UNITED

Record losses. Rising debt. Declining cash. Core business not performing. All despite United’s third biggest-ever revenue 🤔.

The worst season in 50 years on the pitch. United has major challenges. A long thread

Record losses. Rising debt. Declining cash. Core business not performing. All despite United’s third biggest-ever revenue 🤔.

The worst season in 50 years on the pitch. United has major challenges. A long thread

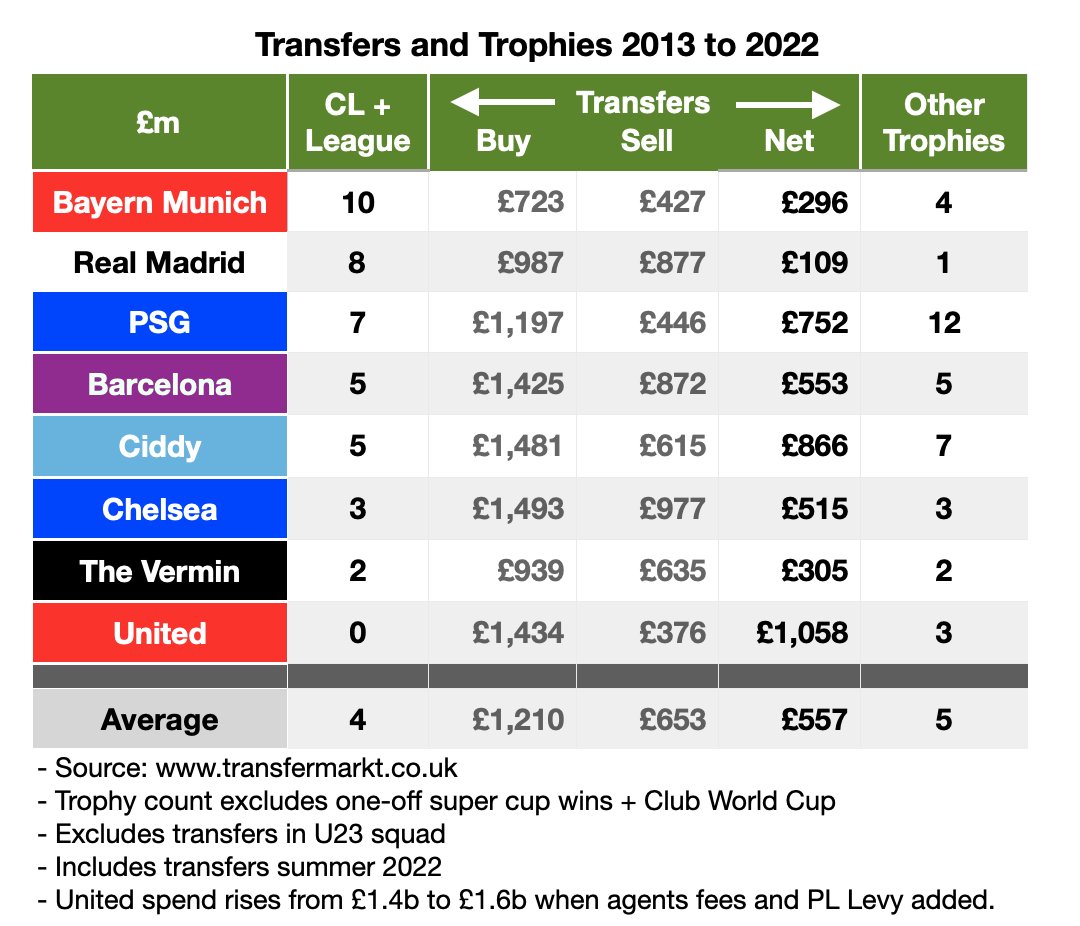

If anything condemns the muttonheads running the club, it’s this 👇 Highest net transfer spend, worst trophy count 🙄

From admired to a laughing stock, in 9 years.

From admired to a laughing stock, in 9 years.

And there’s a crunch point coming. As he wriggled out of the Super League disaster, a crisis of his own making, Glazer promised “world-class” infrastructure.

How is upwards of £1 billion to be financed?🤔

How is upwards of £1 billion to be financed?🤔

New shares? But United's shares have been a bad investment, who would want to invest?

Launched at $14, the price should be above $18 just to keep pace with inflation👇The biggest external shareholder (Baron Capital, 16m shares in 2015) sold most of its holding 👉🗑️

Launched at $14, the price should be above $18 just to keep pace with inflation👇The biggest external shareholder (Baron Capital, 16m shares in 2015) sold most of its holding 👉🗑️

More huge debts?

- But interest rates are rising

- United already has £630m of existing debt

- Most saleable assets, players (book value £316m) and property (£242m) are already pledged as security

- And, debt is already 4 times the equity, so the risk profile rises 👇

👉🗑️

- But interest rates are rising

- United already has £630m of existing debt

- Most saleable assets, players (book value £316m) and property (£242m) are already pledged as security

- And, debt is already 4 times the equity, so the risk profile rises 👇

👉🗑️

Glazer has got a big problem staring him in the face. The European Super League was a betrayal. There will be no reneging over “world-class” infrastructure and the “biggest fan ownership group in world sport”

Where’s the finance coming from?

#TickTock

Where’s the finance coming from?

#TickTock

1. Overview

After all the gimps' financial sh1thousery over the last 17 years, it's striking that 2022 was the worst of the lot👇 Record financial losses 🤔

After all the gimps' financial sh1thousery over the last 17 years, it's striking that 2022 was the worst of the lot👇 Record financial losses 🤔

United is in trouble. Glazers need a capital injection to keep the rickety show on the road. But given their track record, who would want to invest money with them in control?

Analysts are predicting another three years of losses 👇 🤔

Analysts are predicting another three years of losses 👇 🤔

Cash Flow from operations is a key indicator of the health of the core business

Cash flow suffered a 40% drop in 2022 despite 3rd highest-ever revenue 👇🧐 Is the core business in trouble? 🤔

Cash flow suffered a 40% drop in 2022 despite 3rd highest-ever revenue 👇🧐 Is the core business in trouble? 🤔

United’s bank balance (at 30th June) has deteriorated despite large 2022 revenues

Cash is declining 🧐

Cash is declining 🧐

Can United pay its bills as they become due? 🤔 Short-term liabilities are double the assets used to pay them. Ratio worsening, as the table shows👇

No coincidence an expanded £200m loan facility was arranged in April 2022 🧐

No coincidence an expanded £200m loan facility was arranged in April 2022 🧐

Buffoon-in-chief Ed Woodward🤡oversaw years of kamikaze transfer spending. Pity he did not buy a few decent players 😭

Record net spend in summer 2022 (after the financial year-end)

Record net spend in summer 2022 (after the financial year-end)

Transfers have been financed by debt owed to other clubs👇🧐. A deliberate strategy by the Board after 2013

Transfer debt owed to other clubs 👇. On 30th June, £182m was owed to other clubs. Plus £112m in add-ons. After the summer window, this will be much larger

Not much transfer income means the net transfer debt will be much higher 🧐🙄

Not much transfer income means the net transfer debt will be much higher 🧐🙄

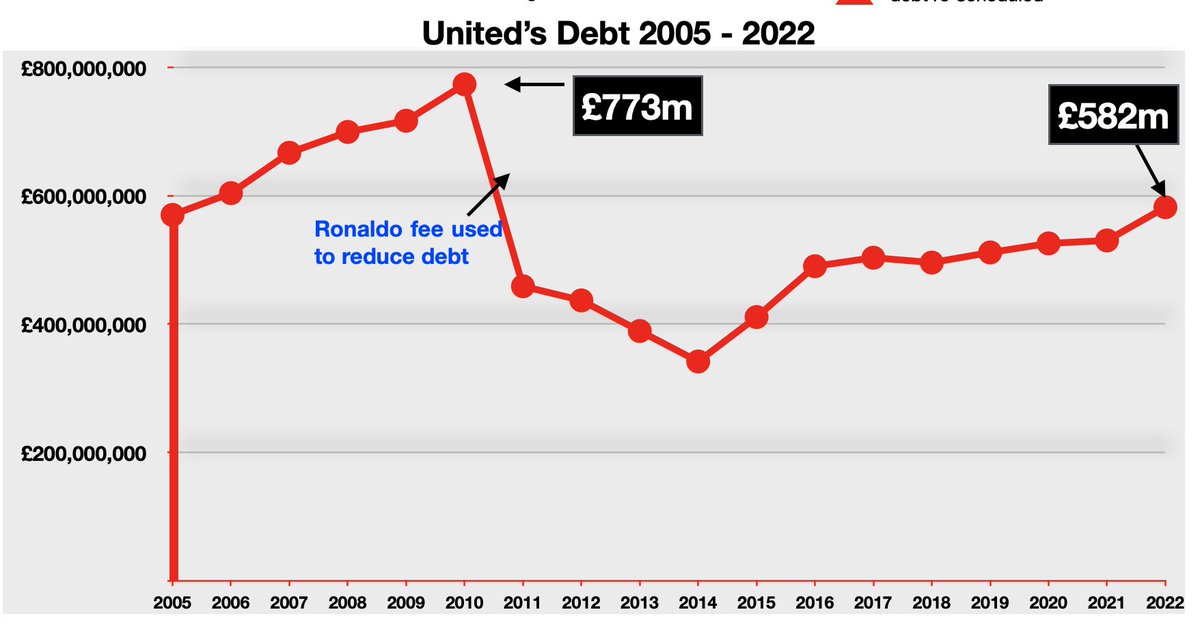

United’s financial debt, owed to the banks, is climbing again 🧐🤔

This is separate from transfer debt owed to other clubs

25/61

This is separate from transfer debt owed to other clubs

25/61

Total financial debt = £630m. There are also £200m of unused credit lines, arranged in April 2022.

£530m still remaining from the 2005 take-over 😡👇

£530m still remaining from the 2005 take-over 😡👇

When transfer debt is added, the total debt is an eye-watering £874m, the largest ever 😮. Although, not all the add-ons will be triggered

All the debt numbers above were as at 30th June. After 30th June, United spent £218m in transfers. Paid for over 5 years! 🧐. Debt is growing👉🗑️

UEFA adds financial and transfer debts to analyse clubs’ finances. You can see the trend since 2013👇. 2023 will be even bigger, and interest rates are rising🤔

United will not generate enough cash to substantially reduce debt over next three years

United will not generate enough cash to substantially reduce debt over next three years

Finance Charges = £858m over 17 years👇🙄👉🗑️ When adjusted for inflation, well over £1 billion

£118m in 2009, was the year Ronaldo was sold for £90m and Owen, Obertan, Diouf and Valencia arrived 🧐. “No value in the market”, was in reality “no money in the bank”👉🗑️

£118m in 2009, was the year Ronaldo was sold for £90m and Owen, Obertan, Diouf and Valencia arrived 🧐. “No value in the market”, was in reality “no money in the bank”👉🗑️

The gimps and Woodward🤡re-financed the debt four times after 2005 (in 2006, 2010, 2013, 2015). £162m in arrangement and early termination fees to the banks👇. All dead money 😡

There is nothing wrong with debt if it is used to invest (like Spurs for its stadium) or to help short-term cash flow

But United’s debt mountain has been destructive. Nothing gained. Only to buy United’s shares for the gimps and to cover the Board’s massive incompetence

But United’s debt mountain has been destructive. Nothing gained. Only to buy United’s shares for the gimps and to cover the Board’s massive incompetence

Old Trafford should be the visible symbol of a great football institution, and its neglect is shameful. Carrington is not in the top tier of training grounds, as Ronaldo found on his return

The underlying explanation why is disgusting 👇😡

The underlying explanation why is disgusting 👇😡

@swissramble compared infrastructure spending across the PL. United is well down the list👇

Commercial revenue was long held out as something exceptional. Reality is different.

As an index, United’s commercial growth between 2005-21 is lower than Spurs (!) and Liverpool. Since 2016, terrible👇

As an index, United’s commercial growth between 2005-21 is lower than Spurs (!) and Liverpool. Since 2016, terrible👇

United has a big commercial revenue, but competitors are catching up.

@swissramble numbers below👇. United’s growth versus 2016 shows relative performance has been poor👉🗑️. United has lower commercial revenue than Madrid, Barcelona, Bayern

@swissramble numbers below👇. United’s growth versus 2016 shows relative performance has been poor👉🗑️. United has lower commercial revenue than Madrid, Barcelona, Bayern

Fans are unhappy at United sponsored by a rum assortment of noodle makers, tractor manufacturers👇, the Saudi government, Aeroflot, Asian betting partners, crypto-currency, Mr Potato snacks, plus others. That said, noticeable shift recently to slightly more prestigious sponsors

In the three years between 2019-22, there was massive negative cash flow (£199m) 🤔.

Yet, £89m out of the club in dividends and share re-purchase👇. Which was financed by external loans of £100m😡

Yet, £89m out of the club in dividends and share re-purchase👇. Which was financed by external loans of £100m😡

How have the gimps managed to pay dividends despite massive losses? 🤔 Complex accounting shenanigans.

For example, ‘selling’ one United subsidiary company to another subsidiary and creating £250m of ‘profit’. No cash profit, only accounting entries😡👇

For example, ‘selling’ one United subsidiary company to another subsidiary and creating £250m of ‘profit’. No cash profit, only accounting entries😡👇

Share buy-back during the Covid pandemic😡

As Covid took off in the spring and summer of 2020, the club spent £21m buying 1.6m of its own shares👇. Whatever the explanation, not a good look

50/61

As Covid took off in the spring and summer of 2020, the club spent £21m buying 1.6m of its own shares👇. Whatever the explanation, not a good look

50/61

On top of £168m dividends, came share sales. In Oct 2021, new share sales raised $161m. In March 2021, $95m. Entirely to Glazers. Since 2012, 52m shares sold raising $832m👇.

All to the benefit of the Glazers (directly and indirectly). None invested in the club 🙄👉🗑️

50/60

All to the benefit of the Glazers (directly and indirectly). None invested in the club 🙄👉🗑️

50/60

Top 5 executives (non-Glazer) paid £92m since 2013. Woodward🤡 was paid £24m over nine years 🤣

Snouts and trough🐷

Snouts and trough🐷

Executives awarded 1.4m share options since 2013. Consistent awards across all years despite calamities on and off the pitch👇🧐

98,888 awarded in 2022 despite record financial losses🐷👉🗑️

98,888 awarded in 2022 despite record financial losses🐷👉🗑️

No football expertise on Board. No one of status to call them crackpots

Why was Woodward 🤡left in charge of the football operation for 9 years despite being a quarter-wit? And what’s he still doing on the Board?🤔👇

Why was Woodward 🤡left in charge of the football operation for 9 years despite being a quarter-wit? And what’s he still doing on the Board?🤔👇

Give your fanzines a read. Once they’re gone, they’re gone

https://twitter.com/barneyrednews/status/1577253418220937216

• • •

Missing some Tweet in this thread? You can try to

force a refresh