been a major earthquake or a comparable event. It is almost impossible to conceive three leaks at three locations within 24 hours to be a coincident. It very much looks like sabotage.

A leak of a deep sea pipeline is very rare. There hasn’t been a major earthquake or a comparable event. It is almost impossible to conceive three leaks at three locations within 24 hours to be a coincident. It very much looks like sabotage.

How could a sabotage be implemented? Here is a detailed thread by @jupawlak:

https://twitter.com/jupawlak/status/1574706752691511299?s=20&t=6Fo-rrEJlYkItC8b2kKc-w

3. What are the short-impacts on supply?

The immediate impact is zero. NS 2 was never in operation and Russia stopped delivering gas through NS 1 weeks ago.

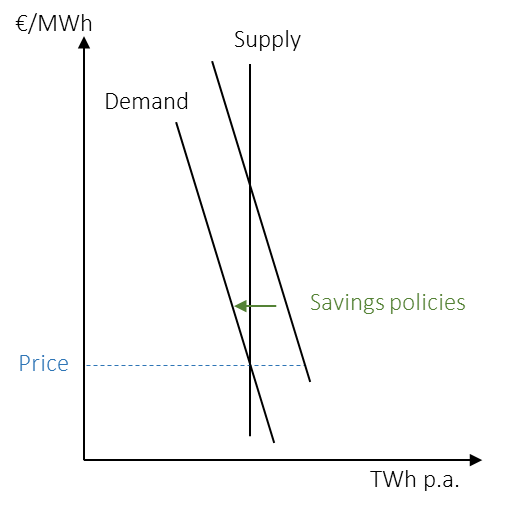

While it was unlikely that Russia would deliver any gas through the pipelines this winter, this possibility is now gone.

The immediate impact is zero. NS 2 was never in operation and Russia stopped delivering gas through NS 1 weeks ago.

While it was unlikely that Russia would deliver any gas through the pipelines this winter, this possibility is now gone.

4. What’s the market response?

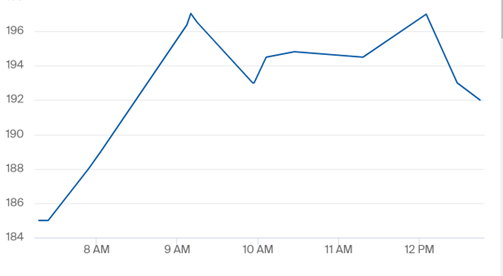

Surprisingly small. TTF Cal-23 trades 10% higher than yesterday, but changes of this magnitude have been quite usual in the past weeks.

Surprisingly small. TTF Cal-23 trades 10% higher than yesterday, but changes of this magnitude have been quite usual in the past weeks.

5. Who was is, and why?

That’s the big one. Damaging two pipelines at the bottom of the sea is a big deal, so a state actor is likely. Hard to imagine a NATO member doing this, even those most critical about the pipeline projects.

That’s the big one. Damaging two pipelines at the bottom of the sea is a big deal, so a state actor is likely. Hard to imagine a NATO member doing this, even those most critical about the pipeline projects.

Hard to imagine Ukraine doing this, for many reasons, not least the impact that would have on its support by European countries. That leaves us with Russia.

6. What does is imply?

If that’s true, it’s pretty concerning. At the very least it means Russia is burning the bridges: it is sending the clearest possible signal it won’t deliver gas any time soon.

If that’s true, it’s pretty concerning. At the very least it means Russia is burning the bridges: it is sending the clearest possible signal it won’t deliver gas any time soon.

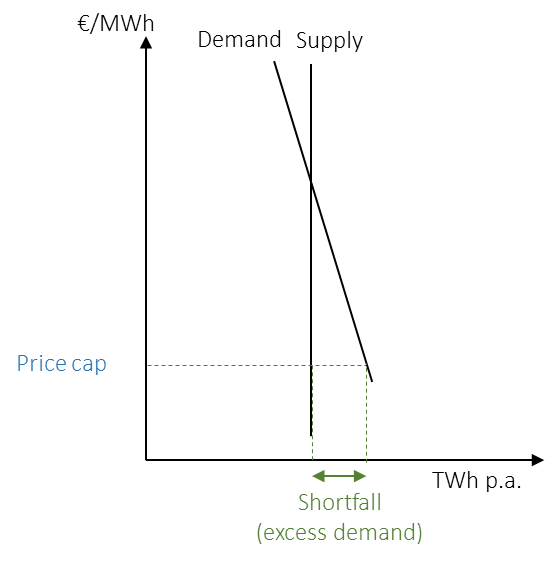

More concerning even, it could be a signal that our energy infrastructure is vulnerable. Yes, these are Gazprom-owned pipelines in international waters that were out of operation. But ...

... a similar attack on a pipeline from Norway to the UK, Germany or Poland would have huge impacts of European gas supply. Or a gas field. Or a LNG terminal. Or smth.

It is a stark reminder of the vulnerability of our energy infrastructure.

It is a stark reminder of the vulnerability of our energy infrastructure.

Add: more assessments coming in that two explosions happened. Could be that one damaged both tubes of NS 1 and the other one pipe of NS 2 (both lines have two pipes each)

https://twitter.com/AComprime/status/1574757287952060419?s=20&t=2j-uETchEGe3VMrfIn-V7Q

... including an estimate of the explosive

https://twitter.com/visegrad24/status/1574773403680112646?s=20&t=2j-uETchEGe3VMrfIn-V7Q

• • •

Missing some Tweet in this thread? You can try to

force a refresh