New Dutch law being prepared:

Banks need to monitor ALL payments from 100 euro

This is probably connected to the planned CBDC’s, where small payment still will be anonymous, while larger will ALL be registered and monitored

Banks need to monitor ALL payments from 100 euro

This is probably connected to the planned CBDC’s, where small payment still will be anonymous, while larger will ALL be registered and monitored

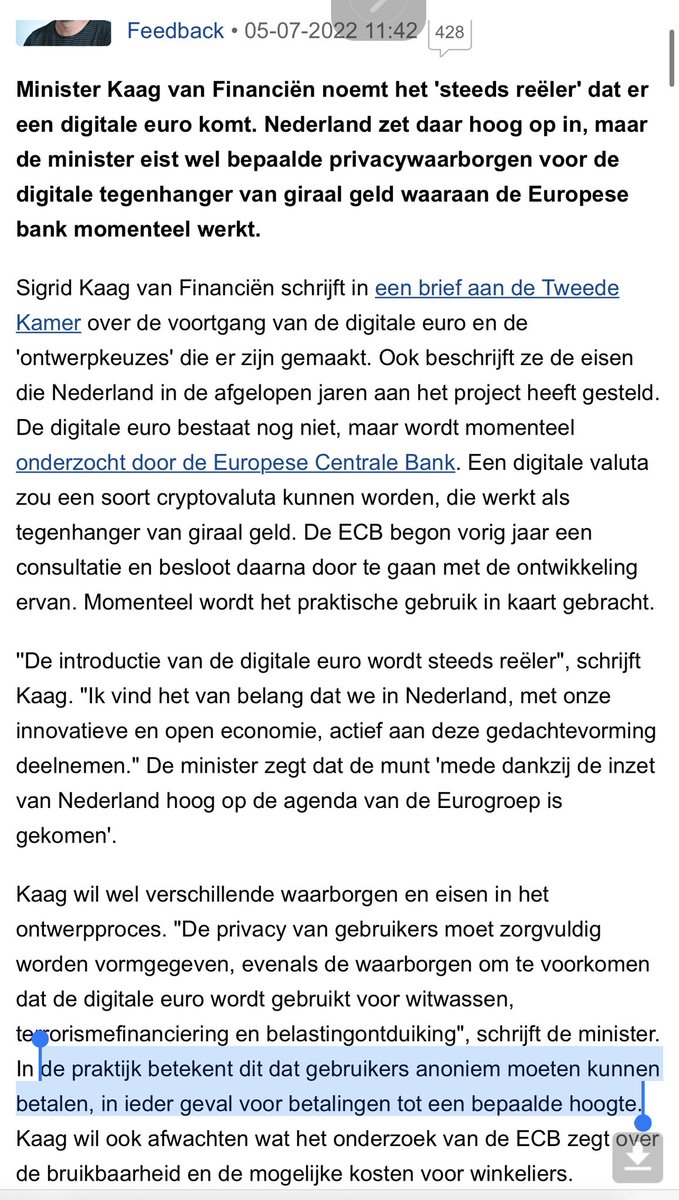

Let op formulering van Kaag:

Digitale munt wordt door de ‘ECB onderzocht’, terwijl er duidelijk sprake is van voorbereiding

Vraag Máxima maar 😀

Digitale munt wordt door de ‘ECB onderzocht’, terwijl er duidelijk sprake is van voorbereiding

Vraag Máxima maar 😀

Maxima and the BIS/g Guy:

CBDCs for the People

Clearly being planned and promoted by BIS President (and former central banker) Agustin Carstens and H.M. Queen Máxima of the Netherlands

Who ever assigned the Dutch queen to this (political sensitive) important task????

CBDCs for the People

Clearly being planned and promoted by BIS President (and former central banker) Agustin Carstens and H.M. Queen Máxima of the Netherlands

Who ever assigned the Dutch queen to this (political sensitive) important task????

It’s Official

From His Masters mouth:

It is about ‘Total Control’ over your cash

This is Orwellian, however being planned (almost worldwide) by most central banks 🏦

From His Masters mouth:

It is about ‘Total Control’ over your cash

This is Orwellian, however being planned (almost worldwide) by most central banks 🏦

Bitcoin and the lightning network could do all this (while staying anonymous), however they will NEVER be allowed to develop to more than a monetary sideshow #fortherecord

Club Meeting: January 2019, Davos

Klaus (WEF President), Mark (Dutch PM), Máxima (Dutch Queen), Kaag (Finance Minister)

#tismaareenpraatclubje

Klaus (WEF President), Mark (Dutch PM), Máxima (Dutch Queen), Kaag (Finance Minister)

#tismaareenpraatclubje

How to spin ‘Total Control’ over money?

Always pretend you are doing it to help the poor ..

#inclusive

Always pretend you are doing it to help the poor ..

#inclusive

• • •

Missing some Tweet in this thread? You can try to

force a refresh