Something very important is going on in the pension fund industry.

Why was the Bank of England forced to intervene as the lender of last resort?

Is something going seriously wrong?

A thread.

1/

Why was the Bank of England forced to intervene as the lender of last resort?

Is something going seriously wrong?

A thread.

1/

First, some context.

The size of the global pension fund industry is estimated to be in the $35-40 trillion area.

It's a very large and systematically important industry not only because of its size, but also because of its social impact.

When it comes to countries...

2/

The size of the global pension fund industry is estimated to be in the $35-40 trillion area.

It's a very large and systematically important industry not only because of its size, but also because of its social impact.

When it comes to countries...

2/

...the share of pension fund assets as % of GDP can be vastly different as some countries choose to accumulate retirement savings in other vehicles.

Conservatively speaking, the UK pension fund industry has $4 trillion in assets or roughly ~120% of GDP - it's very large.

3/

Conservatively speaking, the UK pension fund industry has $4 trillion in assets or roughly ~120% of GDP - it's very large.

3/

Pension funds' liabilities are a promise to pay a stream of retirement cash flows in the far future (~30y+).

This organically exposes pension funds to 30y+ interest rate risk which needs to be hedged, at least to a certain extent.

Pension funds also must generate returns.

4/

This organically exposes pension funds to 30y+ interest rate risk which needs to be hedged, at least to a certain extent.

Pension funds also must generate returns.

4/

To hedge interest rate risks, swaps are a very convenient instrument

A ''receiver'' interest rate swap is nothing else than an agreement to receive cash flows at a fixed rate against the obligation to pay cash flows at the prevailing floating rate over time

The trick is...

5/

A ''receiver'' interest rate swap is nothing else than an agreement to receive cash flows at a fixed rate against the obligation to pay cash flows at the prevailing floating rate over time

The trick is...

5/

...swaps don't require any principal investment upfront.

The beauty of a swap is that there is no principal investment up front. The cash that would have been invested in long dated safe bonds has now been deployed in other, higher yielding assets.

Bear this in mind.

6/

The beauty of a swap is that there is no principal investment up front. The cash that would have been invested in long dated safe bonds has now been deployed in other, higher yielding assets.

Bear this in mind.

6/

To avoid bilateral counterparty risks, today swaps are mostly cleared by a Clearing House.

An initial margin (often paid by posting bonds as collateral) and variation margins (as interest rates move during the lifetime of the swap; mostly paid in cash) are required.

7/

An initial margin (often paid by posting bonds as collateral) and variation margins (as interest rates move during the lifetime of the swap; mostly paid in cash) are required.

7/

So, short recap

UK pension funds are huge

They are sitting on a very large amount of 30y receiver swaps (''betting'' on lower interest rates) to hedge long-dated liabilities

This requires very little upfront cash payments, hence cash is invested in stocks, EMs, credits etc

8/

UK pension funds are huge

They are sitting on a very large amount of 30y receiver swaps (''betting'' on lower interest rates) to hedge long-dated liabilities

This requires very little upfront cash payments, hence cash is invested in stocks, EMs, credits etc

8/

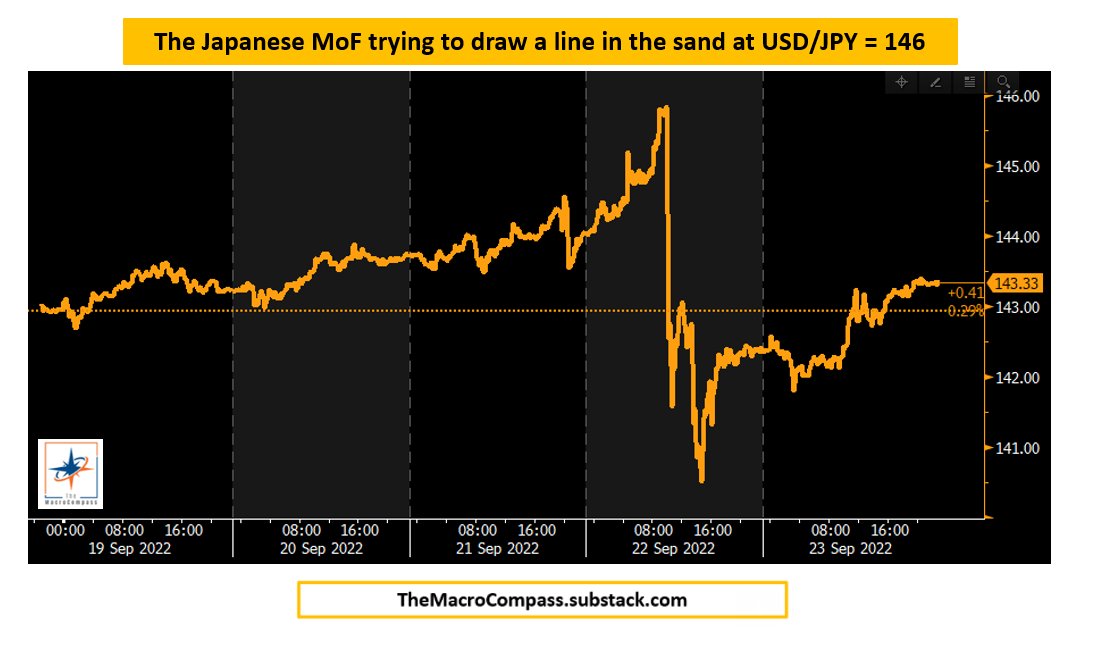

Then, this happens.

30y swap rates explode higher like never (literally, never) before - it's margin call time.

Wait a second though - most of the pension fund cash is tied in riskier assets that the Clearing House doesn't accept as collateral!

Well, we'll go to the BoE...

9/

30y swap rates explode higher like never (literally, never) before - it's margin call time.

Wait a second though - most of the pension fund cash is tied in riskier assets that the Clearing House doesn't accept as collateral!

Well, we'll go to the BoE...

9/

...and post this collateral there and get some cash in repo from them.

Ah, but pension funds don't have direct access to the BoE.

Ok, let's ask banks...yeah, sure :)

Banks were smelling this from far away, and actually contributed to the massive move higher in rates.

10/

Ah, but pension funds don't have direct access to the BoE.

Ok, let's ask banks...yeah, sure :)

Banks were smelling this from far away, and actually contributed to the massive move higher in rates.

10/

If I know my clients' risk of insolvency will move higher as rates move viciously higher, as a bank I am likely to hedge some of my risk and position for that.

I can buy some OTM options (payer swaptions) and as rates move up I will exacerbate the problem (and make money).

11/

I can buy some OTM options (payer swaptions) and as rates move up I will exacerbate the problem (and make money).

11/

Margin calls squared.

The only way out is to liquidate assets (bonds, stocks, all!) and meet margin calls to try and avoid insolvency.

But these assets are dumped into market makers with limited risk warehousing ability (post GFC regulation) and hence it's fire sale time.

12/

The only way out is to liquidate assets (bonds, stocks, all!) and meet margin calls to try and avoid insolvency.

But these assets are dumped into market makers with limited risk warehousing ability (post GFC regulation) and hence it's fire sale time.

12/

The Bank of England was forced to step in and intervene by effectively limiting the margin call vicious circle and a very likely slaughterhouse in the domestic pension fund industry.

By mechanically forcing 30y yields down, they stopped the bleeding.

13/

By mechanically forcing 30y yields down, they stopped the bleeding.

13/

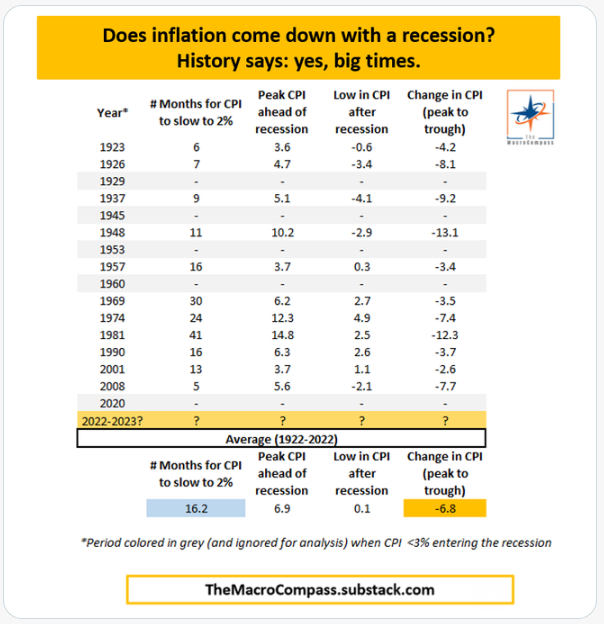

Is this only a UK issue?

The UK pension fund industry as % of GDP is very large - but it's not the only one.

If you run the numbers on some European and Nordics pension funds you'll quickly realize a ~200 bps move in 30y EUR rates could seriously cause troubles.

14/

The UK pension fund industry as % of GDP is very large - but it's not the only one.

If you run the numbers on some European and Nordics pension funds you'll quickly realize a ~200 bps move in 30y EUR rates could seriously cause troubles.

14/

The most relevant aspect here is that the pension fund industry dynamics could easily force Central Banks' hands at the very moment when credibility is the most at stake.

The BoE didn't ''pivot'' - they simply had to step in to temporarily stop the bleeding...

15/

The BoE didn't ''pivot'' - they simply had to step in to temporarily stop the bleeding...

15/

...in a systematically important sector.

By doing so, they lower (real) interest rates and actively fight bond vigilantes demanding higher yields to fund external deficits and their very own credibility in fighting inflation.

So, what's ahead?

16/

By doing so, they lower (real) interest rates and actively fight bond vigilantes demanding higher yields to fund external deficits and their very own credibility in fighting inflation.

So, what's ahead?

16/

I just published my new free piece that looks into the major FX moves across the world, and provides a framework to assess which countries are best/worst equipped to navigate these challenging conditions.

Have a look, it's free!

17/

themacrocompass.substack.com/p/fx-markets-o…

Have a look, it's free!

17/

themacrocompass.substack.com/p/fx-markets-o…

Finally, a warm word of appreciation for my friend and former colleague Eric Zijdenbos - he helped a great deal in gathering these thoughts due to his vast knowledge and first hand experience with the European pension fund players.

18/18

18/18

• • •

Missing some Tweet in this thread? You can try to

force a refresh