THOUGHT FOR DAY: In 2021 LTA@£1.073m = public sector pension of £46,657 before breaching

With inflation 10.1% '22, 7.9% '23 LTA should be £1.423m buying same pension of 46.7k

Instead LTA will by 27/28 be real terms £818k = pension just £35.6k!

RT if you agree➡️NHS collapse 📉

With inflation 10.1% '22, 7.9% '23 LTA should be £1.423m buying same pension of 46.7k

Instead LTA will by 27/28 be real terms £818k = pension just £35.6k!

RT if you agree➡️NHS collapse 📉

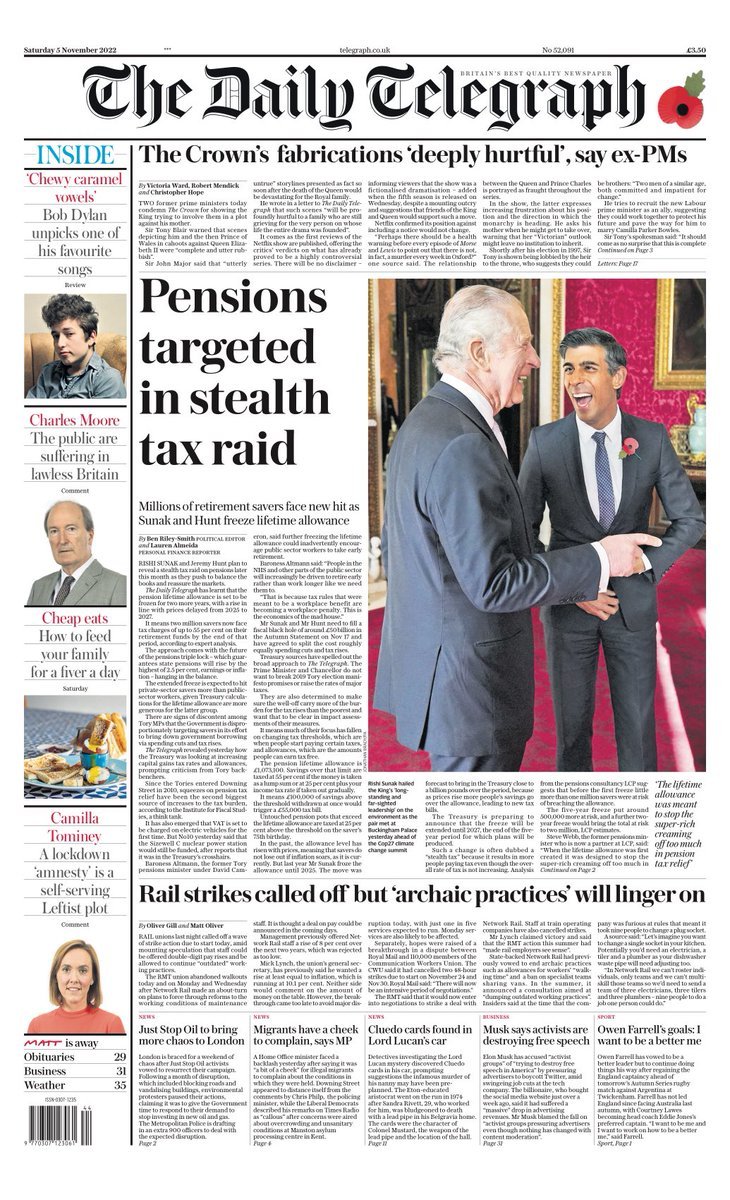

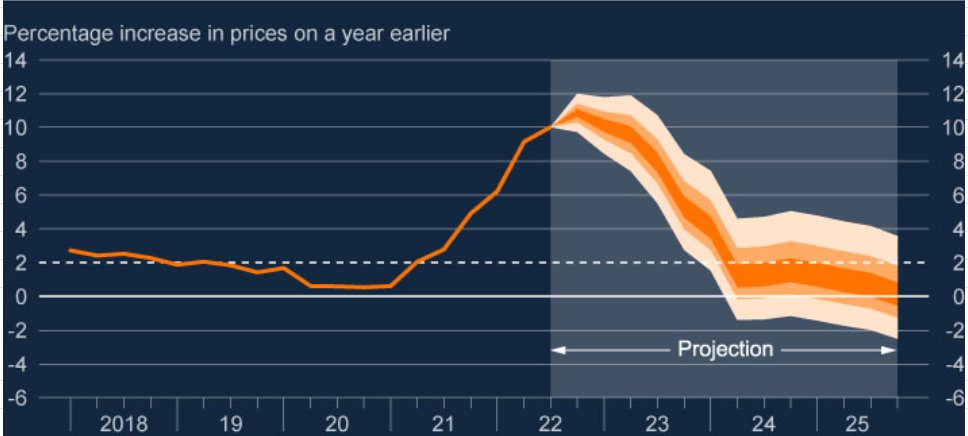

2/ 🧵This is based on the story in the @Telegraph. Another great quote from Baroness @rosaltmann “People in the NHS and other parts of the public sector will increasingly be pushing to retire early, rather than working longer as we need them to."

3/ Baroness @rosaltmann (former @Conservatives Pension Minister) continues

"This is because tax rules that were supposed to be an advantage in the workplace have become a punishment in the workplace. These are the economics of crazy house."

"This is because tax rules that were supposed to be an advantage in the workplace have become a punishment in the workplace. These are the economics of crazy house."

4/ We have long known that the LTA is a complete car crash for retention in the NHS. You might remember a certain @BorisJohnson who promised in 2019

"This is something I have raised repeatedly, the £1.1m pension cap, which is affecting doctors and other people. It’s obviously

"This is something I have raised repeatedly, the £1.1m pension cap, which is affecting doctors and other people. It’s obviously

5/ wrong, it’s causing a real problem, I have raised it repeatedly with the Treasury and they keep telling me they’ve addressed it but the headlines show it has not been addressed, and we will fix it, we will fix it."

But he didn't "fix it". Far from it...

But he didn't "fix it". Far from it...

6/ His then chancellor Rishi Sunak thought freezing it was a good idea... and these shocking figures below 👇 were when inflation was only 2%

https://twitter.com/goldstone_tony/status/1365947865625944064?s=20&t=vixKPVNHKL2ArOiZKiL7hQ

7/ But with inflation at 10.1% currently, and the upgraded @bankofengland inflation released this Thursday for next year (7.9% September 2023 CPI) the LTA is dropping like a stone

8/ So had the inflation link remained, it would have kept the purchasing power of the inflation linked LTA - with the LTA rising (assuming 7.9% inflation next year, and settling at 2.5%) to £1.423m in 2027/8 - still being able to buy a public sector pension of around £47k + TFLS

9/ Instead if this further freeze continues the LTA will drop in real terms (compare to 2021 when it was frozen) of just £818,344, buying a pension worth just £35,580 in 2021 terms!!!

This will impact colleagues younger (and lower down earnings spectrum) than *ever* before

This will impact colleagues younger (and lower down earnings spectrum) than *ever* before

10/ We have already seen Voluntary Early Retirements more than triple from 17.2% to 58.6% due to the huge erosion of the real terms value of the LTA👇

11/ This produces this *extremely* close correlation between loss of the real terms value of the LTA and early retirement rates (R=0.975, P<0.000001)

12/ Ministers have in recent months "bragged" that early retirements have been "stable" - but they were stable when the LTA was in real terms flat i.e. keeping up with inflation, not when it was frozen with runaway inflation. Mark my words

EARLY

RETIREMENTS

WILL

GO📈

*MASSIVELY*

EARLY

RETIREMENTS

WILL

GO📈

*MASSIVELY*

13/ And while we are on the subject of early retirements and #DoesntPayToStay - lets consider PAY & final salary pensions

This year we have seen unprecedented retirements due to high inflation (10.1%) vs pay awards of <4% avg i.e. MASSIVE 6.1% pay cut

This year we have seen unprecedented retirements due to high inflation (10.1%) vs pay awards of <4% avg i.e. MASSIVE 6.1% pay cut

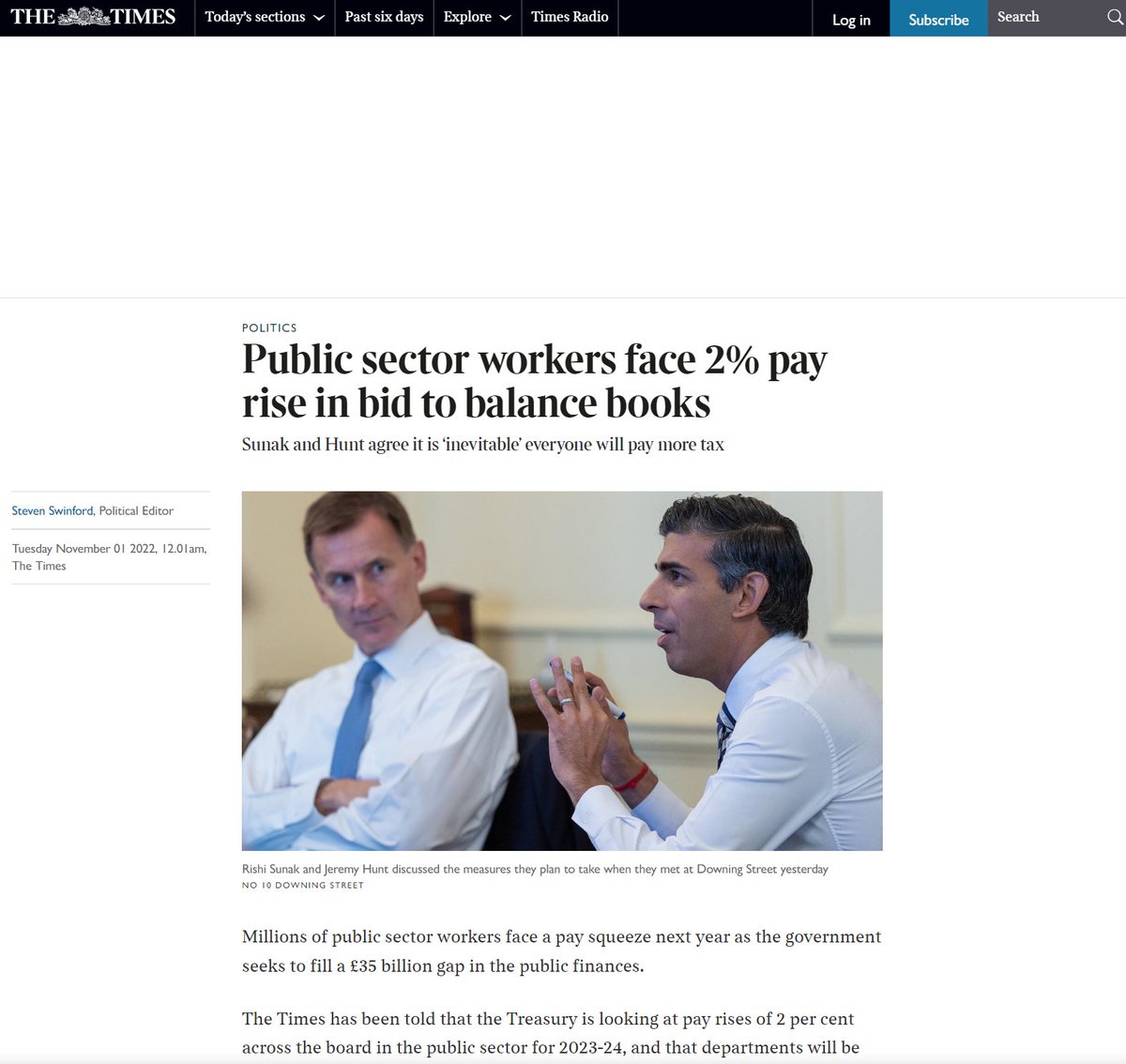

14/ This week we are seeing threats once again of a 2% "rise" (p.s. @thetimes when pay goes up less than inflation, its not a RISE but a PAY CUT)

So with the @bankofengland predicting CPI 23/24 of 7.9% & @hmtreasury 2% pay award we are again talking about *ANOTHER* 5.9% pay cut

So with the @bankofengland predicting CPI 23/24 of 7.9% & @hmtreasury 2% pay award we are again talking about *ANOTHER* 5.9% pay cut

15/ And of course *ANOTHER* 5.9% pay cut, is another 5.9 final salary pension cut - which will of course once again drive another wave of retirements as it #DoesntPayToStay

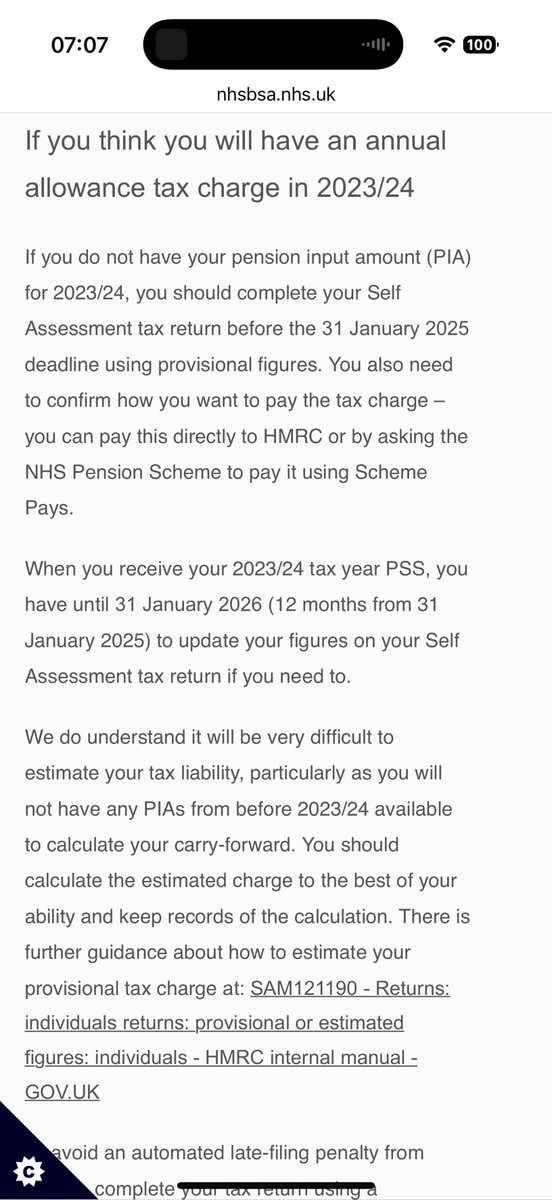

16/ But the misery doesnt end there because 5.9% pension cut (on top of the HUGE pension cuts in 2022) will drive MASSIVE negative pension growth for annual allowance, which will be conveninetly ignored by government (= pension theft) whilst still driving taxable AA growth in '15

17/ So governments current proposals to fix issues relating to "inflation" are I am afraid WOEFULL. They *must* #FixTheFinanceAct including #FixNegativePIAs or the problems relating to inflation very much remain (& will drive behaviours that will push waiting lists even higher📈)

18/ I know @Jeremy_Hunt understands many of these issues, & has been a powerful voice to get these fixed.

Now he is in a position to do something, he *must* act

Now he is in a position to do something, he *must* act

https://twitter.com/Jeremy_Hunt/status/1555139559796912128?s=20&t=d7ZPGMJF0ecpgCJGdiN0cA

19/ The solutions I have seen proferred by government including the completely inadequate solutions for inflation (i.e. just moving revaluation dates in CARE) *will not fix all the problems relating to inflation*

We @BMA_Pensions have been clear what solutions will work

We @BMA_Pensions have been clear what solutions will work

20/ Please do not add petrol to the fire with the suggestions rumoured in the media this weekend. It *WILL* be break the whats left of the NHS & will make fixing waiting lists (& economy) not acheivable

21/ Similary please do not try and recycle ideas we have already told you WILL NOT WORK (i.e. "flexibility"; 50:50 or decile accrual).

It was rejected at consultation twice before, and will be rejected again. Don't make an already hideously complicated issue even more so

It was rejected at consultation twice before, and will be rejected again. Don't make an already hideously complicated issue even more so

22/ We cant afford more tinkering with the scheme regs / half baked solutions or previously consulted on failed solutions (i.e. "flexibility").

Speak with us @BMA_Pensions urgently

#FixTheFinanceAct

#FixNegativePIAs

#TaxUnregistered

#FULLMandatedRecycling

Pls RT if you agree

Speak with us @BMA_Pensions urgently

#FixTheFinanceAct

#FixNegativePIAs

#TaxUnregistered

#FULLMandatedRecycling

Pls RT if you agree

• • •

Missing some Tweet in this thread? You can try to

force a refresh