Two years ago SBF wrote a thread on bet size and Kelly betting.

I questioned him on it. He engaged with me.

Let’s take a look at this thread and SBF’s views on bet sizing in light of the events with FTX and Alameda this week.

I questioned him on it. He engaged with me.

Let’s take a look at this thread and SBF’s views on bet sizing in light of the events with FTX and Alameda this week.

https://twitter.com/SBF_FTX/status/1337250686870831107

First off, nearly all financial blow ups arise from too much leverage. Too much leverage is a killer. So right away, you should question the idea that “better is bigger”.

Often bigger requires leverage. Often “bigger” is bigger than a fully Kelly bet therefore it's not better.

Often bigger requires leverage. Often “bigger” is bigger than a fully Kelly bet therefore it's not better.

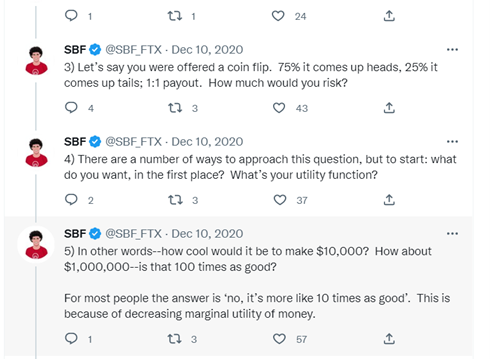

SBF goes into a coin flip type bet. A red flag comes up right away because he uses “utility functions” to determine the answer.

This is typical economic thought, but it's dangerous and I’m going to show you why.

This is typical economic thought, but it's dangerous and I’m going to show you why.

More standard economic explanation of utility theory. Notice though he says that a natural log utility function is “reasonable”.

Once again, labeling this "utility" as only reasonable is why standard economics is dangerous.

Once again, labeling this "utility" as only reasonable is why standard economics is dangerous.

Kelly doesn’t assume this is “reasonable” as SBF implies. Kelly says this is a maximum, which you shouldn’t cross.

Utility theory was essentially created by Daniel Bernoulli, in 1738, and even he states more than log betting is irrational.

Utility theory was essentially created by Daniel Bernoulli, in 1738, and even he states more than log betting is irrational.

https://twitter.com/breakingthemark/status/1339570290469253122?s=20&t=5IsAfwW6TZqNuV_aon9EVw

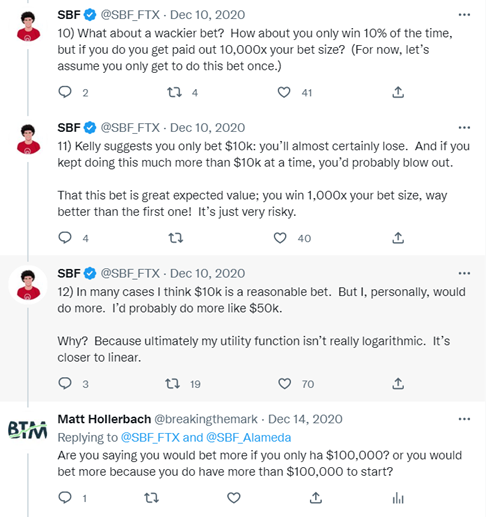

Now we get to the goods stuff. SBF changes the bet to something more radical, lower chance to win, much higher payout if you do.

He gets the Kelly fraction correct (technically $9,991), and then says he would personally bet 5X that value!

He gets the Kelly fraction correct (technically $9,991), and then says he would personally bet 5X that value!

Why would SBF bet 5X the Kelly max Bet?

Because he thinks his utility function is different then the rest of us.

And that’s why utility theory is really dangerous.

Kelly says his bet should be a maximum bet.

Bernoulli says his bet is a maximum bet. Its irrational to go bigger.

Because he thinks his utility function is different then the rest of us.

And that’s why utility theory is really dangerous.

Kelly says his bet should be a maximum bet.

Bernoulli says his bet is a maximum bet. Its irrational to go bigger.

But economics doesn’t teach it this way* so SBF thinks he’s unique, ok with higher risk, and is willing to go 5X the Kelly max bet.

Anyone wonder now why his two companies blew up? It was inevitable

*see @ole_b_peters and Ergodicity Economics for more on utility theory's flaws

Anyone wonder now why his two companies blew up? It was inevitable

*see @ole_b_peters and Ergodicity Economics for more on utility theory's flaws

SBF then moves to justify his desire/ability to push beyond Kelly bet sizing because……altruism.

Hes a good person and he's going to give the winning away so he should be super aggressive.

He’s not betting for himself, he thinks he’s betting for the world.

Hes a good person and he's going to give the winning away so he should be super aggressive.

He’s not betting for himself, he thinks he’s betting for the world.

I’ll return to this point later, as from the global perspective, he’s not necessarily wrong.

But from his own perspective, from his company's perspective, from his employee's, and his client's and investor's perspective he's wrong.

Betting beyond Kelly does them very wrong.

But from his own perspective, from his company's perspective, from his employee's, and his client's and investor's perspective he's wrong.

Betting beyond Kelly does them very wrong.

The irony here is that #22 the reason you only bet 10k. It's the logic behind the Kelly Criterion.

Mathematically if you have potential future bets, you have to keep capital dry to play them, so that one bad current bet doesn’t destroy you. Kelly maximizes this for you.

Mathematically if you have potential future bets, you have to keep capital dry to play them, so that one bad current bet doesn’t destroy you. Kelly maximizes this for you.

Now I found this line of though so ridiculous, I couldn’t belive he was possibly willing to bet 5X the Kelly maximum.

So I asked him to confirm that bit.

So I asked him to confirm that bit.

https://twitter.com/breakingthemark/status/1338503496346333185?s=20&t=4iF8xhdoFk54qIMdebwZfw

And now we see SBF has a very different view of the Kelly Criteria, and of what a Geometric growth rate is.

SBF thinks the all in bet maximizes the long term growth rate.

SBF thinks the all in bet maximizes the long term growth rate.

The all in bet maximizes the arithmetic growth rate, but it certainly doesn’t maximize the geometric growth rate. A Kelly bet does.

So which growth rate is “long term”.

From a single players perspective, it's clearly the geometric return.

breakingthemarket.com/the-most-misun…

So which growth rate is “long term”.

From a single players perspective, it's clearly the geometric return.

breakingthemarket.com/the-most-misun…

Now we move into a disagreement how to calculate the growth rate, essentially on the difference between the arithmetic and geometric return. SBF tries to brush it off as semantics, but it's not semantics. It's the one of the most important concepts in investing.

He agrees my formula for geometric growth rate is the same a log growth, but then he says that’s just one choice or one strategy.

He says you can look at other metrics.

And he doesn’t know which is right.

He says you can look at other metrics.

And he doesn’t know which is right.

I point out that there is a "right" and math shows that betting more than Kelly is lunacy (as Bernoulli did 300 years ago), and SBF says we are just going to have to agree to disagree.

So I think it’s obvious that SBF doesn’t think the Kelly bet is any sort of maximum that shouldn’t be crossed.

He thinks it's just another strategy or metric that could be maximized, not one that is critical to investing success.

I belive this is a big reason he blew up.

He thinks it's just another strategy or metric that could be maximized, not one that is critical to investing success.

I belive this is a big reason he blew up.

Now back to the altruistic, for the benefit of the world point.

If your goal is to maximize the world’s growth, then there is an argument that you should attempt to maximize your own arithmetic growth.

From this view, you are a part of a larger portfolio

breakingthemarket.com/why-market-ind…

If your goal is to maximize the world’s growth, then there is an argument that you should attempt to maximize your own arithmetic growth.

From this view, you are a part of a larger portfolio

breakingthemarket.com/why-market-ind…

If you blow, up, no big deal. You’re just a small part of the whole world. But if you hit big, everyone wins if you then share it.

You could argue that by taking on the extra risk, you are sacrificing yourself for the potential great good.

You could view this as honorable.

You could argue that by taking on the extra risk, you are sacrificing yourself for the potential great good.

You could view this as honorable.

But once your failure causes failure in others (increased correlations),

Once other investors and your clients also go bankrupt if you go bankrupt, then betting more than Kelly isn’t honorable anymore, it’s clearly extremely reckless and unethical.

Once other investors and your clients also go bankrupt if you go bankrupt, then betting more than Kelly isn’t honorable anymore, it’s clearly extremely reckless and unethical.

IMHO, SBF’s inability to see this difference is the cause of the mess this week.

If he hadn’t thought Kelly betting was just another strategy, or that it had anything to do with his own utility, then he wouldn’t have overleveraged his firms, and they wouldn’t have blown up.

If he hadn’t thought Kelly betting was just another strategy, or that it had anything to do with his own utility, then he wouldn’t have overleveraged his firms, and they wouldn’t have blown up.

So keep this in mind with your own investing.

Don't personally bet past Kelly.

And don't invest with people who flaunt the idea of proper bet sizing, ignoring the concept of a Kelly maximum bet, instead believing "better is bigger."

Don't personally bet past Kelly.

And don't invest with people who flaunt the idea of proper bet sizing, ignoring the concept of a Kelly maximum bet, instead believing "better is bigger."

• • •

Missing some Tweet in this thread? You can try to

force a refresh