Businesses die when they run out of money.

There is one tool to survive a cash crisis.

The 13-week Rolling Cash Flow Forecast 🧵:

There is one tool to survive a cash crisis.

The 13-week Rolling Cash Flow Forecast 🧵:

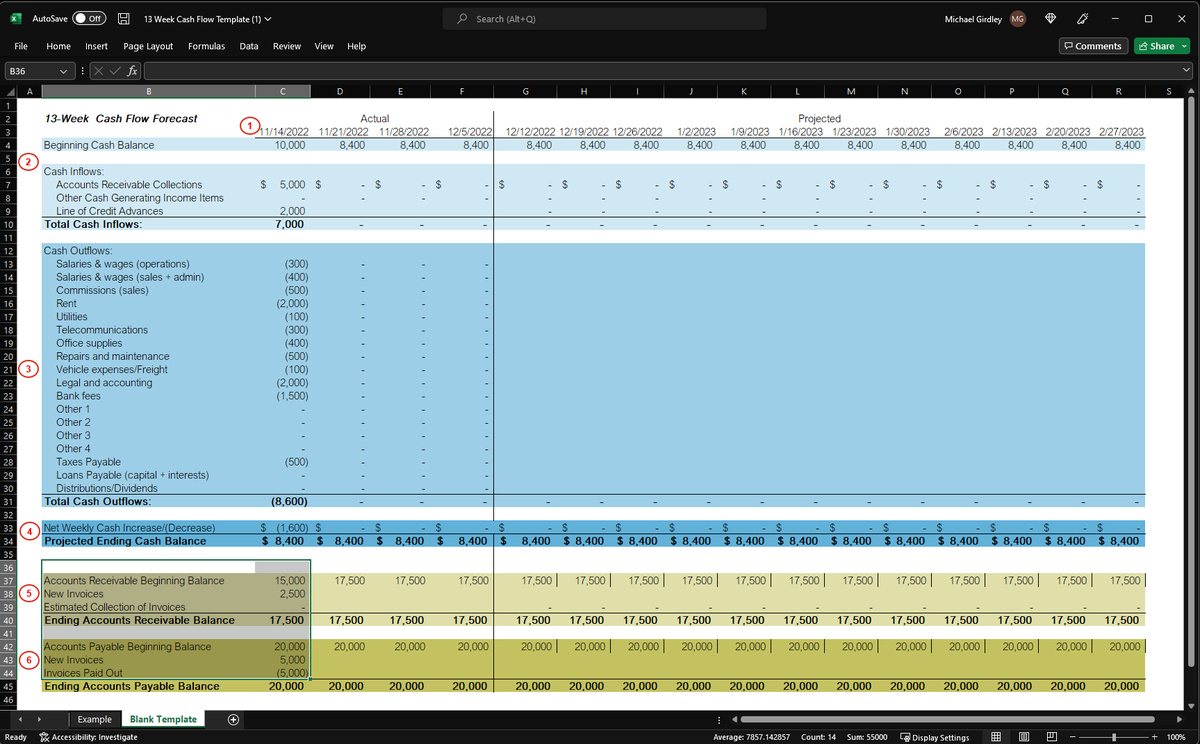

It is a simple spreadsheet.

To forecast your cash precisely by the week.

For 13 weeks -- a short enough time to be precise.

And just enough time to get ahead of problems.

Here’s the Excel template I’ve used (link at end):

To forecast your cash precisely by the week.

For 13 weeks -- a short enough time to be precise.

And just enough time to get ahead of problems.

Here’s the Excel template I’ve used (link at end):

Step 1: Start with this week.

Enter this Monday’s date.

We have a column for this week and the next 12.

Enter this Monday’s date.

We have a column for this week and the next 12.

Step 2: Income

Fill in your current starting cash on hand.

Then the cash coming in this week.

Fill in your current starting cash on hand.

Then the cash coming in this week.

Step 3: Expenses

List the cash that’s going out from operations.

Like rent, salaries, fees, or loan payments.

List the cash that’s going out from operations.

Like rent, salaries, fees, or loan payments.

Step 4: Ending cash position

Each week, start with the cash on hand.

Bring in some more cash.

Spend some.

Then see what's left for next week.

We want our cash to stay above zero.

No cash = no business!

Each week, start with the cash on hand.

Bring in some more cash.

Spend some.

Then see what's left for next week.

We want our cash to stay above zero.

No cash = no business!

Steps 5 & 6: Accounts Receivables and Payables

Receivable = money owed to us (like suppliers).

Payable = money we owe (like vendors).

These are often on "terms" (like net 30), so we want to forecast when they must be paid.

We enter the current ones, new ones, and due dates.

Receivable = money owed to us (like suppliers).

Payable = money we owe (like vendors).

These are often on "terms" (like net 30), so we want to forecast when they must be paid.

We enter the current ones, new ones, and due dates.

That’s the basic idea.

You update things for the next week and beyond.

Revise each week and delete the first week.

So it’s always up to date for the next 13 weeks.

And you can now try to avoid running out of cash.

You update things for the next week and beyond.

Revise each week and delete the first week.

So it’s always up to date for the next 13 weeks.

And you can now try to avoid running out of cash.

Usually, you're here because your bank account is nearly empty!

So now…

Your job as CEO is to stretch your cash:

•Delay payments

•Renegotiate w/ vendors

•Expand borrowing

•Raise cash

•Get paid early

•Etc.

Buying time to fix the problems that got you in this mess!

So now…

Your job as CEO is to stretch your cash:

•Delay payments

•Renegotiate w/ vendors

•Expand borrowing

•Raise cash

•Get paid early

•Etc.

Buying time to fix the problems that got you in this mess!

I am using this spreadsheet format now.

In real businesses.

As the economy gets worse, more of us will need it.

You can find the spreadsheet free on my blog at:

girdley dot com

In real businesses.

As the economy gets worse, more of us will need it.

You can find the spreadsheet free on my blog at:

girdley dot com

Follow me @girdley for more like this.

Comment/Retweet the first tweet below if you know others that should know about this:

Comment/Retweet the first tweet below if you know others that should know about this:

https://twitter.com/girdley/status/1591056907036282880

I write a newsletter that breaks down under-the-radar businesses making big profits.

Subscribe here for free:

getrevue.co/profile/girdle…

Subscribe here for free:

getrevue.co/profile/girdle…

• • •

Missing some Tweet in this thread? You can try to

force a refresh