Here's a full strategy designed for beginner ICT students without making your head hurt!

Doesn't require daily bias.

Complete guide A-Z (With Pictures)⬇️

Doesn't require daily bias.

Complete guide A-Z (With Pictures)⬇️

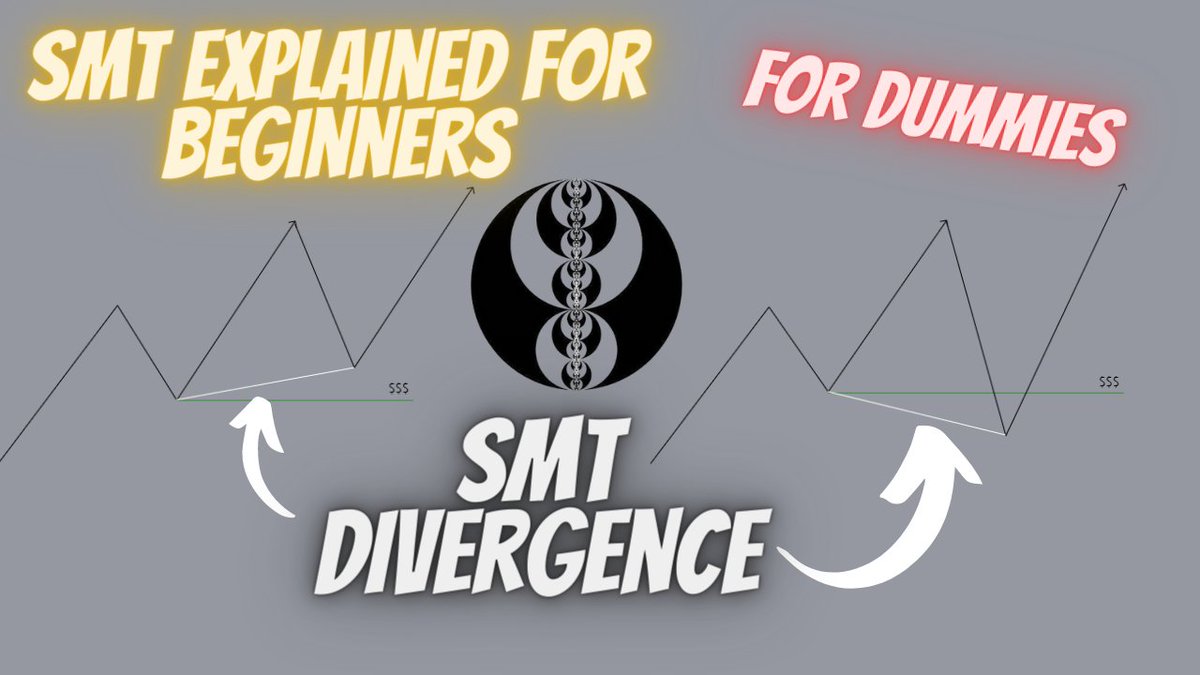

What is the strategy? It's simple... Liquidity + OB + SMT

So let's start with some basic rules we want to set in place!

- Only trading ES & NQ

- Risking MAX 1% of account per play or 1/10th of your max drawdown on a funded account

So let's start with some basic rules we want to set in place!

- Only trading ES & NQ

- Risking MAX 1% of account per play or 1/10th of your max drawdown on a funded account

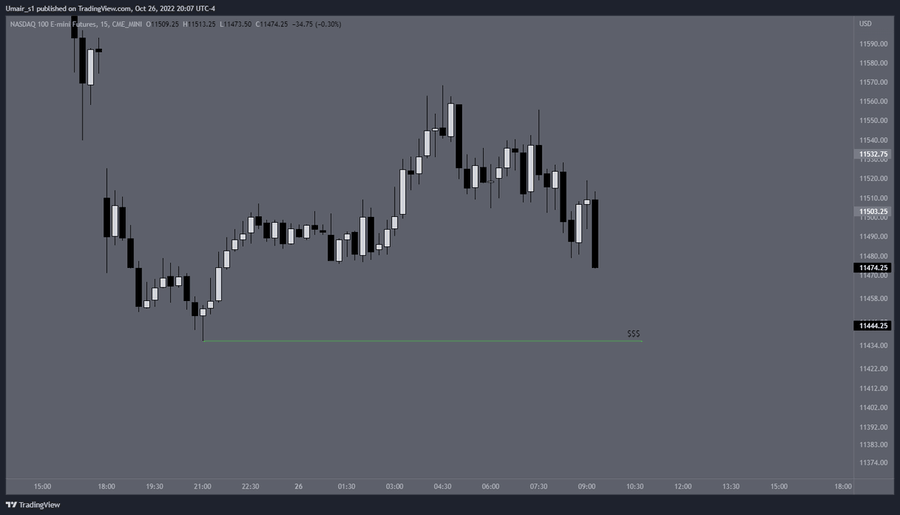

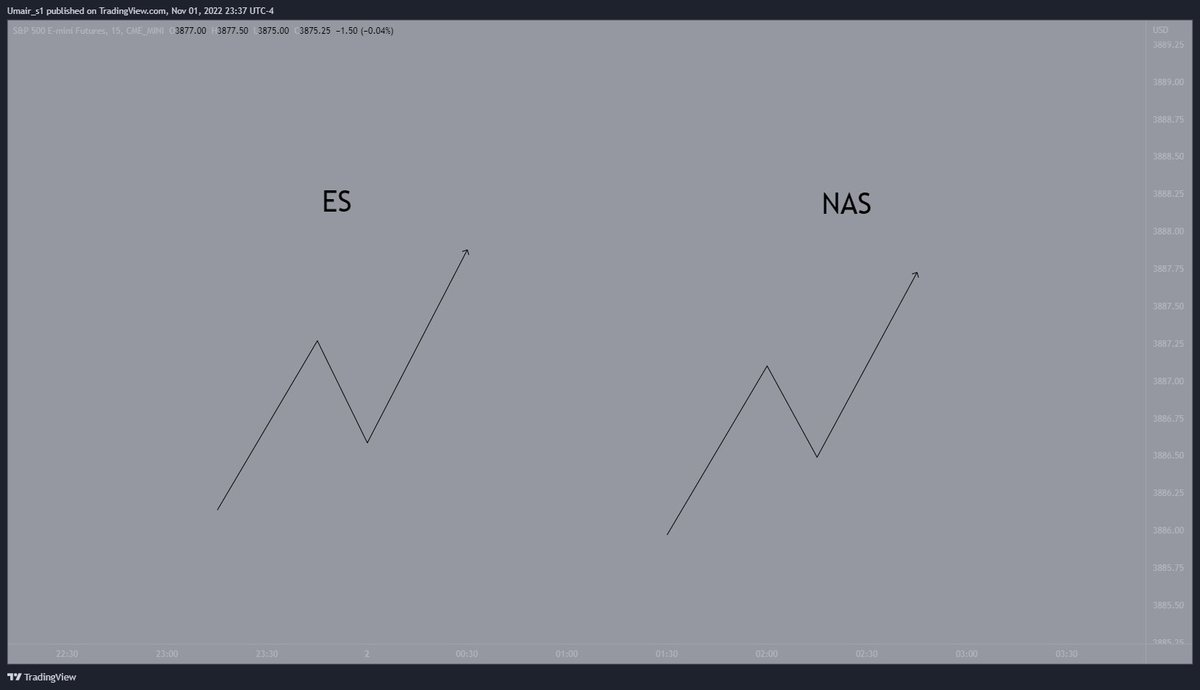

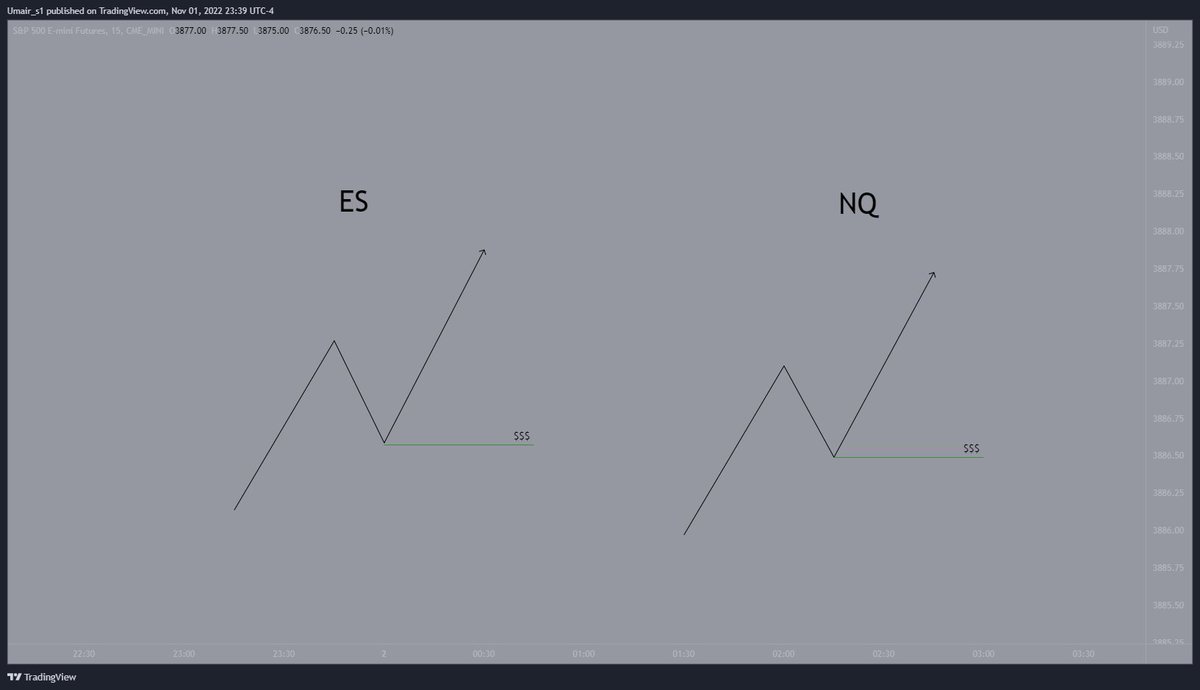

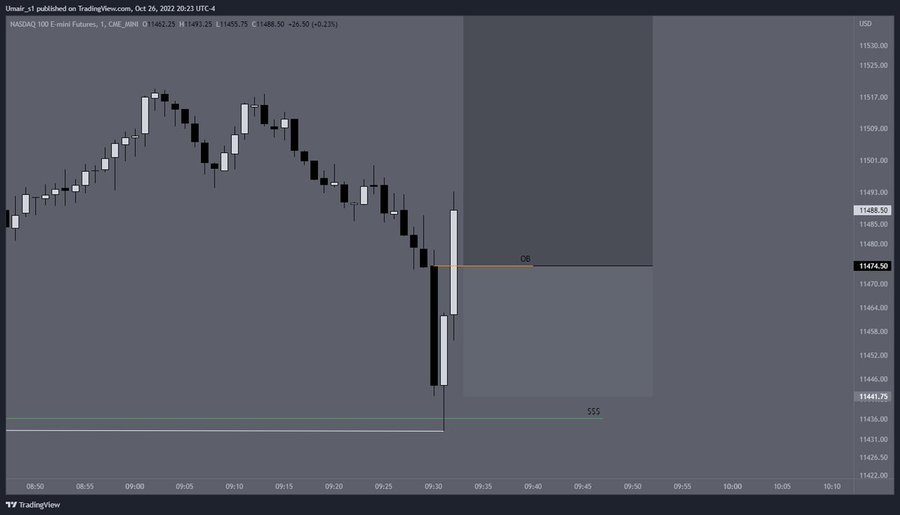

Step 2: Watch both ES and NQ to see which one purges liquidity first. In this case, NQ purges liquidity first while ES doesn't and makes a higher high, this is an SMT divergence.

Step 3: Now that we have a SMT, we know that smart money is in play and looking for a reversal. We will be trading the ticker that purges liquidity, NQ in our case, and if both tickers purge liquidity, then the play is invalid.

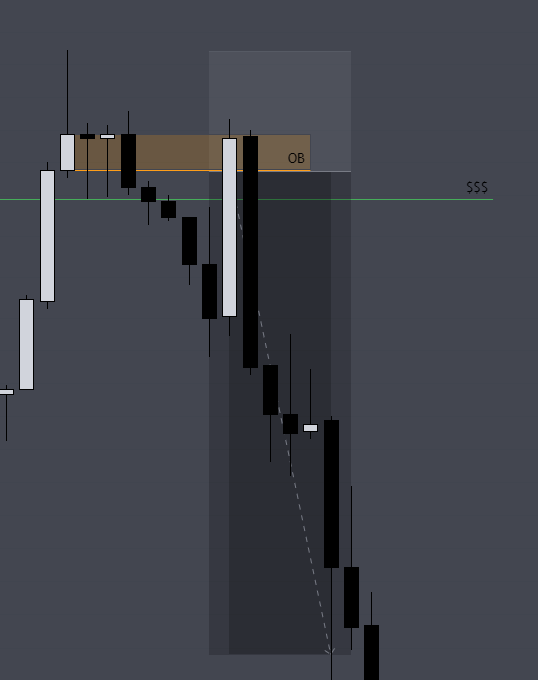

Step 4: Once liquidity is purged, wait for 1, 5, or 15m OB to form and enter on the body of the OB with stops at the end of the wick (Beginners use 5 or 15m OB). For advanced ICT traders, you can use whatever entry pattern you desire.

An important thing to remember is that this strategy is not designed to help you be able to predict the market to exact price points, it's to help you make money.

Average winning trades can range anywhere from 2R to 10R, this means you only need to be right on your analysis 33% of the time to be PROFITABLE, not break even.

Here is a youtube video covering the strategy in video format. I also live stream 9:30am EST Mon-Fri on youtube!

If this does seem a bit hard for you, I have just released a private discord that's aimed at students who have an understanding of ICT concepts but can't find the profitable part yet

Once you enter the discord you will be asked some questions so I can identify everyone's trading personality and weakness. You will be asked to journal every 10 trades with a journal I've created. I will NOT be giving signal alerts, only market commentary to help everyone learn

Every weekend I will livestream reviewing everyone's journal and giving feedback

You can learn more about it here⬇️

discord.com/invite/5Bn8Q29…

You can learn more about it here⬇️

discord.com/invite/5Bn8Q29…

• • •

Missing some Tweet in this thread? You can try to

force a refresh