FOMC week is behind us. First a scorecard update. The realized moves of the $SPX on days around the meeting. Over the last 6 meetings, realized vol on meeting day is 36%. There have often been large moves the following day. Realized vol day of and day+1 is also 36%.

As @FerroTV pointed out, the most informative part of the presser might have been the “Bloomberg on delay” moment when a reporter told Powell the market was up in response to the statement and then asked how he thinks about that.

Adjusted for what we'd expect from a Fed Chair, the reaction was almost visceral. Fed views a market rally as inconsistent, even problematic, relative to necessary path. Much of the discussion over the preceding months has been about the need for tighter financial conditions.

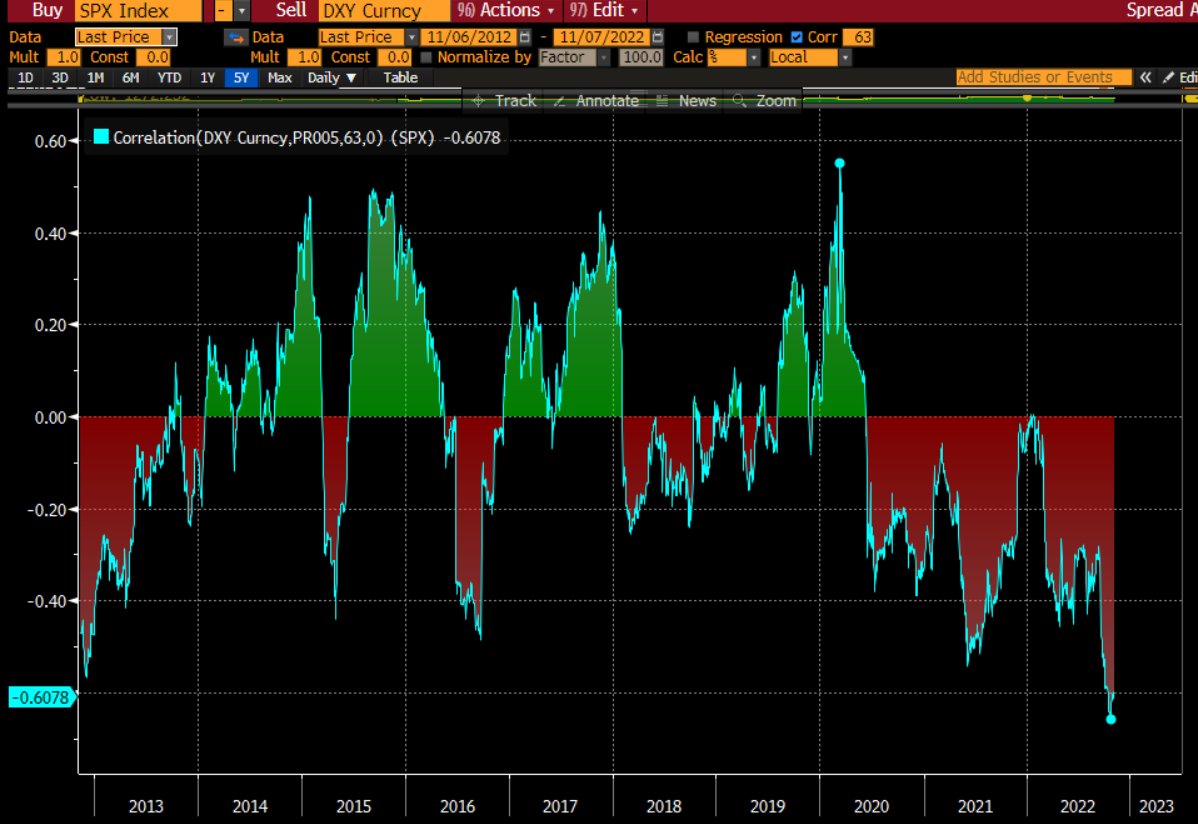

Daily changes in the SPX and the GS FinCon Index are -80+% correlated. The correlations of the subcomponents of the index (short rates, long rates, USD, credit spreads and the SPX) have all intensified. Below, the SPX to DXY and SPX to 10y. so, Powell's reaction makes sense.

There’s a broader issue here and it’s tied to the unique nature of market prices. When updating live, prices are an instantaneous scorecard, the exact opposite of what @CliffordAsness calls #volatilitylaundering. Live prices impose themselves critically in two ways.

First, they create mark to market risk, which forces decision making, thank you UK Gilt crisis. Next, and this is where this week’s FOMC presser is so relevant, prices tell us what to believe. In that instant when the reporter may have had delayed quotes, Powell was forced to

entertain the idea that fincon was easing on the back of the statement/meeting so far (below, SPX & DXY intraday on 11/2). In this way, the live price has very unique impact. We all believe what we see and observe - and it is the most recent observation we assign most weight to.

• • •

Missing some Tweet in this thread? You can try to

force a refresh