Thanks for the many people that reached out about this brainteaser, it is now time for me to post the solutions :)

It turns out the solution is an integral part of how @Panoptic_xyz tracks options NFTs

what does 28253706383254293962.... have to to with NFTs ??

Thread👇

1/16

It turns out the solution is an integral part of how @Panoptic_xyz tracks options NFTs

what does 28253706383254293962.... have to to with NFTs ??

Thread👇

1/16

https://twitter.com/guil_lambert/status/1577709891942318083

(TL;DR) It is really encoding for a ETH-SHIB Reverse Jade Lizard as hinted (!)

We'll show below how it encodes for:

• 1 long put @ 7509 x 10^-12

• 1 short put @ 8070 x 10^-12

• 1 short call @ 8936 x 10^-12

We'll show below how it encodes for:

• 1 long put @ 7509 x 10^-12

• 1 short put @ 8070 x 10^-12

• 1 short call @ 8936 x 10^-12

2/ So first of all, let's get back to how positions are tracked by the UniswapV3Pool.sol smart contract

Any liquidity deployed by 𝚘𝚠𝚗𝚎𝚛 between a 𝚝𝚒𝚌𝚔𝙻𝚘𝚠𝚎𝚛 and 𝚝𝚒𝚌𝚔𝚄𝚙𝚙𝚎𝚛 is stored in a mapping defined by the keccak256 hash of (owner, tickLower, tickUpper)

Any liquidity deployed by 𝚘𝚠𝚗𝚎𝚛 between a 𝚝𝚒𝚌𝚔𝙻𝚘𝚠𝚎𝚛 and 𝚝𝚒𝚌𝚔𝚄𝚙𝚙𝚎𝚛 is stored in a mapping defined by the keccak256 hash of (owner, tickLower, tickUpper)

2/ The hash returns a struct that stores several quantities, including the liquidity owned by the user.

The struct also contains information about the fees accumulated and the tokens owed to owner when the position was last touched.

The struct also contains information about the fees accumulated and the tokens owed to owner when the position was last touched.

3/ However, users do not directly interact with the UniswapV3Pool smart contracts.

Instead, they will mint a position by directly interacting with the NonFungiblePositionManager.sol smart contract.

The NFPM contract helps track liquidity and issues a ERC721 NFT to the minter.

Instead, they will mint a position by directly interacting with the NonFungiblePositionManager.sol smart contract.

The NFPM contract helps track liquidity and issues a ERC721 NFT to the minter.

4/ The minter receives a cool on-chain generated NFT that can be seen on the app.uniswap.org website.

Also, each NFT position has a unique 𝚝𝚘𝚔𝚎𝚗𝙸𝚍, which increases *sequentially* at every mint --look at the (𝚝𝚘𝚔𝚎𝚗𝙸𝚍 = _𝚗𝚎𝚡𝚝𝙸𝚍++) in the code above.

Also, each NFT position has a unique 𝚝𝚘𝚔𝚎𝚗𝙸𝚍, which increases *sequentially* at every mint --look at the (𝚝𝚘𝚔𝚎𝚗𝙸𝚍 = _𝚗𝚎𝚡𝚝𝙸𝚍++) in the code above.

5/ In @Panoptic_xyz, users sell options by adding liquidity in a Uni v3 pool, and buy options by removing liquidity from the pool

Panoptic users "bypass" the NFPM and use instead the SemiFungiblePositionManager.sol to trade options

LPs can still use either for "vanilla" LPing

Panoptic users "bypass" the NFPM and use instead the SemiFungiblePositionManager.sol to trade options

LPs can still use either for "vanilla" LPing

6/ One key distinction between the NFPM and the SFPM is that the SFPM issues an ERC1155 token to track users' positions.

The balance of the ERC1155 represents the amount of liquidity for that position, we call that the 𝚙𝚘𝚜𝚒𝚝𝚒𝚘𝚗𝚂𝚒𝚣𝚎.

The balance of the ERC1155 represents the amount of liquidity for that position, we call that the 𝚙𝚘𝚜𝚒𝚝𝚒𝚘𝚗𝚂𝚒𝚣𝚎.

7/ The 256bit 𝚝𝚘𝚔𝚎𝚗𝙸𝚍 of the ERC1155 position is also different: it is not sequential, but instead encodes information about the position.

It turns out that a *lot* of information can be encoded in 256bits.

It turns out that a *lot* of information can be encoded in 256bits.

8/ Back to the riddle: 282537063832542939627736618700216160083437754282540792586635888

What is encoded in that number?

First, let's look at it as a hex:

AFD2C04800AFD2808200AFD253870111

2F62F2B4C5FCD7570A70 -< 𝚙𝚘𝚘𝚕𝙸𝚍

The last 80 bits is the 𝚙𝚘𝚘𝚕𝙸𝚍

What is encoded in that number?

First, let's look at it as a hex:

AFD2C04800AFD2808200AFD253870111

2F62F2B4C5FCD7570A70 -< 𝚙𝚘𝚘𝚕𝙸𝚍

The last 80 bits is the 𝚙𝚘𝚘𝚕𝙸𝚍

9/ The 𝚙𝚘𝚘𝚕𝙸𝚍 is the first 20 characters of the Uniswap v3 pool, and in this case, that's the SHIB-ETH-30bps, whose address is:

0x2F62f2B4c5fcd7570a709DeC05D68EA19c82A9ec

-> first 20 characters

etherscan.io/address/0x2f62…

0x2F62f2B4c5fcd7570a709DeC05D68EA19c82A9ec

-> first 20 characters

etherscan.io/address/0x2f62…

10/ So this tokenId is for a position in the SHIB-ETH-30bps pool.

What about the rest of the tokenId? Converting the rest to binary, we get:

10101111110100101100000001001000000000001010111111010010100000001000001000000000101011111101001001010011100001110000000100010001

What about the rest of the tokenId? Converting the rest to binary, we get:

10101111110100101100000001001000000000001010111111010010100000001000001000000000101011111101001001010011100001110000000100010001

11/ From the map, we know there is 16 bits for "Ratios", and each option leg is 40 bits:

ratios (4x4bits):

0000000100010001

leg0 (1x40bits):

0000000010101111110100100101001110000111

leg1:

0000000010101111110100101000000010000010

leg2:

10101111110100101100000001001000

ratios (4x4bits):

0000000100010001

leg0 (1x40bits):

0000000010101111110100100101001110000111

leg1:

0000000010101111110100101000000010000010

leg2:

10101111110100101100000001001000

12/ The ratios are all 1 for each leg: the position mints 1 option for each leg.

Let's unwrap Leg0: this one corresponds to a long put at strike -187080.

Let's unwrap Leg0: this one corresponds to a long put at strike -187080.

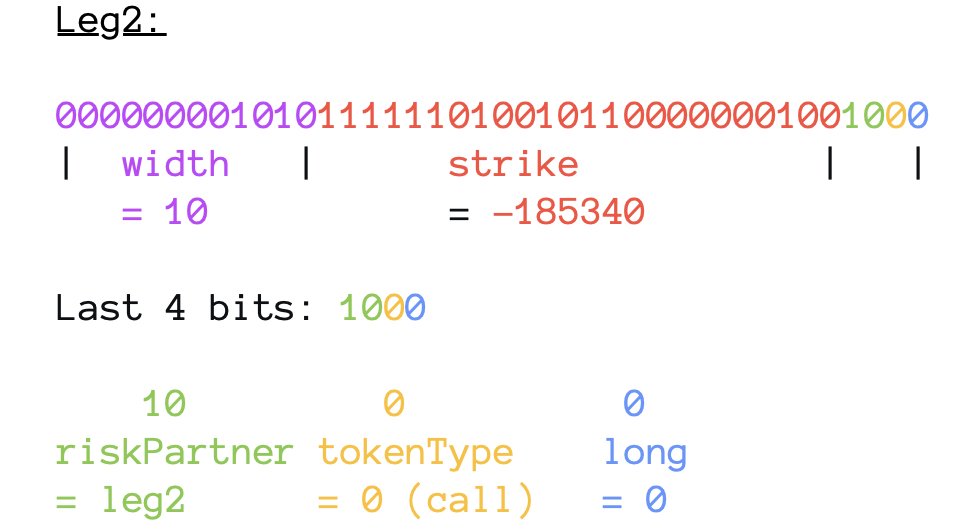

13/ Similarly, upwrapping Leg1 we get that it encodes for a short put at strike -186360

Leg2 encodes for a short call at strike -185340

Each leg also has a "width" of 10, which means each LP positions is 30*10 ticks wide.

Leg2 encodes for a short call at strike -185340

Each leg also has a "width" of 10, which means each LP positions is 30*10 ticks wide.

14/ So, 28253706383... encodes for a specific, multi-legged option position

Decoding it revealed that it consists of a long put, a short put, and a short call in the ETH-SHIB 30bps pool.

Decoding it revealed that it consists of a long put, a short put, and a short call in the ETH-SHIB 30bps pool.

15/ Why track position that way?

The key here is that users can 1) track complex positions using a single number and 2) they will receive a number of ERC1155 token that corresponds to the amount of liquidity deployed in that position.

The key here is that users can 1) track complex positions using a single number and 2) they will receive a number of ERC1155 token that corresponds to the amount of liquidity deployed in that position.

16/ This also means a 4626 vault could easily be created for any options strategy

Simply point the vault to the 2825370... tokenId and all added liquidity will be automatically deployed as a Reverse Jade Lizard in the Uni v3 pool

That tokenId could also be updated over time 👀

Simply point the vault to the 2825370... tokenId and all added liquidity will be automatically deployed as a Reverse Jade Lizard in the Uni v3 pool

That tokenId could also be updated over time 👀

Stay tuned for more updates about THE perpetual, oracle-free options protocol, and don't forget to follow @Panoptic_xyz for updates, AMAs, alpha leaks, and much more!

https://twitter.com/guil_lambert/status/1581636784693596160?s=20&t=3fTP8gvr9YjTDXdJQo8Byg

• • •

Missing some Tweet in this thread? You can try to

force a refresh