Fed's latest Financial Stability Report is out. It's always worth a read.

Here are some things I found interesting.

federalreserve.gov/publications/f…

Here are some things I found interesting.

federalreserve.gov/publications/f…

Report suggests that stocks aren't really 'overvalued' - they are around historical median from fundamental and relative valuations.

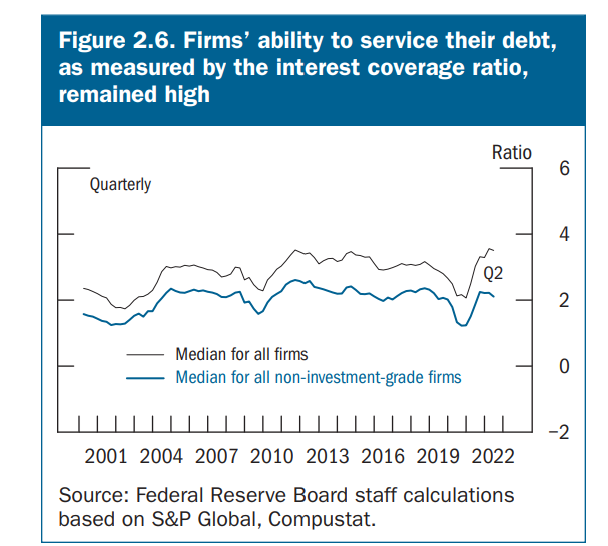

Yes interest rates have gone up, but the ability of corporations to service their debt is the highest in 20 years. This is because earnings went up with inflation, while debt locked in at historically low rates for a few years.

And next year Fed will begin to pilot some climate related bank supervison. The example given is to make sure 30y mortgages on beachside homes properly account for the risk of being swallowed by the sea. But I suspect its likely just a way to discourage banks from lending to O&G.

• • •

Missing some Tweet in this thread? You can try to

force a refresh