Cash free debt free ➡️ What does it really mean and why does it cause hang ups in so many deals? 🧵

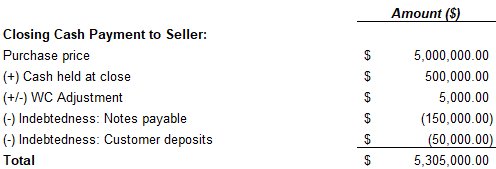

You see this term in most transactions. Simply put, seller gets to keep all of the cash on the balance sheet at closing but they have to pay off or retain all of the debt (and "debt-like" items). Simple funds flow below, right? Lets break it down

Cash - Keep this one straightforward. This is the cash sitting in the bank at closing. In most SMBs the actual cash balance varies based on seller discretion. One seller may distribute out their profits while another may hold it in the business. Either way, it’s their cash

Indebtedness - There's actual "debt" and then there's "debt-like" items. The sum of these should make up "indebtedness". I'd look at these separately as one is hopefully straightforward and the other is subjective

Debt - In simple terms, this is bank debt. Term loans, lines of credits, floor plans, etc. It's the sellers choice in how to capitalize the business. A business with debt is not worth the same as a business without debt and your valuation assumed debt free

Debt-like items - Now to the subjective part that can make or break a deal. Lets use a few examples. Note, I'm presenting this in the most favorable light of the buyer. None of these represent "the rule" ⬇️

Customer deposits - Paying to complete projects (inventory, people, etc.) but receiving no cash for them? Day 1 = hole. Seller says that future deposits fund these projects (deposits are WC). What if growth slows? Future deposits won't keep up with costs and you'll be left 😢

Deferred revenue - In software, deferred revenue may not have as direct of a "cost to serve". In a perfect world, all deferred revenue is indebtedness. In a middle ground, focus on understanding what the cost to serve is (i.e. understand GM) and treat this as indebtedness

Employee bonuses - Closing right before bonuses are paid? Its one thing to know you have to make payroll, but it hurts to think you'd stroke a check to employees for last years performance immediately after closing. Push for the seller to fund bonuses earned pre-closing

How is indebtedness handled? This part can be negotiated. It may be directly paid off as part of closing (closing wires sent to debtors), it may be treated as a PP reduction, or it may be cash left behind (reduce the amount of cash the seller takes off the balance sheet)

As a buyer, classifying items as indebtedness is the most favorable approach. If not indebtedness, make sure it makes it into the definition of WC. This protects from large swings in balances. E.g. if seller decided to advance bill customers pre-closing, you should be protected

Hopefully this is helpful to some out there as you work through your deals. Hit me up with any more specific questions! #ETA

• • •

Missing some Tweet in this thread? You can try to

force a refresh