Another mild inflation number from the US - this time the PPI! 😅🐮

Inflation is heading lower, but watch out!

A thread 1/n

Inflation is heading lower, but watch out!

A thread 1/n

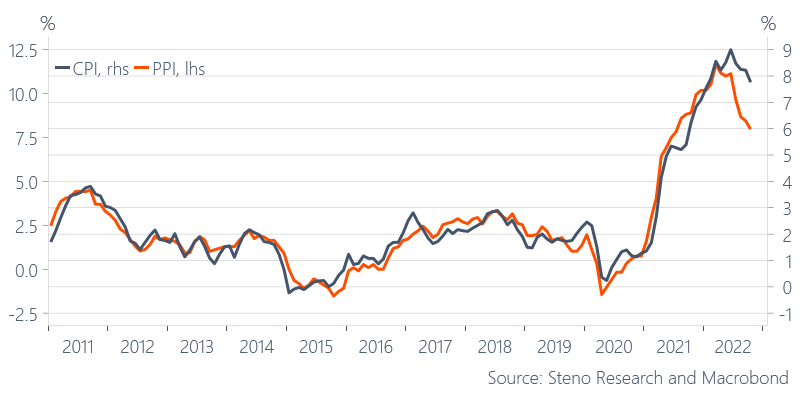

PPI now clearly hints of lower CPI readings around 6-7% within a couple of months from now.. Good news and it adds to a series of downwards pointing indicators for inflation

2/n

2/n

Freight rates for example hint of SHARP goods disinflation in coming months.. Supply chains are softening up, which ought to bring prices of goods down ultimately..

3/n

3/n

Also food prices are bound for a correction lower in the CPI index due to 1) lower energy prices and 2) lower transportation costs

4/n

4/n

But.. we need to look at what it means for the Fed and for markets as well ..

Using historical parallels, the market will likely try and chase equities higher on lower CPI prints in search of a Fed pivot on rates AND QT

This happened in 1974 as well

5/n

Using historical parallels, the market will likely try and chase equities higher on lower CPI prints in search of a Fed pivot on rates AND QT

This happened in 1974 as well

5/n

The problem is just that an early pivot risks refueling inflation pressures (as it did in the 1970s) when the Fed pivoted alongside weakening CPI momentum

6/n

6/n

Powell has been pretty firm that he does not want to repeat the mistakes of the 1970s, why a pivot on BOTH rates AND the balance sheet seems a bit farfetched to hope for already. At best we get a slowdown in the pace of hikes

7/n

7/n

Remember that we need a pivot in both rates and QT to truly turn positive on equities, not least as a recession / slowing economy is the main reason why the CPI is disinflating

8/n

8/n

A falling PPI (year over year) usually corresponds to an EARNINGS RECESSION as it is a symptom of weak demand.. So even if it is good medium-term news, it is not necessarily something to celebrate short-term

h/t @MikaelSarwe

9/n

h/t @MikaelSarwe

9/n

So even if the market is chasing equities higher short-term on milder inflation news, do not miss the forest for the trees here.

Inflation is slowing as that the economy is edging closer to a recession

Follow my free updates here for more

10/n

andreassteno.substack.com

Inflation is slowing as that the economy is edging closer to a recession

Follow my free updates here for more

10/n

andreassteno.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh