I see very little coverage of $NETI. This is my #2 position and still growing.

Figured I'd start writing why I love this name for those unfamiliar with why Eneti is a great opportunity.

Figured I'd start writing why I love this name for those unfamiliar with why Eneti is a great opportunity.

A bit of background... $NETI was initially $SALT (Scorpio Bulkers) - a dry bulk company tied to Scorpio Holdings (same ties to $STNG).

Many investors were burned when Scorpio Bulkers announced they were divesting their dry bulk fleet to invest in windmill installation vessels.

Many investors were burned when Scorpio Bulkers announced they were divesting their dry bulk fleet to invest in windmill installation vessels.

The change from SALT to NETI finalized in Feb '21. Here's BDI through '21+ which shows the mega run that SALT investors missed when the transitioned happened.

SALT was arguably the best public fleet to take advantage of the dry bulk run in '21... I was one of those burned.

SALT was arguably the best public fleet to take advantage of the dry bulk run in '21... I was one of those burned.

Needless to say, there's some valid skepticism of a mgmt team that sold dry bulk before a major run and invested in a largely unproven sector. Arguably, they don't even know this sector!

So if I haven't scared you off yet, let's talk about why this is a fantastic investment.

Three major themes:

#1 - it is a hated stock

#2 - it isn't well understood

#3 - the thesis hasn't played out yet

These are what you love when you are a value investor!

Three major themes:

#1 - it is a hated stock

#2 - it isn't well understood

#3 - the thesis hasn't played out yet

These are what you love when you are a value investor!

We've covered #1. As for #2 - well have you ever heard of a WTIV (Wind Turbine Installation Vessel)?

As of 2020, there were 16 built: en.wikipedia.org/wiki/Wind_turb…

These are vessels which install wind turbines in the ocean and are extremely $$$/high tech.

As of 2020, there were 16 built: en.wikipedia.org/wiki/Wind_turb…

These are vessels which install wind turbines in the ocean and are extremely $$$/high tech.

Surprisingly, there are other WTIV companies. I'd direct you to look at Cadeler ($CA2 - French Exchange).

NETI acquired theirs by buying Seajacks. They also got an experienced mgmt team in the process.

NETI acquired theirs by buying Seajacks. They also got an experienced mgmt team in the process.

Right now, Cadeler and Eneti mostly operate Jackup Rigs.

Read more here: en.wikipedia.org/wiki/Jackup_rig

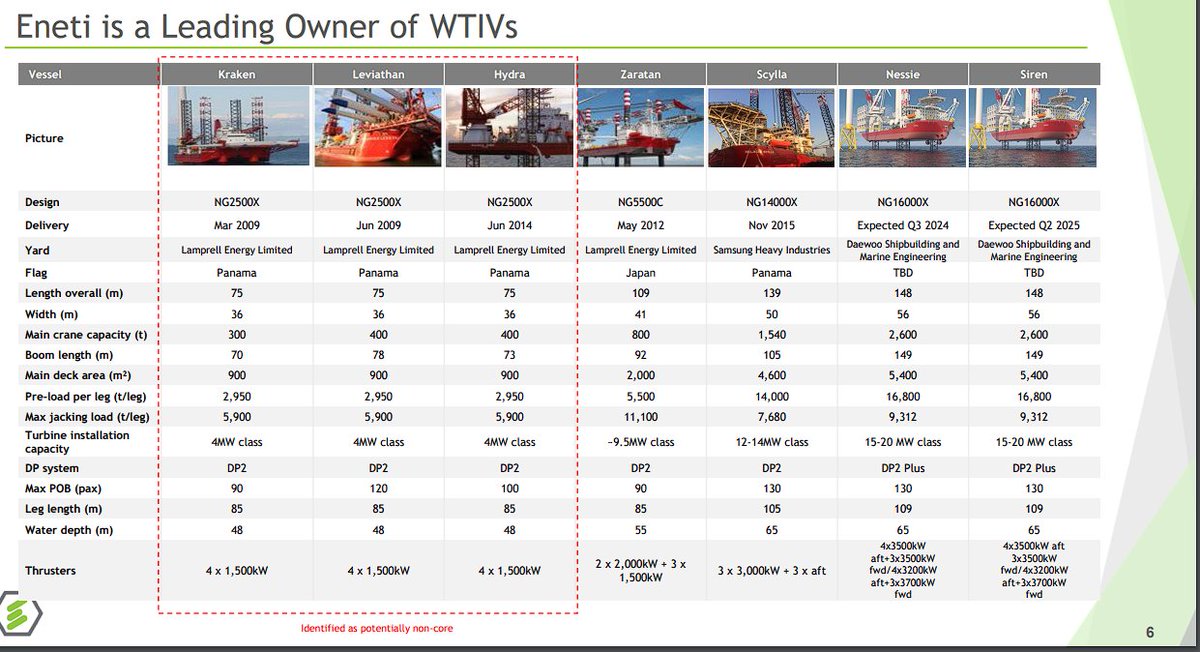

NETI's fleet is as follows. It has identified their rigs as non-core. The WTIVs are smaller sized with two NG16000s coming in '24/25. This is the catalyst.

Read more here: en.wikipedia.org/wiki/Jackup_rig

NETI's fleet is as follows. It has identified their rigs as non-core. The WTIVs are smaller sized with two NG16000s coming in '24/25. This is the catalyst.

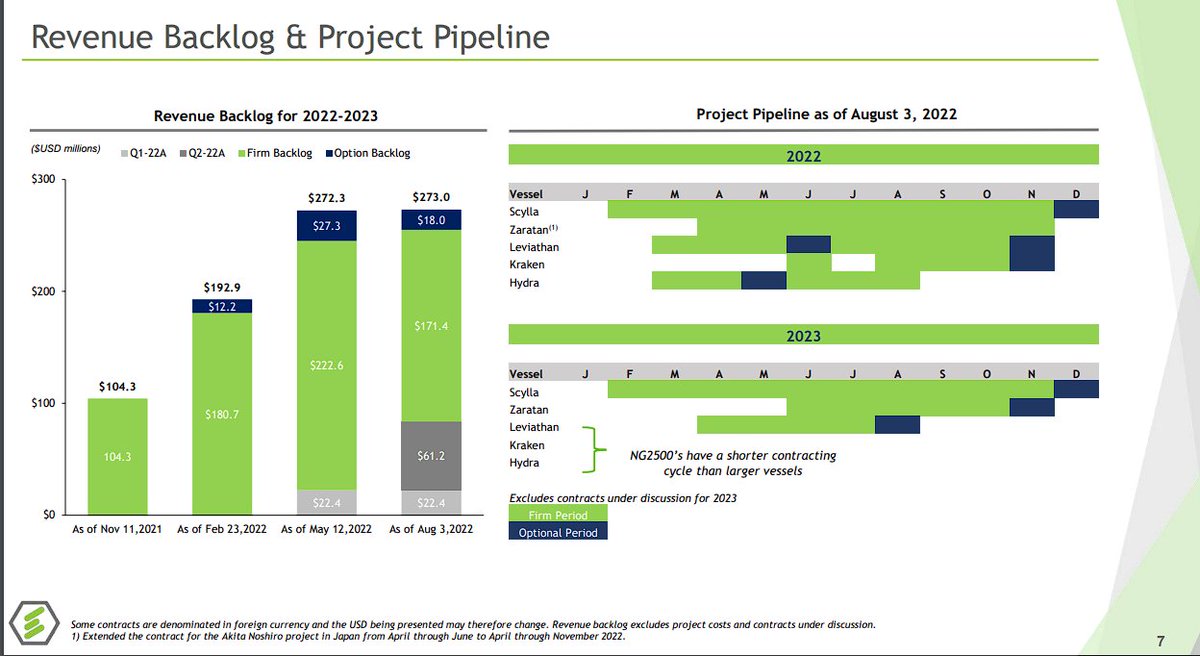

Windmill farm installations take a while. As such, earnings become a bit unpredictable quarter to quarter as payments/revenues might come in later than expected to an investor.

Ignoring earnings headlines, we can see solid contract/revenue streams for the rigs.

Ignoring earnings headlines, we can see solid contract/revenue streams for the rigs.

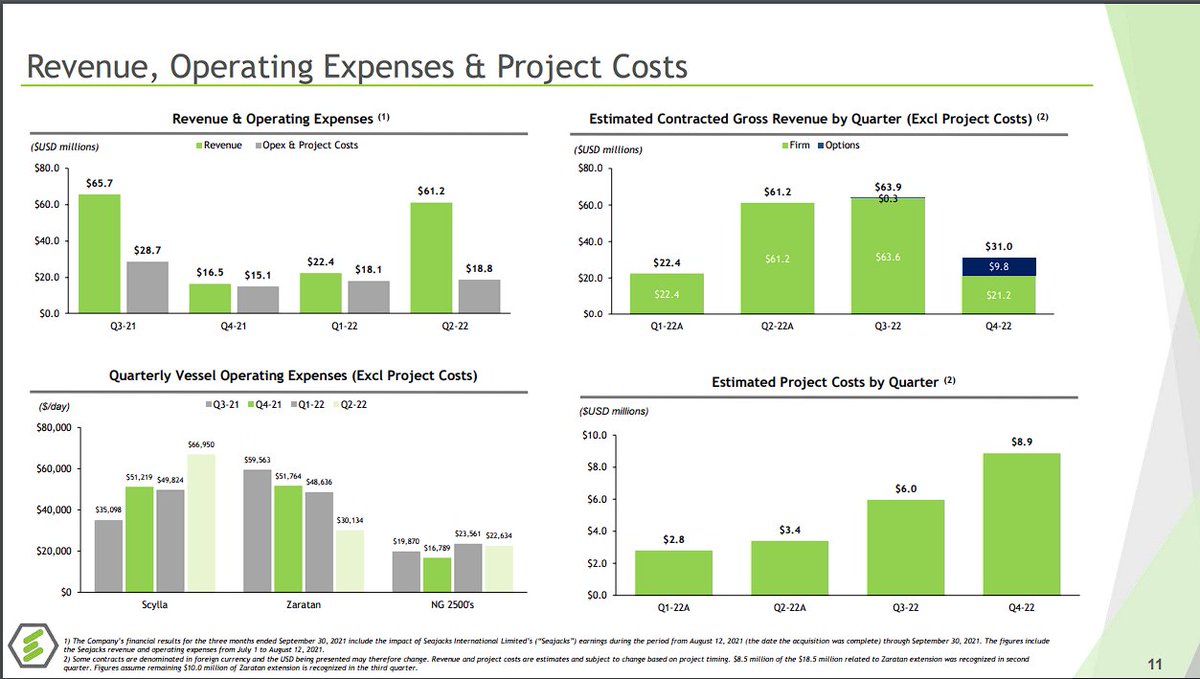

With the existing rigs and contracts, NETI posted $1.36 EPS in Q2. Again, this isn't a predictor of future quarters as it included some '21 revenue.

However, it indicates that a company without its thesis is posting positive EPS.

However, it indicates that a company without its thesis is posting positive EPS.

So what's the thesis?

The WTIV's that NETI is buying are worth $300m+ and will net $200k+/day.

There are 7 new ships coming online by '23. Contracts are being lost due to lack of WTIVs.

soefart.dk/article/view/7…

The WTIV's that NETI is buying are worth $300m+ and will net $200k+/day.

There are 7 new ships coming online by '23. Contracts are being lost due to lack of WTIVs.

soefart.dk/article/view/7…

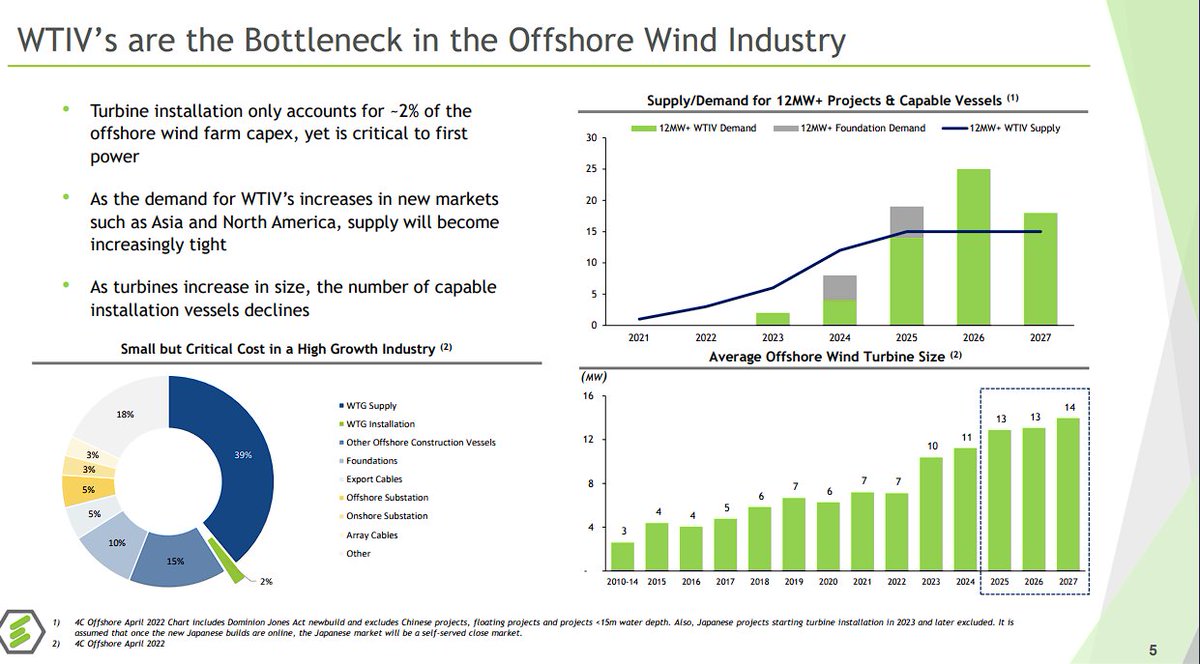

NETI does a good job explaining this in their slide deck.

There are few ships capable of installing the large MW turbines and demand for higher MW turbines is increasing. Quite simply - supply of WTIVs will not meet demand.

There should be sub 30 WTIVs through 2027.

There are few ships capable of installing the large MW turbines and demand for higher MW turbines is increasing. Quite simply - supply of WTIVs will not meet demand.

There should be sub 30 WTIVs through 2027.

And I'll add in jest that there are Jones Act WTIVs for the US, which cost a heck of a lot more...

Because earnings are hard to follow on these long term contracts, NETI outlines it for us here.

Expect a stellar Q3 and weaker Q4 unless the jack-ups find good employment.

Expect a stellar Q3 and weaker Q4 unless the jack-ups find good employment.

Eneti has a market cap of $315m. Now imagine 2 new vessels coming online that are bringing in $200k/day at 100% utilization.

Costs are not super high in this sector. Earnings will be fantastic. Plus every ESG fund should have NETI in their portfolio.

Costs are not super high in this sector. Earnings will be fantastic. Plus every ESG fund should have NETI in their portfolio.

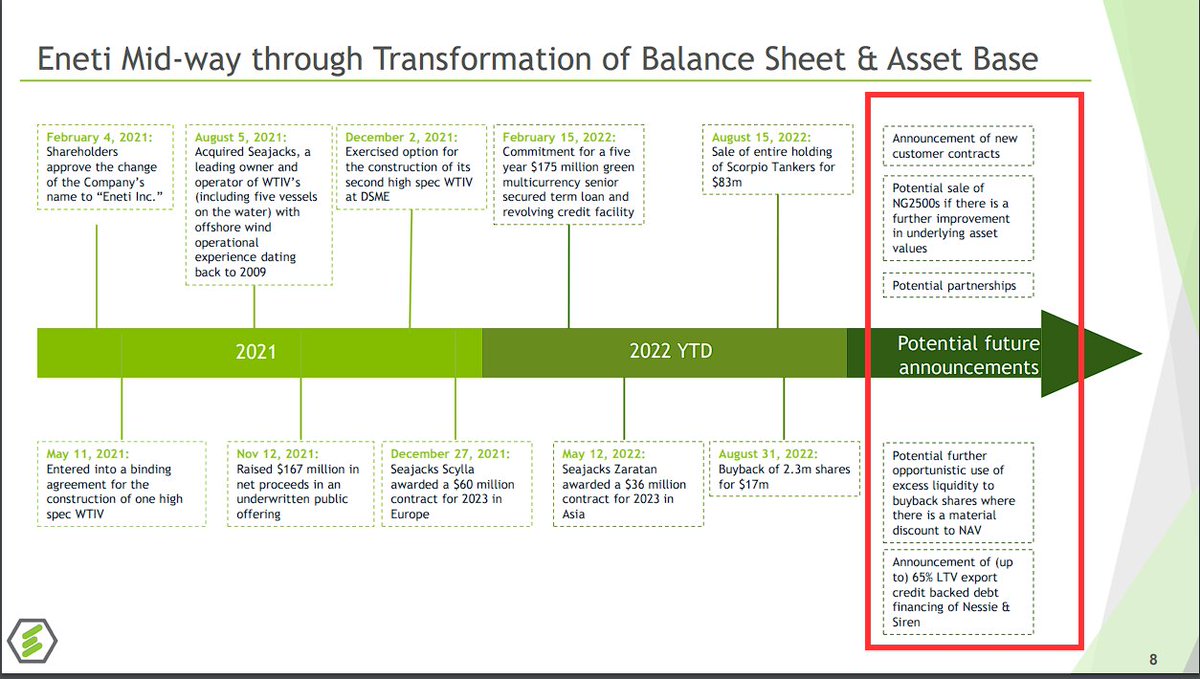

NETI tells us to look at the following catalysts:

#1 - NETI trades below book value. Selling vessels is good for shareholders.

#2 - Cash is high - as seen by the $50m buyback program

#3 - New Debt Financing for the NG16000s

#1 - NETI trades below book value. Selling vessels is good for shareholders.

#2 - Cash is high - as seen by the $50m buyback program

#3 - New Debt Financing for the NG16000s

To summarize:

- NETI is hated b/c of their transition

- WTIVs are a very small sector and will continue to be small

- WTIV earnings are very very good and will stay good given the small fleet size

- New WTIVs will give NETI the ability to capitalize on the WTIV contract boom

- NETI is hated b/c of their transition

- WTIVs are a very small sector and will continue to be small

- WTIV earnings are very very good and will stay good given the small fleet size

- New WTIVs will give NETI the ability to capitalize on the WTIV contract boom

Book value is ~$17/share so the floor is high.

The existing jack-ups will continue to post solid earnings and can be sold at accreditive values for shareholders.

The new WTIVs will realize incredible returns in a few years for patient shareholders.

The existing jack-ups will continue to post solid earnings and can be sold at accreditive values for shareholders.

The new WTIVs will realize incredible returns in a few years for patient shareholders.

Great opportunity to invest in a really cheap company that is basically guaranteed to post fantastic, predictable earnings.

Consider me a buyer. Happy to wait for those earnings and see others figure out this thesis in a few years as Cadeler and Eneti post WTIV earnings in 24/25

Consider me a buyer. Happy to wait for those earnings and see others figure out this thesis in a few years as Cadeler and Eneti post WTIV earnings in 24/25

• • •

Missing some Tweet in this thread? You can try to

force a refresh