The new #MetisMarathon proposal from @HermesOmnichain means massive liquidity coming to $METIS projects could be only days away.

Millions of dollars are being injected and directed towards deep liquidity for the entire ecosystem.

Let's dive in.. 🧵 ⬇️

Millions of dollars are being injected and directed towards deep liquidity for the entire ecosystem.

Let's dive in.. 🧵 ⬇️

If you are unfamiliar with the proposal and incentives, I did a thread a few weeks back when this first came to light.

Feel free to take a look if you want to catch up with their first proposal, you can do so here:

Feel free to take a look if you want to catch up with their first proposal, you can do so here:

https://twitter.com/SmallCapScience/status/1564298356469350403?s=20&t=dV7-pCdP6jLS-GI_8C24lA

The first proposal to the $METIS team a few weeks back went well but the $METIS team had a few tweaks to the proposal.

With feedback received and adjustments made, I'd expect this version to be pushed through hassle free. Based on the team comments below, time is a priority.

With feedback received and adjustments made, I'd expect this version to be pushed through hassle free. Based on the team comments below, time is a priority.

According to 0xLight in the $HERMES Discord, they are meeting with the $METIS team today to discuss the next steps on the proposal.

I'm expecting this to move forward in the next week, if not sooner but thats speculation on my part.

I'm expecting this to move forward in the next week, if not sooner but thats speculation on my part.

Every incentive is structured to go to $HERMES users locking into $veHERMES, meaning circ. $HERMES should become deflationary.

The proposal is broken into 5 general parts:

1. V1 Locking Incentives

2. V1 Bribes

3. V2 Locking Incentives

4. V2 Bribes

5. Bonus Incentives

The proposal is broken into 5 general parts:

1. V1 Locking Incentives

2. V1 Bribes

3. V2 Locking Incentives

4. V2 Bribes

5. Bonus Incentives

$HERMES circulating MC - $1.5M

$HERMES locked + unlocked MC - $5.62M

The circulating supply is around 26M HERMES and weekly emissions are only about 821k. That means $HERMES emissions are about $50.5k weekly at current rates (keep this in mind)

$HERMES locked + unlocked MC - $5.62M

The circulating supply is around 26M HERMES and weekly emissions are only about 821k. That means $HERMES emissions are about $50.5k weekly at current rates (keep this in mind)

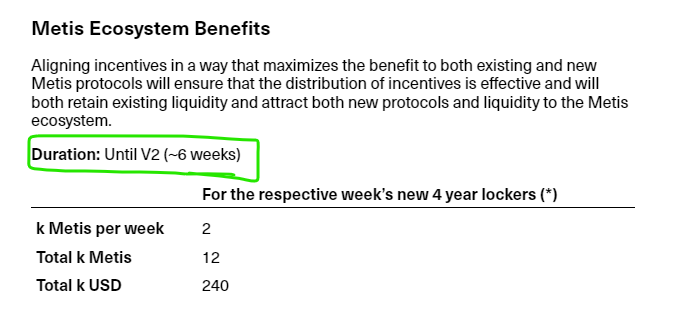

1. V1 Locking incentives -

V1 $HERMES operates a ve model where locking for 4 years gets you one veHERMES. This proposal asks for 240k USD worth of $METIS over the 6 weeks leading up to their v2 launch.

$40k a week in locking incentives compared to $50k of emissions! 👀

V1 $HERMES operates a ve model where locking for 4 years gets you one veHERMES. This proposal asks for 240k USD worth of $METIS over the 6 weeks leading up to their v2 launch.

$40k a week in locking incentives compared to $50k of emissions! 👀

2. V1 Bribes

V1 Bribes also are rewards that go to $veHERMES holders. Bribes + Locking incentives weekly are worth more than current emissions, bullish!

The amount of incentives from the $METIS team is based entirely on TVL of the 7 selected LP pairs.

V1 Bribes also are rewards that go to $veHERMES holders. Bribes + Locking incentives weekly are worth more than current emissions, bullish!

The amount of incentives from the $METIS team is based entirely on TVL of the 7 selected LP pairs.

The 6 selected pairs to receive bribes are METIS / HERMES LPs which support price/liquidity.

Current Liquidity in Selected Pairs -

• METIS/m.USDC - $905k

• METIS/WETH - $365k

• METIS/WBTC - $2.9k

• WETH/m.USDC - $890k

• m.USDC/m.USDT- $2.8M

• HERMES/METIS - $354k

Current Liquidity in Selected Pairs -

• METIS/m.USDC - $905k

• METIS/WETH - $365k

• METIS/WBTC - $2.9k

• WETH/m.USDC - $890k

• m.USDC/m.USDT- $2.8M

• HERMES/METIS - $354k

V1 Bribes based on current TVL per pool:

• METIS/m.USDC - $35k

• METIS/WETH - $35k

• METIS/WBTC - $35k

• WETH/m.USDC - $35k

• m.USDC/m.USDT- $63k

• HERMES/METIS - $35k

Total Metis v1 Bribes - $238k

• METIS/m.USDC - $35k

• METIS/WETH - $35k

• METIS/WBTC - $35k

• WETH/m.USDC - $35k

• m.USDC/m.USDT- $63k

• HERMES/METIS - $35k

Total Metis v1 Bribes - $238k

Between bribes + locking there is a total of $478k of v1 rewards over 6 weeks (~$80k per week).

Reminder:

Hermes current circ. MC - $1.5M

Hermes circ. + locked MC - $5.62M

V1 rewards over 6 weeks…

31.8% of circ MC!

8.5% of total locked + unlocked HERMES MC!

Massive!

Reminder:

Hermes current circ. MC - $1.5M

Hermes circ. + locked MC - $5.62M

V1 rewards over 6 weeks…

31.8% of circ MC!

8.5% of total locked + unlocked HERMES MC!

Massive!

V1 Rewards are massive and keep in mind, 6 of 7 pools are currently at the lowest tier of TVL rewards (< $2.5M). As liquidity flows in, these rewards should grow week over week.

Funds/Whales also have the opportunity to massively boost incentives by bringing large TVL to these.

Funds/Whales also have the opportunity to massively boost incentives by bringing large TVL to these.

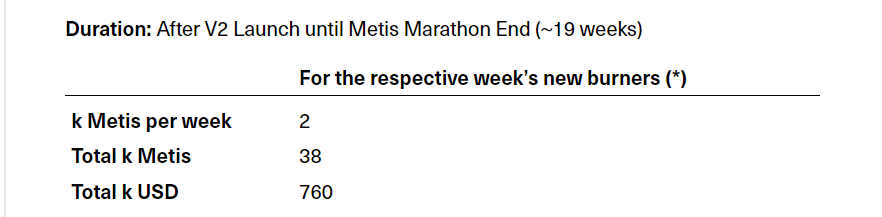

3. V2 Locking Incentives

V2 will be over 19 weeks and their locking incentives are set at $760k, or $40k per week.

This will continue to reduce supply over time for the next 25 weeks, v2 should also see a massive uptick in users as HERMES launches on Arbitrum.

V2 will be over 19 weeks and their locking incentives are set at $760k, or $40k per week.

This will continue to reduce supply over time for the next 25 weeks, v2 should also see a massive uptick in users as HERMES launches on Arbitrum.

4. V2 Bribes

V2 Bribes are also massive and striped across 3 METIS-specific pairs. These LPs will deepen METIS liquidity and should be much deeper by the time V2 rolls around in ~6 weeks.

V2 Bribes are also massive and striped across 3 METIS-specific pairs. These LPs will deepen METIS liquidity and should be much deeper by the time V2 rolls around in ~6 weeks.

Current V2 Pairs & Liquidity:

• METIS/m.USDC - $905k

• METIS/WETH - $365k

• METIS/WBTC - $2.9k

V2 Bribes over 19 weeks for selected pairs based on current TVL:

• METIS/m.USDC - $95k

• METIS/WETH - $95k

• METIS/WBTC - $95k

$285k V2 Bribes

Total V2 - $1.045M (worst case)

• METIS/m.USDC - $905k

• METIS/WETH - $365k

• METIS/WBTC - $2.9k

V2 Bribes over 19 weeks for selected pairs based on current TVL:

• METIS/m.USDC - $95k

• METIS/WETH - $95k

• METIS/WBTC - $95k

$285k V2 Bribes

Total V2 - $1.045M (worst case)

5. Bonus Incentives

In order to encourage individual projects to also bribe veHERMES, up to $500k is set aside for matching bribes.

This is "$0" right now because it is dependent on the $METIS team approving the individual projects. I'm expecting this $500k to be spent

In order to encourage individual projects to also bribe veHERMES, up to $500k is set aside for matching bribes.

This is "$0" right now because it is dependent on the $METIS team approving the individual projects. I'm expecting this $500k to be spent

The total rewards currently across V1/V2 Locking + Bribes is $1.763M!

Keep in mind the total Hermes circ. + locked MC - $5.62M. That $1.763M also doesn't include the $500k of bonus incentives or the potential upside that comes with larger incentives when the TVL grows. 👀

Keep in mind the total Hermes circ. + locked MC - $5.62M. That $1.763M also doesn't include the $500k of bonus incentives or the potential upside that comes with larger incentives when the TVL grows. 👀

100% of rewards go to HERMES lockers in this model and the rewards are larger than the current circulating MC of HERMES.

It's also worth noting, this proposal assumes $METIS is worth $20, it's currently $24 and has a chance to go on a massive run as capital comes in.

It's also worth noting, this proposal assumes $METIS is worth $20, it's currently $24 and has a chance to go on a massive run as capital comes in.

A number of DAOs are also already blackholing $HERMES by farming and immediately locking.

$MAIA, $AERA, and more recently $HUM have all started accumulating locked $HERMES to further control their own emissions.

Bribes are also flowing...

$MAIA, $AERA, and more recently $HUM have all started accumulating locked $HERMES to further control their own emissions.

Bribes are also flowing...

https://twitter.com/SmallCapScience/status/1570096785292500993?s=20&t=kErgrPubXJyDd6ddTWwRVg

A little more free alpha - I've seen multiple $HUM &/or $HERMES aggregators create their Twitter accounts lately or pop into the discords.

Things are heating up in the accumulation race and finalized rewards haven't been announced yet.

Here is $ARES...

twitter.com/AresFinance?s=…

Things are heating up in the accumulation race and finalized rewards haven't been announced yet.

Here is $ARES...

twitter.com/AresFinance?s=…

Another massive catalyst for $HERMES and the $METIS ecosystem is the possibility of $AAVE coming onchain with incentives.

Keep an eye on this, it's what finally made $OP explode with activity. Rally votes from any $AAVE whales you know 😉

governance.aave.com/t/launch-aave-…

Keep an eye on this, it's what finally made $OP explode with activity. Rally votes from any $AAVE whales you know 😉

governance.aave.com/t/launch-aave-…

Keep in mind that the founder of @AaveAave has been in support of coming to $METIS for a longtime.

@StaniKulechov is also an advisor for $METIS, hard for me to see this not passing imo! 🤞

@StaniKulechov is also an advisor for $METIS, hard for me to see this not passing imo! 🤞

https://twitter.com/StaniKulechov/status/1487519065669345280?s=20&t=kErgrPubXJyDd6ddTWwRVg

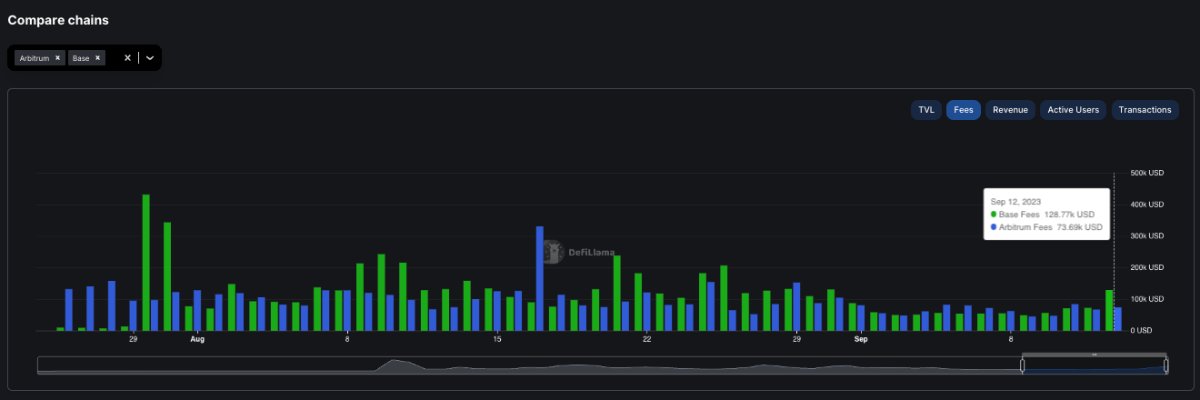

Don't believe me on the importance of $AAVE? Look at $OP where they went from $250M to $2.5B in TVL in under a month.

$AAVE is currently $1.2B of the $1.7B TVL on $OP, $METIS will look very similar assuming everything passes governance.

The storm is coming!

$AAVE is currently $1.2B of the $1.7B TVL on $OP, $METIS will look very similar assuming everything passes governance.

The storm is coming!

$HERMES v2 will make it an omnichain DEX using Uni v3 liquidity on @arbitrum. According to the proposal, v2 is 6 weeks away and this proposal was sent 10 days ago.

<5 weeks and $HERMES will also be benefiting from Arbitrum projects, deep liquidity, and the rumored $Arbi airdrop!

<5 weeks and $HERMES will also be benefiting from Arbitrum projects, deep liquidity, and the rumored $Arbi airdrop!

DAOs/Projects/Myself are all running out of time to accumulate on this one, when it happens I'm expecting all of it to happen quickly.

The team is in Singapore for Token2049. I'm expecting the above catalysts to come in a swarm once the team is back.

The team is in Singapore for Token2049. I'm expecting the above catalysts to come in a swarm once the team is back.

https://twitter.com/MetisDAO/status/1574852451013902336?s=20&t=AkzUG-56j3ODgb32j77ckg

Since you hung around until the end of the thread, most of this was written at the end of last week...

The real alpha is that the $METIS / $HERMES teams hopped off 15 minutes ago and everything went perfectly, final step is for them to doxx.

LFG! 📈

The real alpha is that the $METIS / $HERMES teams hopped off 15 minutes ago and everything went perfectly, final step is for them to doxx.

LFG! 📈

Disclaimer -

I own $HERMES, $HUM, and other positions on $METIS. This is for my own record and none of this should be seen as financial advice.

I'm not a financial advisor, this is all for my personal records.

GL everyone! 🏁

I own $HERMES, $HUM, and other positions on $METIS. This is for my own record and none of this should be seen as financial advice.

I'm not a financial advisor, this is all for my personal records.

GL everyone! 🏁

• • •

Missing some Tweet in this thread? You can try to

force a refresh