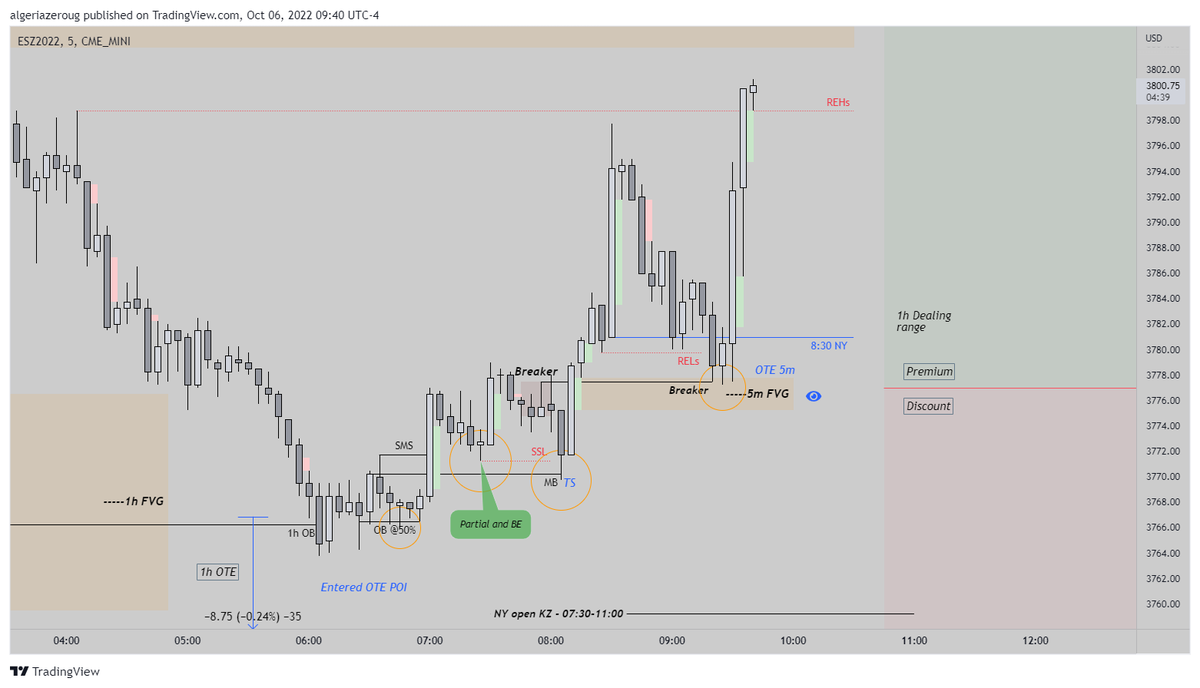

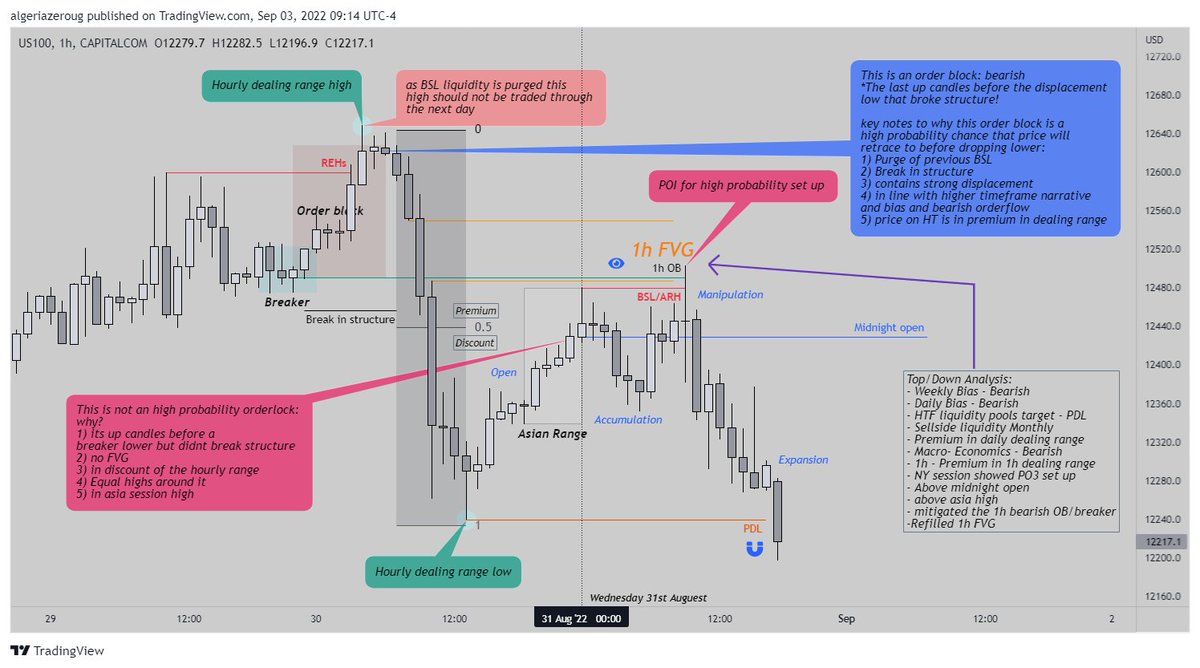

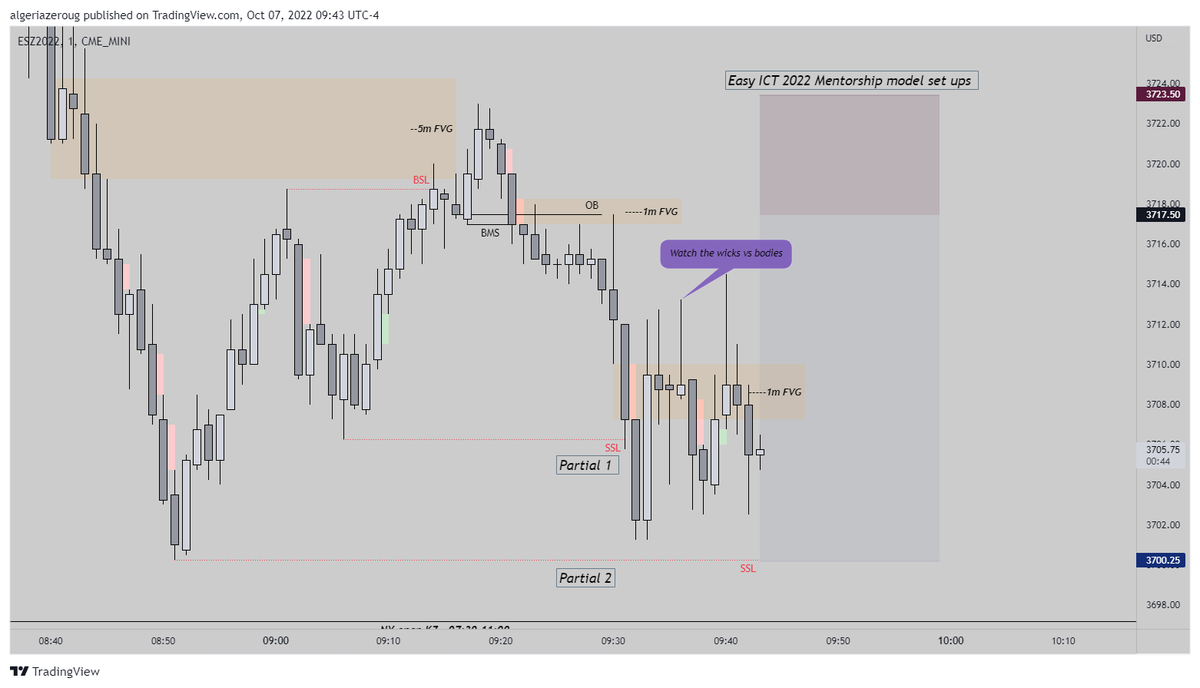

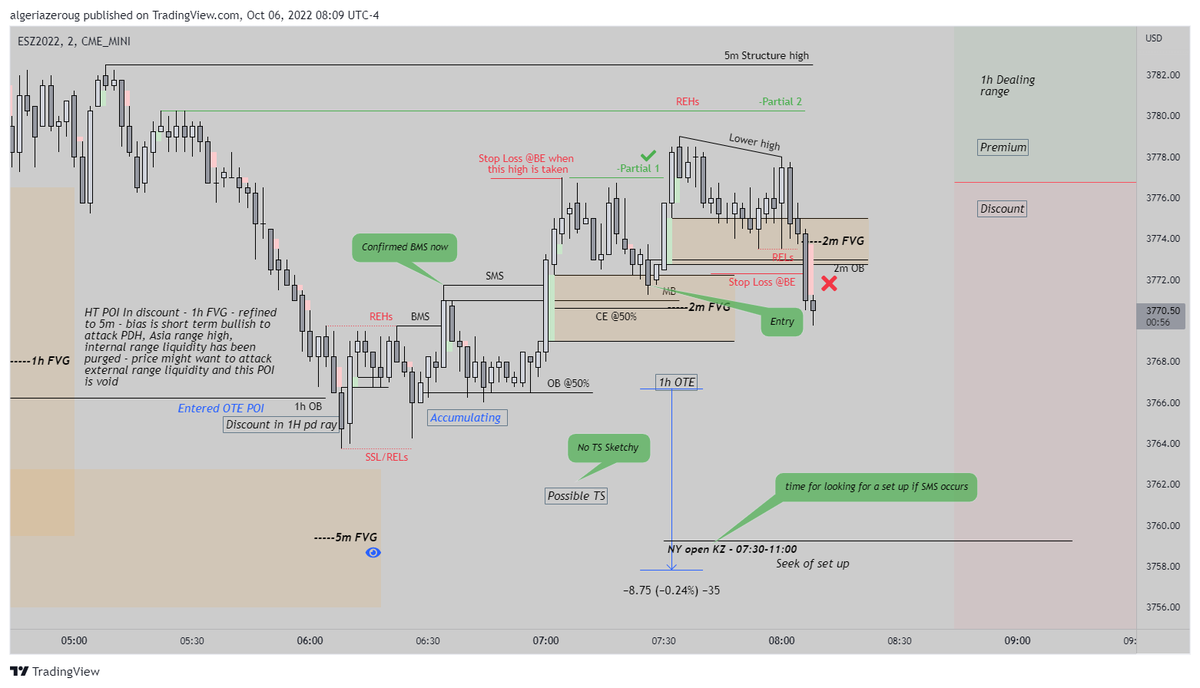

ES price action - not saying this will reverse but just want you to see an example on how I look at price in my POIs prepping for NY session

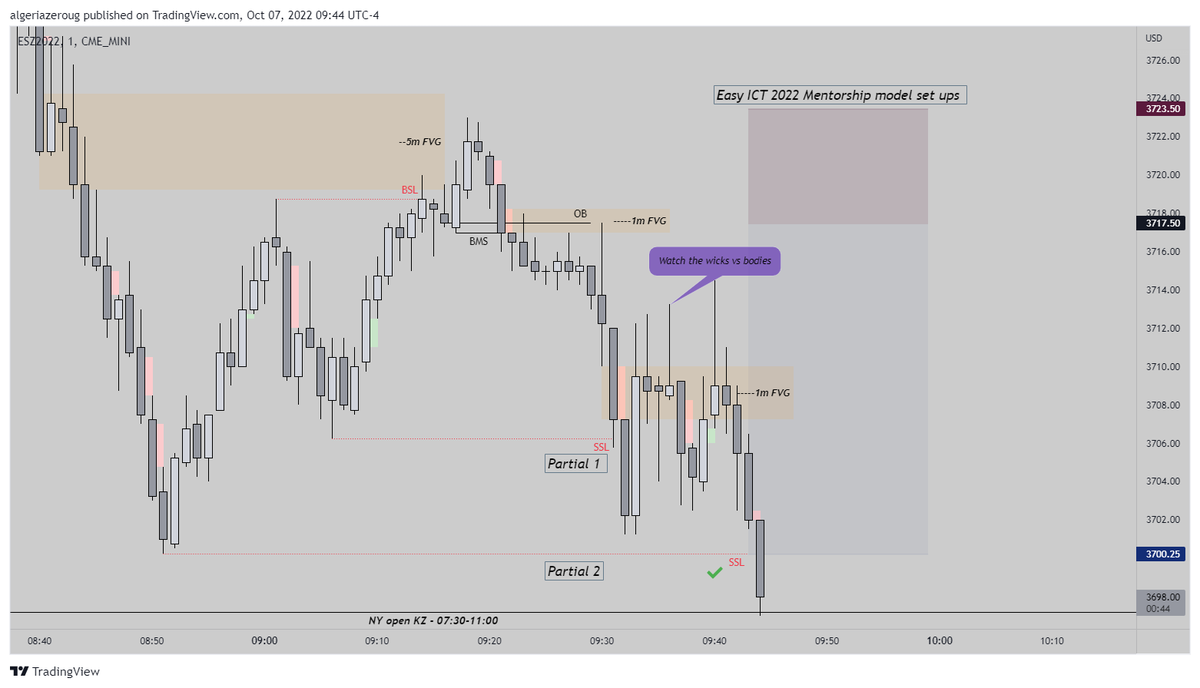

And that's how I scalp/swing in my POI, successful or not I don't care lol, managed the trade , used a trading plan etc.. if I am right for PDH to be attacked, then nice if I am wrong then nice too lol who cares

In the end - profitable trade even with direction being wrong ;) #trademanagement

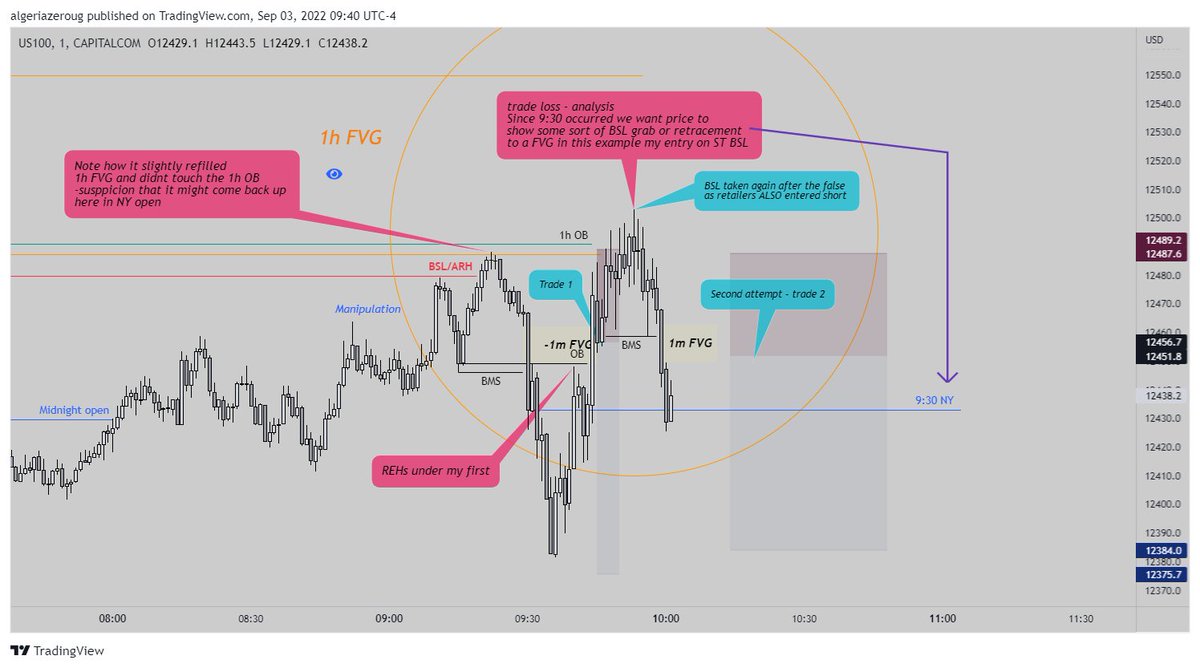

Recap of trade - SL should of been under the FVG below as there was more to refill - mistake on my end

8:30 bearish judas swing 👁️

• • •

Missing some Tweet in this thread? You can try to

force a refresh