ALKALI METALS - PROXY PLAY FOR AIR BAG POLICY.

GOI's New policy change is recommending 6 airbags for for every cars from Oct 23. Even though it's mandatory from next year, auto manufacturers may start to follow this as earlier (1/n)

@itsTarH

@LuckyInvest_AK

@soicfinance

GOI's New policy change is recommending 6 airbags for for every cars from Oct 23. Even though it's mandatory from next year, auto manufacturers may start to follow this as earlier (1/n)

@itsTarH

@LuckyInvest_AK

@soicfinance

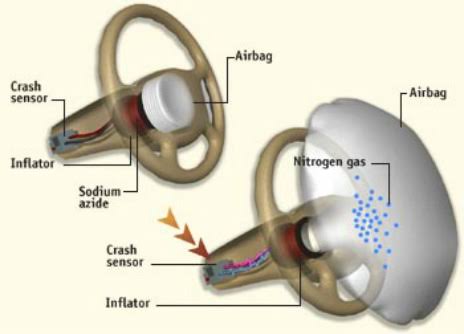

Before studying about the company this you need to know regarding a chemical called sodium azide, which is an essential ingredient of airbag. Every air bags contains 50-200 mg of sodium azide . (2/n)

So as a commodity Prices of sodium azide is set to boom with this new regulation. But manufacturing of this chemical requires high Expertise because of the explosive nature. (3/n)

Currently in India, a major portion of car sales is economic cars like Wagon R, Alto etc. Which is having 2 airbags now, by the new rule they have to shift to 6 airbags. Than means 3 times more Sodium azide required !!! (4/n)

So now let's move to #ALKALIMETALS

Alkali Metals Limited manufactures variety of products ranging from sodium derivatives, pyridine derivatives, fine chemicals and pharmaceutical APIs. It's a micro cap with 100cr market cap. (5/n)

Alkali Metals Limited manufactures variety of products ranging from sodium derivatives, pyridine derivatives, fine chemicals and pharmaceutical APIs. It's a micro cap with 100cr market cap. (5/n)

Alkali Metals has a product portfolio of 365 products . The company's product portfolio includes sodium and other Alkali Metals, Derivatives like Amides, Hydrides, Alkoxides, Azides & Tetrazoles, Pyridine Compounds, cyclic compounds, Specialty Fine chemicals, Drugs & APIs (6/n)

The company handles extremely hazardous processes and products involving Sodium based compounds and pyridine derivatives.The company's products are building blocks in the manufacture of bulk drugs and pharma intermediates. (7/n)

The company is recognized as an Export House by DGFT and also recognized by Dept. of Science and Technology, New Delhi as an approved In house R & D Facility (8/n)

The company sold 1189 MT of finished products in FY21. [6]

The three sodium derivatives such as sodium amide, sodium azide, and sodium hydride contributed 67% to the overall FY21, the company generated ~49.60% Domestic revenue and ~50.40% from Exports.

(9/n)

The three sodium derivatives such as sodium amide, sodium azide, and sodium hydride contributed 67% to the overall FY21, the company generated ~49.60% Domestic revenue and ~50.40% from Exports.

(9/n)

Company holds a USFDA approved plant in VIZAG. It's very hard to acquire USFDA approval and very few micro caps posses it. In my opinion, market value of this plant itself will be equal to market cap of company (10/n)

Available at a PE of 18.

With a low debt of around 17 cr.

Company holds around 41Cr as reserves too (too strong).

Company maintains a positive Net cash flow.

Promoters hold around 70% stake in this company. (11/n)

With a low debt of around 17 cr.

Company holds around 41Cr as reserves too (too strong).

Company maintains a positive Net cash flow.

Promoters hold around 70% stake in this company. (11/n)

They are paying dividends properly even paid 2rs per share dividend in last Aug.

Such dividend paying micro cap managements can be considered as good . (12/n)

Such dividend paying micro cap managements can be considered as good . (12/n)

All the above statements are part of my study and not buy /sell recommendation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh