These are the painful experiences of Kenyans under these ASSET FINANCING institutions, MOGO and PLATINUM CREDIT:

#SpeakToKinuthia

#SpeakToKinuthia

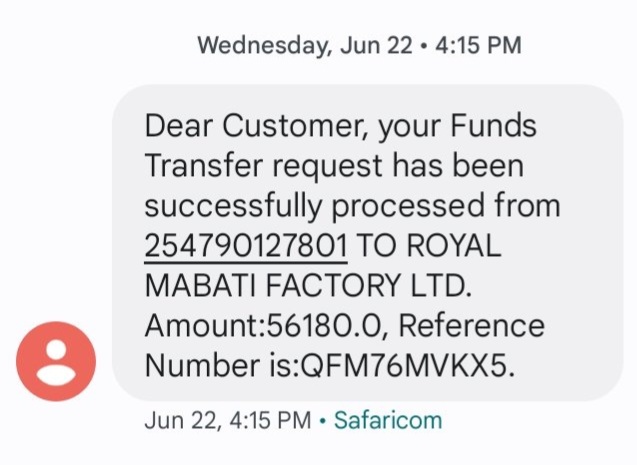

Platinum Credit gave me a loan of 384K and in 4 months I had paid 618,750. A whole over 255,000.

Real conmen

#SpeakToKinuthia

Real conmen

#SpeakToKinuthia

Another client took a 200k loan from MOGO , repaid 60k in two months. On the third month he defaulted. Requested for restructuring. It was declined.

His axio worth 500k was taken and now about to be auctioned.

#SpeakToKinuthia

His axio worth 500k was taken and now about to be auctioned.

#SpeakToKinuthia

• • •

Missing some Tweet in this thread? You can try to

force a refresh