came across a discussion & there's a misconception between 'Trading For A Living' and being a 'Full-Time Trader'

TFAL is the ultimate grail. it is extremely difficult to achieve even being profitable to a 7-fig trading a/c for 8yrs (I'm in #fintwit for 12 yrs 😅)

let me explain

TFAL is the ultimate grail. it is extremely difficult to achieve even being profitable to a 7-fig trading a/c for 8yrs (I'm in #fintwit for 12 yrs 😅)

let me explain

This thread is certainly not to dash your trading dream. Trading can certainly become a full-time career option.

Opportunities and accessibility in this era to trade execution, even sophisticated data that aids your edge, is dwindling it to a low barrier-to-entry profession

1/

Opportunities and accessibility in this era to trade execution, even sophisticated data that aids your edge, is dwindling it to a low barrier-to-entry profession

1/

It is life changing decision to halt yr ongoing career/biz to even attempting to trade full-time. this decision will affect;

i) yr career opportunities (there's time loss & progression in yr skills),

ii) yr family (no certainty in mthly income is a fact),

iii) your lifestyle

2/

i) yr career opportunities (there's time loss & progression in yr skills),

ii) yr family (no certainty in mthly income is a fact),

iii) your lifestyle

2/

When u made this decision as a career, u need measurable profitability of yr trading skill/strategy Qtr after Qtr, or Yr after Yr. I speak with 14 yrs experience, i've not witnessed anyone that is profitable every single month. (not day-trader)

Drawdown is always ahead of you

3/

Drawdown is always ahead of you

3/

Certainty in profitability require yr historical trades to pass quantifiable & measurable profitability metrics generated from yr realized trades. anything <300 trades, <24 mths period is random & will not give u mental peace during drawdown.

You need assurance on yr edge.

4/

You need assurance on yr edge.

4/

Min of 300 trades & min 24 mths period = yr strategy needs to generate sufficient opportunities for law of large number

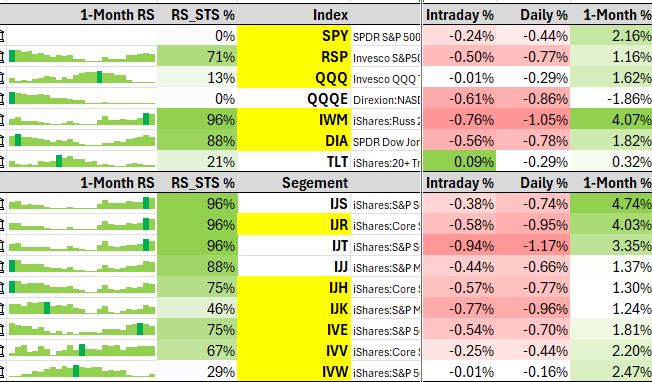

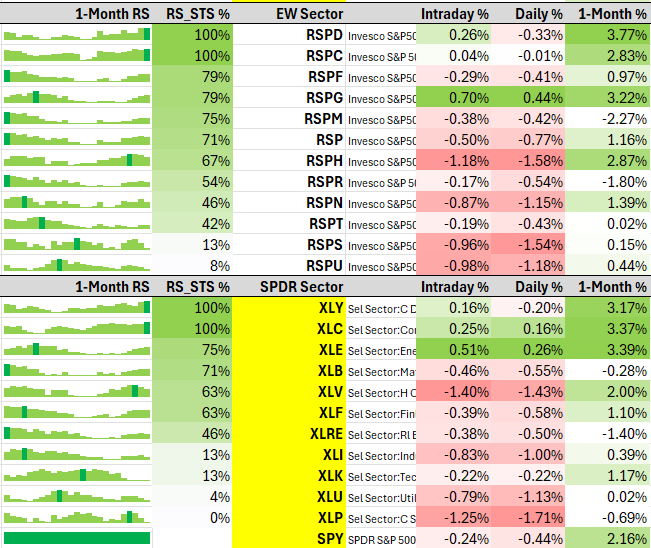

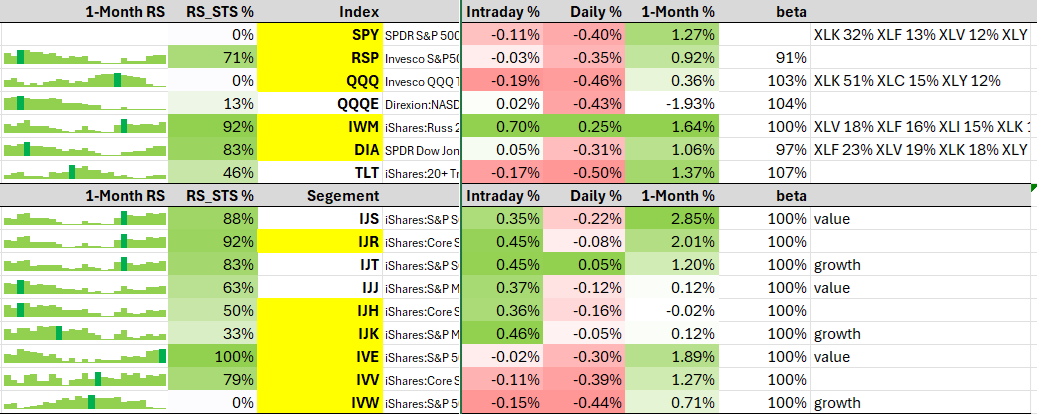

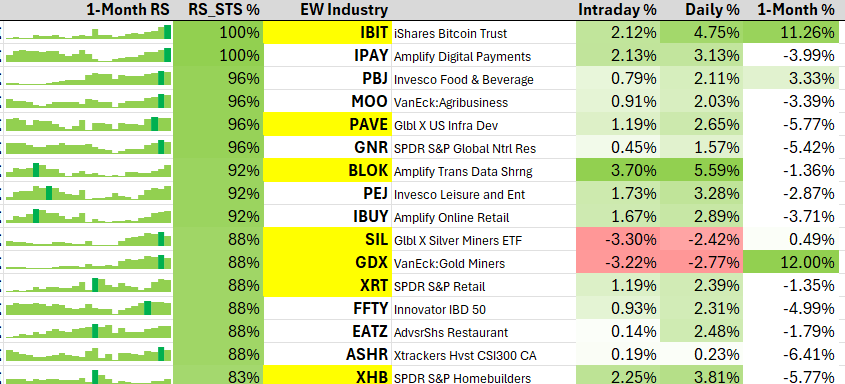

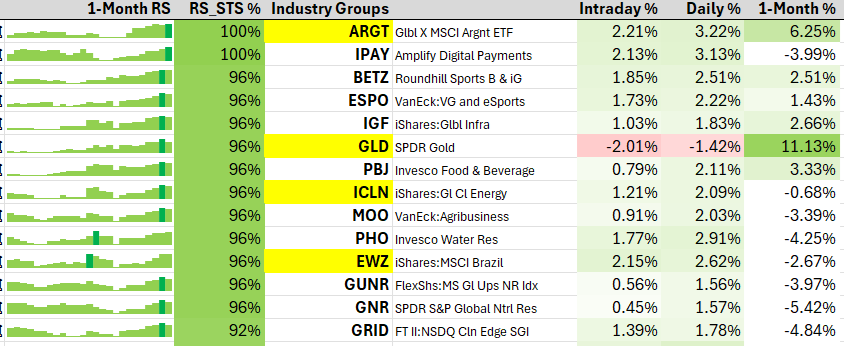

it is achievable even for positional trader. I'm certain of generating min. of 10 actionable swing ideas, stalk 30 impending swing ideas at any day in USmkt

5/

it is achievable even for positional trader. I'm certain of generating min. of 10 actionable swing ideas, stalk 30 impending swing ideas at any day in USmkt

5/

Do not backed on back-testing to find yr trading edge. There's no shortcut. U need to trade real money to undergo human errors, brokerage cost & dividends, spread widening on post-earnings open, slippages in turnaround & slippages that stop u out ahead of your sell stop order

6/

6/

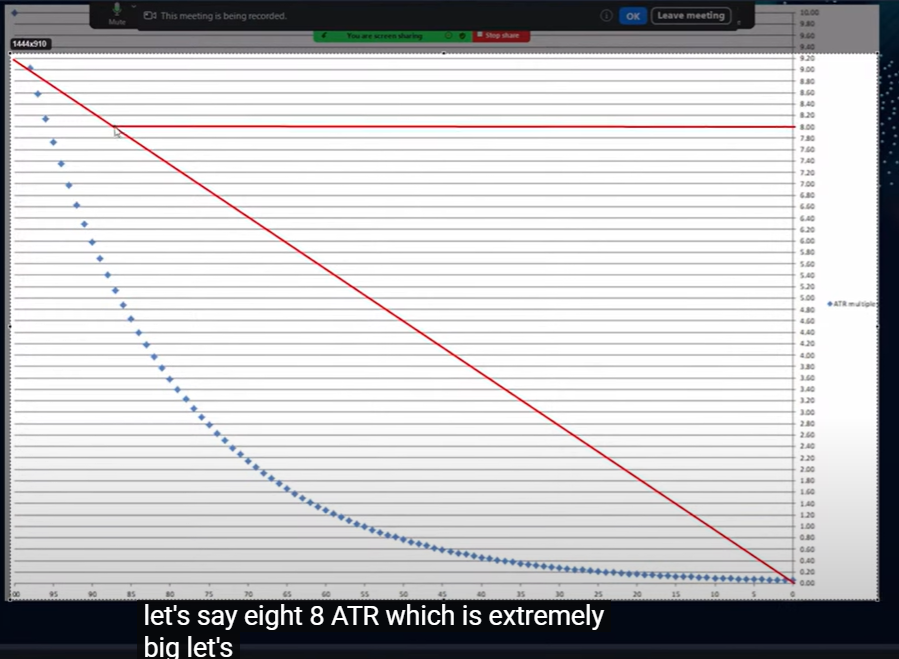

To give u an idea, slippages in turnaround alone in my 9 years with 4 diff brokers cost me almost 6-7% of my current equity. my risk is only 0.15%-0.25% per trade on current equity.

this is very substantial. back-testing is skewed and distorted, not reliable to prove yr edge

7/

this is very substantial. back-testing is skewed and distorted, not reliable to prove yr edge

7/

Measurable metrics that can u could depend on are;

i) Trading Expectancy - a calculation that shows what the typical profit is for each trade placed

ii) Risk of Ruin - probability that money will be lost to the point where it is no longer possible to recover the losses

8/

i) Trading Expectancy - a calculation that shows what the typical profit is for each trade placed

ii) Risk of Ruin - probability that money will be lost to the point where it is no longer possible to recover the losses

8/

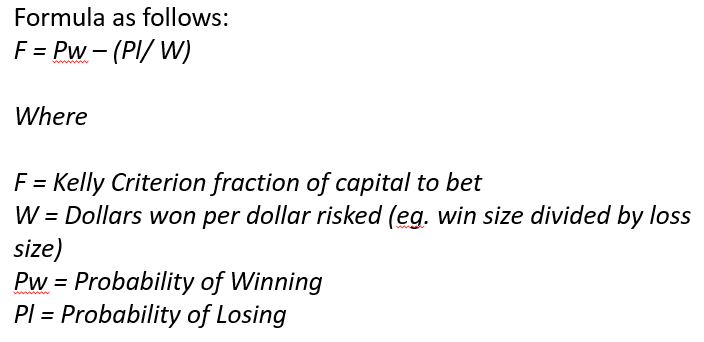

iii) Further risk optimization with Kelly Criterion - optimization of your risk appetite per trade based on the performance of the last 300 trades you initiated

9/

9/

Only until u grind out the above experience and numbers to be assured of staying Full-Time with a proven edge, u will understand longevity in staying afloat in the trading career is not just solely dependent on chart analysis, tracking company earnings or risk management,

/10

/10

it is also about data mining of yr own trading coupled with the real brokerage activities I mentioned above,

all this data is solely unique to u. and it is also some part of the reason why the same strategy can have vastly different performance from different traders.

/11

all this data is solely unique to u. and it is also some part of the reason why the same strategy can have vastly different performance from different traders.

/11

all the above is only sufficient to even consider full time until;

i) u have a sizable trading account that u could afford a quarter/annual withdrawal rate that is sufficient to cover u & yr fam expenses, mortgages but minimal enough to allow yr account to continue compound

/12

i) u have a sizable trading account that u could afford a quarter/annual withdrawal rate that is sufficient to cover u & yr fam expenses, mortgages but minimal enough to allow yr account to continue compound

/12

ii) u hv a side income to supplement living expenses to reach the goal of this lifestyle while nurturing yr trading skill. even via YT income, subscription etc. there are very good legit materials out there fm traders @PradeepBonde @TraderLion_ @PrimeTrading_ @JohnMuchow

/13

/13

iii) u have an inheritance to fall back on, or spouse is supplementing income to offset the month-month measurable expense in exchange for your obligation as a stay home dad for kids/chores etc. this is real, no shame about it if things work out well for all parties

/14

/14

as i have mentioned at the start, I consider myself a full-time trader and it is difficult to trade for a living.

this full-time career starts at a stage when i already had an ongoing mortgage and property expense of almost 3.5k mthly + 1.5k fixed variable expense.

/15

this full-time career starts at a stage when i already had an ongoing mortgage and property expense of almost 3.5k mthly + 1.5k fixed variable expense.

/15

my equity of near 300k from my trading a/c in 2015-2016 will not be able to afford an annual withdrawal of 60k/y (that is a whooping 20% withdrawal rate. ideal is barely <10% of annualised return. with an annualised return of 30%, I could only afford a withdrawal of 9k/y

/16

/16

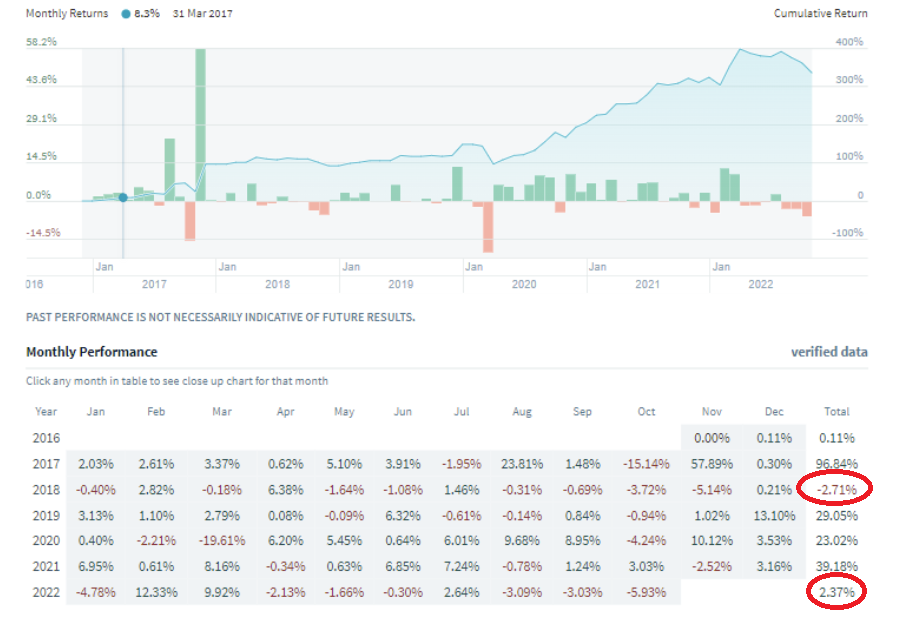

to re-emphasis, annualised return is merely a geometric avg of %gain generated each year over a given time period. it is only when the variable of 'time' get stretched longer, the % return can become a reliable projection.

/17

/17

my performance in '18 and '20 is definitely a great example why most FT trader cannot depend on a % rate of withdrawal to sustain the annual expense.

again, unless u begin a trading a/c that is sizable at 7-fig sum where absolute $ for a mere % is sufficient & substantial

/18

again, unless u begin a trading a/c that is sizable at 7-fig sum where absolute $ for a mere % is sufficient & substantial

/18

even legendary trader like Stanley Druckenmiller, with a annualised return at 30%+/yr for 30 straight years (without a losing yr) may not have self-rewarded any withdrawal at the beginning years of his career to maintain such astronomical return over the long stretch

/19

/19

so for my own case, I needed to create a series of income stream to supplement this career path.

I am fortunate to already have a strong industry following back in my own country (singapore), to be given opportunity as a speaker to share in financial spaces & events

/20

I am fortunate to already have a strong industry following back in my own country (singapore), to be given opportunity as a speaker to share in financial spaces & events

/20

income creation includes; paid speaking events, referral fees for brokerage account opening, continual yield based investments (etc REITs),

also got into startups with my professional skills (boutique property development biz, land feasibility studies consultancy)

/21

also got into startups with my professional skills (boutique property development biz, land feasibility studies consultancy)

/21

all of the above is for survival needs, to put food on the table & have shelter over my head while engaging in this FT trading career

trading will never give u income visibility. the gains are meant to be compounded, or cushion a potential drawdown that is always ahead of u

/22

trading will never give u income visibility. the gains are meant to be compounded, or cushion a potential drawdown that is always ahead of u

/22

only over time that u continue to diligently save from your active side hustles, or get substantially rewarded from yr longer term investments (profitable sale of real estate), then u transit yrself to a stage of translating the 'active' income sources into 'passive' income

/23

/23

at this stage, I have transited all the active income sources into 10 properties on (9 on mortgage but with triple nett positive rental) to generate that required income to offset the necessary life expenses, continual investment in REITs to further grind the annual $ yield.

/24

/24

it is only when u are not reliant on any forms of active income/hustle to support yr expense, u can have all the time in any given day to fully focus on living as a full time trader

& if yr strategy has further proven edge over the period, u now have more time to refine it

/25

& if yr strategy has further proven edge over the period, u now have more time to refine it

/25

The true meaning of 'Trading For A Living' is being able to be solely reliant from the means of trading to foot every single bill, mortgages, kids education to support yr family life. there is a definite withdrawal rate required on the trading a/c

/26

/26

this is not an easy feat in less than 10 yrs for most. even now, I'm still a work in progress even after 12 yrs & I'm definitely only comfortable at my current stage of Full-Time Trading bcos there is visible passive income that I could depend on.

This give me mental peace

/27

This give me mental peace

/27

imho, u only attain 'Trading For A Living' when u can solely be reliant on yr trading a/c for all expense, and yet could still remain calm with mental peace during trading drawdowns, inflationary period, higher interest cost on your mortgage finance by the same trading a/c.

/28

/28

i hope this summary gives everyone a better perspective of why 'Trading For A Living' is such a grail. Even top institutional traders find it extremely difficult to be solely on their own with no fallback.

Do help me to like, share or retweet!

Do help me to like, share or retweet!

• • •

Missing some Tweet in this thread? You can try to

force a refresh