💸💸💸 @MakerDAO just executed the first DAO balance sheet investment in US Treasuries and Corporate bonds with a ceiling of $500 million USDC.

How is that possible?

🧵👇

How is that possible?

🧵👇

First, we need to know that @MakerDAO holds ~$4 billion in stablecoins. 💰

These assets come from the PSM operations — Maker's highly efficient decentralized exchange focused on stablecoins.

These assets come from the PSM operations — Maker's highly efficient decentralized exchange focused on stablecoins.

Basically, the PSM is a tool for swapping USDC, USDP, and GUSD for freshly-minted DAI at a 1:1 rate. 🔄

Every time a user puts their stablecoins to receive DAI in exchange, the PSM allocates these stablecoins as liquidity reserves.

Every time a user puts their stablecoins to receive DAI in exchange, the PSM allocates these stablecoins as liquidity reserves.

The important fact here is that these reserves are investable assets. 🤑

In accordance with the decisions made by Maker Governance, the Maker Protocol can deploy these reserves on different investment vehicles.

That means, in short, more revenue.

In accordance with the decisions made by Maker Governance, the Maker Protocol can deploy these reserves on different investment vehicles.

That means, in short, more revenue.

We all know what the current crypto market looks like. 📉

Following this situation, the demand for leverage through volatile assets decreased in Maker, removing a significant amount of stability fee revenue from volatile-asset vaults.

Following this situation, the demand for leverage through volatile assets decreased in Maker, removing a significant amount of stability fee revenue from volatile-asset vaults.

However, in this economic environment of rising interest rates and capital flowing out from volatile assets, the Maker Protocol is very well positioned with a strong balance sheet composed of USD-linked, investable stablecoins. 📈📈📈

The Maker community is aware of that. 🤝

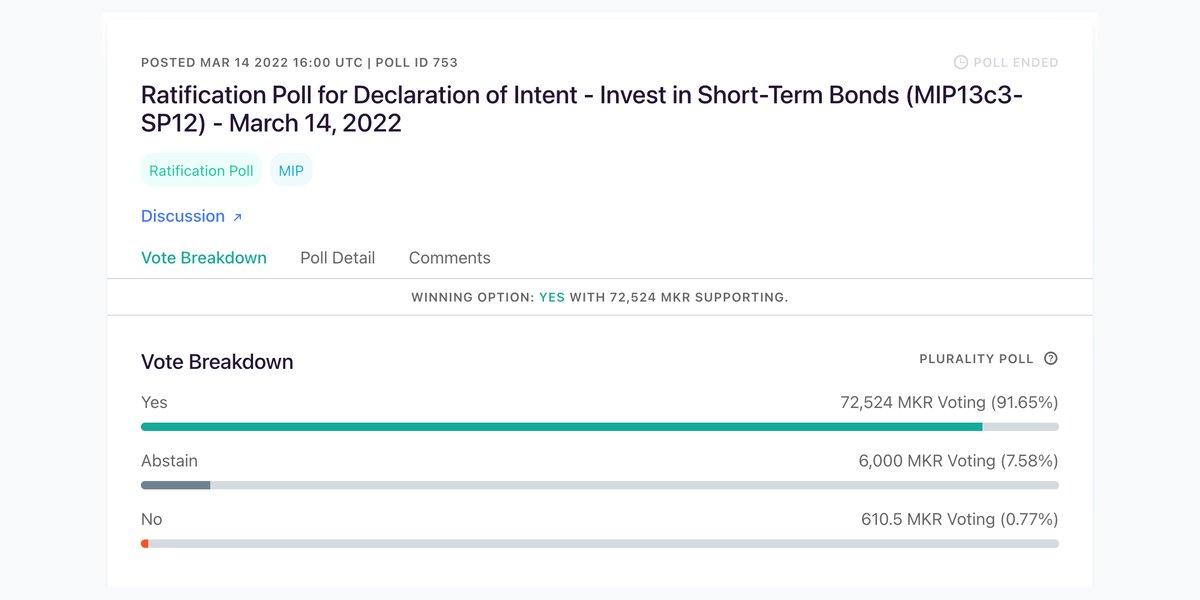

In March 2022, Maker Governance voted in favor of a Declaration of Intent to invest this balance sheet in short-term, bond-linked investment vehicles, paving the way for future proposals to deploy this strategy

➡️ vote.makerdao.com/polling/QmR6QM…

In March 2022, Maker Governance voted in favor of a Declaration of Intent to invest this balance sheet in short-term, bond-linked investment vehicles, paving the way for future proposals to deploy this strategy

➡️ vote.makerdao.com/polling/QmR6QM…

In May 2022, Maker Governance voted in favor of MIP65: Monetalis Clydesdale, ratifying the previously voted Declaration of Intent again. 🤝

➡️ vote.makerdao.com/polling/QmXHM6…

➡️ vote.makerdao.com/polling/QmXHM6…

MIP65 is a Maker Improvement Proposal submitted by Monetalis with the aim of investing $500 million from the PSM's USDC in a specific bond strategy composed of US Treasury and Corporate bonds.

👇

👇

The latest Executive Vote executed the first pilot transaction for MIP65: A 1-million-DAI Debt Ceiling Maker Vault from which Monetalis will draw 1 million DAI and deploy the first bond investment of the history of @MakerDAO through Sygnum Bank. 💰

🤝 uk.sports.yahoo.com/news/sygnum-le…

🤝 uk.sports.yahoo.com/news/sygnum-le…

Further Executive Votes will deploy the rest of the approved capital — 500 million, 80% in US Treasury and 20% in Corporate Bonds. 🗳

There are more ongoing proposals that seek to invest the PSM reserves into different bond-linked strategies.

For further reading on this matter, we suggest you this thread:

For further reading on this matter, we suggest you this thread:

https://twitter.com/MakerDAO/status/1577305269746425860?s=20&t=Pdth7LDz86hvTeVdMDSGGQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh