Joel Greenblatt compounded at 49% (!) from 1985 to 2005.

And the best thing, he taught a Columbia Class on how to do it.

Here are 7 Investing Gems from his Columbia Classnotes👇🏼

And the best thing, he taught a Columbia Class on how to do it.

Here are 7 Investing Gems from his Columbia Classnotes👇🏼

1. All about Context

Investors all look at the same numbers.

Yet people come to different conclusions about a company’s future success.

The best-performing investors are excellent at putting things into context/perspective.

Investors all look at the same numbers.

Yet people come to different conclusions about a company’s future success.

The best-performing investors are excellent at putting things into context/perspective.

2. Normalized Earnings

A huge part of getting the right context is normalizing earnings.

Adjust the reported earnings for one-time events that cannot be expected to repeat.

Normalized earnings tell the real story.

A huge part of getting the right context is normalizing earnings.

Adjust the reported earnings for one-time events that cannot be expected to repeat.

Normalized earnings tell the real story.

3. Simplicity

If you can’t figure out normalized earnings, stay away from that company.

There are thousands of opportunities in the markets.

Keep it simple and safe.

If you can’t figure out normalized earnings, stay away from that company.

There are thousands of opportunities in the markets.

Keep it simple and safe.

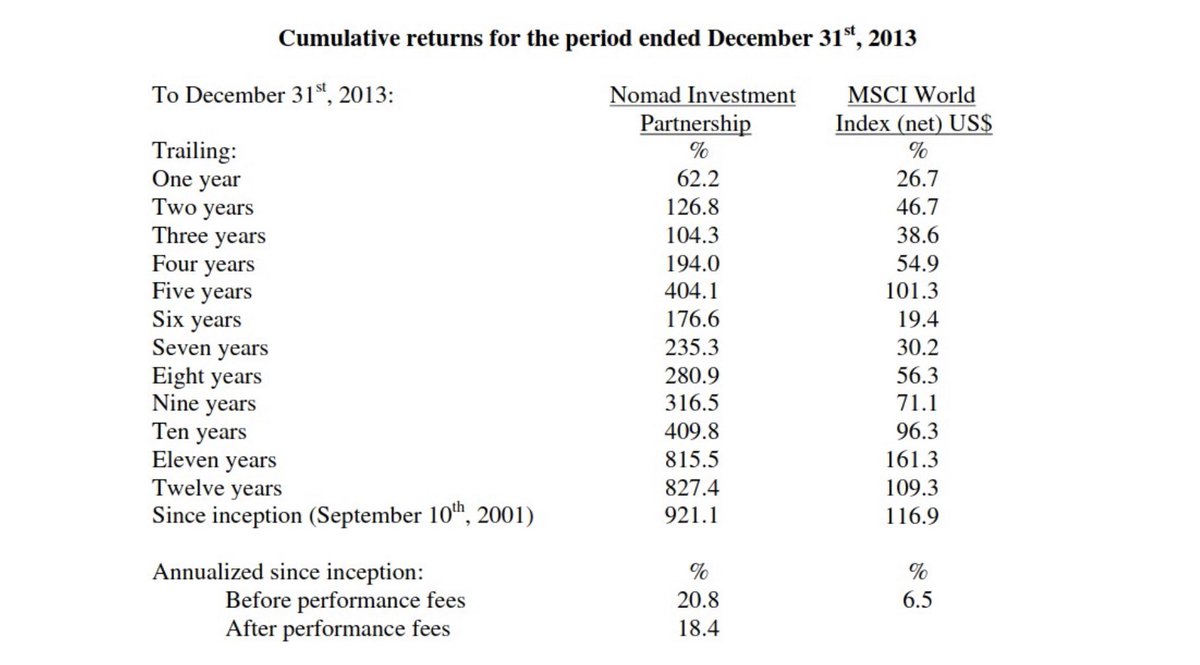

4. Be Sticky

It can take time until the market realizes its mistake.

That time will be hard on your mind.

Be sticky and believe in the work you’ve done.

Having a long-term thesis and an idea of catalysts will make waiting and reassessing easier.

It can take time until the market realizes its mistake.

That time will be hard on your mind.

Be sticky and believe in the work you’ve done.

Having a long-term thesis and an idea of catalysts will make waiting and reassessing easier.

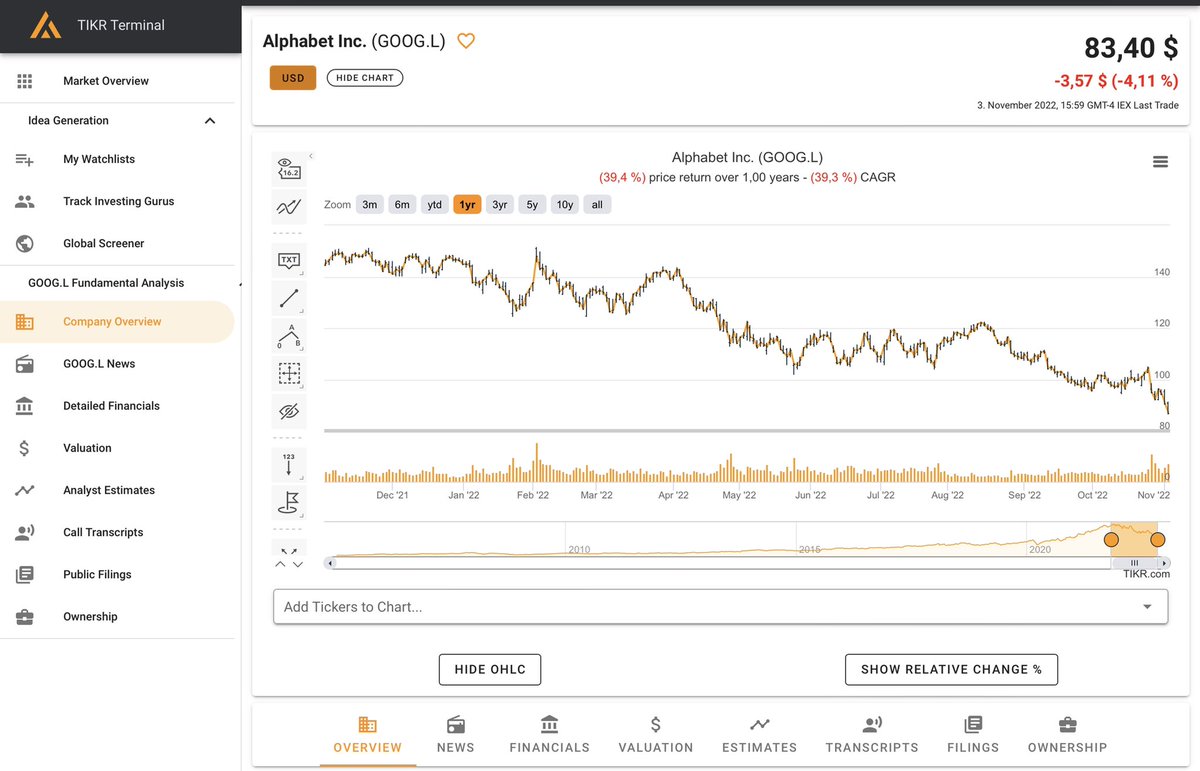

5. Volatility

Volatility is an opportunity for well-informed investors.

If I have an idea of fair value, volatility on the way is an opportunity to maximize profits.

Volatility is an opportunity for well-informed investors.

If I have an idea of fair value, volatility on the way is an opportunity to maximize profits.

6. Asymmetrical Bets

The basic idea of investing in cheap companies is the asymmetric risk/reward ratio.

You want the downside limited and the upside limited.

It sounds so easy, but so few people do it.

Most people solely focus on the upside.

Downside protection is king.

The basic idea of investing in cheap companies is the asymmetric risk/reward ratio.

You want the downside limited and the upside limited.

It sounds so easy, but so few people do it.

Most people solely focus on the upside.

Downside protection is king.

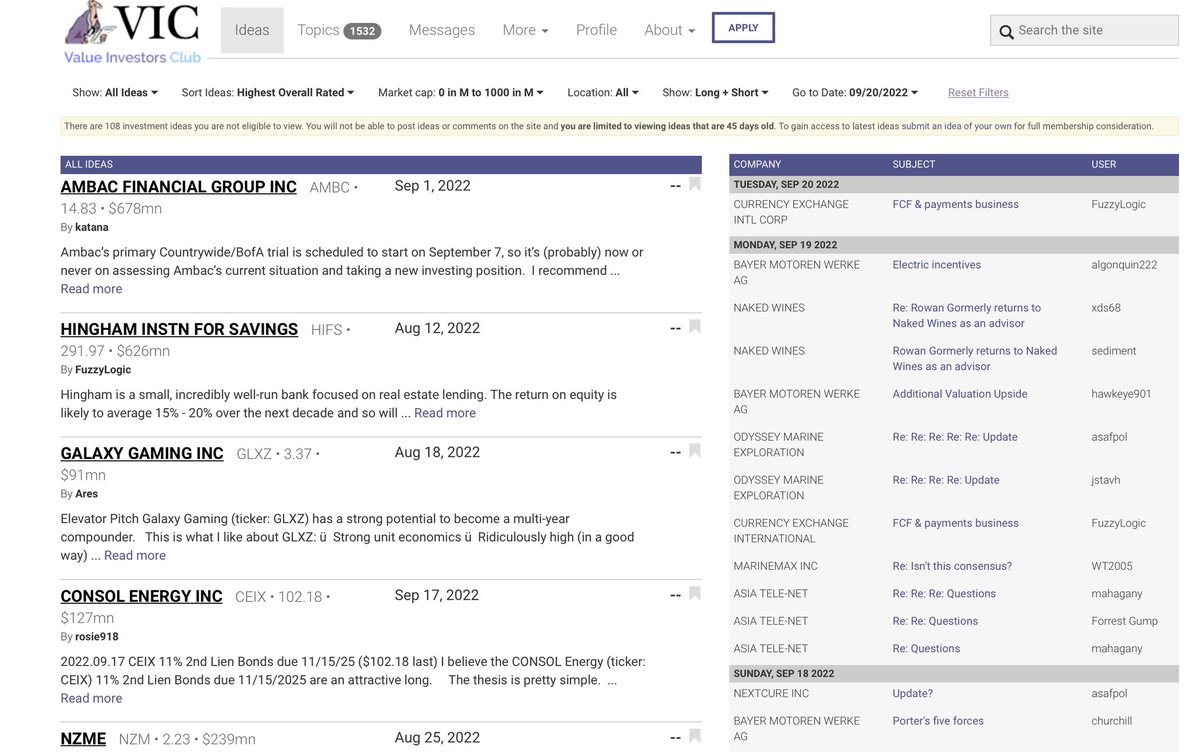

7. The Most Mis-Priced Market

Small caps are the best friends of individual investors.

Too small for institutions and eventually too small for the best individual investors.

Because they’ll accumulate too much money to keep investing there.

Small caps are the best friends of individual investors.

Too small for institutions and eventually too small for the best individual investors.

Because they’ll accumulate too much money to keep investing there.

That‘s it for today!

If you enjoyed this post, please Like and Retweet this Thread so more people get to see it.

To learn more about investing follow me @MnkeDaniel.

Cheers!

If you enjoyed this post, please Like and Retweet this Thread so more people get to see it.

To learn more about investing follow me @MnkeDaniel.

https://twitter.com/mnkedaniel/status/1590333057323925506?s=61&t=wky0JkoqgwFEh51CKge4HQ

Cheers!

Ohh, and in case you want to read more in-depth articles on Investing and markets, you should consider following my Substack.

danielmnke.substack.com

danielmnke.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh