Use your salary to invest in passive income, so that passive income replaces your salary.

💰Let's breakdown 4 ways to create passive income & change your life:

💰Let's breakdown 4 ways to create passive income & change your life:

You work for active income, but passive income works for you.

If you don't figure out how to make money in your sleep, a day may come where you lose sleep due to money.

Use active income to invest in passive income, so that passive income replaces your active income.

If you don't figure out how to make money in your sleep, a day may come where you lose sleep due to money.

Use active income to invest in passive income, so that passive income replaces your active income.

Invest in assets so that they replace your liabilities over time.

First your passive income will cover your phone bill,

then it will cover your car payment,

then it will cover your mortgage,

then it will cover your salary.

First your passive income will cover your phone bill,

then it will cover your car payment,

then it will cover your mortgage,

then it will cover your salary.

Financial freedom is having enough passive income to cover your living expenses.

Financial freedom creates time freedom.

Create financial freedom to enjoy the passage of time.

Financial freedom creates time freedom.

Create financial freedom to enjoy the passage of time.

You can create passive income through:

• REITs

• Business Income

• Dividend Stocks Income

• Covered Call Options Income

Let's discuss each:

• REITs

• Business Income

• Dividend Stocks Income

• Covered Call Options Income

Let's discuss each:

1) Let's talk about REITs:

A REIT (Real Estate Investment Trust) allows you to invest in real estate without the need to own property.

REITs offer a way to invest in real estate without the hassle of being a landlord.

A REIT (Real Estate Investment Trust) allows you to invest in real estate without the need to own property.

REITs offer a way to invest in real estate without the hassle of being a landlord.

Real estate investors provide the capital for an investment and let professionals manage the REIT on their behalf.

REIT investors earn passive income in the form of dividends.

Basically when you invest in a REIT, you are purchasing shares in a company which owns real estate.

REIT investors earn passive income in the form of dividends.

Basically when you invest in a REIT, you are purchasing shares in a company which owns real estate.

When you invest in a REIT, you don't own any property, you own shares of the company that owns the property.

REITs commonly invest in multiple investment properties, which gives the REIT’s a diverse real estate investment portfolio and reduces risks.

REITs commonly invest in multiple investment properties, which gives the REIT’s a diverse real estate investment portfolio and reduces risks.

REITS are a great way to gain exposure to high-yield dividends, and a great way to gain exposure to the Real Estate sector.

REITs have delivered an average return of 11% from 1980.

You can invest in REITs 3 different ways:

(1) You can buy a REIT Index Fund/ ETF,

REITs have delivered an average return of 11% from 1980.

You can invest in REITs 3 different ways:

(1) You can buy a REIT Index Fund/ ETF,

(2) You can buy individual publicly traded REITs on the stock market,

(3) You can invest with others into private REITs

(3) You can invest with others into private REITs

You can find REITs for every sector, such as real estate in:

- Malls

- Retail

- Storage

- Casinos

- Industrial

- Healthcare

- Cell Towers

- Apartments

- Data Centers

- Malls

- Retail

- Storage

- Casinos

- Industrial

- Healthcare

- Cell Towers

- Apartments

- Data Centers

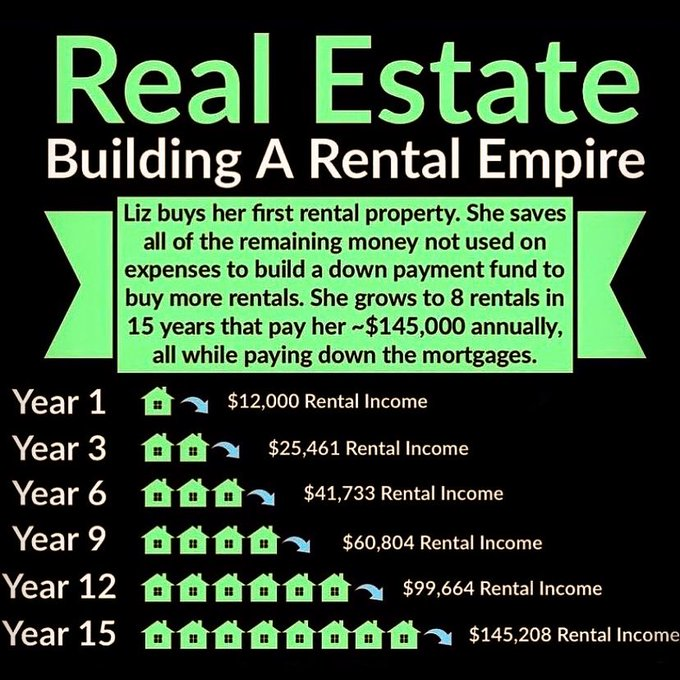

2) Let's talk about business income:

If you can work 40+ hours a week for someone, then you can work at least 1 hour a day for yourself.

Create multiple steams of income from a side-business or side-hustle, so that working 40+ hours a week becomes a choice, not an obligation.

If you can work 40+ hours a week for someone, then you can work at least 1 hour a day for yourself.

Create multiple steams of income from a side-business or side-hustle, so that working 40+ hours a week becomes a choice, not an obligation.

Always use strategic tax planning to maximize your income.

As a business owner, you can deduct everyday expenses if they are used for business purposes. Examples include:

- rent

- Wifi

- electricity

- cell phone bill

- business meals

- vehicle expenses

- home office deduction

As a business owner, you can deduct everyday expenses if they are used for business purposes. Examples include:

- rent

- Wifi

- electricity

- cell phone bill

- business meals

- vehicle expenses

- home office deduction

Use the 5-9 to replace your 9-5.

If you can work 8+ hours a day for someone else, you can use your evenings to work on a side-hustle, side business or learning new skills which you can be paid for.

If you can work 8+ hours a day for someone else, you can use your evenings to work on a side-hustle, side business or learning new skills which you can be paid for.

Many income generating hobbies or skills that people know or can learn have been replaced by scrolling social media for hours.

Time is your greatest asset, you do not get back lost time.

Create additional income from a side hustle or side business, and retire early.

Time is your greatest asset, you do not get back lost time.

Create additional income from a side hustle or side business, and retire early.

3) Let's talk about dividend stocks income:

Dividends are payments that a company makes to share profits with its stockholders.

Dividend yield is the dividend per share / stock price, and is expressed a percentage.

$SCHD is my favorite dividend index fund

Dividends are payments that a company makes to share profits with its stockholders.

Dividend yield is the dividend per share / stock price, and is expressed a percentage.

$SCHD is my favorite dividend index fund

$SCHD is my favorite dividend index fund because it only invests in dividend stocks:

• that paid investors every year for at least 10 years

• whose shares have significant daily trading volume

• whose companies have the best relative financial strength

• that paid investors every year for at least 10 years

• whose shares have significant daily trading volume

• whose companies have the best relative financial strength

9 Highest Dividend-Paying Stocks in the S&P 500:

8.6% $T

7.9% $LUMN

7.1% $MO

6.2% $KMI

5.9% $OKE

5.6% $WMB

5.5% $IRM

5.4% $PPL

5.2% $VNO

8.6% $T

7.9% $LUMN

7.1% $MO

6.2% $KMI

5.9% $OKE

5.6% $WMB

5.5% $IRM

5.4% $PPL

5.2% $VNO

Dividend Tax Planning Strategy:

A 4% dividend on a $1,000,000 investment account can be $40,000 tax free in retirement ($80,000 if you are married).

You pay 0% tax on long-term capital gains if your income is under $40,000 ($80,000 if you are married).

A 4% dividend on a $1,000,000 investment account can be $40,000 tax free in retirement ($80,000 if you are married).

You pay 0% tax on long-term capital gains if your income is under $40,000 ($80,000 if you are married).

$MSFT is a great dividend growth stock.

Upside in Microsoft’s Azure cloud platform, heavy dominance in the cloud computing space.

• Azure is growing faster than Amazon's AWS

• Azure has a large and constantly growing market share for the Cloud Computing market

Upside in Microsoft’s Azure cloud platform, heavy dominance in the cloud computing space.

• Azure is growing faster than Amazon's AWS

• Azure has a large and constantly growing market share for the Cloud Computing market

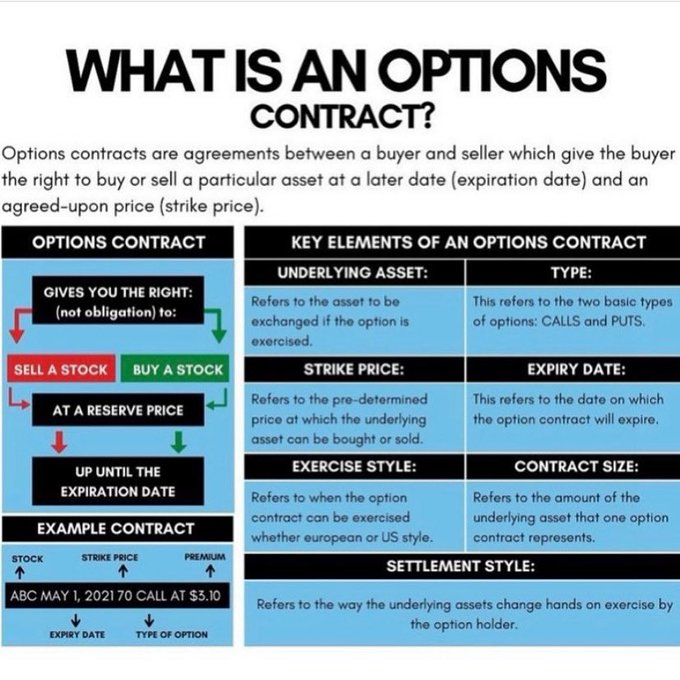

4) Let's talk about covered call option income:

Trading options is how you make money when the markets trade sideways or are down trending.

There are so many opportunities to profit with options, but you should also understand the risks!

Trading options is how you make money when the markets trade sideways or are down trending.

There are so many opportunities to profit with options, but you should also understand the risks!

Options can make you a lot of money when used correctly and can also be very harmful if used incorrectly.

Call options & put options provide a range of strategies for hedging, income or speculation. Options may seem overwhelming at first, but it's easy after you know the basics

Call options & put options provide a range of strategies for hedging, income or speculation. Options may seem overwhelming at first, but it's easy after you know the basics

If you want to learn options for FREE. I put together this Youtube playlist with great videos I found on:

• Covered Calls

• Options Explained

• Cash Covered Puts

• Time Decay

• The Greeks

• LEAPs

Options 101: youtube.com/playlist?list=…

• Covered Calls

• Options Explained

• Cash Covered Puts

• Time Decay

• The Greeks

• LEAPs

Options 101: youtube.com/playlist?list=…

Create streams of passive income or you'll be working a long time!

If you found this thread🧵helpful:

• Follow me: @FluentInFinance

•🔁RT the FIRST tweet

•❤️LIKE the tweets

This account was created to help you build wealth & learn about money!

If you found this thread🧵helpful:

• Follow me: @FluentInFinance

•🔁RT the FIRST tweet

•❤️LIKE the tweets

This account was created to help you build wealth & learn about money!

• • •

Missing some Tweet in this thread? You can try to

force a refresh