P/Es are misleading, though simplicity makes the P/E ratio one of the most commonly used valuation metrics. Read on to see the problems with P/E and how we apply a better measure of value. #WednesdayWisdom 1/15

The flaws with P/E ratio begin with the denominator – earnings. Accounting earnings are unreliable for two reasons: 2/15

1. Accounting rules changes - shifts in rules change reported earnings when there’s no change in the business.

2. Accounting rules manipulations – loopholes in the rules make it easy for executives to mislead.

3/15

2. Accounting rules manipulations – loopholes in the rules make it easy for executives to mislead.

3/15

Empirical research shows accounting earnings have almost no impact on long-term valuations. Additionally, P/E ratios ignore assets and liabilities that have a material impact on valuation. 4/15

If accounting earnings actually drove valuations, then companies with high EPS growth should command higher multiples. Conversely, companies with low or negative EPS growth should have lower PE multiples. As the image below shows, there is no such correlation. 5/15

The R2 value of 0.3% in the image above means that EPS growth over the past five years is statistically insignificant in explaining the difference in P/E ratios between stocks in the S&P 500. 6/15

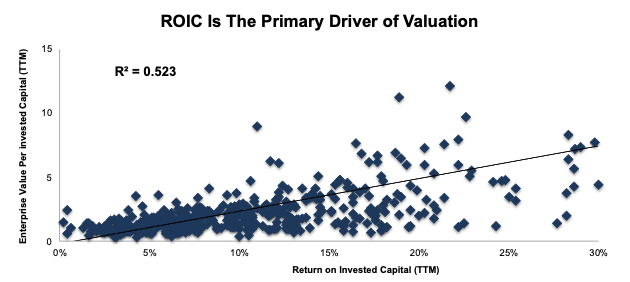

Instead of P/E, ROIC is the primary driver of differences in stock valuations. The image below shows that ROIC explains 53% of the differences in the Enterprise Value/Invested Capital ratio (a cleaner version of the price-to-book ratio) for S&P 500 stocks. 7/15

The R2 value of 53% in the image above means ROIC explains over half of the difference in valuations between stocks in the S&P 500. This correlation means companies that improve their ROIC are more likely to see their stock prices rise. 8/15

It’s understandable why investors might think that accounting earnings drive stock prices. After all, you tend to see stock prices go down when companies miss earnings expectations and go up when they beat expectations 9/15

Headline numbers can have an immediate and dramatic influence on stock prices. The key word in that sentence is “immediate”. A big increase in EPS might drive short-term gains in stock prices, but it doesn’t create long-term value. 10/15

Investors need to be looking at ROIC rather than EPS, and they need to recognize that a P/E multiple tells you next to nothing about the actual value of a stock. 11/15

Our models and calculations, including our ROIC calculation, are 100% transparent because we want clients to know how much diligence we do to give them the best earnings quality and valuation models in the business. Learn all about our models here: newconstructs.com/education/mode… 12/15

And our models and calculations are 100% the best in the business according to @J_Fin_Economics @EY_US @HarvardHBS @MITSloan newconstructs.com/proof-of-the-s…. 13/15

Get all the details on the problems with P/E ratios at the page below.

newconstructs.com/p-e-ratios-are… 14/15

newconstructs.com/p-e-ratios-are… 14/15

Get all the details on flaws with other common metrics at the page below. newconstructs.com/education/basi… 15/15

• • •

Missing some Tweet in this thread? You can try to

force a refresh