MUST WATCH:

Incase you don’t realize how bad our debt/bubble situation is… listen now.

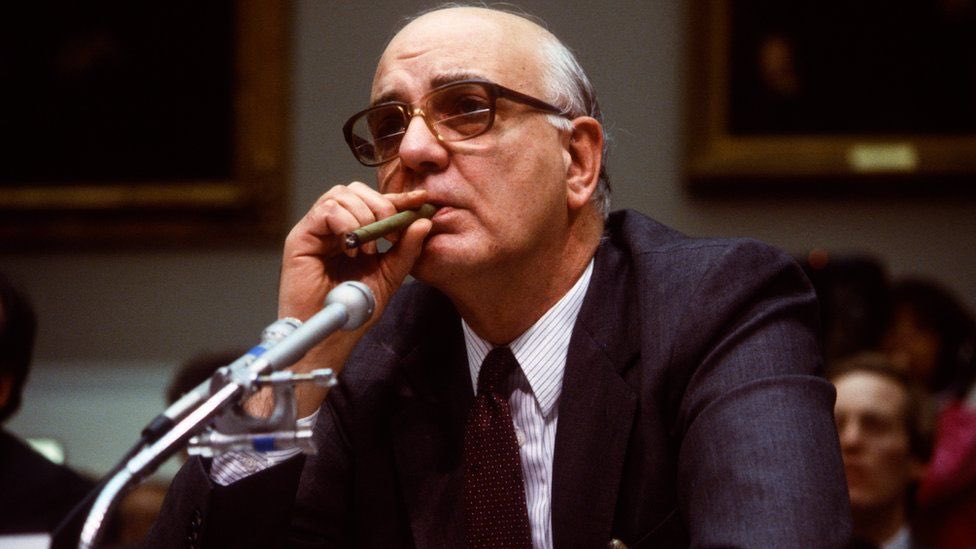

Druckenmiller playing no games today

Incase you don’t realize how bad our debt/bubble situation is… listen now.

Druckenmiller playing no games today

It’s truly incredible…

We all know our spending is out of control and can’t be sustained, yet we do nothing about it. In fact, we vote for leaders who want to spend even more.

We all know our spending is out of control and can’t be sustained, yet we do nothing about it. In fact, we vote for leaders who want to spend even more.

• • •

Missing some Tweet in this thread? You can try to

force a refresh