I'm very excited to share the @CatoCMFA's new policy guide for the next Congress!

Here's a brief thread on some of the recommendations. 🧵

cato.org/sound-financia…

Here's a brief thread on some of the recommendations. 🧵

cato.org/sound-financia…

First, we call for stronger financial privacy protections. The U.S. government has been chipping away at financial privacy for decades with little to no public oversight.

It's time to restore the protections that should have been there all this time.

It's time to restore the protections that should have been there all this time.

Next, we turn our attention to stablecoins and CBDCs. While stablecoins offer a promising step forward, CBDCs are clearly a step back.

Congress should work to lessen government regulations inhibiting stablecoins while ensuring that the Fed cannot issue a CBDC.

Congress should work to lessen government regulations inhibiting stablecoins while ensuring that the Fed cannot issue a CBDC.

In the third chapter, we consider cryptocurrencies more generally.

From removing the Infrastructure bill's broker definition to removing capital gains taxes on transactions, there is much Congress can do to level the playing field for cryptocurrency competition.

From removing the Infrastructure bill's broker definition to removing capital gains taxes on transactions, there is much Congress can do to level the playing field for cryptocurrency competition.

Next, the guide takes a look at the growing ESG debates ahead of @jenniferjschulp's conference next month.

Investors should be free to invest as they see fit, but neither Congress nor the SEC should be mandating that decision for them.

Investors should be free to invest as they see fit, but neither Congress nor the SEC should be mandating that decision for them.

Shifting to monetary policy, it's long past time to rein in the Fed.

To get started, that means narrowing the mandate, holding the Fed to a credible rule, and shrinking the balance sheet.

To get started, that means narrowing the mandate, holding the Fed to a credible rule, and shrinking the balance sheet.

Next, we turn to removing barriers for small businesses and investors, alike.

For instance, Congress should remove the barriers keeping average Americans out of the stock market. How much money you have shouldn't be the deciding factor for whether you are "qualified" to invest.

For instance, Congress should remove the barriers keeping average Americans out of the stock market. How much money you have shouldn't be the deciding factor for whether you are "qualified" to invest.

Finally, the guide ends with broader reforms to improve competition across financial markets as a whole.

That includes winding down the GSEs, eliminating duplicative federal regulators, fixing MMF rules, and much more.

That includes winding down the GSEs, eliminating duplicative federal regulators, fixing MMF rules, and much more.

That is a lot of ground to cover, but don't fret! The entire policy guide is just 41 pages. Sifting through hundreds and thousands of pages of research is our job, not yours.

However, for those interested in learning more, you can find my work alongside that of @norbertjmichel, @GeorgeSelgin, @jenniferjschulp, @JackSolowey, and the rest of the CMFA at the link below.

#CatoEcon

cato.org/center-monetar…

#CatoEcon

cato.org/center-monetar…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

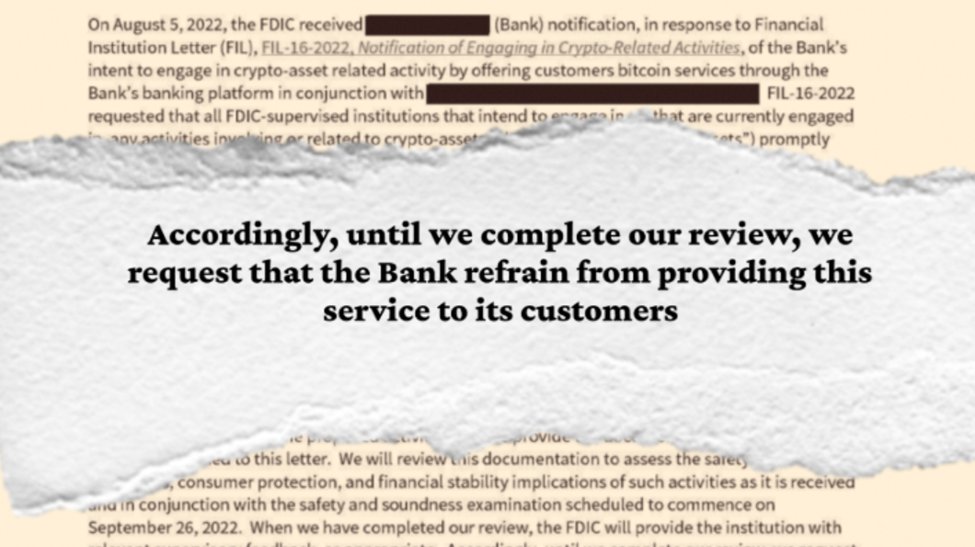

![Approximately 2,800 [redacted] customers can purchase, sell, and store Bitcoin using an application from [redacted] through the bank’s online and mobile banking platform… The FDIC has a number of questions… Until that review is completed, [redacted] should not expand the service to additional customers. (April 5, 2022)](https://pbs.twimg.com/media/GgnYDZ8WEAAWi8S.jpg)

![[Redacted] should not proceed with any crypto-asset activity until such time that the FDIC has determined [redacted] ability to implement the activity in a safe and sound manner. (May 5, 2023)](https://pbs.twimg.com/media/GgnYhoHXAAAcWkm.jpg)