7️⃣ things you need to know about today’s u-turn.

1. Let’s start with the fact that actually it wasn’t just a u-turn. It was more. Not only did it reverse the majority of policies in the mini-budget, it went further, reversing a Sunak era plan to cut the basic rate of income tax.

1. Let’s start with the fact that actually it wasn’t just a u-turn. It was more. Not only did it reverse the majority of policies in the mini-budget, it went further, reversing a Sunak era plan to cut the basic rate of income tax.

2. That this happened so quickly, and with more than half an eye towards markets, is a symptomatic of a far bigger deal.

Govt policy is being dictated not by the Tory party or Parliament but by financial markets.

I can’t remember another occasion we’ve had that since 1992.

Govt policy is being dictated not by the Tory party or Parliament but by financial markets.

I can’t remember another occasion we’ve had that since 1992.

3. And markets were able to dictate policy because there is still clear and present danger out there. As I reported earlier, there is at least one fund in one asset manager which was close to the brink this morning. A further rise in yields would have tipped it over

https://twitter.com/edconwaysky/status/1581925920994009088

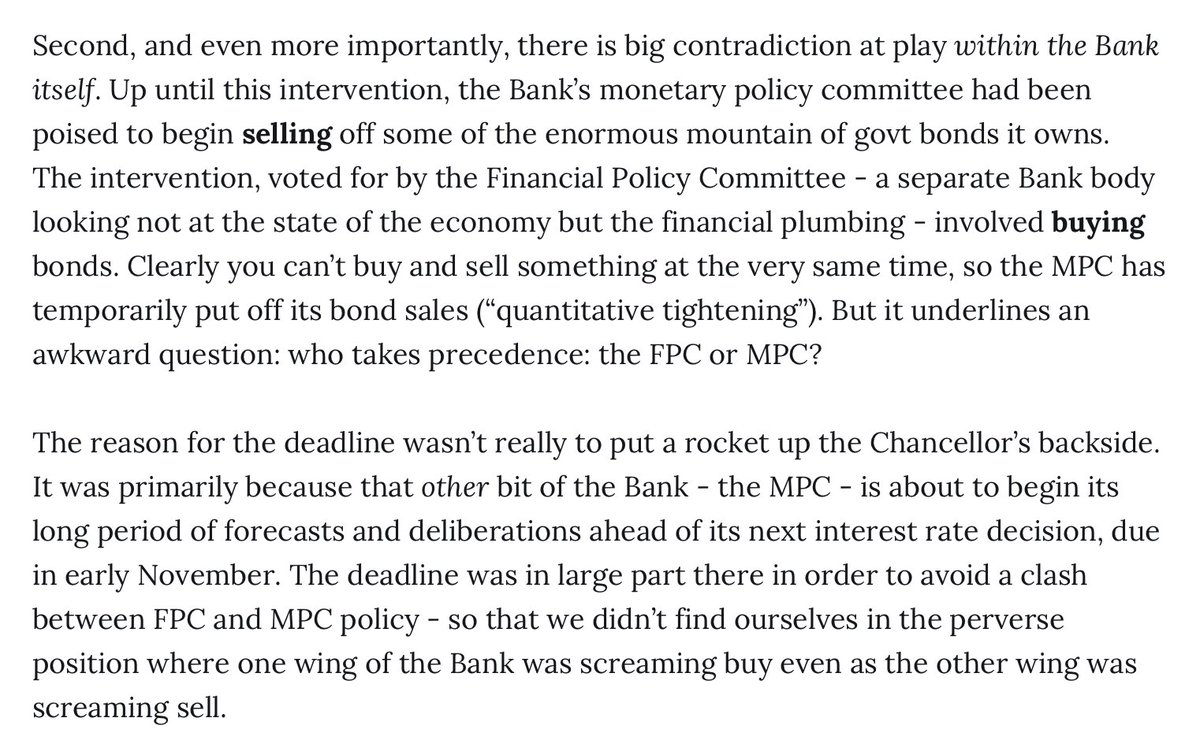

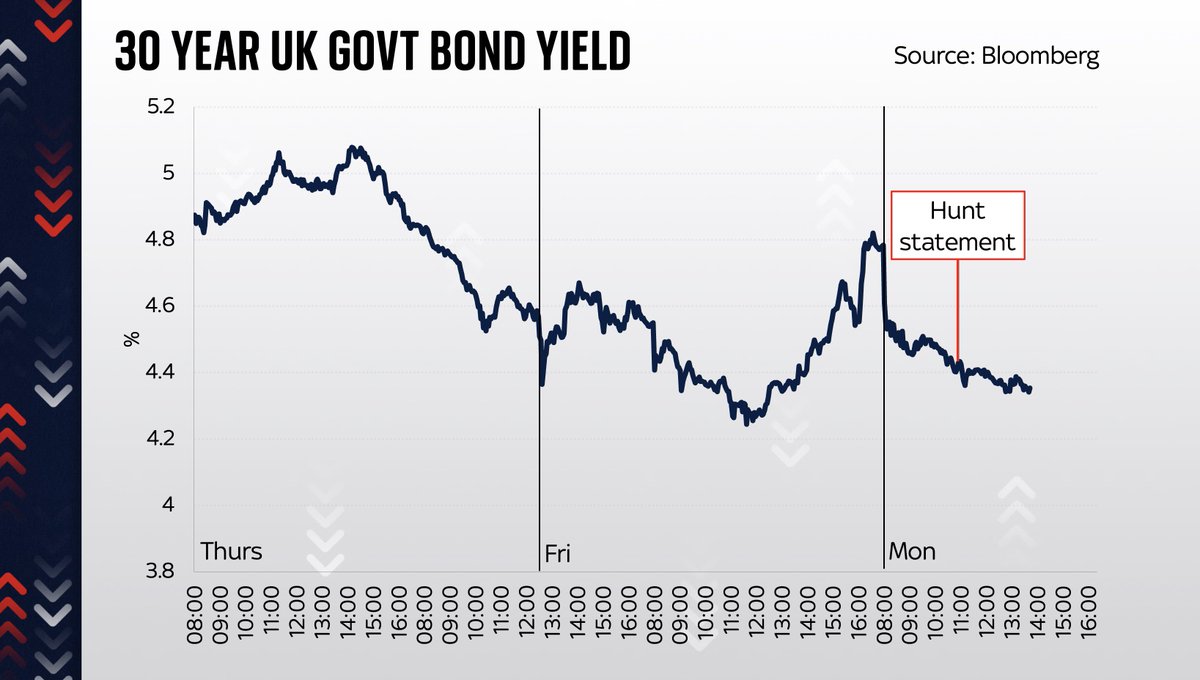

4. The good news is today’s measures really do seem to have injected some confidence back into markets.

Gilt yields now down markedly.

That in turn is pushing down expectations for BoE rates, which in turn will likely push down fixed rate mortgages. Quite a relief for everyone

Gilt yields now down markedly.

That in turn is pushing down expectations for BoE rates, which in turn will likely push down fixed rate mortgages. Quite a relief for everyone

5. When it comes to calming financial markets, this was comfortably the most successful intervention from the govt since @trussliz became PM.

Yet @trussliz is nowhere to be seen. The intervention came from an outsider.

Striking. But consistent with this being a credibility crisis

Yet @trussliz is nowhere to be seen. The intervention came from an outsider.

Striking. But consistent with this being a credibility crisis

6. The most game-changing of all the measures wasn’t even costed today.

Changing the energy price guarantee from a two year policy to a six month policy will potentially save tens of billions. Maybe even £100bn plus.

But no way of knowing because it depends on gas prices.

Changing the energy price guarantee from a two year policy to a six month policy will potentially save tens of billions. Maybe even £100bn plus.

But no way of knowing because it depends on gas prices.

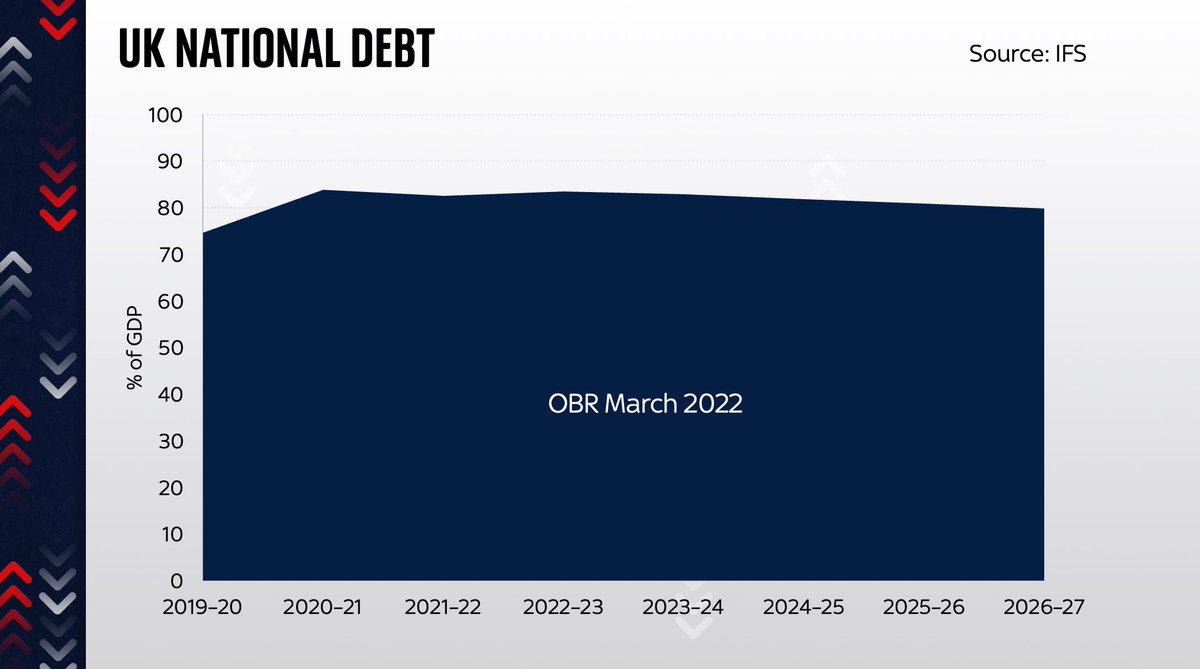

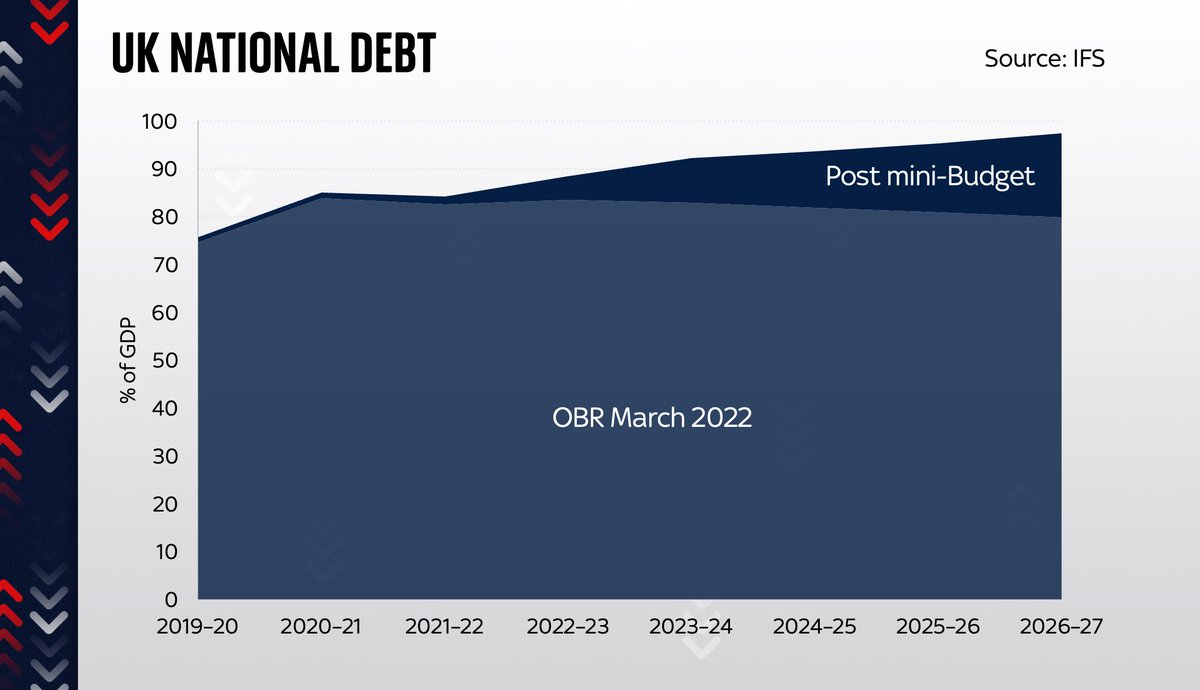

7. Crucially, even though today’s measures went further than most people expected there is still a sizeable shortfall.

If @Jeremy_Hunt wants to get the national debt falling, he’ll need to find another £30-40bn of spending cuts and/or tax rises.

So there’s more coming…

If @Jeremy_Hunt wants to get the national debt falling, he’ll need to find another £30-40bn of spending cuts and/or tax rises.

So there’s more coming…

• • •

Missing some Tweet in this thread? You can try to

force a refresh