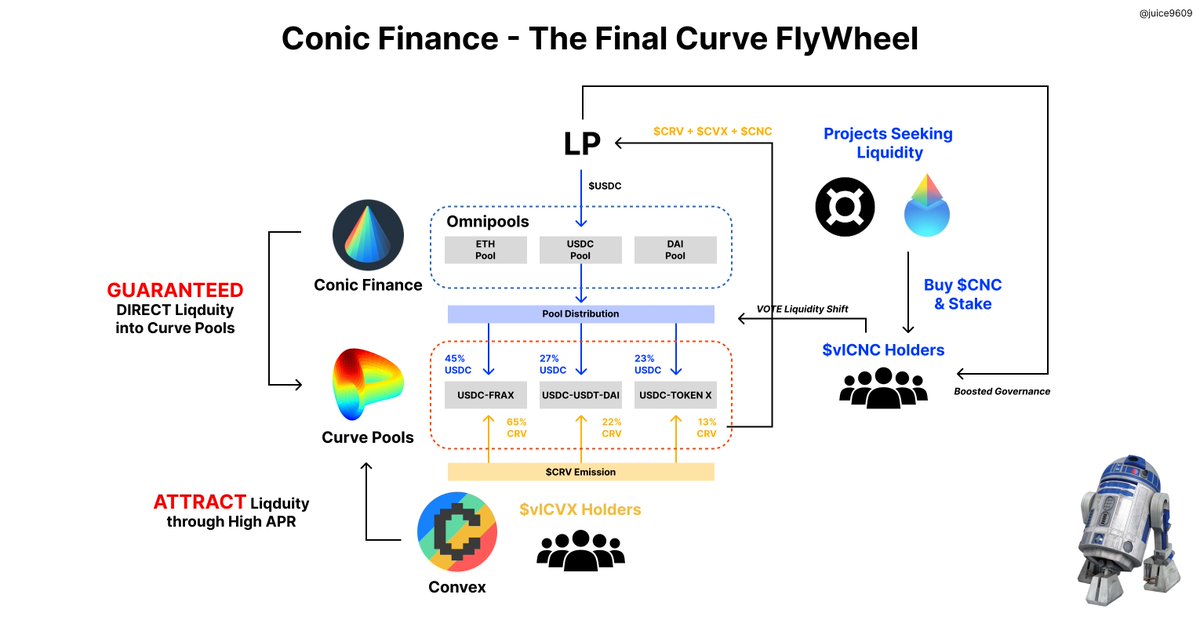

1/ Understanding the underlying value of $CNC of @ConicFinance 🍦 to accurately evaluate the value it brings to the $CRV-$CVX-$CNC flywheel 🛞

A 🧵 on everything you need to know on why $vlCNC is the next big thing (Hint: Cheap Liquidity 😉)

A 🧵 on everything you need to know on why $vlCNC is the next big thing (Hint: Cheap Liquidity 😉)

2/ To understand the basic mechanism of @ConicFinance , please refer to the thread i made below

https://twitter.com/juice9609/status/1573293029993381889?s=20&t=JPBEpdtNg8wNfxIHRnR8GA

3/ @ConvexFinance was the first flywheel, allowing protocols to bribe for higher emission of $CRV on specific pools in @CurveFinance

This allowed @FraxFinance to acquire $vlCVX and direct higher $CRV emissions on $FRAX pools compared to other pools ($FRAX > $3POOL)

This allowed @FraxFinance to acquire $vlCVX and direct higher $CRV emissions on $FRAX pools compared to other pools ($FRAX > $3POOL)

4/ Therefore, protocols desiring liquidity in Curve essentially needs to accumulate $vlCVX to direct $CRV rewards into wanted pools (also called the #CurveWar)

TLDR: Acquire more $veCRV ($vlCVX) to vote on $CRV emission

A summary of 🧵's by @CurveCap

substack.com/profile/197443…’s

TLDR: Acquire more $veCRV ($vlCVX) to vote on $CRV emission

A summary of 🧵's by @CurveCap

substack.com/profile/197443…’s

5/ $vlCVX also receives bribes from different protocols for $vlCVX holders to vote on their pool emissions

This creates a fluctuation of $CRV emissions on each pool every 2 weeks

This creates a fluctuation of $CRV emissions on each pool every 2 weeks

6/ Pools that receive votes generate ↑ APR to ATTRACT liquidity

However, $vlCNC actually DIRECTS liquidity into the “MOST EFFICIENT POOL” with "highest" yield

$vlCVX = direct $CRV inflation gauges = ↑ APR

$vlCNC = direct liquidity shift → pools with ↑ APR

However, $vlCNC actually DIRECTS liquidity into the “MOST EFFICIENT POOL” with "highest" yield

$vlCVX = direct $CRV inflation gauges = ↑ APR

$vlCNC = direct liquidity shift → pools with ↑ APR

7/ However, at the same time, because the deployment of liquidity deposited on @ConicFinance is not based on a smart contract to always deploy in the "HIGHEST" or the most efficient pool,

There may be a war to accumulate $CNC to direct #Omnipool liquidities to specific pools

There may be a war to accumulate $CNC to direct #Omnipool liquidities to specific pools

8/ Essentially, this means #Omnipools may be distributed on pools with ↓ and even unattractive Curve pools if the $vlCNC holders choose to do so 😲

You probably see where this is going - #CNCWar

Protocols can easily fight to lock more $vlCNC to govern the #Omnipools liquidity

You probably see where this is going - #CNCWar

Protocols can easily fight to lock more $vlCNC to govern the #Omnipools liquidity

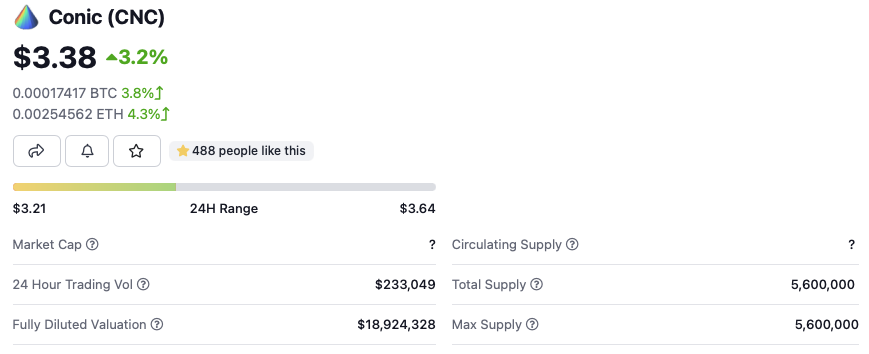

9/ I personally see high demand and benefits for $CNC relative to LPs in the short run (until $CNC MC becomes > than the TVL of the pools)

✅ This is also enhanced by the "GUARANTEE" factor TVL assets are directed by $vlCNC holders as @ConvexFinance only “ATTRACTS” liquidity

✅ This is also enhanced by the "GUARANTEE" factor TVL assets are directed by $vlCNC holders as @ConvexFinance only “ATTRACTS” liquidity

10/ This translates to a simple formula =

1 $vlCNC / #Omnipool TVL

#Omnipools are efficient yield collecting pools so it will naturally grows in TVL with high APR (as $CNC is distributed on top of $CRV & $CVX)

$CNC MC < Omnipool = 🙆♂️ Cheap

$CNC MC > Omnipool = 🙅♂️ Cheap

1 $vlCNC / #Omnipool TVL

#Omnipools are efficient yield collecting pools so it will naturally grows in TVL with high APR (as $CNC is distributed on top of $CRV & $CVX)

$CNC MC < Omnipool = 🙆♂️ Cheap

$CNC MC > Omnipool = 🙅♂️ Cheap

11/ Then why would LPs want to deposit if liquidity is dictated by $vlCNC holders?

1. Efficient way of earning high yield based on emission shifts

2. Rewards are in $CRV + $CVX + $CNC (> than depositing on Convex)

3. LP Boost Factor: mechanism to prevent abuse of #Omnipool

1. Efficient way of earning high yield based on emission shifts

2. Rewards are in $CRV + $CVX + $CNC (> than depositing on Convex)

3. LP Boost Factor: mechanism to prevent abuse of #Omnipool

11/ $vlCNC is boosted by two factors:

What this does is it allows LPs to have a bigger say on how the TVL will be distributed across pools in Curve

✅ A setup to prevent protocols with no LP exposure to abuse the protocol’s model through immediate $CNC buy up (when cheap)

What this does is it allows LPs to have a bigger say on how the TVL will be distributed across pools in Curve

✅ A setup to prevent protocols with no LP exposure to abuse the protocol’s model through immediate $CNC buy up (when cheap)

12/ $CNC accumulators and LPs (with higher voting boost) will compete to shift liquidity of @ConicFinance

• This is good for $CNC as there is ↑ demand

• LPs are earning $CNC on top of providing liquidity - therefore, they also do have interest of having healthy $CNC demand

• This is good for $CNC as there is ↑ demand

• LPs are earning $CNC on top of providing liquidity - therefore, they also do have interest of having healthy $CNC demand

13/ So we will see more protocols competing in the #CNCwar to buy and direct liquidity at cheaper price (when MC < TVL)

As obvious as it seems, it is a matter of time until @ConicFinance acquires higher TVL than $20 M

As obvious as it seems, it is a matter of time until @ConicFinance acquires higher TVL than $20 M

14/ So what are left until we kick off?

1. $CNC Airdrop worth about $1,000 claim for $CVX holders is due until October 4 = less $CNC sell pressure for airdrop claimers (67.5% left)

1. $CNC Airdrop worth about $1,000 claim for $CVX holders is due until October 4 = less $CNC sell pressure for airdrop claimers (67.5% left)

https://twitter.com/CredibleCrypto/status/1574823400891039744?s=20&t=6ShrbtJ0GqWlkGCiFfqO1g

15/ 2. Conic will go live very very soon (hasn't been confirmed yet by team though)

Once @ConicFinance is ready, it's ready to earn high yield and grow demand for $CNC

Once @ConicFinance is ready, it's ready to earn high yield and grow demand for $CNC

https://twitter.com/defi_airdrops/status/1574687829481132037?s=20&t=6ShrbtJ0GqWlkGCiFfqO1g

16/ 3. Lastly, Audits - This was an important part that was mentioned by the @ConicFinance team as they want to finish the audit first to scale up

But it also does seem like things are moving quite fast and they are getting ready very soon

But it also does seem like things are moving quite fast and they are getting ready very soon

https://twitter.com/napgener/status/1573074783960535040?s=20&t=6ShrbtJ0GqWlkGCiFfqO1g

17/ It is only a matter of days or few weeks until everyone gets to know about @ConicFinance 🤷

It is a very well-built protocol and $CNC will grow in demand

So catch this 💎 while you can!

Unrolled Version:

typefully.com/juice9609/b2UN…

It is a very well-built protocol and $CNC will grow in demand

So catch this 💎 while you can!

Unrolled Version:

typefully.com/juice9609/b2UN…

18/ Please ❤️ & 🔄 retweet the thread if you liked what you read

Don't forget to follow me @juice9609 for more visualized and easy-to-understand analysis like this!

Don't forget to follow me @juice9609 for more visualized and easy-to-understand analysis like this!

https://twitter.com/juice9609/status/1575705300971028480?s=20&t=77CEdnGlx4OOQ1dsuJqSuw

• • •

Missing some Tweet in this thread? You can try to

force a refresh