The CPI report came in Thursday with headline at 7.7% and core at 6.3%, both lower than expected. And boy oh boy did risk assets like that. Everything was partying like there was no tomorrow.

Let’s have a quick look at what F happened here?

1/n

Let’s have a quick look at what F happened here?

1/n

Firstly, yields in the US and Europe collapsed, which saw the dollar weakening given Europe a bit more breathing room. China was the only country to see yields rise on a weekly basis properly reflecting the reopening story.

2/n

2/n

Everyone and their mother suddenly celebrated inflation at 7.7% and that saw the largest daily move up in the SPY since the spring of 2020. You know .. back when rates and inflation were near zero. I don’t quite get the rush to suddenly turn uber bullish risk assets.

3/n

3/n

… And we haven’t even talked about earnings and growth yet, which looks to be under even more pressure going into next year. #META #AMZN and others are firing people left and right. Is that supposed to be positive news, now?

4/n

4/n

I have gotten absolutely burned by the bond market this year, thinking that the bond market should reflect the slow down in the real economy. The big question going into next year is whether we’ll see this? Let’s make the 60/40 portfolio great again

5/n

5/n

In Europe the BTP-Bund spread compressed and you can bet that Lagarde is crossing fingers that the CPI data coming out from the US will continue to ease her job of fighting inflation and keeping the EZ glued together.

6/n

6/n

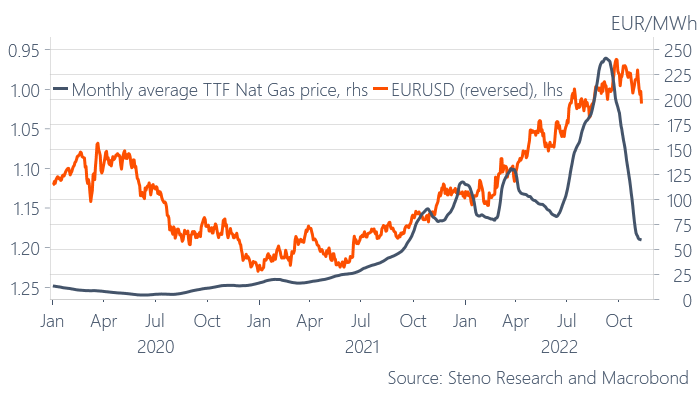

The EUR/USD also moved higher on the inflation news and it looks like I might not have to create that onlyfans account… For now at least. I wouldn’t be surprised if we see rate expectations move lower come Q1 and Q2, only for the Euro to get hammered again

7/n

7/n

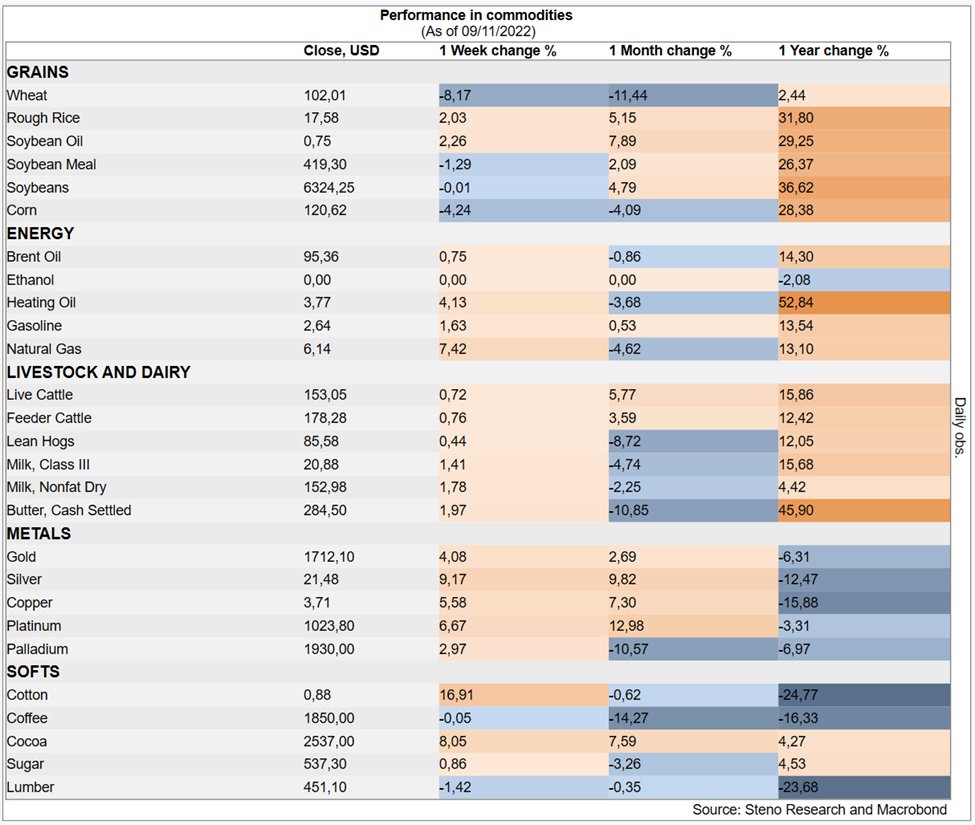

As mentioned in the beginning, only China saw yields rise. This was properly due to the reopening story. Dr. Copper has been on a tear in recent weeks and if Xi finally decides to open up industrial metals will look very interesting.

8/n

8/n

Best wishes for the weekend from Andreas

You can follow all om my free thoughts right here

andreassteno.substack.com/p/steno-signal…

9/n

You can follow all om my free thoughts right here

andreassteno.substack.com/p/steno-signal…

9/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh