ICreate Limited, $ICREATE.ja, has released its Q3 report. Here's a #SOTRSummary:

-Revenue ⬆️231% 🔥🔥

-Net Profits of 6.9M made versus a loss in the same quarter last year.

More details in the next tweet 👇🏾

-Revenue ⬆️231% 🔥🔥

-Net Profits of 6.9M made versus a loss in the same quarter last year.

More details in the next tweet 👇🏾

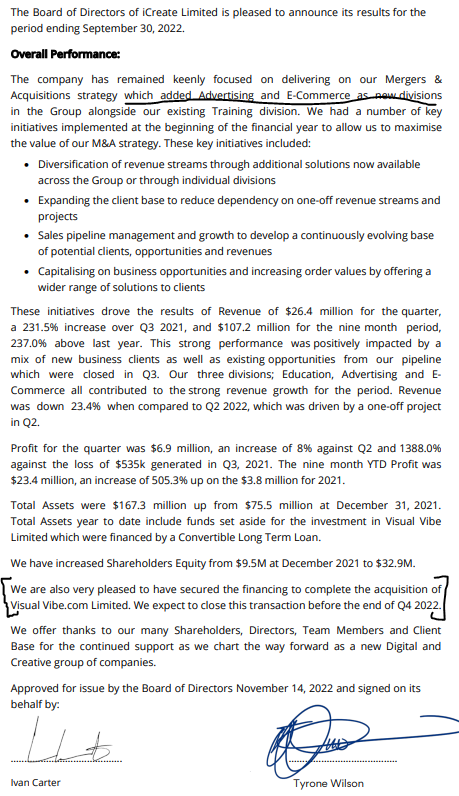

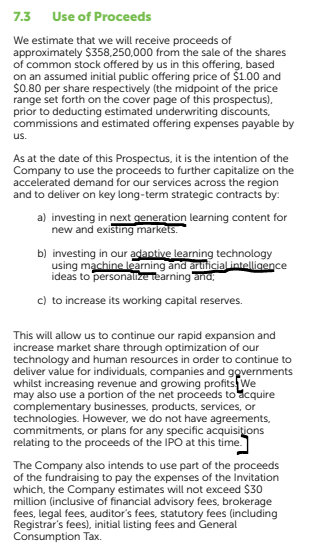

The CEO of ICreate had previously stated that a rights issue would be used to fund the acquisition of Visual Vibe. The report above and a recent notice seem to indicate that has changed and that the funds have been secured for the acquisition.

jamaicaobserver.com/business/icrea…

jamaicaobserver.com/business/icrea…

This updated notice was shared via the JSE on Nov 11th. Highlights are:

-exchange of shares as part payment

-loans being converted to shares at a price of $1

-pre-emptive rights of current shareholders dis-applied

PLEASE READ FOR DETAILS.

-exchange of shares as part payment

-loans being converted to shares at a price of $1

-pre-emptive rights of current shareholders dis-applied

PLEASE READ FOR DETAILS.

The company had also previously communicated a Rights Issue record date of September 26, 2022.

However, there has been no confirmation whether the rights issue is still a go from either the notice or this report.

However, there has been no confirmation whether the rights issue is still a go from either the notice or this report.

Investors have questioned whether a rights issue would be necessary given that the funds for the Visual Vibe purchase have now been secured.

-balance sheet continues to grow

-debt to equity at 3.7x but will change as loans are converted

-assets are largely dominated by receivables and other current assets (?)

-debt to equity at 3.7x but will change as loans are converted

-assets are largely dominated by receivables and other current assets (?)

-though profits have grown massively, operating cash has grown increasingly negative (this seems to be driven by other current assets and receivables (?))

-this was further compounded by investments

-these balances were funded by loans totaling 89.6M

-this was further compounded by investments

-these balances were funded by loans totaling 89.6M

See below the top 10 shareholder listings between July 2022 and September 2022.

There have been a few changes in the top 10 as well as changes in shareholdings thus far.

There have been a few changes in the top 10 as well as changes in shareholdings thus far.

ICreate has had an up and down year re its share price. The stock started the year at 0.84 and peaked at about 4.60+ (⬆️448%). The stock has since come down to trade as low as 1.50 this week, a 67% drop from its peak.

The company is still trading at a negative trailing earnings.

The company is still trading at a negative trailing earnings.

Please see our most recent session with the CEO of ICreate here:

How do you feel about the soon to be complete ICreate acquisition?

Tell us in our community here: t.me/+LoPrrHCLGYQ3Z…

Tell us in our community here: t.me/+LoPrrHCLGYQ3Z…

• • •

Missing some Tweet in this thread? You can try to

force a refresh