🧮 I have created a calculator to have an estimate of the returns that my investments in @BlackWhaleDeFi could achieve in various periods of time.

This information is on the internet, but if you stay until the end I will share the calculator so you can try it or download it.

This information is on the internet, but if you stay until the end I will share the calculator so you can try it or download it.

First of all, comment that this thread is educational, the results could change due to variations in the time of the APY, % vault, fees...

It is a very useful tool to understand Impermanent Loss (IP) and know where your investments are headed.

It is a very useful tool to understand Impermanent Loss (IP) and know where your investments are headed.

What variables must be taken into account?

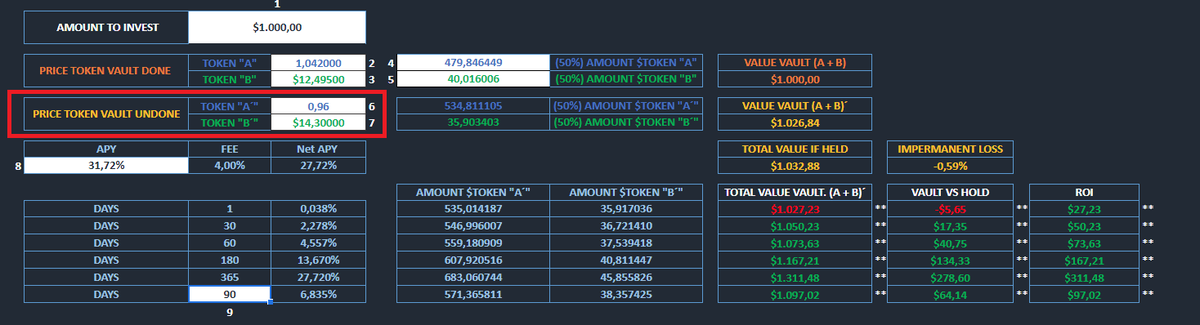

1⃣ AMOUNT TO INVEST

2⃣ PRICE TOKEN VAULT DONE –TOKEN A

3⃣ PRICE TOKEN VAULT DONE - TOKEN B

4⃣ (50%) AMOUNT $TOKEN "A"

5⃣ (50%) AMOUNT $TOKEN "B"

6⃣ PRICE TOKEN VAULT UNDONE –TOKEN A´

7⃣ PRICE TOKEN VAULT UNDONE - TOKEN B´

8⃣ APY

9⃣ DAYS

1⃣ AMOUNT TO INVEST

2⃣ PRICE TOKEN VAULT DONE –TOKEN A

3⃣ PRICE TOKEN VAULT DONE - TOKEN B

4⃣ (50%) AMOUNT $TOKEN "A"

5⃣ (50%) AMOUNT $TOKEN "B"

6⃣ PRICE TOKEN VAULT UNDONE –TOKEN A´

7⃣ PRICE TOKEN VAULT UNDONE - TOKEN B´

8⃣ APY

9⃣ DAYS

These variables (white cell) are the only ones we have to modify.

Let's see it with an example of the $KUJI / $ATOM pair:

1⃣ Amount to invest = $1,000

2⃣ We will have to enter the price of the tokens in which we will make the vault.

a) #KUJI = $1,042

b) #ATOM = $12,495

Let's see it with an example of the $KUJI / $ATOM pair:

1⃣ Amount to invest = $1,000

2⃣ We will have to enter the price of the tokens in which we will make the vault.

a) #KUJI = $1,042

b) #ATOM = $12,495

3⃣ It will give us the amounts 50% / 50% that we will need to make the vault

a) (50%) AMOUNT $KUJI = 479,486

b) (50%) AMOUNT $ATOM = 40,016

These amounts could vary due to fees and price variations. You can enter them manually in the calculator according to @BlackWhaleDeFi

a) (50%) AMOUNT $KUJI = 479,486

b) (50%) AMOUNT $ATOM = 40,016

These amounts could vary due to fees and price variations. You can enter them manually in the calculator according to @BlackWhaleDeFi

4⃣ Next we will enter the APY. In this example it would be 31.72%.

It must be considered that this variable is constantly changing and varies depending on the arbitrations that are carried out and the total size of the vault.

It must be considered that this variable is constantly changing and varies depending on the arbitrations that are carried out and the total size of the vault.

5⃣ Finally, we can consider various scenarios with various combinations entering the price of $KUJI and $ATOM that it could have in the future

a) Up the price of the two tokens

b) Down the price of the two tokens

c) Lateralize the price of the two tokens

a) Up the price of the two tokens

b) Down the price of the two tokens

c) Lateralize the price of the two tokens

d) Token A price down and Token B up

e) Token A price up and Token B down

f) Token A price up and Token B lateralizes

g) Token A price down and Token B lateralizes

h) Token B price up and Token A lateralizes

i) Token B price down and Token A lateralizes

e) Token A price up and Token B down

f) Token A price up and Token B lateralizes

g) Token A price down and Token B lateralizes

h) Token B price up and Token A lateralizes

i) Token B price down and Token A lateralizes

According to your analysis, you will be able to observe how the returns on investments would behave in various periods of time with:

a) TOTAL VALUE VAULT. (A + B)´

b) INCREASE VAULT VS HOLD

c) ROI

a) TOTAL VALUE VAULT. (A + B)´

b) INCREASE VAULT VS HOLD

c) ROI

🔍 OBSERVATIONS:

The numbers must go with "comma", if they use "dot" it gives an error.

If several users use it at the same time, you will see how the data changes and they will not be able to use it correctly, To solve this activate the option "use it offline" or download it

The numbers must go with "comma", if they use "dot" it gives an error.

If several users use it at the same time, you will see how the data changes and they will not be able to use it correctly, To solve this activate the option "use it offline" or download it

Once we have a strategy prepared and we have analyzed the possible variations in prices, we can use the @blackwhale dapp to start obtaining a return on our assets.

blackwhale.money

blackwhale.money

This calculator i made voluntarily without any founding. Is for wonderful community of @TeamKujira and @BlackWhaleDeFi , in order to educate and add value to the great project they are making.

Here I share the link, enjoy it😉

$KUJI $USK #GUD

docs.google.com/spreadsheets/d…

Here I share the link, enjoy it😉

$KUJI $USK #GUD

docs.google.com/spreadsheets/d…

Finally if you have any questions about @BlackWhaleDeFi you can consult this wonderful article or visit their social networks.

medium.com/@235711/black-…

medium.com/@235711/black-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh