Billionaire Investor David Rubenstein just published the phenomenal book “How to Invest”.

In it, he interviews many of the greatest investors currently living on this planet.

Here's a list of learnings every investor needs to understand👇🏼

In it, he interviews many of the greatest investors currently living on this planet.

Here's a list of learnings every investor needs to understand👇🏼

Luck

Luck is the reason why many bad investors never stop investing actively.

Sometimes you get lucky and make a profit.

Mixing that up with skill is one of the most unfortunate mistakes.

Being able to tell what role luck (even bad luck) plays in your investments is crucial.

Luck is the reason why many bad investors never stop investing actively.

Sometimes you get lucky and make a profit.

Mixing that up with skill is one of the most unfortunate mistakes.

Being able to tell what role luck (even bad luck) plays in your investments is crucial.

Due Diligence and its Limits

Proper due diligence is a necessity for successful investing.

However, as we currently see, the future is unpredictable and can change every thesis.

Be aware of these limits of due diligence and protect your portfolio against this uncertainty.

Proper due diligence is a necessity for successful investing.

However, as we currently see, the future is unpredictable and can change every thesis.

Be aware of these limits of due diligence and protect your portfolio against this uncertainty.

Instinct

The greatest investors have some sort of instinct or intuition for good investments.

What is this instinct?

Above all, it's the tendency to deviate from the norm when it’s necessary.

It’s not until analysts give out warnings and sell ratings that they get interested.

The greatest investors have some sort of instinct or intuition for good investments.

What is this instinct?

Above all, it's the tendency to deviate from the norm when it’s necessary.

It’s not until analysts give out warnings and sell ratings that they get interested.

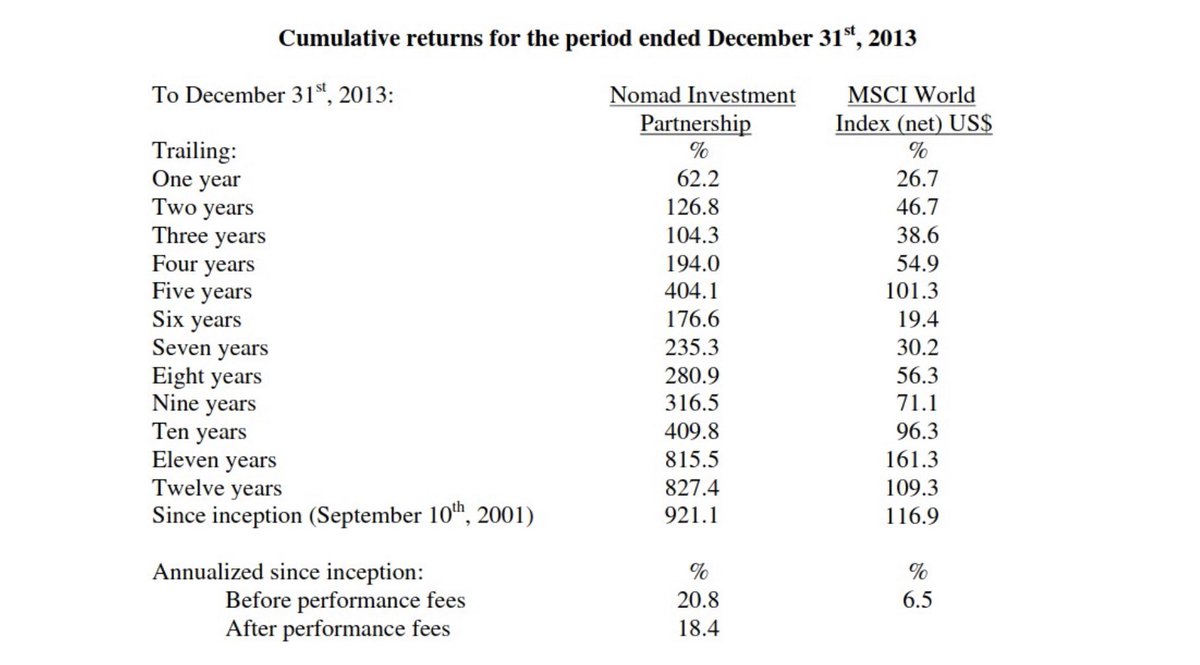

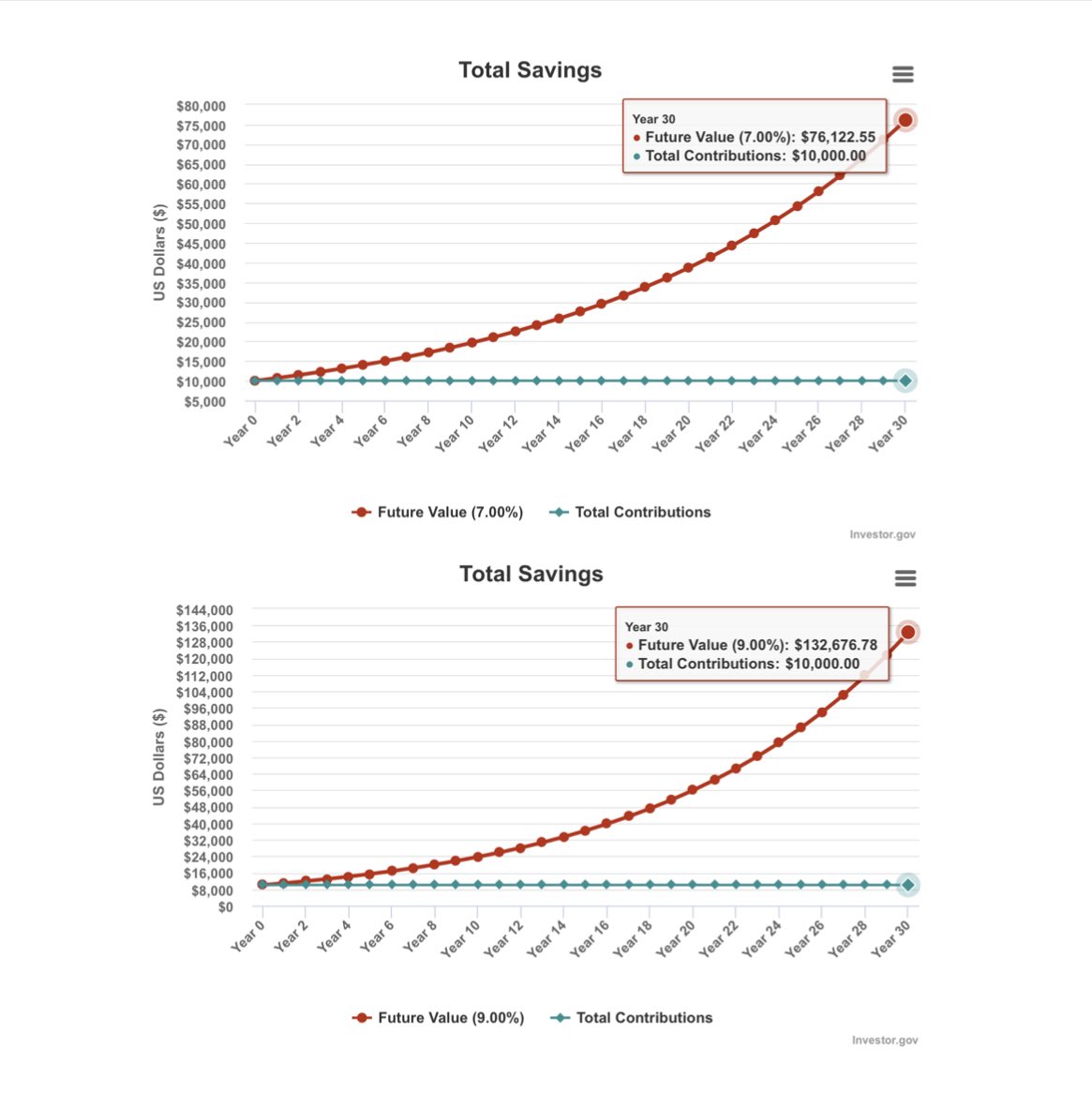

Realistic Expectations

Unrealistic expectations are another common reason for bad performance.

They cause investing approaches that are closer to gambling than investing.

Stick to historic averages and aim for slightly higher.

As you can see, the difference is already huge.

Unrealistic expectations are another common reason for bad performance.

They cause investing approaches that are closer to gambling than investing.

Stick to historic averages and aim for slightly higher.

As you can see, the difference is already huge.

Time of Sale

I’m a fan of Buffett and I like the idea of holding investments forever.

But that is rarely the reality, even with Buffett.

Therefore, selling at the right time is just as important as buying at the right price.

To do so, you need an idea of fair value.

I’m a fan of Buffett and I like the idea of holding investments forever.

But that is rarely the reality, even with Buffett.

Therefore, selling at the right time is just as important as buying at the right price.

To do so, you need an idea of fair value.

Curiosity

Great investors are curious and inquisitive people.

They read all the time and focus on gaining new knowledge.

Without this attitude, you’ll run out of good investment ideas sooner or later.

Try to take something new out of every situation.

Great investors are curious and inquisitive people.

They read all the time and focus on gaining new knowledge.

Without this attitude, you’ll run out of good investment ideas sooner or later.

Try to take something new out of every situation.

Consult others

Regardless of one's intelligence, we are all prone to certain errors.

More so than someone else might be.

Thus, consulting others before making investment decisions is the best way to find flaws in your thesis.

Regardless of one's intelligence, we are all prone to certain errors.

More so than someone else might be.

Thus, consulting others before making investment decisions is the best way to find flaws in your thesis.

Now, something on my behalf.

I’ll start a Newsletter next Tuesday.

The goal is to teach people new to investing about how to invest and understand the markets.

Thus, I’ll cover both Micro- and Macroeconomics.

I’ll start a Newsletter next Tuesday.

The goal is to teach people new to investing about how to invest and understand the markets.

Thus, I’ll cover both Micro- and Macroeconomics.

You’ll get:

- Comprehensive Company Analyses

- Semi-Weekly Macro Updates

- More in-depth articles regarding the topics I cover here on Twitter

- Occasional Book Summaries/Reviews

- Comprehensive Company Analyses

- Semi-Weekly Macro Updates

- More in-depth articles regarding the topics I cover here on Twitter

- Occasional Book Summaries/Reviews

If that sounds interesting, you can subscribe through the link in my bio.

For now, you can subscribe for free.

The posts however will be for paid subscribers and the costs are $6,38 / Month.

Of course, I’ll continue writing on Twitter!

For now, you can subscribe for free.

The posts however will be for paid subscribers and the costs are $6,38 / Month.

Of course, I’ll continue writing on Twitter!

Now, thanks for reading!

If you enjoyed this post, please Like and Retweet this Thread.

Have a great day!

If you enjoyed this post, please Like and Retweet this Thread.

Have a great day!

https://twitter.com/mnkedaniel/status/1584963761353674754?s=61&t=RYoaXyTaGquJ4U2iG1j5Yg

• • •

Missing some Tweet in this thread? You can try to

force a refresh